If you’re a landlord or tenant in India, a rent receipt is a necessary document for keeping track of rental payments. A well-organized template in Word can simplify the process. Here’s how you can create one that is clear, legally compliant, and easy to use.

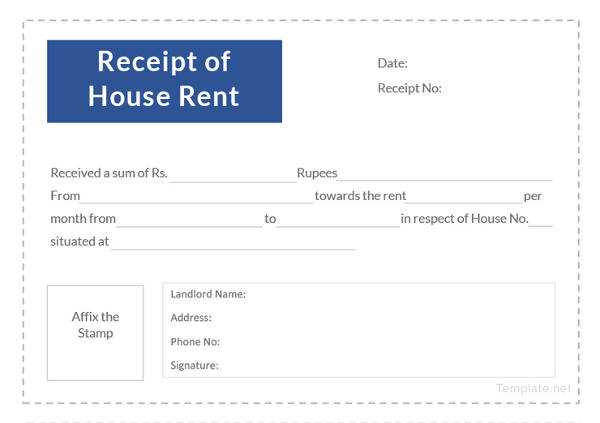

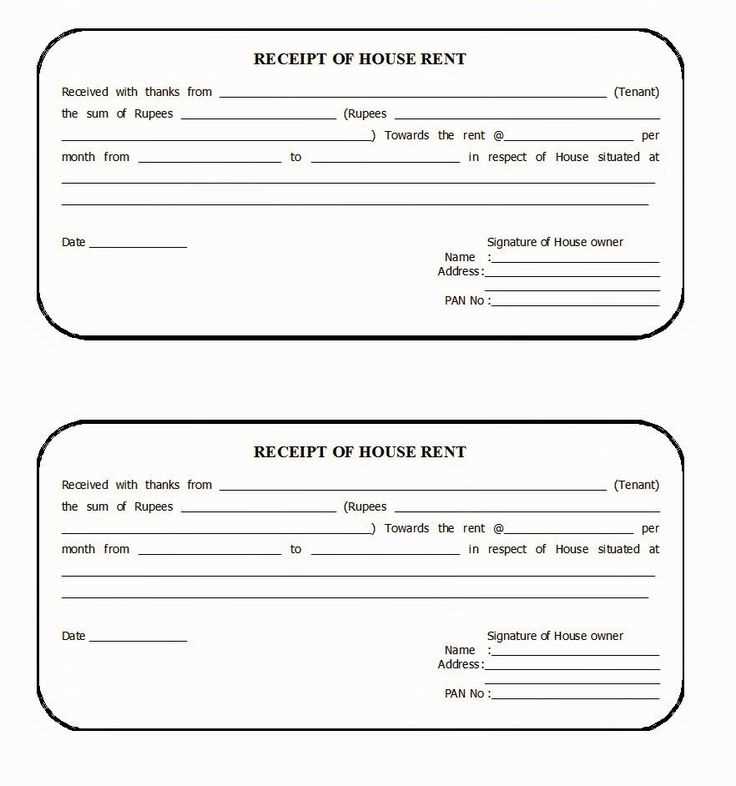

Start with the basics: include the date of payment, the amount paid, and the tenant’s details. The receipt should clearly indicate the rental period covered, whether it’s weekly, monthly, or annually. Include the property address, as well as the landlord’s details for clarity. Make sure both parties sign the receipt for authenticity.

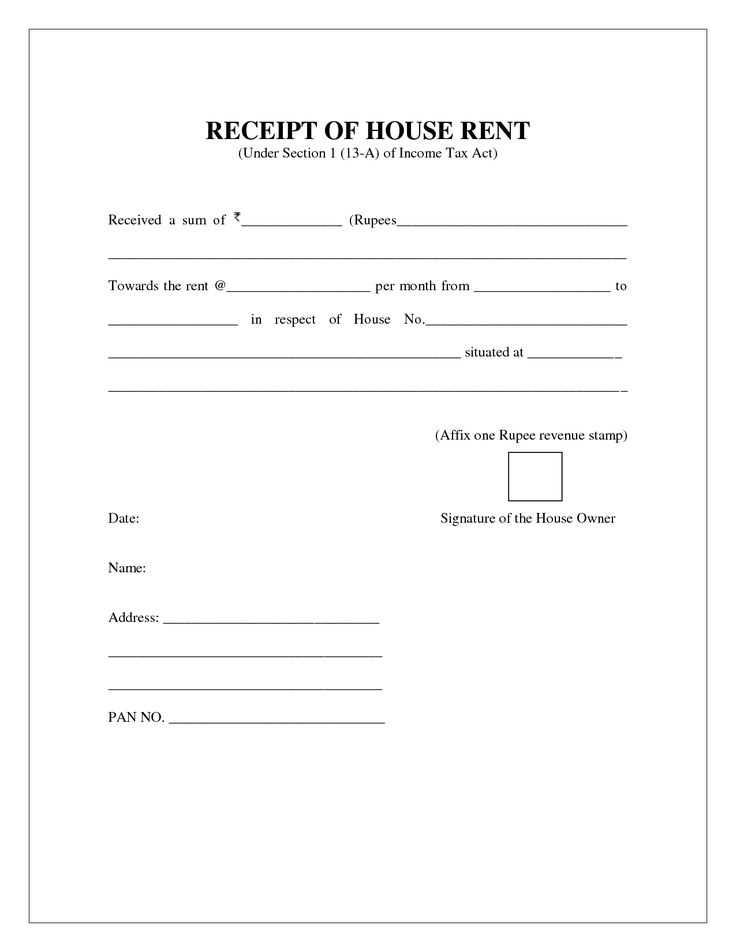

Additionally, the rent receipt template should have space to include GST details, if applicable, based on the rental amount and location. This will help ensure the document is comprehensive for both parties, especially when it comes to tax purposes.

