If you’re looking for a quick, reliable way to create receipts, using a free template is an excellent solution. A simple, well-designed receipt template can save you time, eliminate errors, and keep your transactions organized. Fortunately, plenty of free templates are available online, specifically tailored for businesses and personal use in the UK.

Many of these templates come in various formats, such as Word, Excel, and PDF, offering flexibility for different needs. Whether you’re running a small business or simply need receipts for personal transactions, you can find templates that are easy to customize with your details. This means you can add your company logo, payment method, and other necessary information without hassle.

For UK users, certain templates are crafted to meet local legal and financial requirements, making sure all the right fields are included. Templates also come in various designs, allowing you to choose one that fits your business style or personal preferences. Simply fill in the required fields and you’ll have a professional-looking receipt ready in minutes. Plus, it’s free!

Free Receipts Template UK: A Practical Guide

Using a free receipt template in the UK simplifies tracking transactions and keeps your records organised. There are several online resources that provide downloadable receipt templates that comply with UK standards. These templates are particularly helpful for small businesses and freelancers who need a simple way to issue receipts for services or products sold.

Choosing the Right Template

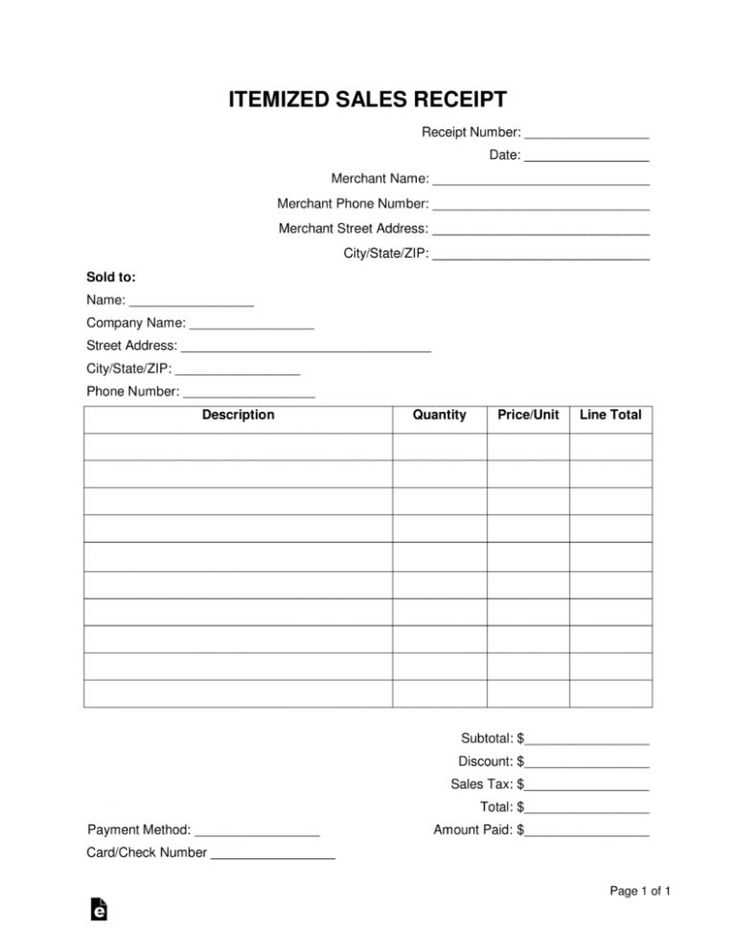

When selecting a template, ensure it includes all necessary details like the seller’s and buyer’s names, the date of the transaction, the amount paid, and a unique reference number. Look for templates that are clear and easy to customise for your specific needs. A basic receipt should have the following sections:

- Company or individual name and contact details

- Buyer’s name and contact information

- Transaction details (itemized list, quantity, price)

- Total amount paid

- Date and time of payment

- Payment method

- Receipt number

Where to Find Free Templates

Several websites offer free downloadable receipt templates. Websites like Microsoft Office, Template.net, and Google Docs provide free options in various formats, including Word, Excel, and PDF. These templates are pre-formatted, so you can easily plug in your details without worrying about design. Some platforms even allow for customisation to add your logo or change font styles to match your branding.

Be sure to verify that the template you choose aligns with UK legal requirements for receipts, such as displaying VAT details if applicable. If you are a business owner or freelancer, using these templates helps you maintain proper financial documentation and stay compliant with tax regulations.

How to Download Free Receipt Templates in the UK

To download a free receipt template in the UK, follow these simple steps:

- Visit trusted websites offering free templates. Popular options include websites like Entrepreneur, Vertex42, or Free-Templates.

- Browse the available templates. Look for ones that cater specifically to UK businesses, ensuring that VAT fields and other necessary legal details are included.

- Choose the format that works best for you. Most templates are available in Excel, Word, or PDF formats. Excel templates are ideal for customization, while Word and PDF are great for simple, professional receipts.

- Click the download button. Ensure your antivirus software is active to avoid any security risks when downloading files.

