Creating a payment receipt template ensures you have a clear record of transactions for both your business and customers. It’s vital that your template includes all key details such as payment method, amount, date, and the purpose of the payment. A well-structured receipt offers transparency and can help avoid any confusion or disputes in the future.

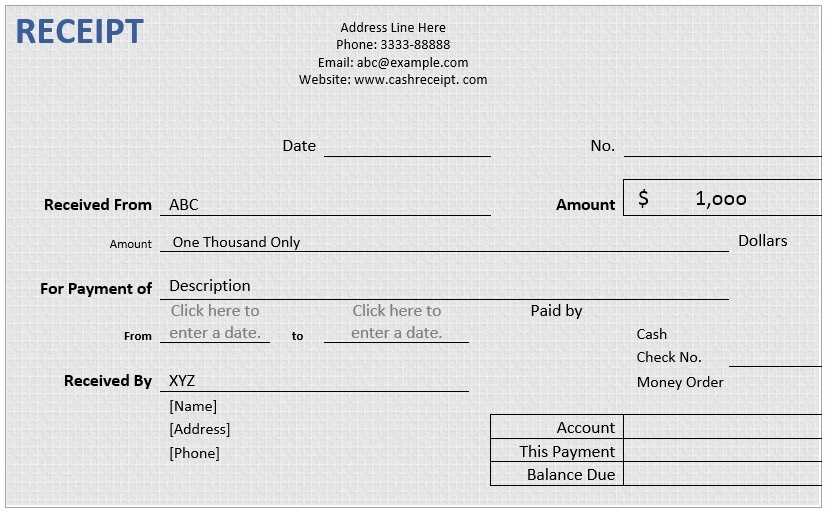

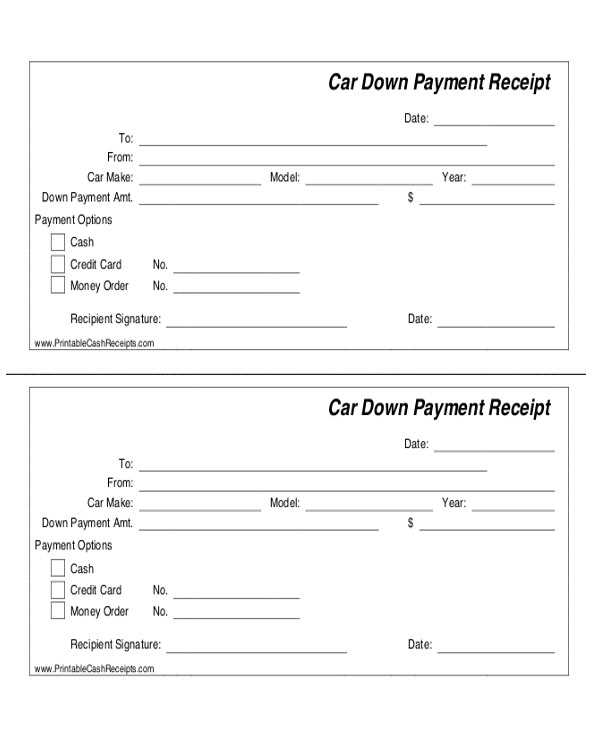

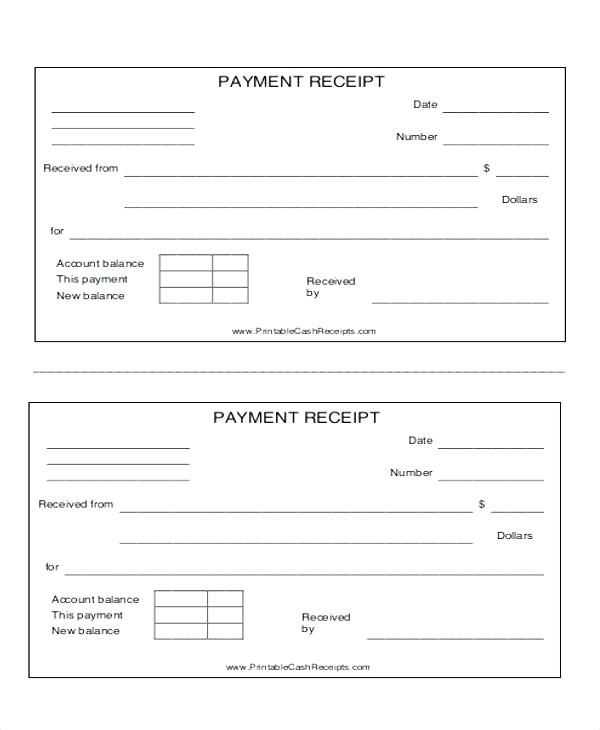

Start by including the payer’s and payee’s names, the transaction amount, and the date of the payment. These details form the core of the receipt. Be sure to also note the payment method, whether it was made by cash, card, or other methods, to maintain a complete record.

