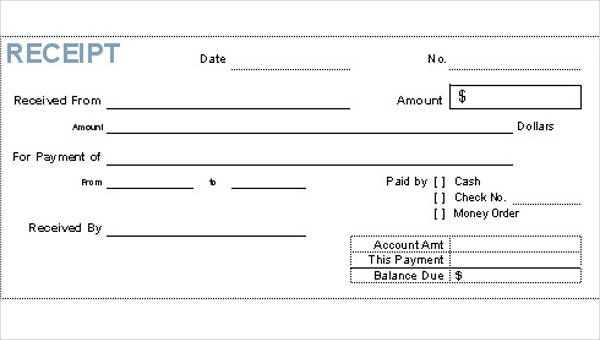

Get started with a free, easy-to-use cash receipt book template that suits your needs for tracking transactions. This simple tool helps maintain an accurate record of cash received, keeping your financial processes transparent and organized.

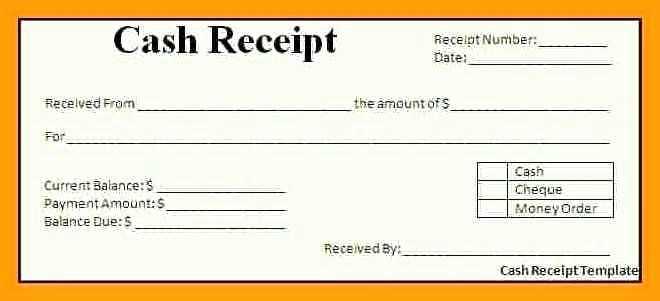

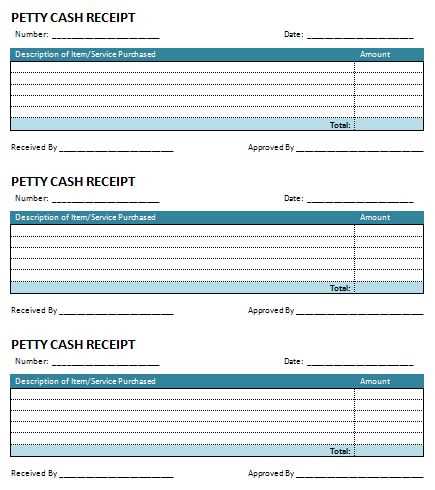

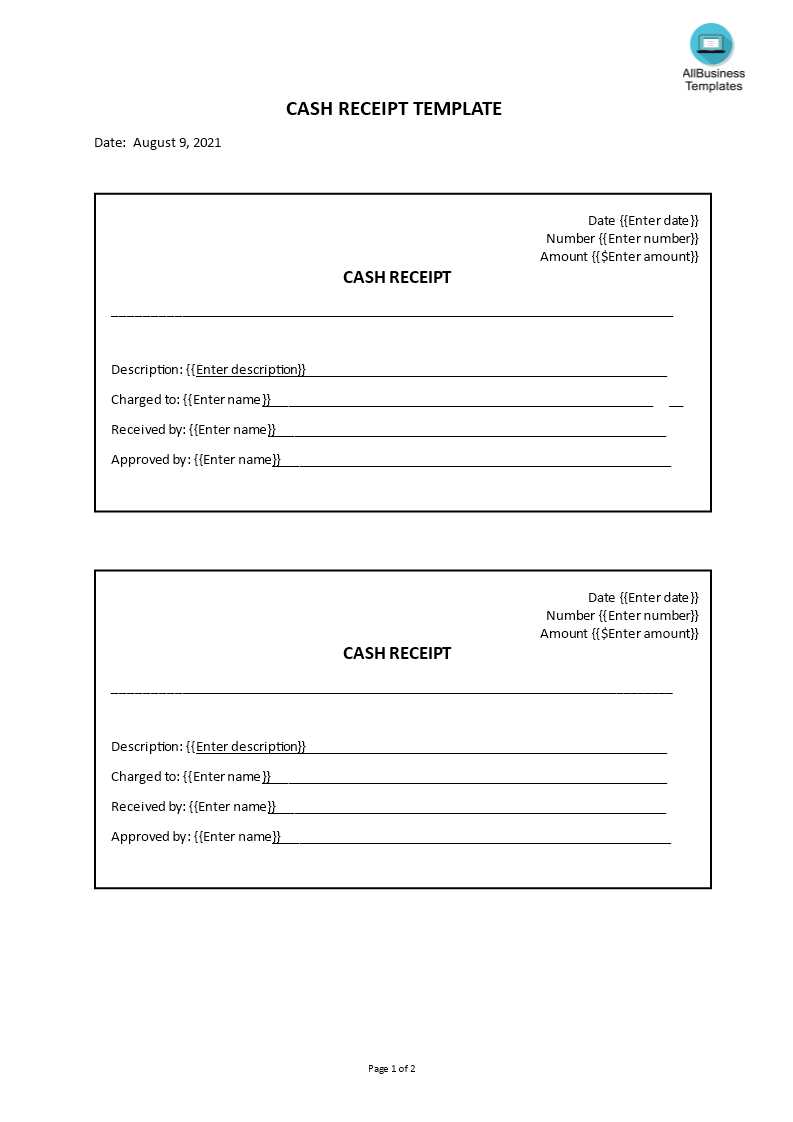

The template is designed to be intuitive, providing spaces for the transaction date, amount received, payer’s details, and the purpose of the payment. With just a few details, you can quickly document each payment to ensure clarity and avoid discrepancies down the line.

