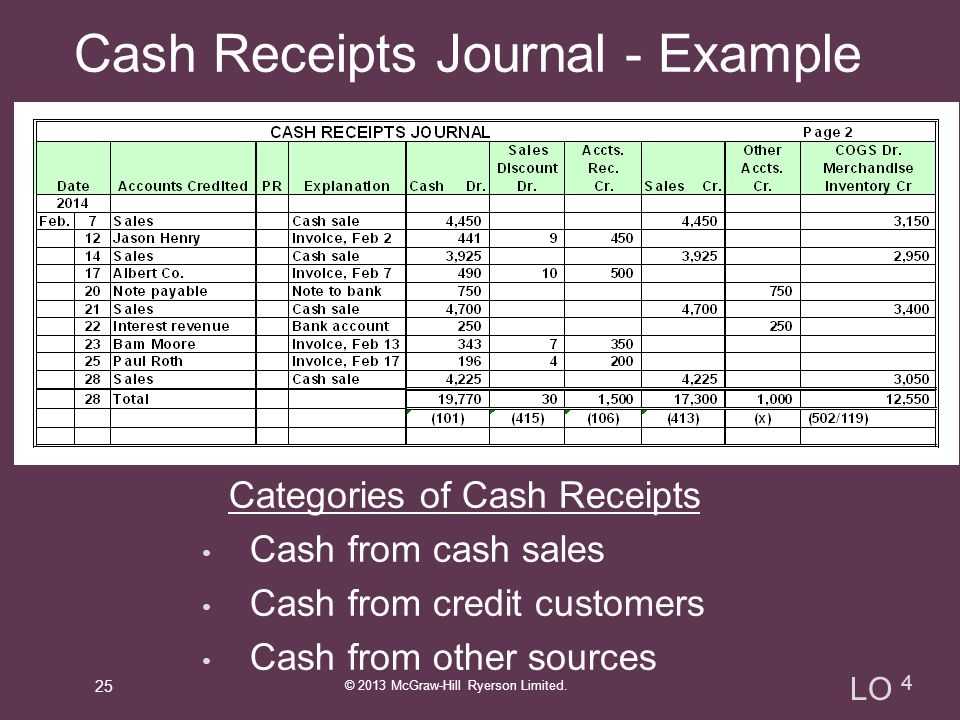

If you’re managing finances for a business or personal project, using a cash receipts journal template can save you time and help you stay organized. This template simplifies the process of tracking all incoming payments, ensuring nothing is overlooked.

The cash receipts journal is designed to record every payment received, whether it’s from customers, clients, or other sources. By documenting each transaction, you can quickly generate reports and keep accurate financial records. You can download a free version of this template, which includes all the necessary columns such as date, payer, amount, and account affected.

Having a reliable system in place for cash receipts will streamline your accounting tasks, reduce errors, and make your financial reviews more efficient. By filling out the template regularly, you ensure that your financial data stays current and easily accessible when needed.

Here’s the corrected version without repetitions:

When managing your cash receipts journal, it’s critical to structure it for clarity and accuracy. Follow this template to track all incoming payments effectively. Each transaction should be recorded in a clear and concise format. Below is a simple structure to use:

| Date | Description | Receipt Number | Amount | Account Credit |

|---|---|---|---|---|

| 01/01/2025 | Cash Sale | 001 | $500 | Sales Revenue |

| 01/02/2025 | Customer Payment | 002 | $300 | Accounts Receivable |

| 01/03/2025 | Loan Received | 003 | $1,000 | Loan Payable |

Ensure to update the journal as payments are received, verifying the amounts and appropriate account credits for each entry. This approach provides a clear, organized record of transactions.

- Cash Receipts Journal Template Free Download

A Cash Receipts Journal template helps you track incoming payments efficiently. Download a free version to streamline your accounting process and maintain accurate records. The template is simple, user-friendly, and tailored to help businesses track cash inflows from various sources, like sales or loan repayments.

How to Use the Template

Start by entering the date and description of each cash receipt. The template allows you to include columns for the payer’s name, amount received, and the account being credited. This structure helps keep transactions organized and ensures that you can quickly reconcile your cash inflows with your bank statements.

Advantages of Using a Cash Receipts Journal

The template not only saves time but also helps prevent errors that can occur in manual entry. It provides a clear overview of cash movements, making it easier to generate reports and track financial progress. You can also adjust the format to suit your business’s unique needs without needing advanced accounting knowledge.