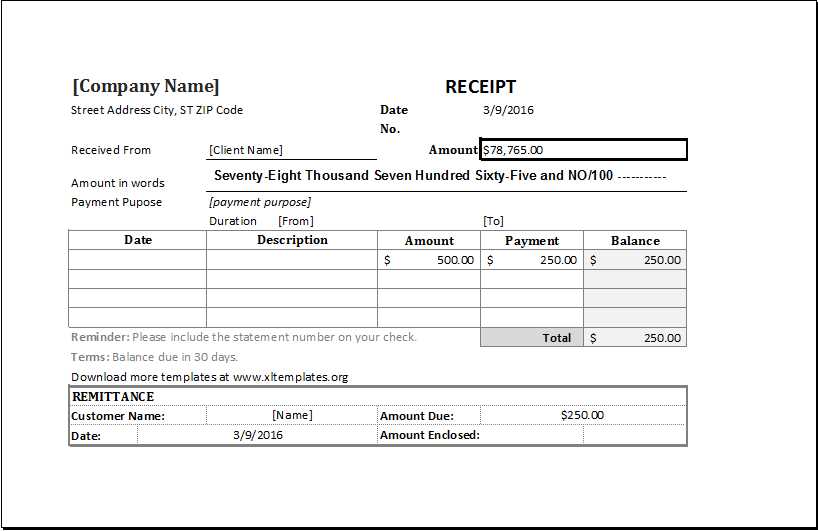

It’s also helpful to provide a reference number for each transaction. This number can assist in tracking specific payments, especially if you process large volumes of transactions. Don’t forget to include any applicable taxes, discounts, or additional fees to ensure the amount matches the total due.

For clarity, break down the payment into sections if necessary, detailing individual items or services provided. This transparency allows for easy verification of the transaction by both parties. Lastly, including your business contact information on the receipt guarantees that customers can reach out if any questions arise later on.

Here’s the revised version with reduced repetition:

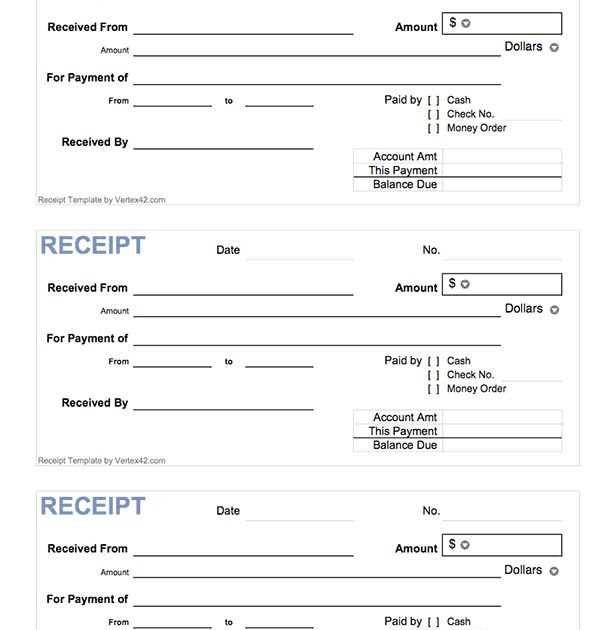

To streamline your payment receipt template, focus on simplifying the layout and minimizing repetitive details. Make sure the key information is easy to spot without unnecessary redundancy.

Key Elements to Include

- Payee and Payer Information: Include the full names, addresses, and contact details of both parties.

- Transaction Date: Specify the exact date the payment was made.

- Amount Paid: Clearly state the payment amount in both words and figures.

- Payment Method: Indicate how the payment was made (e.g., cash, check, online transfer).

- Receipt Number: Provide a unique identifier for easy reference.

Additional Tips for Clarity

- Use consistent font sizes and spacing to keep the document neat.

- Avoid repeating the same payment terms in multiple places–only mention them once, clearly and concisely.

- Ensure the language is straightforward and avoids overly complex wording.

By focusing on these elements, you’ll create a clean, effective payment receipt template that clearly communicates all necessary details without unnecessary repetition.