Utilizing this template helps you track all cash transactions in one place, making it easier to reconcile and reference later. It’s an ideal solution for small businesses or individuals who need a straightforward way to keep financial records clear and accessible without unnecessary complications.

How to Customize Your Template for Your Business Needs

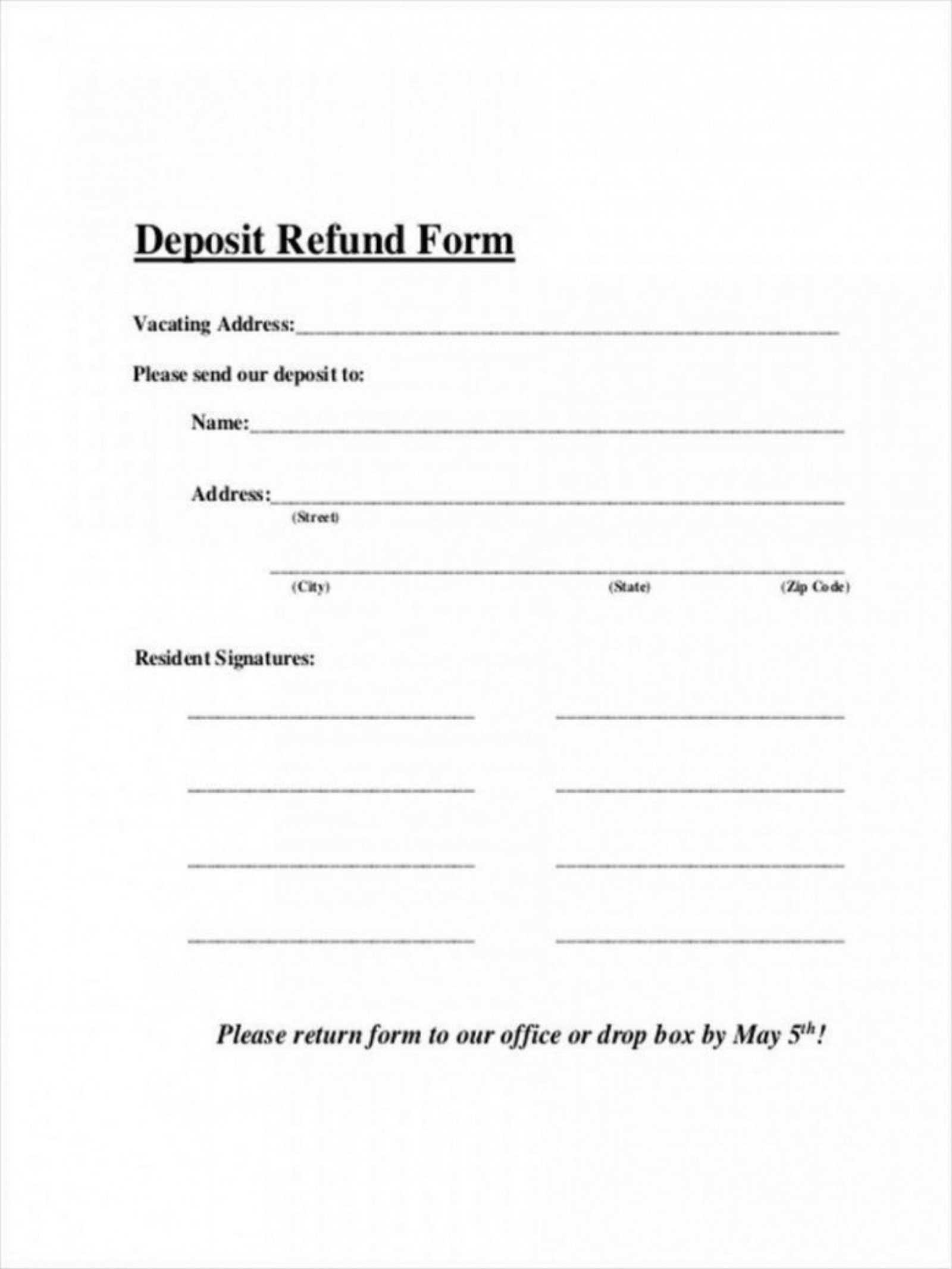

Begin by adjusting the header section of your cash receipt book template. Replace the default name with your business name, address, and contact details to ensure your branding is clear from the first glance. Include any relevant identifiers such as tax or business registration numbers for further professionalism.

