Provide tenants with a clear and accurate receipt for their security deposit return. A well-crafted receipt ensures both parties understand the amount refunded and any deductions made. Use this template to create a document that reflects all necessary details without confusion.

Include the tenant’s name, property address, and date of refund to ensure all essential details are listed. Make sure to mention the total deposit amount, along with any itemized deductions such as cleaning fees or damages. Always be transparent in these entries to avoid misunderstandings later on.

Conclude the receipt by having both parties sign and date it, confirming the transaction is complete. This simple step protects both the landlord and tenant, providing a clear record for any future disputes or verification needs.

Here is the revised version, with minimal repetition:

Ensure clarity in your security deposit return receipt by addressing these points:

- Tenant Details: Include the tenant’s full name and address to avoid confusion.

- Property Information: Specify the address of the rental property being returned to its original condition.

- Deposit Amount: Clearly state the exact amount of the deposit returned or withheld.

- Itemized Deductions: List any damages or unpaid rent deducted from the deposit. Be specific.

- Return Date: Note the exact date when the deposit was returned or any deductions applied.

By following these steps, you ensure that the document remains concise and legally sound, minimizing any potential disputes.

- Security Deposit Return Receipt Template

Ensure the security deposit return receipt is clear and legally binding by including essential details. The receipt should reflect the return of the deposit, outlining the amount, date, and condition of the property.

Here is a simple template to follow:

| Field | Description |

|---|---|

| Tenant Name | Full name of the tenant receiving the deposit refund. |

| Property Address | Complete address of the rented property. |

| Security Deposit Amount | The exact amount being returned. |

| Refund Date | The date the refund is processed. |

| Landlord Name | Full name of the landlord or property manager. |

| Reason for Deduction (if any) | List any deductions for damage or unpaid rent. |

| Final Inspection Notes | Notes on the condition of the property at the time of inspection. |

| Signature of Tenant | Tenant’s signature acknowledging receipt of the deposit refund. |

| Signature of Landlord | Landlord’s signature confirming the deposit return. |

This template helps to ensure that both parties are clear about the refund process, maintaining transparency and avoiding misunderstandings.

