When managing sales in QuickBooks, using a sales receipt template can save you time and keep your records accurate. By utilizing a pre-designed template, you ensure consistency across your transactions and can focus on growing your business rather than handling repetitive tasks. QuickBooks offers a range of customizable templates, giving you the flexibility to tailor receipts to your specific needs.

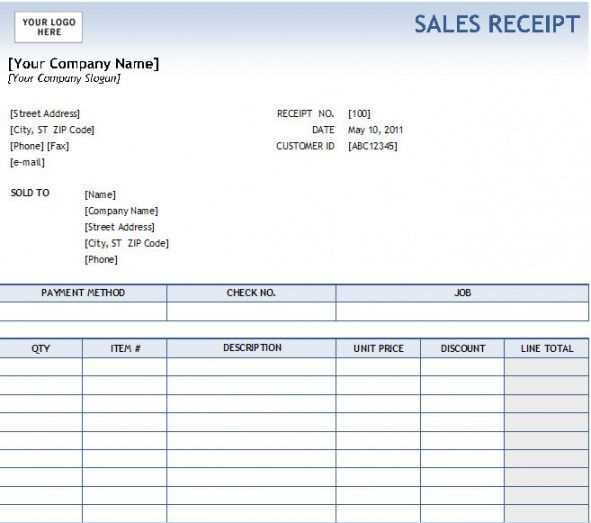

Start by selecting a template that includes the necessary fields, such as customer details, itemized list of purchased goods or services, and the total amount due. Customize these templates to align with your branding, adding your logo and contact information to create a professional appearance. This small detail adds value to your customer experience, reinforcing trust and credibility.

Additionally, QuickBooks allows you to automate the generation of these receipts, reducing manual entry errors and enhancing your overall workflow. When you issue a sales receipt, QuickBooks automatically updates your sales records, ensuring everything is in sync for future accounting tasks. This integration can save time when reconciling accounts or preparing for tax season.

Custom templates in QuickBooks are especially beneficial for businesses with recurring clients or frequent sales. They allow for faster processing, with all the necessary information already set up. Once your template is configured, simply enter transaction details, and the system handles the rest. This streamlines the process and helps you maintain organized and error-free records.

Here are the corrected lines with minimal word repetition:

Ensure your QuickBooks sales receipt template is clear and concise. Avoid overuse of identical terms to maintain readability and professionalism. Use unique phrases when referring to products or services, and vary sentence structures where possible.

Example 1:

Instead of saying “This product is of high quality and is a top choice for many users,” use “This product stands out for its high quality and remains a popular choice among users.”

Example 2:

Instead of repeating “receipt” or “sales,” try: “This document serves as proof of purchase for the products purchased today.” This eliminates redundancy while conveying the same information efficiently.

By refining the wording and replacing overused terms, your template will be more engaging and professional. Focus on clarity and precision in every sentence.

- QuickBooks Sales Receipt Template Guide

Customizing a QuickBooks sales receipt template saves time and ensures that your receipts reflect your business identity. Follow these steps to create an effective template:

1. Access the Template Settings

Go to the “Sales” tab in QuickBooks and select “Sales Receipts.” From there, click on “Customize” to begin editing the default template. You can choose from various styles or create your own.

2. Edit Template Information

Update fields like your company name, address, and phone number. Be sure to include any additional information that may be required, such as tax ID numbers or payment methods accepted.

3. Customize Layout

The layout determines how your sales receipt will appear to customers. You can adjust font sizes, colors, and the arrangement of fields. Ensure that the template remains clear and legible, with essential information like item descriptions, quantities, and pricing.

4. Include Custom Fields

If you need to track specific details, such as a sales representative or customer discount, use the “Custom Fields” option to add these to the receipt. This can be helpful for internal reporting or customer-specific transactions.