- Once downloaded, open the template on your computer and start filling in your business details, such as company name, address, and VAT number, if applicable.

Free receipt templates are easy to download and can be used immediately, saving time and effort on creating custom receipt formats from scratch.

Choosing the Right Format for Your Business Receipts

Pick a format that fits your business needs and complies with UK regulations. The key is simplicity and clarity, ensuring that all necessary information is included without unnecessary detail.

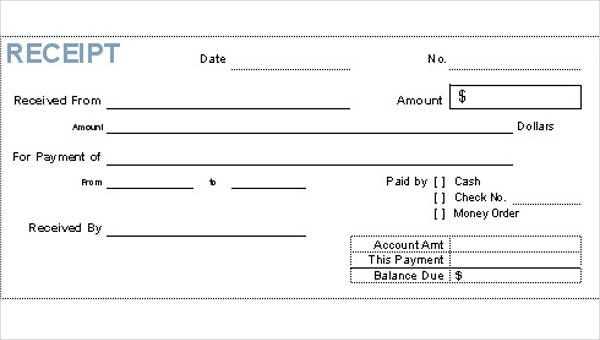

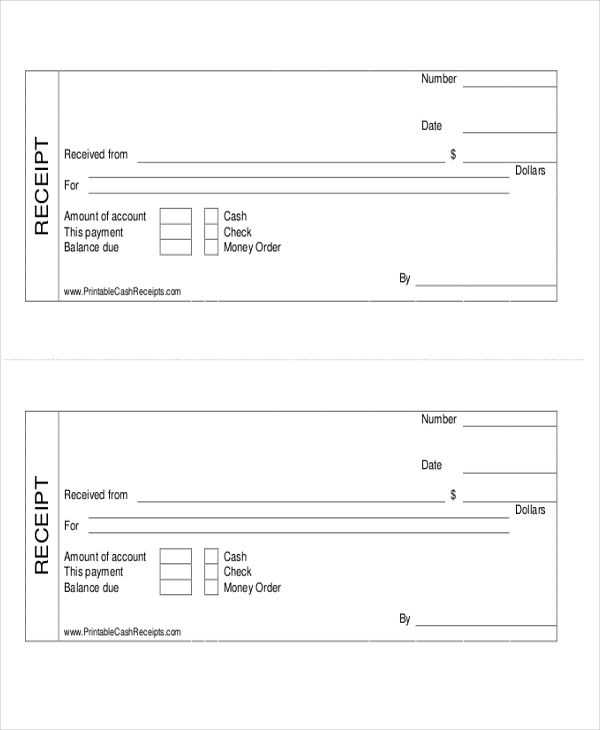

For small businesses, an easy-to-use template that includes fields for the business name, date, item details, and total cost is sufficient. You can create receipts in a text document or use a pre-made template from a receipt generator.

For larger businesses or those in specific industries (like retail or hospitality), a professional accounting software might be a better choice. These systems allow for quicker generation of receipts, automatic tax calculations, and organized record-keeping, ensuring accuracy and compliance with VAT regulations.

If you’re sending receipts electronically, a PDF format is the most common and acceptable. PDFs preserve the formatting and ensure that the recipient can easily access and store the receipt. Ensure your PDF templates are customizable to include all required information, including any reference numbers or unique identifiers.

If you prefer paper receipts, make sure the design is clear and readable. Include space for your logo and contact details, but avoid overloading the receipt with information that’s not relevant to the transaction.

Lastly, consider integrating receipts with your accounting system or CRM. This will streamline your processes and reduce the risk of manual errors in record-keeping.

Customising a Free Receipt Template for Your Needs

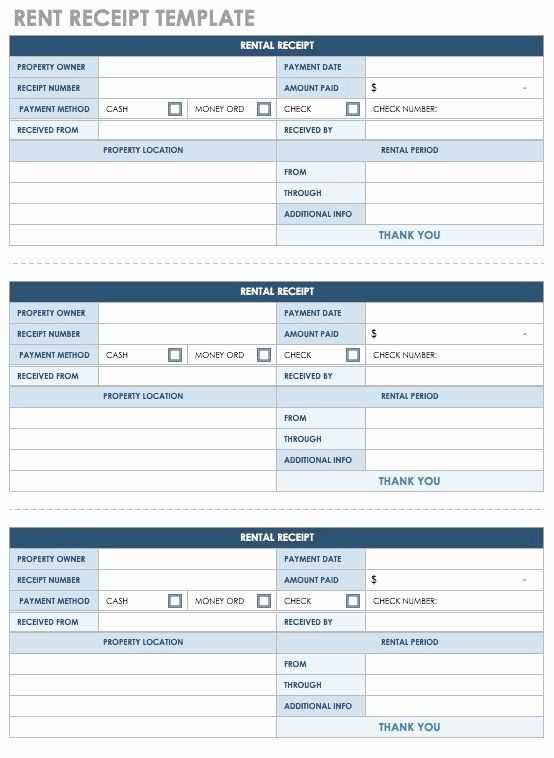

Customising a free receipt template is a quick way to create professional, personalised receipts for your business or personal use. Whether you need to add your logo, change the layout, or modify the information, tailoring the template ensures it meets your requirements.