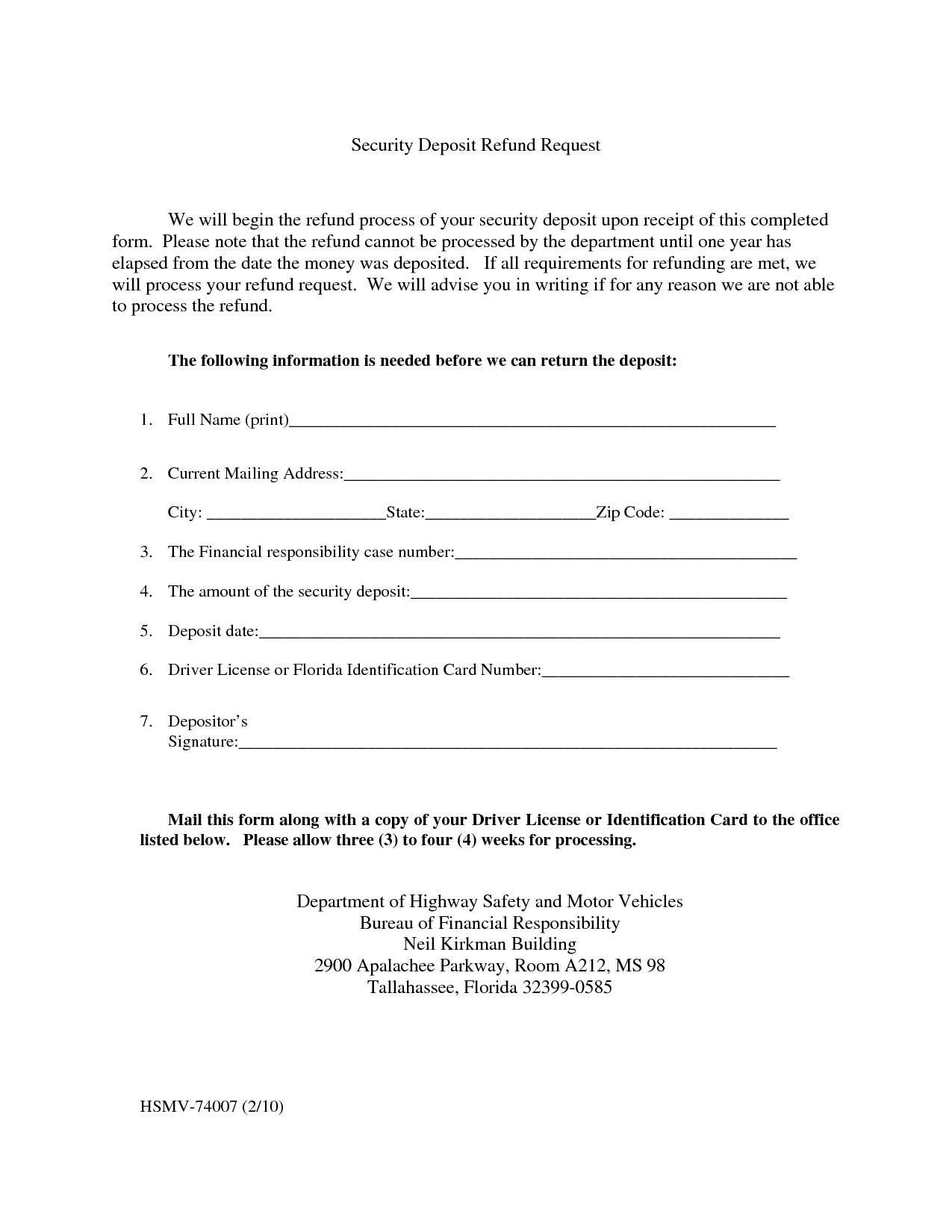

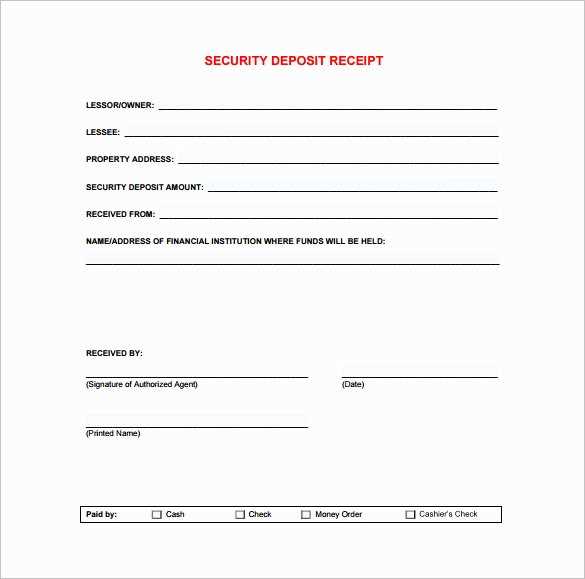

To create a clear and professional security deposit receipt, follow these steps:

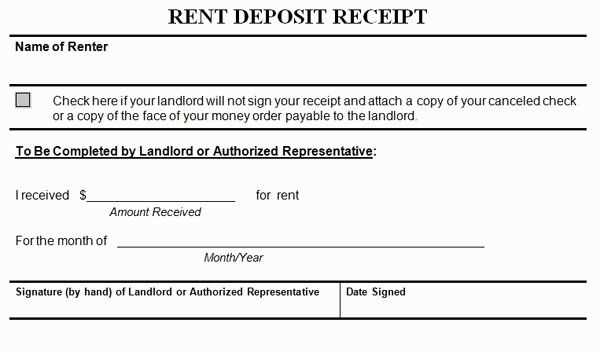

- Header: Begin with a title like “Security Deposit Receipt” at the top of the document for clarity.

- Property and Parties Information: Include details about the property and both parties involved. Mention the tenant’s name, landlord’s name, and property address.

- Deposit Amount: Clearly state the amount of the deposit being paid, preferably in both words and numbers to avoid confusion.

- Payment Details: Specify the method of payment (cash, check, or electronic transfer), along with the date of payment.

- Condition of Property: Note any initial observations of the property’s condition, such as damages or if everything is in good shape, to set expectations for the return of the deposit.

- Return Conditions: Outline the conditions under which the deposit will be returned. This should include how much will be returned if any damages occur or if the lease is not properly fulfilled.

