A pre-printed in-kind donation receipt template streamlines the process of acknowledging donations and ensures compliance with tax regulations. It allows organizations to issue professional, consistent receipts quickly without having to create new documents from scratch each time a donation is received.

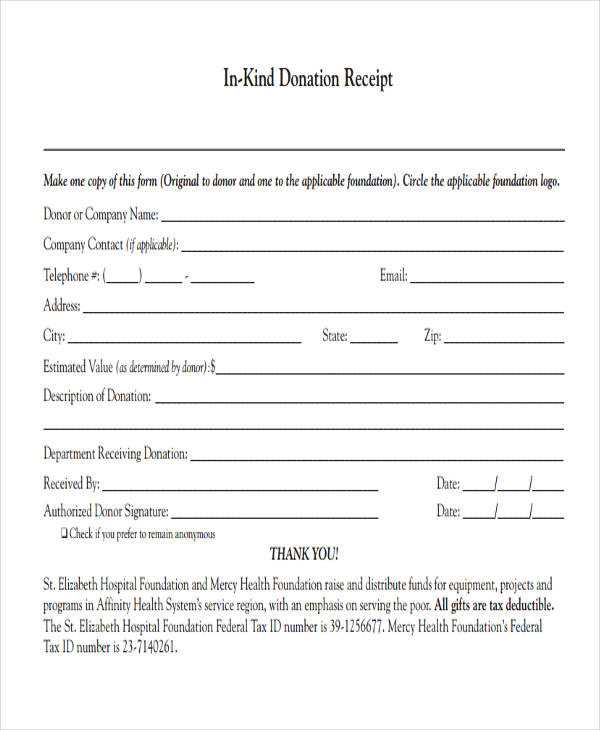

The template should include all necessary information: donor’s name, donation description, estimated value, and the date of the donation. Ensure that your receipt also clarifies the non-cash nature of the gift, as this is critical for accurate tax reporting. For convenience, add a checkbox or section where the donor can select the method used to estimate the donation value, whether through fair market value or another established standard.

When designing the template, maintain clarity and simplicity. Include fields for your organization’s name and address, as well as space for a signature or authorization from a responsible party. The pre-printed nature of the template makes it easier to batch receipts for donors, saving time while still adhering to legal requirements. Be sure to provide adequate room for customization in case additional donor information is needed.

Using a pre-printed template saves time and ensures consistency in your organization’s donation acknowledgment process. It helps keep everything organized and professional, while maintaining transparency with donors. With the right template, you can ensure both donors and your team are on the same page about the value and specifics of each gift received.

Here’s the revised version of the text with removed repetitions, while maintaining the original meaning:

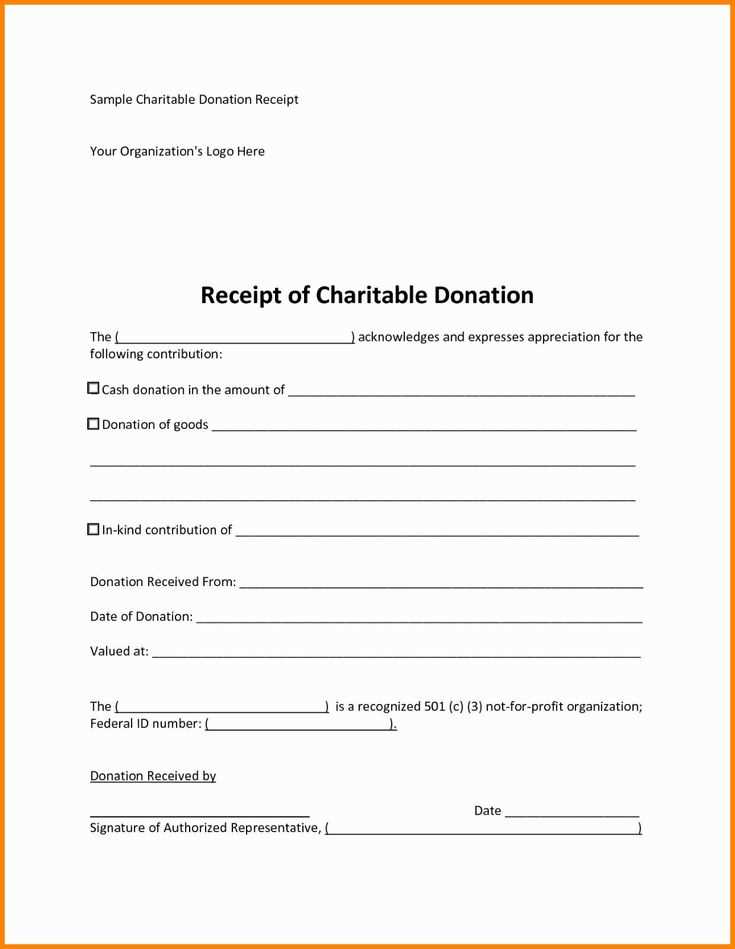

To ensure a clear and concise donation receipt template, focus on eliminating unnecessary duplication while preserving the core message. Begin by stating the name of the organization, followed by the donor’s name and contact details. Clearly mention the date of the donation and a description of the item(s) or amount donated. Include a statement that confirms no goods or services were provided in exchange for the donation, if applicable.

Key elements to include in the template:

- Organization name and contact information

- Donor’s full name and address

- Date of donation

- Description of the donated goods or amount

- Statement of no goods or services received, if relevant

- Signature of authorized representative

Ensure the language is straightforward and free from unnecessary phrases. This will make the receipt clear for both the donor and the organization, avoiding confusion. A simple, structured format enhances readability, making it easier for recipients to keep track of their donations for tax purposes.

- Pre-Printed In-Kind Donation Receipt Template

A pre-printed in-kind donation receipt template simplifies the process of acknowledging donations of goods or services. These templates provide a standardized structure, making it easier to create accurate and professional receipts. Ensure that the template you choose complies with local tax laws and guidelines for charitable donations.

Key Elements of an In-Kind Donation Receipt

The receipt should clearly outline the following information:

- Donor Information: Name, address, and contact details.

- Donation Details: A brief description of the donated item(s), including the condition and fair market value (if required).

- Charity Information: Name, address, and contact details of the organization receiving the donation.

- Date of Donation: The specific date the donation was made.

- Tax-Exempt Status: A statement confirming the organization’s tax-exempt status, if applicable.

- Signature: A space for both the donor and the charity representative to sign, confirming the donation.

Tips for Customizing a Pre-Printed Template

Customize the template to match your organization’s branding and to meet specific legal or organizational requirements. Ensure there is space to input the value of each donated item and include any necessary disclaimers about the organization’s role in valuing the donation. Avoid offering tax advice or valuations, as this is the donor’s responsibility.

Start by including the donor’s full name and address. This helps identify who made the donation and is required for tax purposes.

Clearly describe the donated items, specifying the type, quantity, and condition. For example, instead of simply stating “clothing,” specify “10 gently used winter coats.” This level of detail is crucial for the donor’s records and accurate valuation.

State the date of donation. This helps establish the time frame for tax filings and ensures the donation is properly recorded for the year it was made.

Provide a statement that no goods or services were provided in exchange for the donation. This ensures the donor understands the full value of the donation is tax-deductible.

If possible, assign a fair market value (FMV) to the donated items. This is often necessary for the donor’s tax deductions, especially when the value is significant. If you are unable to determine the value, you can leave this part open or provide a range for the donor to estimate.

End with the signature and title of the authorized representative from your organization. This adds credibility and ensures the donor knows the receipt is official.

Customizing a pre-printed receipt for your organization requires careful attention to detail. You need to ensure the design aligns with your brand identity and meets legal requirements for donation receipts. Follow these steps to tailor a pre-printed template effectively:

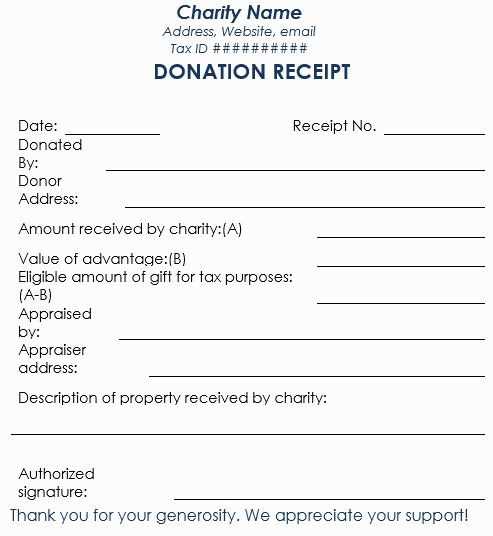

1. Include Required Legal Information

Your receipt must include all mandatory details as outlined by local tax authorities. This usually includes the organization’s name, address, tax ID number, and a statement about the non-deductible portion of a donation if applicable. Double-check the wording to ensure compliance with the tax laws in your jurisdiction.