1. Adjust Layout and Design

Begin by adjusting the layout of your template. Choose a format that suits the type of transactions you handle. You can switch the position of the logo, payment details, or other key sections. Consider using bold or different font sizes to make the most important information stand out.

2. Modify Information Fields

- Company Name and Logo: Replace placeholder text with your business name and logo. If you don’t have a logo, simply use your name in a bold, large font to increase visibility.

- Date and Time: Ensure the date and time fields automatically update for each transaction. You may need to adjust the template’s date format depending on your location (e.g., MM/DD/YYYY vs. DD/MM/YYYY).

- Payment Details: Update the payment information section to match your business model, whether it’s for cash, credit, or online transactions. Include transaction numbers or reference IDs if necessary.

- Additional Notes: Add a “thank you” note or any relevant terms and conditions to personalise the receipt further. Some templates allow for adding discounts or loyalty rewards.

3. Incorporate Tax and Legal Information

If applicable, include the tax breakdown on the receipt. This can be especially important for businesses subject to VAT or other sales taxes. Check local requirements to make sure you’re covering everything your receipts should contain legally.

4. Customise Colour Scheme

To make your receipt more aligned with your brand, change the colour scheme. A consistent colour palette enhances recognition and professionalism. Stick to your brand colours or use a neutral palette that works well with any logo.

5. Test and Save Your Template

Once you’ve made the necessary adjustments, save your template and print a test receipt. Review the details to ensure everything is correctly formatted, and that the design looks clean and clear. This final check ensures no errors before you start using it in real transactions.

Legal Considerations When Using a Receipt Template in the UK

Using a receipt template in the UK requires attention to specific legal guidelines to ensure compliance with local laws. A receipt serves as proof of a transaction and must meet certain standards to be legally valid. Below are key points to keep in mind when using a receipt template.

Basic Requirements for a Valid Receipt

In the UK, a receipt should include clear details about the transaction. Key elements include:

| Item | Details |

|---|---|

| Seller’s Information | Business name, address, and contact information |

| Buyer’s Information | Name or description of the buyer (if applicable) |

| Date of Transaction | The specific date the transaction took place |

| Itemized List of Goods/Services | Clear description of the items sold or services provided |

| Amount Paid | The total amount paid, including VAT if applicable |

| VAT Number (if applicable) | The seller’s VAT registration number (if registered for VAT) |

Compliance with the VAT Act

If your business is VAT-registered, receipts must also include VAT information. According to the VAT Act 1994, the receipt must clearly state the amount of VAT charged, the VAT rate, and the seller’s VAT registration number. Failure to comply with these rules can result in fines or penalties from HMRC.

For businesses below the VAT registration threshold, VAT does not need to be included on receipts. However, it’s crucial to ensure that the template reflects your business’s VAT status.

Lastly, make sure that the template you use reflects your business accurately, particularly if your business changes location, contact details, or tax status. Keeping receipts up to date and in line with legal requirements can prevent issues down the line.

How to Keep Track of Receipts for Tax Purposes

Organise your receipts by date and category as soon as possible. Store them in dedicated folders or envelopes to keep everything in one place. Use separate sections for business and personal expenses to make tax reporting simpler. A clean and methodical approach will save time and reduce the risk of missing any important receipts.

Digital Tools for Managing Receipts

Use receipt scanning apps or software to digitize your receipts. These tools can automatically extract key information, such as amounts and dates, making it easy to store and organise them electronically. The digital format will also help you back up important documents, preventing accidental loss or damage to paper receipts.

Track Recurring Expenses

For recurring expenses, set up a system to track them monthly. Whether it’s rent, utilities, or regular supplies for your business, tracking these expenses consistently will help ensure they are properly accounted for during tax season. Recording these expenses as they occur will also prevent them from being forgotten later on.

Common Mistakes to Avoid When Using Receipt Templates

Always double-check the accuracy of the information before sending a receipt. Small errors like incorrect dates, names, or amounts can lead to confusion and potential disputes. Ensure that every detail is entered correctly, especially payment amounts and transaction descriptions.

Not Customizing Templates

Using a generic template without adapting it to your business can make your receipts look unprofessional. Add your business name, logo, and contact details to make the receipt clearly identifiable. This helps to build trust with customers and makes it easier for them to reach out in case of issues.

Omitting Tax Information

If applicable, always include tax details on receipts. Failing to show tax rates and the total amount of tax charged can lead to misunderstandings with customers or tax authorities. Clearly display this information so it is easy to read and understand.

Be mindful of the format. A poorly designed or overly cluttered receipt can confuse your customers. Stick to clear sections, use legible fonts, and avoid overloading the receipt with unnecessary information. A clean and organized receipt is much more user-friendly.

Finally, avoid overlooking digital receipts. If you’re sending receipts online, make sure the format is compatible with various devices and email clients. Ensure that the file size is manageable and the layout is responsive on different screen sizes.