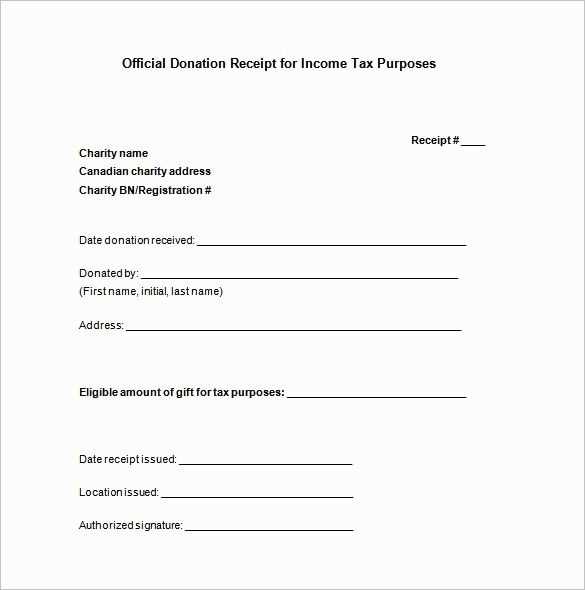

A charitable contribution receipt letter provides a formal record of donations made to a nonprofit organization. It’s an important document for both the donor and the charity, offering proof of the transaction for tax purposes. The letter should clearly outline the donation’s details, including the date, amount, and any goods or services provided in return.

Begin the letter by acknowledging the donation with a personalized and warm tone. This helps strengthen the relationship between the charity and the donor. Specify the exact amount donated or describe the items if it’s a non-monetary gift. If applicable, mention any benefit the donor received, such as tickets or meals, as this affects the total tax deduction they can claim.

Ensure the letter includes the organization’s contact information, including the official name, address, and tax identification number. These details help verify the legitimacy of the receipt. End the letter with a thank you statement, reinforcing appreciation for the donor’s support and emphasizing its positive impact on the community or cause.