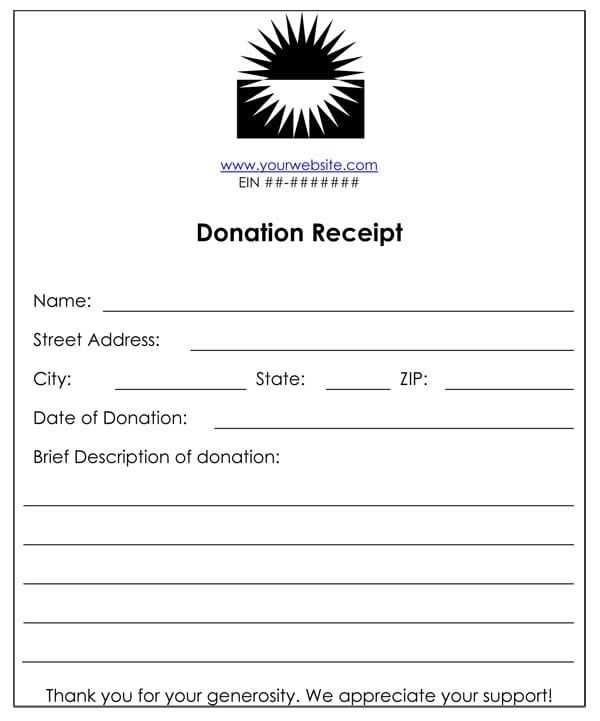

2. Add Your Organization’s Logo and Branding

Incorporate your logo and color scheme to make the receipt easily identifiable as coming from your organization. This helps strengthen your brand and provides a professional touch. Ensure the logo is positioned clearly but doesn’t overwhelm the receipt’s functionality.

3. Customize the Donation Description

Modify the receipt’s template to specify the type of donation–whether it’s monetary, in-kind, or services. Include details like the quantity and description of in-kind donations. Be specific about the goods or services donated to avoid ambiguity.

4. Add Custom Text or Thank You Messages

Consider adding a short message or a thank-you note on the receipt. This adds a personal touch that can foster goodwill and encourage future donations. Keep the tone warm yet professional.

5. Maintain Readable Format

While it’s important to customize the design, readability should remain a priority. Choose fonts that are clear and easy to read, and avoid cluttering the receipt with too many elements. Leave enough space between sections for a clean, organized layout.

6. Keep Donation Amount and Date Clear

The donation amount, date, and donor’s name must be immediately visible. This ensures the receipt serves its purpose for both the donor and the tax authorities. Arrange these details prominently at the top of the receipt.

7. Test the Template

Before finalizing the design, print a few test receipts. This helps you check how the information appears on paper, and if there are any alignment issues. Make adjustments as necessary to ensure the receipt looks professional and functions correctly.

8. Use a Template that Supports Flexibility

Choose a pre-printed receipt template that allows you to make future changes easily. This ensures you can update any part of the design or information without needing to reprint a whole batch of receipts. Look for templates that provide space for customization without limiting functionality.

Example of a Customized Receipt

| Details | Information |

|---|---|

| Organization Name | Example Charity Inc. |

| Tax ID Number | XX-XXXXXXX |

| Donation Description | Two Boxes of Winter Clothing |

| Donation Amount | $150.00 |

| Donor’s Name | John Doe |

| Date of Donation | March 12, 2025 |

| Thank You Note | Thank you for your generous donation! Your support makes a difference. |

By following these steps, you can ensure that your pre-printed receipt meets both functional and branding needs, while also providing your donors with the documentation they need for tax purposes.

Donation receipts must meet specific legal standards for donors to claim tax deductions. These standards vary by jurisdiction, but certain information remains consistent across most regulations.

Ensure your receipt includes:

| Requirement | Details |

|---|---|

| Donor’s Information | The name and address of the donor must be clearly stated. |

| Charity’s Information | The charity’s name, address, and tax-exempt status (or registration number) must be included. |

| Donation Amount | State the exact monetary value or a description of the donated goods, including an estimated value for in-kind donations. |

| Receipt Date | Provide the exact date of the donation. |

| Statement of No Goods or Services | For tax purposes, if the donor did not receive any goods or services in exchange for the donation, state that clearly. Otherwise, describe what was received. |

| Signature | The receipt should be signed by an authorized person from the charity. |

Be mindful of the specific requirements set by your country or state. Some regions also require receipts for donations over a certain amount to include additional details or special forms. Double-check local tax laws to confirm the full list of mandatory elements for donation receipts.

Using a template that includes all necessary legal requirements helps ensure compliance and streamline the process for both the donor and the charity. Keep records of all receipts issued, as this may be required for auditing purposes.

