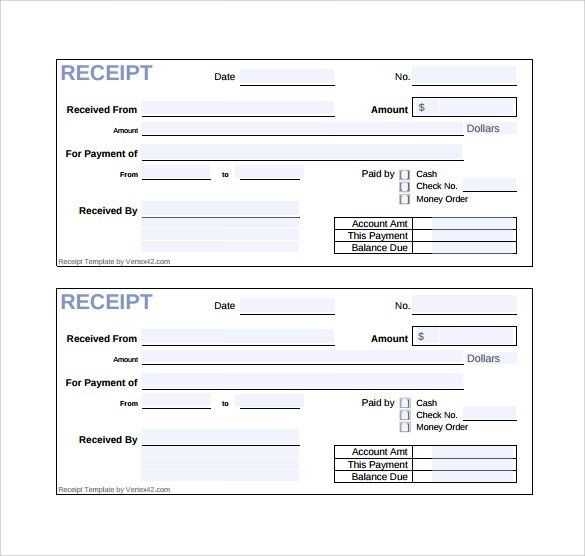

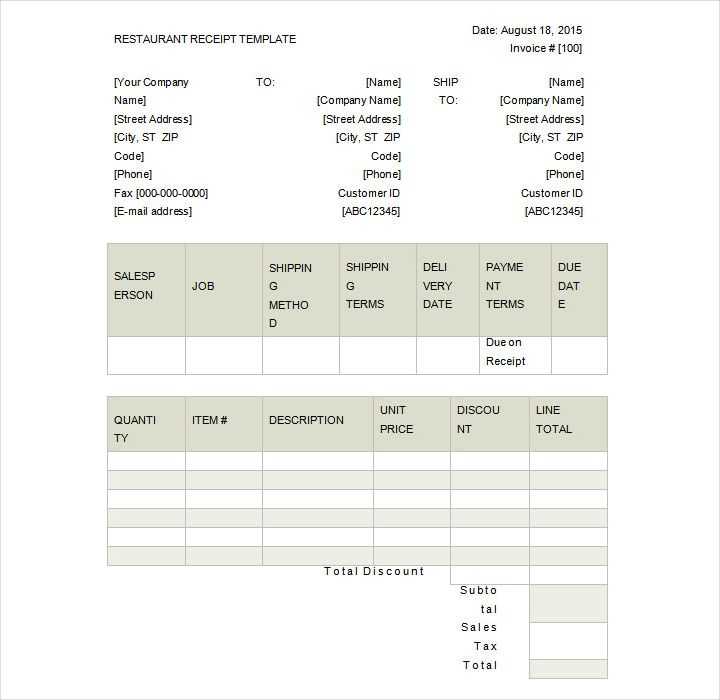

To create an accurate and user-friendly food service receipt, focus on clear itemization. Each dish or service provided should have its own line, with the price clearly stated next to it. Avoid long descriptions; instead, use simple item names that are easy for customers to understand. Include any applicable taxes or service charges at the bottom to ensure transparency.

Next, include space for the transaction date, order number, and the customer’s contact information, if relevant. These details help with tracking and referencing orders in case of issues or future promotions. Use a clean, readable font and avoid clutter to maintain professionalism.

Finally, provide a section for payment method and total amount. Be sure to indicate the method used–whether it’s cash, card, or digital payments–to avoid any confusion. A final clear breakdown of costs helps both the customer and staff quickly verify the transaction details.

Food Service Receipt Template: Practical Guide

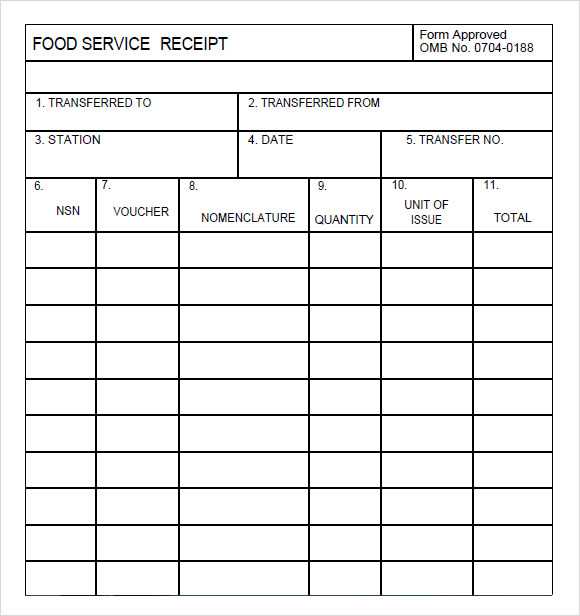

For creating a food service receipt template, focus on clarity and simplicity. A well-structured receipt is easy to read and helps both the customer and service provider track transactions. Start with key details like the date, location, and itemized list of charges.

Key Components of a Food Service Receipt

- Date and Time: Always include the date and time of the transaction. This ensures accurate records for both customers and businesses.

- Business Information: Include the name, address, and contact information of the restaurant or food service.