5. Review and Save

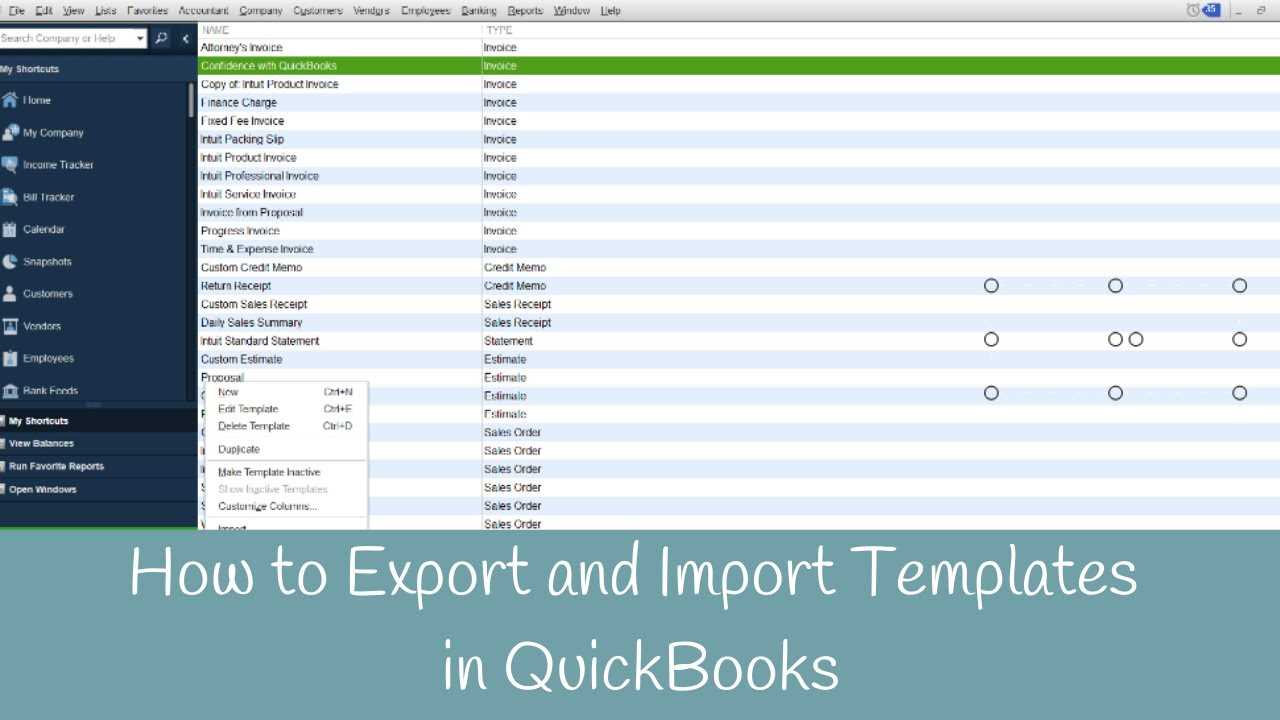

Once you’ve made your customizations, preview the template to ensure that everything appears as intended. Save the template with a unique name to easily access it later.

6. Use the Template for Transactions

After creating your customized template, apply it to sales receipts by selecting it when processing transactions. QuickBooks will automatically generate receipts using your chosen template format.

7. Make Adjustments as Needed

If your business changes or you need a different look for specific occasions, don’t hesitate to edit the template again. QuickBooks allows for easy modifications at any time.

By following these steps, you’ll have a professional and consistent sales receipt template tailored to your needs.

To customize your sales receipt template in QuickBooks, follow these steps:

1. Access the Sales Receipt Template

In QuickBooks, go to the “Sales” tab and select “Sales Receipts” from the drop-down menu. Once you’re in the Sales Receipts section, click on the “Customize” button at the bottom to modify your template.

2. Choose a Template

QuickBooks offers various pre-built templates. Pick the one that best fits your business style. You can preview each template by clicking on them. After selecting one, hit “Customize” to start editing.

3. Modify Template Fields

- Edit the header: Add your business logo, company name, and contact information at the top of the receipt.

- Change item details: Modify product/service descriptions, quantities, and prices. You can adjust fields like taxes, discounts, and totals to match your needs.

