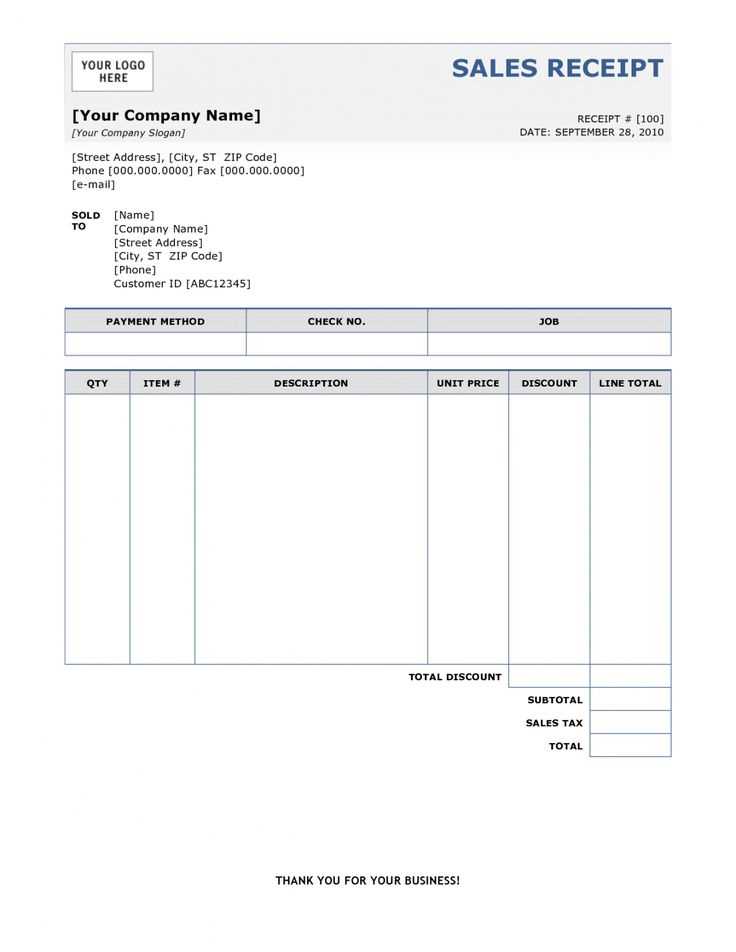

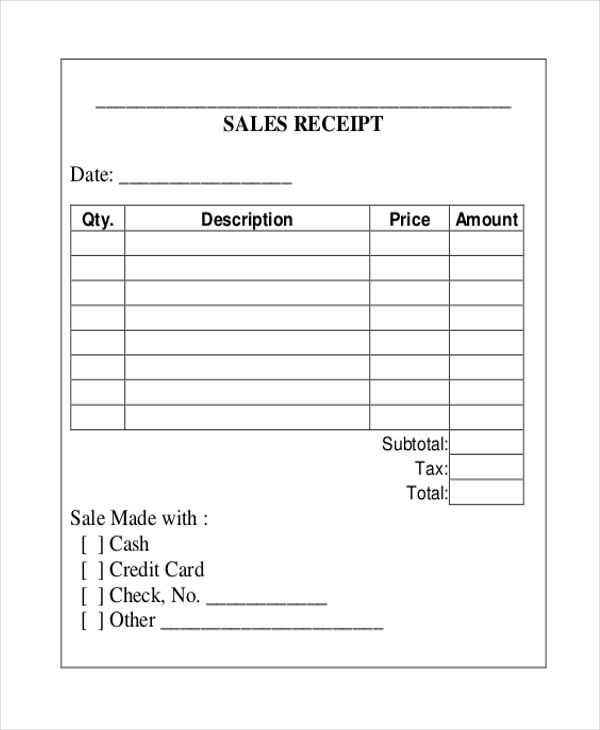

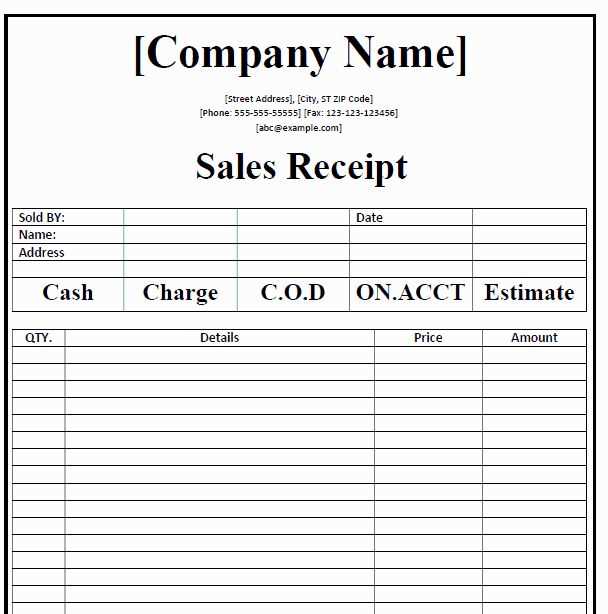

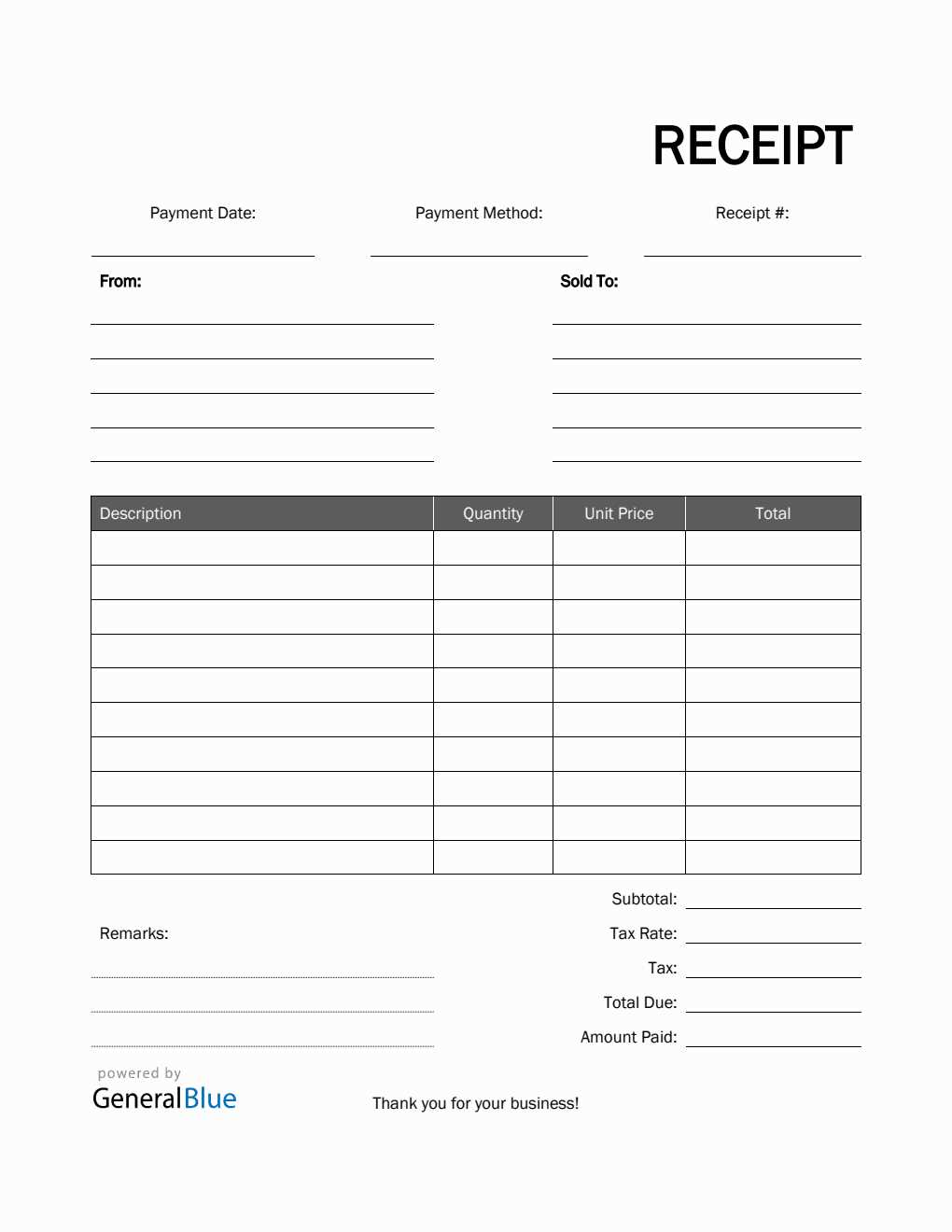

Generate a simple and clean sales receipt using this free template. It includes all necessary sections such as the buyer and seller details, transaction date, items purchased, and total amount. Customizing it for your needs is straightforward–just fill in the required information and print it for your records.

The template ensures clarity by organizing the sale information in a clear, readable format. It also allows for easy adjustments to suit different transaction types, whether you’re selling products or services. Including itemized descriptions, quantities, and prices helps maintain transparency with customers.

If you prefer, you can add your business logo or contact information to make it more personal. The receipt is designed to look professional and can be used across various industries without any complicated design tools or software. It’s ready to be tailored for your specific needs in a matter of minutes.

Here’s a revised version with less repetition of words, while preserving the original meaning and structure:

For a clean and professional sales receipt, include the necessary details clearly and succinctly. Start with the business name, followed by contact information, such as address, phone number, and email. Include the date of the transaction and a unique receipt number for tracking purposes.