Here’s the corrected version:

Ensure all relevant details are filled in clearly and accurately. The receipt must include the tenant’s name, the landlord’s name, rental amount, payment period, and the date of payment. Use a professional font and a clean layout to keep the document legible. If the receipt is printed, make sure to sign it manually for authenticity.

Key Components of a Rent Receipt

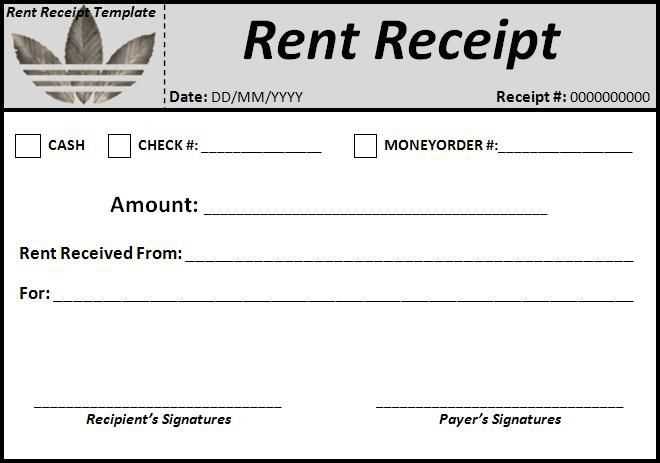

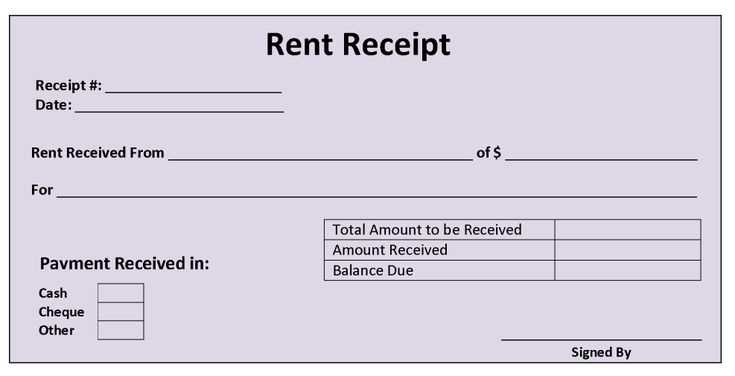

For clarity, the receipt should also include the payment method (e.g., cash, bank transfer) and the rental property address. If the payment is made for a partial period, mention that explicitly. This helps avoid confusion in case of any future disputes. Always include a receipt number to track payments efficiently.

Additional Tips

Consider including a statement like “Received with thanks” or “Paid in full” to confirm that the payment has been processed completely. A clear and concise format adds to the professionalism of the document. Make sure the tenant receives a copy of the receipt immediately after payment is made.

Rent Receipt Template Word Document India

How to Create a Rent Receipt in Word

Essential Elements to Include in Rent Receipts

Customizing Templates for Indian Rent Receipts

Legal Requirements for Rent Receipts in India

Adding Payment Details and Tenant Information

Common Mistakes to Avoid with Rent Receipt Templates

To create a rent receipt in Word, use a template that includes all the necessary details, such as the tenant’s name, property address, payment amount, and the date of payment. Make sure to customize it to reflect specific rental terms and regional legal requirements.

Key elements of a rent receipt:

- Tenant’s name and address

- Landlord’s name and contact details

- Rent amount paid

- Date of payment

- Rental period (start and end dates)

- Signature or acknowledgement by the landlord

When customizing a template for Indian rent receipts, include details like the payment method (e.g., cheque, cash, online transfer) and ensure the receipt complies with Indian tax laws, which may require mentioning GST (Goods and Services Tax) if applicable. Some templates offer the option to add a unique receipt number for record-keeping.

Legal requirements: Rent receipts must be signed by the landlord, and in some states, receipts exceeding a certain amount might require a stamp duty. In the absence of a formal agreement, issuing a rent receipt helps protect both parties legally. In case of disputes, a well-maintained rent receipt is a strong piece of evidence.

Tenant information: Always include correct tenant details, such as their full name and address. Missing information or incorrect details can lead to issues with rent record maintenance or legal complications later on.

Common mistakes to avoid:

- Not including the rent period or payment date

- Forgetting to mention the landlord’s signature

- Leaving out payment method details

- Not customizing the template to reflect specific rental terms