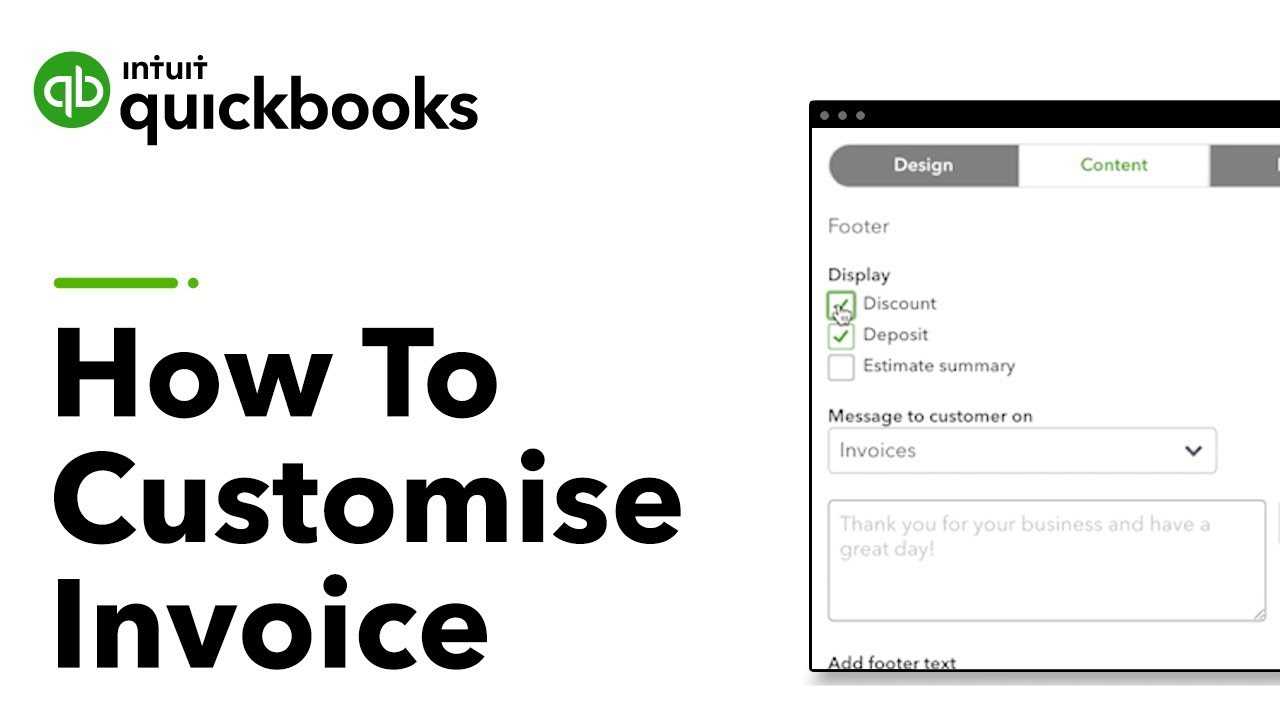

- Customize footer: Add terms, conditions, or additional notes to your customers in the footer area.

4. Adjust Formatting

- Change font styles and sizes to make key information stand out. You can adjust the alignment, colors, and margins to match your branding.

- Decide what information is displayed, such as payment methods, transaction reference numbers, or due dates.

5. Preview and Save

Before finalizing the changes, preview your customized receipt to ensure everything looks as you want. If satisfied, click “Save” to apply your changes. You can always go back and tweak it further later.

By following these steps, you can easily create a personalized sales receipt that reflects your brand and meets your business needs in QuickBooks.