Key Elements to Include

List the items purchased, their quantities, and individual prices. Afterward, calculate the total amount, adding taxes where applicable. Provide payment details, such as method (cash, card, etc.), and any change given. Make sure the receipt is easy to read and organized.

Additional Tips

Consider adding your return policy or a thank-you note at the bottom of the receipt. Keep the font consistent and legible to ensure all details are visible. Adjust your template to suit your business needs while maintaining a professional appearance.

- Selecting the Best Template for Your Business

Choose a template that aligns with the needs of your business and simplifies your daily processes. For example, if you run a service-based business, look for a template that includes sections for hours worked or services provided. This will streamline the process of creating receipts for customers. Also, check if the template allows for easy customization, so you can adapt it as your business grows or changes.

Focus on templates that offer a clean, professional design. A receipt should be easy to read and include all necessary details, such as the date, transaction amount, and any taxes. A template with clear formatting makes the receipt not only user-friendly for customers but also organized for your own record-keeping.

Consider templates that include built-in calculations or placeholders for important data, such as item prices, tax rates, and discounts. This can save time, reduce mistakes, and ensure accuracy when issuing receipts to customers.

Finally, test the template before using it extensively. Ensure it prints correctly and looks professional on both paper and digital formats, if you plan to email receipts. Testing helps avoid any formatting issues that could affect your business image.

To customize your sales receipt design, focus on adding your business logo and contact information at the top. Place your logo prominently for brand recognition, ensuring it’s clear and easy to read. Include your business name, address, phone number, and website in a neat, organized format.

Next, adjust the receipt layout to match your brand’s style. If you have a specific color scheme, use it in the text, borders, or background of the receipt. This adds a professional touch and reinforces your brand identity.

Don’t forget to include a personalized message or thank you note at the bottom of the receipt. A short, friendly message can leave a lasting impression on your customers and make them feel valued. Keep it simple and positive, such as “Thank you for your purchase!” or “We appreciate your business.”

Finally, tailor the itemized list to your business needs. Include relevant product descriptions and pricing details. You can also offer discounts or promotional codes, which can be featured prominently to encourage repeat business.