Charitable Contribution Receipt Letter Template

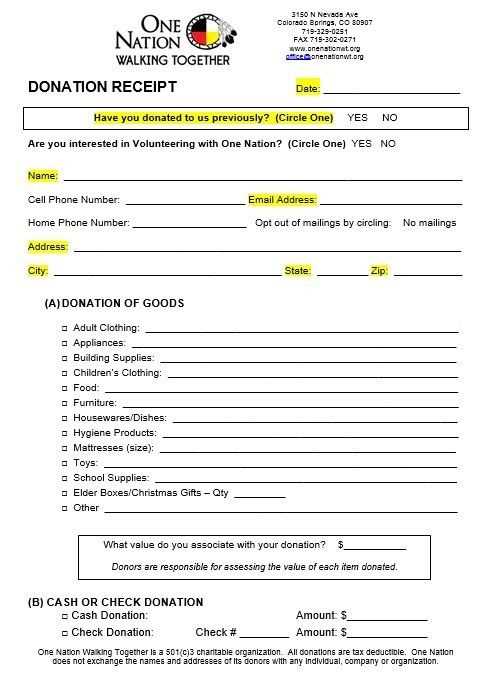

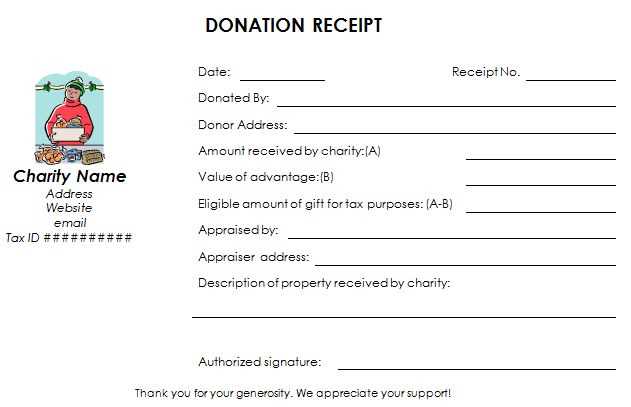

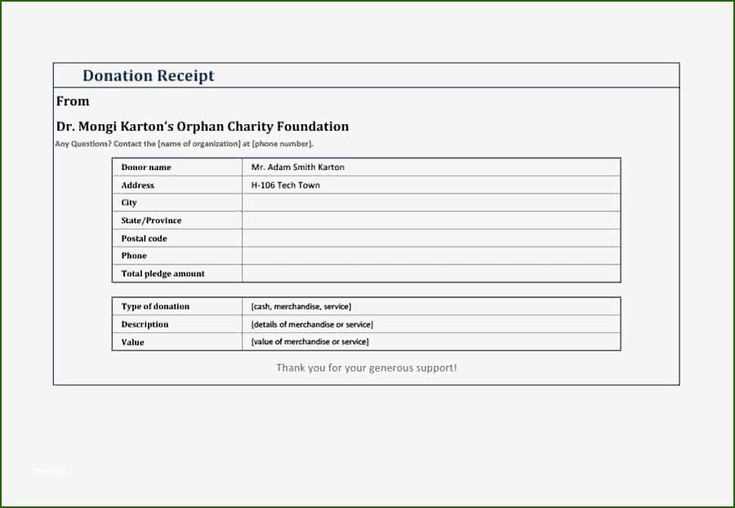

For organizations providing charitable contributions, having a clear and accurate receipt template is a must. The letter should include key details for both the donor and the organization. Below is a template you can use when issuing charitable contribution receipts.

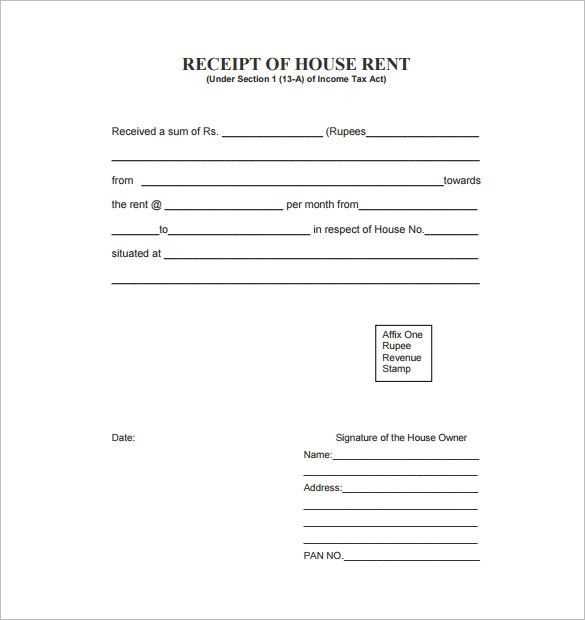

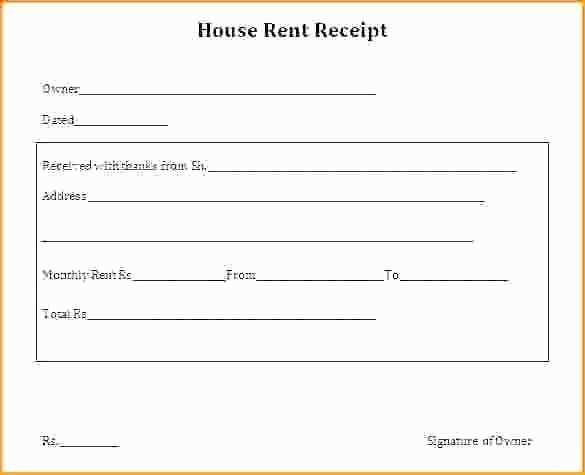

- Organization’s Name and Contact Information: Include the full legal name of your charity, address, phone number, and email.

- Donor’s Information: List the donor’s full name, address, and any other identifying details you may have (like email or phone number).

- Contribution Details: Clearly state the amount or description of the donation. If it is a non-monetary gift, describe the donated items with their estimated fair market value.

- Date of Donation: The date when the donation was received should be included.

- Tax-Exempt Status Notice: Include a reminder that the donation is tax-deductible. For instance: “This contribution is tax-deductible to the extent allowed by law.”

- Signature: Include the signature of an authorized representative from your organization. This adds legitimacy to the receipt.

Make sure your charitable contribution receipt is clear and concise. Avoid unnecessary language or jargon. By following this structure, you’ll provide your donors with a professional and trustworthy record of their contributions.

How to Start Your Charitable Contribution Letter

Begin by addressing the donor with a personalized greeting. This helps set a warm, appreciative tone right from the start. Mention the full name of the donor or use a respectful title if necessary.

Include Donation Details

Clearly state the contribution made. Include specifics like the amount donated, the date of the donation, and if applicable, the items or services contributed. This shows that you are keeping accurate records and acknowledging their generosity properly.

Express Gratitude

Directly thank the donor for their support. Acknowledge the impact their contribution will have, whether it’s on your organization or the cause you’re working on. Keep it sincere and specific to avoid sounding generic.

- “Thank you for your generous donation of $500 on March 10, 2025.”

- “Your contribution will help fund our educational programs for underprivileged children.”

Key Information to Include in the Receipt

Include the name of the donor. This is the primary piece of information, as it identifies who made the contribution.

Record the date of the donation. This helps in tracking the donation for both the donor and the organization.

Specify the amount of the donation. If it’s a monetary donation, list the exact value. For non-cash gifts, describe the items and their estimated fair market value.