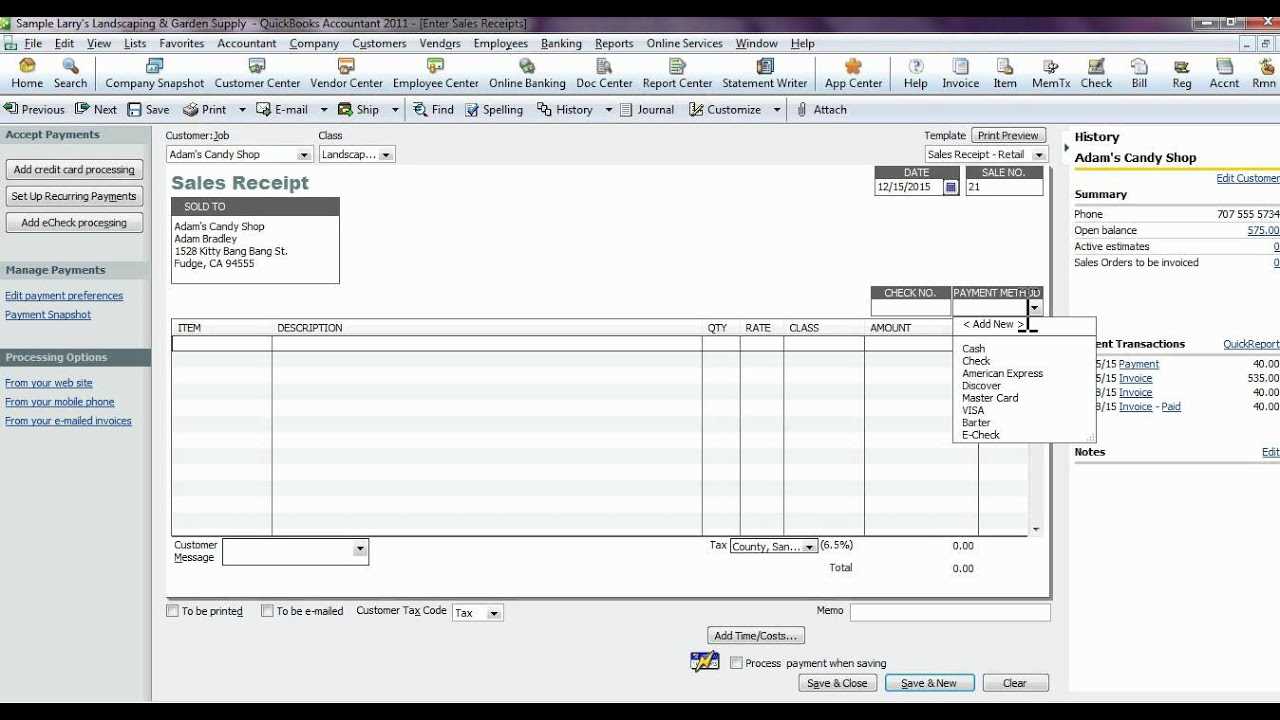

QuickBooks allows you to include multiple payment methods on sales receipts, ensuring that transactions are accurately recorded. To add payment methods, follow these steps:

1. Open the Sales Receipt

Begin by opening the sales receipt you want to modify. If creating a new receipt, go to the “Create Sales Receipt” option under the Sales menu. If editing an existing one, locate the receipt from your list of transactions.

2. Select Payment Method

In the “Payment” section, click the drop-down menu to select the payment method. QuickBooks provides options such as Cash, Credit Card, Debit Card, Bank Transfer, and others based on your setup.

- Cash: Select “Cash” if the customer is paying with physical currency.

- Credit/Debit Card: Choose this option for card payments. If integrated with QuickBooks Payments, card details can be entered directly.

- Bank Transfer: Choose “Bank Transfer” if the customer made an electronic transfer.

- Custom Payment Methods: If you use alternative payment methods, such as checks or mobile payments, create custom payment options in the “Lists” menu under “Payment Methods.”

3. Add Multiple Payments

If the customer is paying using multiple methods (for example, part cash and part credit card), you can add each payment method separately. Click “Add Payment” after selecting the first method, and continue adding payments until the total amount is covered.

4. Save the Receipt

After selecting the appropriate payment methods, double-check the totals to ensure the receipt is accurate. Once confirmed, save the receipt to complete the transaction.