Got it! Is there anything specific you’d like help with today, whether it’s writing, structuring, or formatting your articles?

A payment receipt should include specific details to ensure clarity and transparency for both the payer and the payee. Start with the date of the transaction, as it is the most fundamental piece of information. Clearly display the amount paid in both numeric and written form, leaving no room for misinterpretation.

Transaction Details

Include the method of payment, whether it’s a cash, credit card, or bank transfer. This helps in case of disputes. Also, list the transaction reference number to track the payment if necessary.

Seller Information

The seller’s name, address, and contact information should be clearly visible. This ensures the recipient can easily identify the source of the receipt for any future correspondence.

Finally, include a clear statement of goods or services provided. This should describe what the payment was for, offering a straightforward breakdown if applicable.

To personalize your receipt format, first adjust the layout to match your brand’s identity. Choose the right fonts, colors, and logo placement. This creates a seamless connection between your receipt and your company’s visual style.

Customizing Key Details

Next, decide which details are most relevant for your customers. For example, you can add fields such as customer names, loyalty points, or even a thank-you message. Tailor the information to fit the type of transaction for a more personalized touch.

Incorporating Legal or Regulatory Text

Make sure your receipt includes any mandatory text required by law, such as refund policies or tax information. You can modify the position and font size of these elements to ensure they don’t overwhelm the other details while staying compliant.

Ensure compliance with local regulations by understanding the specific legal requirements in your jurisdiction. Different countries or states may have varying obligations for businesses issuing receipts. For example, some regions may require the inclusion of tax identification numbers or specific terms to clarify the nature of the transaction.

Keep records for auditing purposes. Payment receipts are often necessary for tax reporting and financial audits. Businesses must retain copies of receipts for a defined period, usually a few years, to comply with tax authorities. Ensure that records are stored securely and accessible in case of audits.

Clear terms and conditions on the receipt reduce disputes. Include details like the payment method, the total amount, and any taxes applied. If applicable, specify any warranties or return policies associated with the transaction.

Consider consumer protection laws. In many jurisdictions, consumers are entitled to a refund or return under certain conditions. Payment receipts may need to reflect these rights clearly, along with any restocking fees or terms for exchanges, to avoid misunderstandings.

Choose a format that aligns with both your needs and the preferences of your clients. For printed receipts, ensure they are clear and easy to read, using legible fonts and concise layout. For electronic receipts, consider formats like PDF or email versions, which are easily accessible and shareable.

Avoid cluttering the receipt with unnecessary details. Stick to key information: transaction amount, date, item or service description, and contact details. Ensure the format is flexible enough for various devices if it’s digital, offering compatibility across smartphones, tablets, and desktops.

If you’re providing a receipt for a business, include your company logo and address for professionalism. For personal or informal receipts, keep the design simple yet informative. Always test your chosen format to ensure that all information appears correctly before sending it out.

How can I assist you today? Would you like help with structuring an article or creating a section for your next project?

Store payment receipts in a secure and organized way. Use labeled folders or digital files to separate different types of transactions, such as purchases, invoices, or refunds. This helps ensure that you can access any document quickly when needed.

Paper Document Storage

For physical receipts, invest in fireproof filing cabinets or secure storage boxes. Categorize receipts by date, vendor, or transaction type. Keep records for the necessary amount of time as per local regulations, ensuring they are easy to retrieve when required.

Digital Document Management

Scan paper receipts and save them in organized folders on your computer or cloud storage. Use descriptive filenames that include the transaction date and vendor name for easy reference. Set up automated backups to protect against data loss. Utilize PDF or image file formats for clarity and long-term usability.

Implement a regular review process to remove outdated or unnecessary documents. For both paper and digital formats, consider encryption or password protection to keep sensitive information safe.

Use a clear, well-organized payment receipt template to ensure all relevant information is captured accurately. Here’s a basic structure:

- Date: Include the exact date the payment was made.

- Amount: Clearly state the total amount received.

- Payment Method: Specify how the payment was made (cash, credit card, etc.).

- Payee Information: Include the name and contact details of the payee.

- Issuer Information: Provide the details of the entity issuing the receipt, such as business name, address, and contact information.

- Description of Goods or Services: Outline the goods or services provided in exchange for the payment.

- Transaction ID: Include a unique identifier for the transaction if applicable.

Make sure the receipt is easy to understand and free from unnecessary information. This structure helps maintain clarity and transparency in transactions.