- Signature Lines: Provide space for both the landlord and tenant to sign and date the document. This confirms both parties have agreed to the terms of the receipt.

After completing these sections, keep a copy for both the landlord and tenant for future reference.

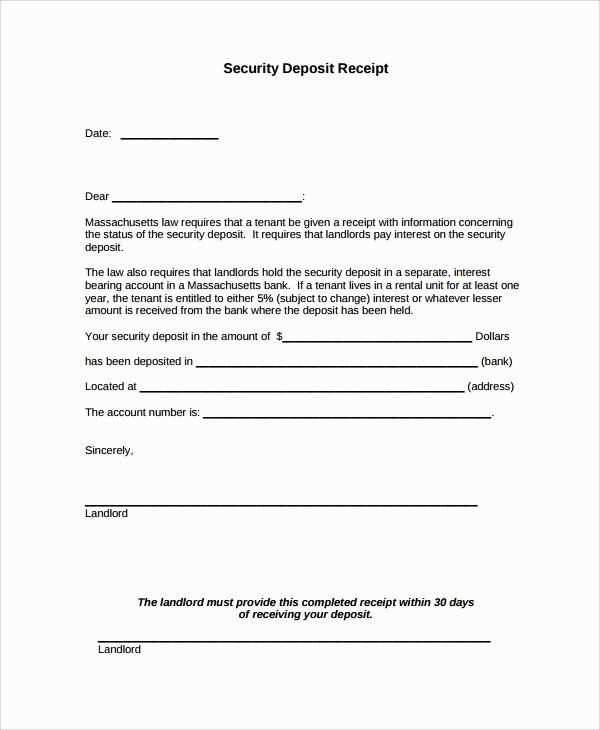

The deposit return receipt should clearly state the full name of the tenant and landlord, as well as the address of the rental property. Include the date the receipt is issued and the total amount of the deposit being returned.

List any deductions made from the deposit, such as for repairs or cleaning. Provide a detailed explanation of each deduction, including the cost and the reason for the charge.

Include the method of payment for the return, whether by check, bank transfer, or cash, and the date it was processed. Also, ensure the tenant’s contact details are included for any future correspondence.

Finally, include a section for both parties to sign, confirming the receipt of the returned deposit and any deductions, which will serve as an official record of the transaction.

Ensure that you return the deposit within the time frame specified in the lease agreement, typically 30 days. Missing this deadline can lead to disputes and legal issues. Familiarize yourself with local laws regarding deposit returns, as they may require specific conditions for deductions or for withholding the deposit in full. Understand the scope of acceptable deductions, such as damages or unpaid rent, and document these carefully with photos and written records. This helps prevent misunderstandings and ensures a fair process for both parties.

State-Specific Requirements

Be aware of variations in state laws regarding security deposits. Some states require landlords to provide an itemized list of deductions within the return period, while others may not. Consult your state’s rental laws to stay compliant and avoid potential conflicts. Always communicate clearly with tenants regarding any charges that will be deducted from the deposit.

Legal Action and Disputes

If a dispute arises regarding the deposit return, tenants can take legal action. In some cases, landlords may be required to pay additional fees if the deposit is wrongfully withheld. Make sure to retain all receipts, photographs, and correspondence to defend your actions if needed.

Inaccurate or incomplete return receipts can cause delays and confusion. Ensure all necessary details are included to avoid such issues.

1. Missing Tenant or Property Information

Make sure the receipt contains the full names of the tenant and the landlord, as well as the property address. If any of these are missing, the receipt might be invalid or hard to verify in case of disputes.

2. Incorrect Deposit Amount

If the return amount listed is wrong, double-check your calculations and documentation. It’s crucial that the security deposit amount and any deductions are clear and reflect the terms in the lease agreement.

3. Unclear Deductions

List every deduction in detail. Avoid vague terms like “damage repair” without specifics. Include receipts or estimates for repairs or cleaning costs. This helps tenants understand the breakdown and prevents misunderstandings.

4. Absence of Date or Signatures

Ensure the return receipt has the correct date of transaction and signatures from both parties. Lack of these elements could undermine the receipt’s legitimacy.

5. Delayed Return of Deposit

If the return is not done within the time frame set in the lease agreement, tenants can seek legal recourse. Make sure the receipt is issued promptly and within the time limits stipulated in the agreement.