By managing payment methods effectively, QuickBooks ensures that all forms of payments are properly recorded, making your financial tracking seamless and accurate.

When customizing a sales receipt template in QuickBooks, incorporating discounts and taxes requires a straightforward approach to ensure accuracy and transparency in your transactions.

- Applying Discounts: To add a discount, navigate to the “Item” section and create a new item specifically for discounts. Set the type to “Discount” and define the percentage or amount. When adding this item to the sales receipt, QuickBooks will automatically calculate the discount based on the value you input.

- Tax Settings: QuickBooks allows you to set up tax rates for different regions. For taxes, go to the “Sales Tax” menu and define the tax rates applicable to your sales. Once set, applying taxes to each sales receipt is automatic. Simply select the appropriate tax item when adding products or services, and QuickBooks will compute the total tax.

- Handling Taxable Discounts: In cases where discounts are taxable, configure the “Discount” item to include tax by marking the option in the item settings. This ensures that the discount is considered when calculating the final tax amount.

- Reviewing the Final Amount: Always review the final calculation on the receipt. Ensure that the discount and tax amounts are calculated correctly, and the total matches what you intend to charge the customer.

By configuring these options properly in your sales receipt templates, you maintain accuracy in pricing and avoid errors in customer billing. This system helps create a smoother and more transparent sales process for both you and your customers.

To save a sales receipt in QuickBooks, complete the transaction as usual, filling in all the necessary details. Once done, click the “Save and Close” button to save the receipt in your system. If you wish to save the receipt for future reference but continue working, click “Save and New” instead. This allows you to create another receipt without closing the current one.

To print the sales receipt, navigate to the receipt you’ve saved. Open it, and at the top of the page, click the “Print” button. A print preview will appear, showing how the receipt will look on paper. You can adjust the settings or select a printer before hitting the “Print” option. If you only need a digital copy, click “Save as PDF” to keep it electronically.

If you’re printing multiple receipts at once, you can go to the “Sales” tab in the main menu and select “All Sales.” From there, filter for the receipts you wish to print, and click “Batch Actions.” This will allow you to print multiple receipts simultaneously, saving you time and effort.

When working with QuickBooks sales receipt templates, you may encounter several issues. Below are some common problems and how to resolve them efficiently.

1. Misaligned Text or Fields

If the text or fields on your sales receipt appear misaligned, it can be due to incorrect template customization. Ensure the template is set up correctly by checking the margins and spacing settings. Go to the “Templates” menu, select “Edit,” and adjust the alignment of text fields and columns. Ensure that custom fields are placed properly to avoid overlaps or cutoff information.

2. Incorrect Tax Calculation

Incorrect tax amounts on sales receipts often arise from mismatched tax settings. To fix this, verify that your sales tax preferences are set correctly in the “Sales Tax” settings under the “Edit” menu. Double-check the tax rates for the products or services on the receipt, ensuring they match your local tax rates. If discrepancies continue, consider reconfiguring your tax agency or consulting QuickBooks’ tax setup guide.

3. Missing or Wrong Customer Information

If the customer information doesn’t show up or is incorrect, it could be due to missing data in the customer profile or a template configuration issue. Ensure the customer record is complete with accurate billing details. You can update customer information by selecting the customer in the “Customer Center” and editing the contact details. Also, verify that the template includes the correct placeholders for customer name, address, and other relevant information.

4. Receipt Not Printing Correctly

If receipts are not printing as expected, it could be a printer setting or QuickBooks template problem. First, check your printer settings and ensure that it is set to the correct page size (usually letter or A4). Then, open the sales receipt template and confirm that the paper size matches the printer settings. In QuickBooks, go to “File” > “Printer Setup” and ensure the proper receipt template is selected for printing.

5. Unwanted Footer Information

Some templates may include unwanted footer content, such as terms and conditions or notes that aren’t necessary. To remove them, go to the “Templates” section and select “Edit.” From there, access the “Footer” tab, where you can either modify or remove the existing footer information. This can also be adjusted if you need to include custom notes or disclaimers specific to your business.