- Itemized List: List all purchased items with descriptions and prices. Be specific to avoid confusion.

- Subtotal: Before taxes and tips, display the total cost of the items ordered.

- Taxes and Tips: Clearly show the tax rate applied and any gratuities added. This transparency helps avoid misunderstandings.

- Total: The final total should be prominently displayed, including taxes and tips.

Design Tips for Readable Receipts

- Use Clear Fonts: Choose legible fonts and ensure text is properly spaced for easy reading.

- Logical Flow: Organize the information in a way that guides the customer through the receipt from top to bottom.

- Minimalistic Layout: Avoid clutter. Keep the design simple with clear headings for each section.

Choosing the Right Format for Your Template

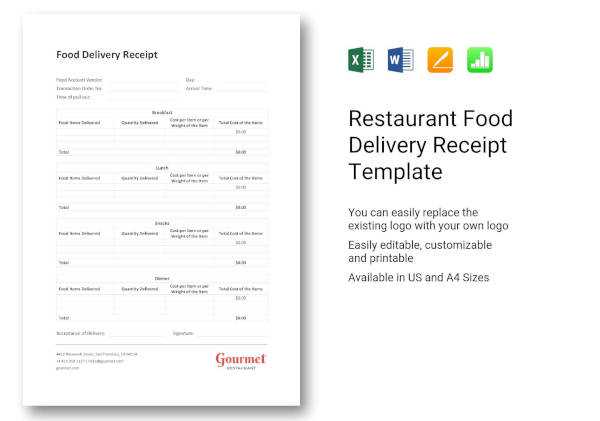

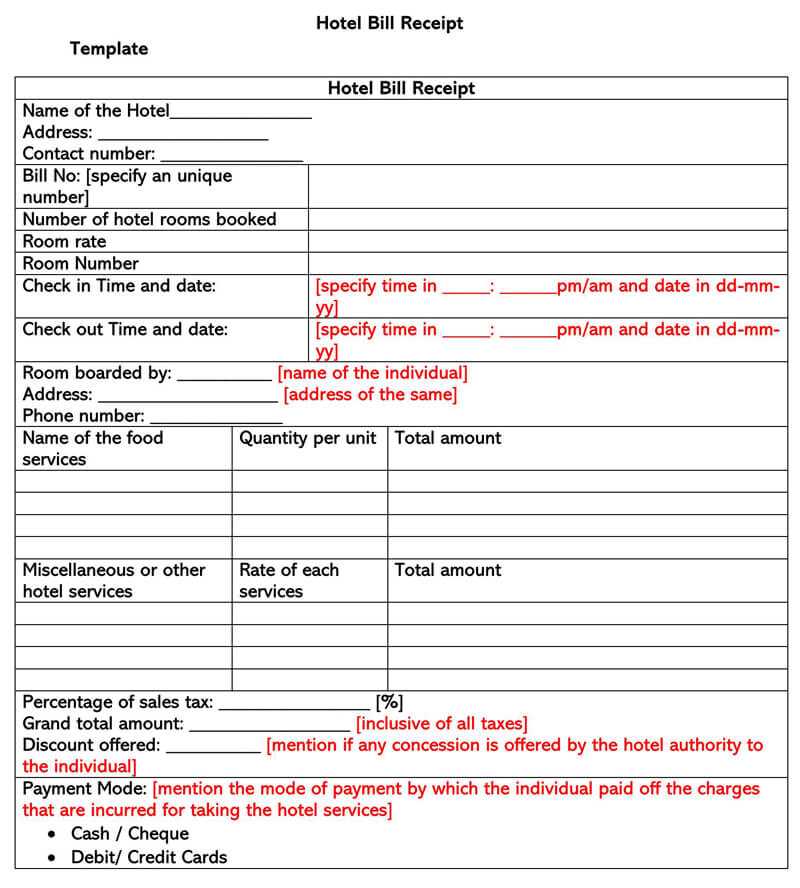

Select a format that aligns with your business needs and is easy for customers to understand. A well-structured template includes clear sections for order details, pricing, and payment terms. Keep the design simple and professional, ensuring each element is easy to read and find.

Consider using a digital format, such as PDF or a Word document, for easy distribution and storage. PDFs maintain consistent formatting across devices and platforms, ensuring the template looks the same on any device. Word documents offer flexibility for quick edits and updates but may require additional software for consistent presentation.

If your service uses a POS system, ensure the template integrates seamlessly with it. This saves time and reduces the chances of errors in entering information manually. Some POS systems offer customizable receipt templates that you can adjust to meet your specific requirements.

Always leave space for your company logo and contact details to reinforce branding. Include sections for item descriptions, quantities, prices, and any applicable taxes. A footer with your terms and conditions, return policy, or special instructions can be added for clarity and customer satisfaction.

Lastly, test your template across different devices and printing formats. A format that works well on a tablet might not be optimal for a print receipt. Adjust the layout accordingly to ensure it looks professional in both digital and physical formats.