Sales receipts should include the seller’s name, business address, and contact information. This allows the buyer to easily identify the source of the transaction. Ensure the receipt lists the date of purchase for clarity in case of future reference.

The itemized list of products or services is another key component. It should clearly describe each item purchased, including quantity, price, and any applicable taxes. Including the total price at the bottom provides a clear final cost.

A unique receipt number helps with tracking and record-keeping. This number can be used to identify individual transactions for accounting purposes or returns.

Payment method is important to confirm how the transaction was completed–whether by cash, card, or another method. If applicable, include the last four digits of the credit card for additional verification.

Lastly, return policy details may be included to set clear expectations for the customer regarding exchanges or refunds.

Organizing your financial records with a sales receipt can save you time and effort during tax season. Every receipt represents a transaction that should be logged for future reference. Ensure you include the date, total amount, and description of items or services for each transaction, which will be valuable for tracking business income and expenses.

Recording Purchases and Sales

When using a sales receipt, it’s important to record both purchases and sales consistently. By categorizing each receipt properly, you can easily differentiate between income and expenses, which helps when assessing profitability and managing cash flow. Keep these records in an organized digital or paper format to ensure accuracy in your financial reports.

Preparing for Tax Filing

Sales receipts are a key tool during tax filing. They serve as proof of income and expenses, and when arranged systematically, they streamline the process. For accurate deductions, track any sales tax and consider consulting with a tax professional for specific guidance on how receipts impact your returns.

After finalizing your sales receipt design, save it in an appropriate file format like PDF or Word to maintain its formatting. These formats ensure compatibility with most devices and printing methods. PDF is preferred for its universal accessibility and consistent layout appearance, regardless of where it is viewed or printed.

- Click on the “Save As” option in your software to choose the file type.

- For PDF, select “PDF” from the file format dropdown list.

- For Word documents, choose “DOCX” for ease of editing and sharing.

To distribute the receipt, consider using email or cloud storage for easy access. Email allows for direct sending to customers, while cloud storage offers secure storage and quick sharing links for customers to download their receipts at any time.

- When emailing, attach the saved receipt file and include a short message confirming the transaction.

- If using cloud storage, create a shareable link to the receipt and send it to customers via email or SMS.

Additionally, for in-person sales, print the receipt directly from your layout file, ensuring your printer settings are configured correctly for a clear, legible output. Always test the print layout before issuing a batch of receipts.

Ensure that your sales receipts comply with local laws and regulations. Many jurisdictions require businesses to provide receipts for transactions involving goods or services, both for record-keeping and consumer protection purposes.

- Data Accuracy: Make sure the receipt includes accurate information, such as the date of purchase, the description of items, the amount paid, and the method of payment.

- Tax Requirements: Include relevant tax details like sales tax, VAT, or other applicable taxes as required by law in your area. This ensures compliance with tax authorities.

- Business Information: Receipts should display your business name, address, and contact details. Some regions may require registration numbers or tax ID numbers to be listed.

- Consumer Rights: Keep receipts available for refunds or warranty claims. In some places, receipts serve as proof of transaction for returns or exchanges, so retaining them is often beneficial for both parties.

Familiarize yourself with local regulations and adjust your templates accordingly to meet specific legal standards.

Use clear, concise headings to organize your sales receipt template. The main title should stand out, followed by subheadings that direct the user through specific sections. Start with sections such as “Transaction Details,” “Itemized List,” and “Payment Method.” Each subheading should correspond to a specific task to guide users seamlessly through the receipt creation process.

For example, in the “Transaction Details” section, include fields for the date, transaction ID, and business name. Under “Itemized List,” provide spaces to list each product or service, along with its price. Ensure that each section is distinct and focused on a specific task to maintain clarity and ease of use for both the creator and the recipient of the receipt.

By structuring your template with these practical subheadings, the layout becomes intuitive, ensuring that users can easily generate a professional receipt without confusion. Keep the design simple and organized for maximum utility.

Got it! Let me know if you need assistance with a specific article or topic you’re working on!