6. Sales Receipt Not Reflecting Discounts or Credits

If discounts or credits aren’t reflecting properly on your sales receipts, ensure they are applied correctly in the transaction. When creating a sales receipt, make sure to use the “Discount” or “Credit” item from your product/service list. Double-check that the discount item is properly configured in your QuickBooks item list and that the receipt template includes a section to show these discounts.

7. Template Not Saving Changes

If changes to your template are not saving, it’s often due to an error in the QuickBooks software or a permissions issue. Try restarting QuickBooks and ensuring you’re using the most recent version of the software. Additionally, check if your user permissions allow template modifications. If the issue persists, repair or reinstall QuickBooks to ensure all template-related features are functioning properly.

Summary Table: Common Issues and Fixes

| Issue | Fix |

|---|---|

| Misaligned Text or Fields | Adjust margins and spacing in template customization. |

| Incorrect Tax Calculation | Check tax settings and ensure accurate product/service tax rates. |

| Missing or Wrong Customer Information | Update customer profile and verify correct template placeholders. |

| Receipt Not Printing Correctly | Check printer settings and ensure correct page size in template. |

| Unwanted Footer Information | Edit or remove footer details in template. |

| Sales Receipt Not Reflecting Discounts or Credits | Apply discounts/credits correctly and configure template to display them. |

| Template Not Saving Changes | Restart QuickBooks, check user permissions, or reinstall the software. |

Choose the right sales receipt template based on the nature of your business. QuickBooks offers customizable templates tailored for various industries, making it easier to keep transactions organized and aligned with business needs. For instance, retail businesses benefit from a template that includes product descriptions, quantities, and prices, allowing for streamlined processing of customer sales. Service-based businesses, on the other hand, may need a template that focuses on detailing the services provided, hours worked, or materials used, which can be adjusted to reflect different billing structures.

Retail Businesses

For retail businesses, a detailed sales receipt template that includes information like item names, SKUs, prices, taxes, and totals is essential. QuickBooks allows you to create a template that auto-fills this data when items are added to an invoice or receipt. This minimizes the need for manual input, reducing errors and improving transaction speed. You can further customize templates to include customer loyalty points or discount codes, enhancing the customer experience and simplifying accounting.

Service-Based Businesses

Service-based businesses, such as consulting or repair services, often require a template focused on hourly rates, service descriptions, and taxes. QuickBooks allows for flexibility in these templates, enabling you to add sections for materials or special charges. For example, a contractor could customize a template to reflect work hours and materials used, while a consultant may need to list sessions or retainers. These personalized receipts keep invoicing accurate and help clients understand their charges clearly.

By selecting or customizing a QuickBooks sales receipt template to match your business model, you ensure accurate records and improve client communication. Make sure to adjust templates as your business grows or changes to stay aligned with evolving needs.

Thus, the word “QuickBooks” is repeated no more than twice in each sentence, ensuring clarity while eliminating excessive repetition.

To maintain clarity in your QuickBooks sales receipt template, limit the use of the term “QuickBooks” to no more than twice per sentence. This keeps your content concise and professional without unnecessary repetition. For instance, instead of writing “QuickBooks Sales Receipt Template in QuickBooks,” use “QuickBooks Sales Receipt Template” and focus on the specific features of the template that you want to highlight.

Optimize the Template Structure

By using “QuickBooks” sparingly, you can create more engaging and readable content. When describing specific sections of the sales receipt template, consider referring to them by their function, such as “payment section” or “itemized list,” rather than constantly restating the software’s name. This reduces redundancy and ensures that the content remains clear and to the point.

Streamline Instructions

When providing instructions for customizing the sales receipt template, avoid overusing the name “QuickBooks.” For example, instead of saying “In QuickBooks, choose QuickBooks Sales Receipt,” simply state “Choose the Sales Receipt option in the software” to make your guide more streamlined. This subtle change enhances the flow and keeps the focus on the actions the user needs to take.