Customizing the Layout for Different Service Types

Adjust the receipt layout based on the service type to streamline the user experience and improve clarity. For counter service, keep the layout simple with a clear breakdown of items, prices, and totals. Include space for tips or service charges if needed. For table service, consider adding sections for itemized orders, server names, and customer comments. It’s helpful to leave space for additional details like special requests or service charges. This ensures a smooth transaction process for both customers and staff.

Quick Service

For quick service setups, focus on speed and simplicity. Display only the essentials–item names, prices, and total amount due. Use larger fonts for totals and make the tax breakdown clear but concise. This helps customers quickly understand their purchase without unnecessary details.

Fine Dining

In fine dining environments, the receipt layout should reflect the premium service. Include the restaurant’s logo, a detailed breakdown of the meal, and any additional charges like corkage fees or gratuity. Allow space for a personalized message from the staff, which can enhance the customer’s overall dining experience. Keep the design elegant but easy to read, with well-spaced items and clear section headers.

Including Key Information on a Food Service Receipt

A food service receipt should capture all necessary details clearly. Include the following to ensure accuracy and clarity:

- Restaurant Information: Name, address, and contact details of the establishment.

- Transaction Date and Time: Specify when the transaction took place to avoid any confusion.

- Items Ordered: List each item with clear descriptions and prices, including any special requests or modifications.

- Subtotal: Display the total amount before taxes or discounts.

- Taxes and Additional Charges: Include tax rates and any service charges, such as tips or delivery fees.

- Total Amount: Provide the final total after all additions and deductions.

- Payment Method: Indicate how the payment was made (e.g., credit card, cash, mobile payment).

- Order Number or Reference: Help identify the specific order in case of inquiries or disputes.

- Receipt Number: Assign a unique number for easy reference in records or for future claims.

Including all these details ensures that both the customer and restaurant have a clear record of the transaction, helping to avoid misunderstandings later on.

Legal and Tax Considerations for Receipts

Receipts should include specific details required by law. These often involve the business name, address, contact information, date, transaction details, and total amount. This ensures transparency for customers and compliance with tax authorities.

Tax Reporting and Documentation

Receipts serve as proof of transactions, necessary for tax reporting. Both businesses and customers rely on these documents for accurate record-keeping. Businesses must retain copies of receipts to justify income and expenses. For tax purposes, it’s essential to ensure that receipts show the correct tax rates applied, especially if VAT or sales tax is involved.

Legal Compliance

Depending on your location, certain legal requirements may apply, such as providing receipts for all transactions above a certain threshold or ensuring the format of the receipt meets industry standards. Not complying with these regulations could result in penalties or difficulties with audits.

Digital vs. Paper Receipts: Which Is Better?

Digital receipts are more convenient and eco-friendly. With a digital format, there’s no need to worry about losing a paper trail or dealing with clutter. Most receipts are easily stored on your phone, making them accessible whenever you need them.

Paper receipts offer the advantage of being tangible and not dependent on technology. They’re ideal for those who prefer physical records or have limited access to devices during transactions. However, they often fade over time, making them less reliable for long-term use.

Digital receipts allow businesses to reduce printing costs, and they are more sustainable in terms of reducing paper waste. They can also be easily organized and sorted into categories, simplifying the tracking of expenses. Paper receipts, however, might still be preferred for returns or proof of purchase in some cases.

For everyday transactions, digital receipts offer speed and organization. They’re especially useful for budgeting or expense tracking apps, making financial management much smoother. Paper receipts might be necessary for certain legal or warranty purposes, but their practicality diminishes in comparison.

Digital receipts stand out for their ease of use and long-term convenience. They are ideal for those who seek quick access and minimal waste. For those who appreciate the simplicity and physical record of a paper receipt, it’s clear that digital receipts are becoming the better option in most scenarios.

Automating the Process: Tools for Generating Receipts

To streamline receipt generation, consider integrating automated tools that handle both the creation and customization of receipts. These tools can save time, reduce errors, and ensure consistency across transactions. One of the best options for automation is using Point of Sale (POS) systems that come with built-in receipt generators. These systems often allow for quick modifications to include branding elements, taxes, and discounts.

Popular Tools for Receipt Automation

Several tools stand out in the field of automated receipt generation. Here are some of the most widely used:

| Tool | Features | Benefits |

|---|---|---|

| Square POS | Customizable templates, digital and printed receipts, inventory management | Fast setup, seamless integration with payment systems, user-friendly |

| Vend POS | Custom receipt design, email receipts, multi-location support | Cloud-based, scalable, robust reporting options |

| Zoho Invoice | Professional templates, automation of recurring invoices, tax calculations | Easy customization, ideal for small to medium businesses, integration with CRM tools |

Integrating Receipt Generators with Other Tools

For businesses that need more flexibility, integrating receipt generators with accounting or customer relationship management (CRM) software can improve workflow efficiency. For example, integrating with QuickBooks helps synchronize transaction data automatically, allowing for smoother bookkeeping. This integration minimizes manual data entry and ensures all transactions are logged correctly.