Focus on functionality first. A good template should reflect your business needs and help organize cash receipts accurately. Look for a layout that suits the volume and type of transactions you process. For example, if you handle a large number of small payments, a template with simple, easily accessible columns will work best.

Consider Compatibility

Your template should integrate easily with your existing accounting systems. Check if it can work with software tools you already use, such as Excel or QuickBooks, to avoid manual data entry and reduce the chance of errors.

Customization Options

Templates that allow easy customization can adapt as your business grows. Look for features like adjustable columns or space for additional notes. This way, the template can evolve with your operations.

Don’t overlook ease of use. A clean, intuitive design will save time for you and your team. Avoid overly complicated templates with too many fields or unnecessary details that may confuse the user.

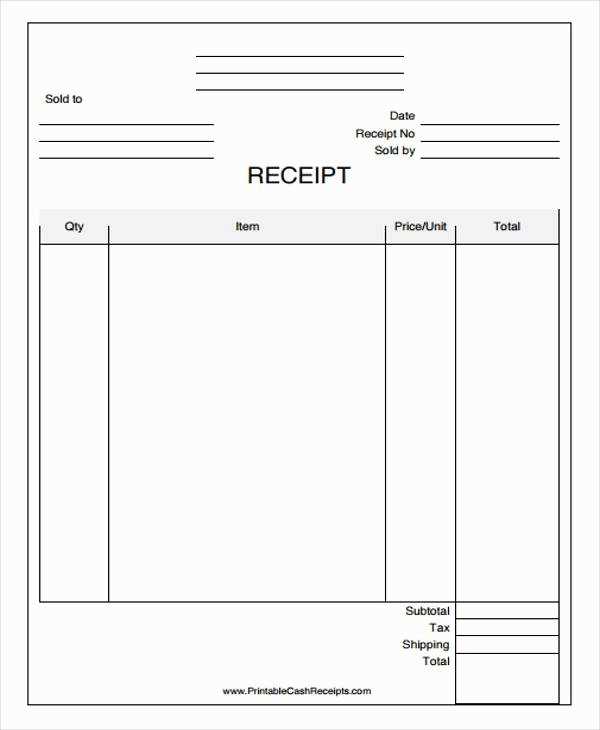

Begin by organizing your journal into clear columns for each critical piece of information: Date, Source, Amount, Payment Method, and Account. This ensures you capture every transaction accurately and efficiently.

For each cash receipt, record the date on which the transaction occurred. This helps maintain an orderly and chronological record of all incoming cash flow.

Next, note the source of the cash received. Whether it’s from a customer, loan, or other source, documenting this will provide clarity on the origin of the funds.

In the “Amount” column, write the total amount of cash received. Make sure this is the exact amount without rounding or errors, as this is the key figure for your financial records.

List the payment method in the designated column. Indicate whether it was a cash, check, or electronic transfer to provide a full picture of how the funds were received.

Finally, document which account the funds should be applied to in your journal. Whether it’s a revenue account or another type, correct allocation ensures your financial statements are accurate.

Review the journal entries periodically to ensure all receipts are accounted for and properly categorized. This will keep your records up-to-date and ready for financial reporting or audits.

Focus on clarity and detail when setting up your cash receipts journal. Key fields help you track cash flow accurately, ensuring your financial records remain organized and easy to review.

Date

Record the exact date of each transaction. This will help you identify trends and track the timing of payments or receipts.

Receipt Number

Assign a unique receipt number to each entry. This helps in referencing transactions for future verification and audit purposes.

Source of Funds

Indicate where the cash originated. Whether it’s from sales, loans, or other sources, this field provides context for the transaction.

Amount

Specify the exact cash amount received. Accuracy in this field avoids errors when tallying your totals at the end of the period.

Description

Provide a brief note explaining the purpose of the cash receipt. This field can capture customer names, invoice numbers, or the reason for payment.

Account/Category

Link each receipt to an account or category in your chart of accounts. This helps in organizing your records by revenue or expense types.

Balance

Track the running balance after each receipt. This will give you a real-time snapshot of your available funds and help with reconciliation.