Detailed Description of the Donation

If the donation is in-kind, provide a clear description of the items given. For example, list the type of goods, their condition, and any other relevant details to establish their value.

Tax Deductibility Statement

State whether the donation is tax-deductible. If so, include a brief note confirming that no goods or services were exchanged for the donation, ensuring that the donor can claim the full amount as a deduction.

Formatting Guidelines for a Professional Appeal

Use clear, readable fonts like Arial or Times New Roman at a size of 11 or 12 points. This ensures the letter remains professional and easy to read. Avoid decorative or hard-to-read fonts.

Maintain consistent margins of about 1 inch on all sides. This will give your letter a clean, organized appearance and prevent it from feeling cluttered.

Align the text to the left, as this is the most commonly accepted format for professional documents. Avoid center-aligning or justifying the text, as these can create awkward spacing and reduce readability.

Ensure the spacing between paragraphs is adequate–usually, a 1.5 line spacing is ideal. This will make your letter more pleasant to read and ensure that each section is clearly separated from the next.

Break the content into logical sections with clear headers to guide the reader. Use bold or underlined text for section headings to make them stand out, but keep it minimal to maintain a professional tone.

Avoid using excessive bullet points. If you need to list multiple items, consider using a table for clearer organization.

| Component | Details |

|---|---|

| Font | Arial, Times New Roman, 11 or 12 pt |

| Margins | 1 inch on all sides |

| Alignment | Left-aligned |

| Line Spacing | 1.5 lines |

| Headings | Bold or underlined, no excessive styling |

| Bullet Points | Minimal use; consider a table for lists |

Include a professional closing statement at the end, followed by your signature, to leave a lasting impression of formality and respect. Always double-check the letter for spelling or grammatical errors before sending it.

Addressing the Donor Correctly and Respectfully

Always use the donor’s full name when addressing them in a letter. If the donation was made by a couple, include both names. For example, write “Mr. and Mrs. John Doe” instead of just “The Does” or “John Doe.” This adds a personal touch and shows respect.

In some cases, the donor may prefer a more formal or informal address. If you are uncertain, it’s safer to lean towards formal titles such as “Dr.” or “Ms.” unless the donor has explicitly indicated otherwise. This ensures that you avoid any unintended assumptions.

Begin the letter with a greeting that matches the tone of your relationship with the donor. A simple “Dear [Donor’s Name]” is both respectful and professional. Avoid overly casual greetings like “Hi” or “Hello” unless the donor is known to prefer it.

Consider the tone of your communication throughout. Acknowledge their support with a statement that directly reflects the significance of their donation. For example, you might say, “Your generosity enables us to continue our mission…” rather than simply “Thank you for your donation.” This conveys that you truly value their contribution.

Legal Requirements and Tax Implications

To ensure compliance with tax regulations, a charitable contribution receipt must contain specific information. The IRS requires that donations of $250 or more be acknowledged in writing by the recipient organization. This acknowledgment should include the donor’s name, the donation amount, and a statement confirming that no goods or services were provided in exchange for the contribution.

For contributions under $250, no written acknowledgment is mandatory, but the donor must still retain evidence of the donation. A canceled check, bank statement, or similar proof is acceptable. For non-cash donations valued at more than $500, the donor must complete IRS Form 8283, and the charity is required to sign it.

Tax Deductions for Donors

Donors may deduct their charitable contributions if they itemize deductions on their tax returns. The deduction amount depends on the type of donation. Cash donations are generally deductible at the full amount, while non-cash donations may require a qualified appraisal if their value exceeds $5,000. Make sure the receipt includes a description of the donated items, as well as the date and location of the donation.

Impact on the Charity

Charitable organizations must also maintain proper records for tax-exempt status. They should issue receipts that meet IRS requirements and keep copies of all acknowledgment letters for at least three years. These records will be necessary if the organization is audited or needs to verify its operations for tax purposes.

Common Mistakes to Avoid in the Letter

Be clear and concise. Avoid vague language that can confuse the recipient. Specify the amount of the donation, the date, and a description of the items or services donated. Incomplete details can lead to misunderstandings and delay tax reporting.

Inaccurate Donation Amount

Ensure that the donation amount is accurately reflected. If there is any discrepancy, it can complicate the recipient’s record-keeping and tax filings. Double-check all numbers before finalizing the letter.

Missing Donor Information

Include the full name and contact details of the donor. Leaving out these details could result in problems with acknowledgment or tax documentation. Always confirm that the donor’s information is up to date.

Do not mix donation types. Clearly differentiate between monetary and non-monetary gifts. If the letter covers both types, make sure each is addressed separately to avoid confusion.

Avoid vague or generic language. Be specific about the items or services donated, especially for non-monetary contributions. The more detail provided, the easier it is for the recipient to account for the donation.