6. Not Providing a Copy to the Tenant

Provide a copy of the return receipt to the tenant immediately after signing. This ensures both parties have the same record of the transaction, which can be useful if there are any disputes in the future.

| Issue | Solution |

|---|---|

| Missing information | Ensure all relevant tenant and property details are included. |

| Incorrect deposit amount | Double-check deposit amount and deductions. |

| Unclear deductions | Provide a detailed breakdown of deductions with supporting documents. |

| Missing date or signatures | Ensure receipt has both signatures and the correct date. |

| Delayed return of deposit | Return deposit on time as per lease agreement. |

| No copy for tenant | Provide a copy of the receipt to the tenant immediately. |

Send the deposit return receipt promptly after the return of the deposit, ideally within a few days. This helps avoid disputes and provides clear documentation of the transaction.

Use Clear and Detailed Language

Be specific in detailing the amount being returned, the condition of the property (if applicable), and any deductions made from the deposit. This transparency builds trust and minimizes confusion.

Provide Multiple Delivery Options

- Email: Send a digital copy for quick and easy access.

- Postal Mail: If required, mail a hard copy, ensuring it’s signed and dated.

- Hand Delivery: For added assurance, deliver the receipt in person with a signature from both parties.

Make sure the method used is convenient for both parties and provides proof of receipt. Keep a copy for your records.

To format a return receipt for tenants, clearly state the date the receipt is issued. This helps establish the timeline for the return of the security deposit. Include the tenant’s full name and the rental property address to avoid any confusion. Ensure that both the landlord’s and tenant’s contact information are accurate and up-to-date.

List the total amount of the security deposit returned, highlighting any deductions, such as for repairs or cleaning. Each deduction should be accompanied by a brief description, including the cost and reason for the charge. Provide the final amount the tenant is receiving after deductions.

It’s important to include a statement confirming the tenant’s agreement or acknowledgment of the return amount. A brief note stating that the security deposit is being returned in full or with deductions will make the process transparent. Sign the receipt with the landlord’s or property manager’s signature for validation.

Ensure the receipt is clear, concise, and free from unnecessary jargon. This promotes transparency and reduces any potential misunderstandings.

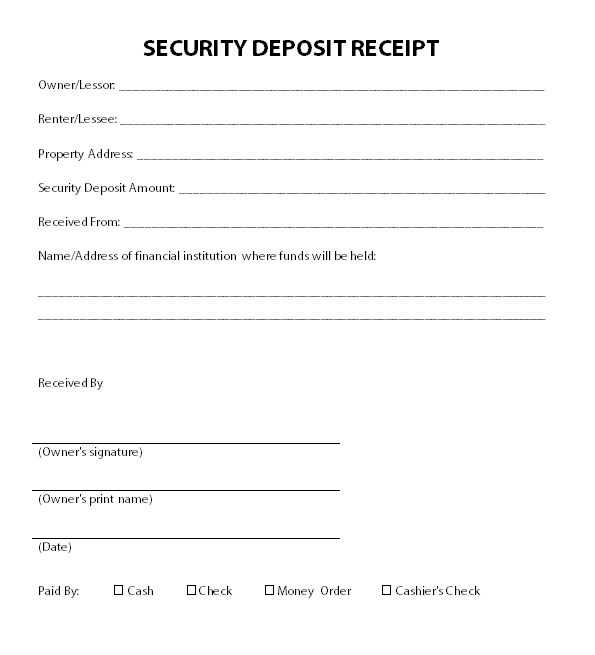

Ensure the security deposit return receipt is clear and precise. Include the following key details:

- Tenant’s Full Name: Clearly list the tenant’s name as it appears on the lease agreement.

- Property Address: Provide the complete address of the rental property.

- Deposit Amount: State the total security deposit amount being returned.

- Amount Deductions: Itemize any deductions from the deposit, specifying the reason for each.

- Remaining Balance: Include the final amount being returned after deductions.

- Return Date: Specify the exact date the deposit is being returned to the tenant.

- Signature: Both landlord and tenant should sign the receipt to acknowledge agreement.

Keep the language direct and avoid unnecessary details. This ensures both parties are aware of the exact amount returned and any deductions made.