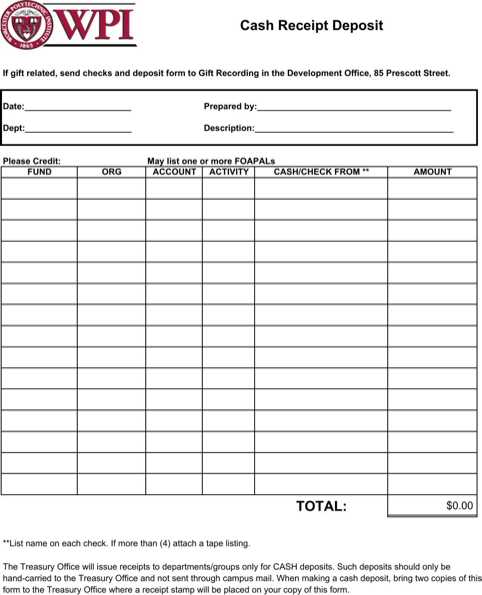

Open the template and begin by analyzing its structure. Identify the sections that you will use most frequently, such as the fields for transaction details, date, and amounts. Customize these areas to match your business’s specific terminology and reporting format.

Adjust the layout to accommodate the volume of transactions you handle. If your business processes numerous receipts, ensure there is enough space to record multiple entries per day. Resize columns or add additional rows as needed.

Modify the color scheme and fonts to match your company’s branding. This will make the template look more professional and cohesive with your other documents. Be mindful not to overcomplicate the design–simple formatting often works best for readability.

Incorporate automatic calculations if possible. For example, set up formulas to sum amounts or calculate totals. This reduces manual effort and the risk of errors. Use software features like conditional formatting to highlight overdue payments or large amounts.

If you are using the template for multiple users, add password protection or limit editing permissions. This ensures that only authorized personnel can make changes, maintaining the integrity of the financial records.

Finally, save the template in a location that’s easily accessible to those who need it. Regularly update the template to reflect any changes in your business’s needs, such as new categories for receipts or additional tax rates.

Not categorizing receipts correctly can cause confusion and errors in your financial records. Ensure that each receipt is labeled under the appropriate account and source. This helps maintain clarity and avoids mixing different types of transactions.

- Missing dates or incorrect entries: Always include accurate dates and double-check the receipt information to avoid discrepancies in your financial reports.

- Failure to record all receipts: Be thorough when documenting every receipt, even small ones. Missing any entry can result in incomplete financial data and cause issues when reconciling accounts.

- Not reconciling regularly: Regularly compare your cash receipts journal with bank statements. Failing to do so increases the chances of overlooking errors or fraud.

- Overlooking detailed descriptions: Adding detailed descriptions for each transaction helps clarify the purpose of the receipt and ensures transparency in financial documentation.

- Inconsistent formatting: Consistency is key. Use the same format for all entries, so the journal is easy to read and track. This also prevents mistakes when reviewing records.

Avoiding these common mistakes ensures that your cash receipts journal remains accurate and reliable, ultimately saving you time and effort in the long run.

Check out websites like Template.net, which offer a wide selection of free, downloadable templates for various purposes, including cash receipts journals. You can easily find templates tailored to your needs with a simple search.

Another good source is Vertex42. They specialize in Excel templates, offering numerous free options for accounting and financial tracking, including cash receipts journals. Their templates are user-friendly and come with clear instructions for use.

If you prefer a more collaborative approach, consider Google Sheets. Search through the Google Sheets template gallery for free accounting templates, where you can modify them directly online without needing to download anything.

Additionally, check out Microsoft Office’s template library, which includes downloadable Excel templates for various financial tasks. They provide a straightforward, reliable option for those using Microsoft tools.

For a more open-source approach, platforms like OpenOffice Templates also offer free, customizable templates that can be easily adapted to your specific requirements.

Each word appears a maximum of twice, yet the meaning remains intact.

Use a clear and simple format for your cash receipts journal. Create columns for the date, description of the transaction, amount received, and the account affected. The journal should be easy to follow for accurate recording and auditing.

Organize the Layout

- Column 1: Date of transaction

- Column 2: Description of the transaction

- Column 3: Amount received

- Column 4: Account affected

Maintain Consistency

Stick to a consistent style to avoid confusion. Ensure the format stays the same for each entry to allow for quick reference and accuracy during audits. This helps to spot errors or inconsistencies immediately.

Avoid overloading the journal with unnecessary information. Focus on the key details that will allow anyone to understand the transaction without additional context.