Start by gathering as much detail as possible about each donated item. For items like electronics, furniture, and collectibles, research their current market value. Use online marketplaces, like eBay or Amazon, to check prices for similar items in comparable condition. This will give you a baseline for valuing the donation.

Documenting Condition

The condition of a donated item directly impacts its value. Clearly assess whether the item is new, gently used, or showing signs of wear. Donors should provide information about the item’s age and condition. For example, a slightly used TV will be valued lower than a new one. Take photos of the items to document their state at the time of donation.

Use of Third-Party Valuation Tools

For high-value or specialty items, consider using professional appraisal services. These experts can provide a more precise value for rare or high-end donations. Keep in mind that the IRS requires appraisals for any single donation worth over $5,000. If you’re unsure about an item’s worth, having an expert opinion will ensure accuracy.

Always keep detailed records, including receipts, descriptions, and photos. If an IRS audit occurs, proper documentation will be crucial. Accurate valuation protects both the donor and the organization receiving the donation, ensuring compliance with tax laws.

For items without an established resale value, organizations can use valuation guides such as IRS Form 8283, which offers suggested values for common donated items. This guide will help streamline the process and ensure that the valuation is reasonable.

When creating donation receipts, prioritize donor privacy and compliance with regulations like GDPR or CCPA. Always gather only necessary information for the receipt, such as the donor’s name, donation amount, and date. Avoid including sensitive details like phone numbers, addresses, or payment methods unless required for tax purposes or legal documentation.

Data Minimization

Limit the data included in the receipt to the basics. Donor contact details should only appear when essential for communication purposes, such as for sending thank-you notes or annual tax reports. Avoid storing unnecessary personal data after the receipt is issued, as keeping excess information could lead to data privacy issues.

Encryption and Security

Ensure donor information is stored securely. Use encryption methods for both physical and electronic records. For digital receipts, opt for secure transmission methods like HTTPS. Consider using password protection for email receipts to prevent unauthorized access. Protect sensitive information at every step of the data-handling process, from collection to storage.

- Encrypt digital receipts during storage and transfer.

- Limit access to donor information to authorized personnel only.

- Use secure servers and backup methods for data storage.

Always inform donors about how their information will be used. A clear privacy policy should outline how donor details are handled and protected. Give donors control over their data by allowing them to opt out of communications or request the deletion of their information if they wish.

One of the most common mistakes is failing to accurately describe the donated items. A vague description can lead to confusion and may even impact the donor’s ability to claim a tax deduction. Make sure each item is listed with enough detail to provide a clear understanding of what was donated. For example, instead of “furniture,” specify “a wooden dining table and six chairs.”

Another frequent error is neglecting to assign a fair market value (FMV) to the donated items. Donors rely on this information to report donations on their tax returns. If you’re unsure of the value, research similar items or request assistance from a professional appraiser. Avoid guessing or leaving the FMV blank, as this could cause problems later.

Misidentifying the Donor

Incorrectly recording the donor’s information can lead to serious issues. Double-check the donor’s name, address, and other relevant details before issuing the receipt. This ensures the record is accurate and avoids any complications if the donor ever needs the receipt for tax purposes.

Not Including the Necessary Legal Statement

In some jurisdictions, receipts must contain specific legal language to comply with tax laws. Failing to include required statements, such as the declaration that no goods or services were exchanged for the donation, can result in the receipt being invalid. Always check the local regulations to ensure compliance.

- Include a statement about non-compensation for the donation

- Provide a disclaimer about any appraised values if applicable

Lastly, make sure the receipt is timely. Delayed receipts might not be useful for tax purposes if they fall outside the donor’s filing window. Issue receipts as soon as possible after the donation is made.

For creating a pre-printed in-kind donation receipt template, it is crucial to ensure clarity and compliance with tax regulations. Begin with clear, concise headings, such as “Donor Information” and “Donation Details,” followed by specific fields like donor name, address, donation date, and a description of the item(s) donated.

Make sure to include a line that states the nonprofit did not provide any goods or services in exchange for the donation, as required by the IRS. This keeps the receipt valid for tax deduction purposes. If applicable, add an estimate of the fair market value of the donated goods.

Incorporate a section with the nonprofit’s legal name, tax identification number (TIN), and a brief thank you note. This ensures that the donor has all the necessary information for their records and tax filing. Keep the design simple and easy to read, using a clean layout with proper alignment for each field.

Lastly, consider including a reminder for donors to keep their receipts for tax purposes, as well as an option to print or request an official receipt from the organization if they prefer a signed version.