Tailor the Information Fields

Modify the fields to match the specific details your business needs to track. For instance, you may want to add fields for payment method, order numbers, or specific product details. This ensures that all necessary data is captured in one document and reduces the need for follow-up queries or additional paperwork.

Customize the Layout and Design

Adjust the layout for simplicity and clarity. Remove any unused sections to streamline the process and focus on what matters. If your receipts require space for notes, add a section for remarks or terms and conditions. Keep the design professional by choosing fonts and colors that align with your branding guidelines.

Save the customized template in a format that suits your operations. You can choose to print or save it electronically for quick access whenever needed. This way, you maintain control over the receipts you issue and ensure they align perfectly with your business’s requirements.

Key Information Every Cash Receipt Template Should Contain

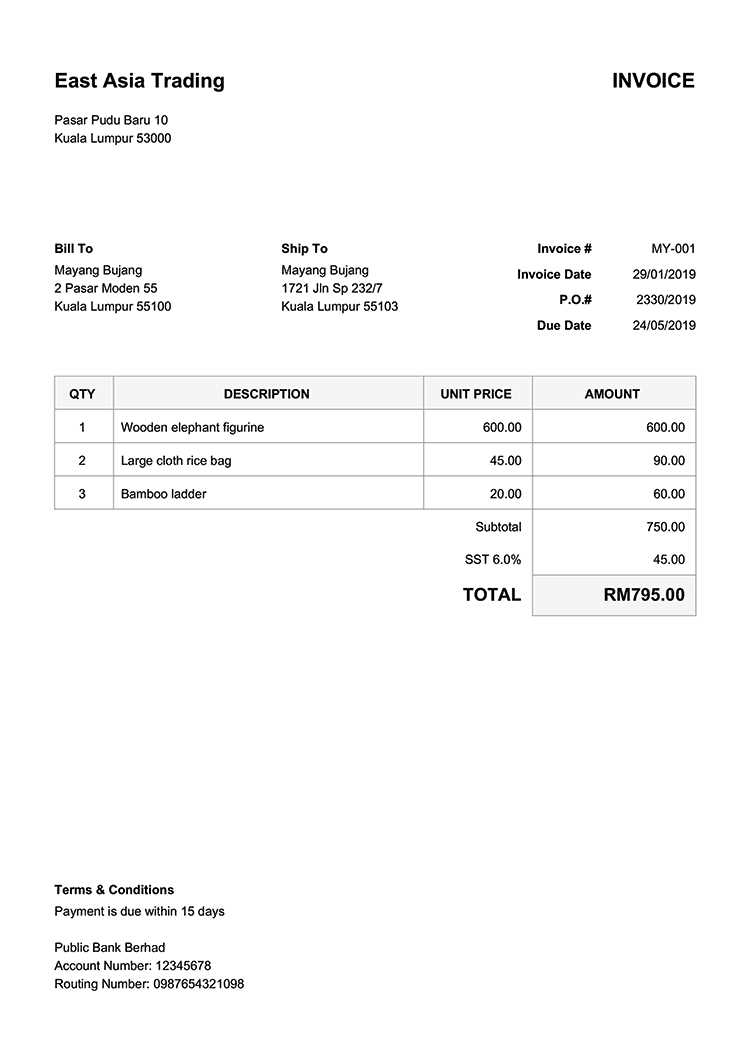

A clear cash receipt template should include the following key details to ensure it serves its purpose effectively:

Receipt Number and Date

Each receipt should have a unique identifier (receipt number) to avoid confusion or duplication. The date of the transaction is also crucial for reference and record-keeping purposes.

Amount Received and Payment Method

Clearly state the amount of money received and specify the method of payment, whether it’s cash, check, credit card, or any other form. This helps keep accurate financial records and provides clarity on the transaction.

By including these details, a cash receipt ensures transparency, proper tracking, and can be easily referenced in case of disputes or audits.

How to Organize and Track Payments Using a Receipt Template

Using a receipt template helps maintain clear, organized records of payments. To ensure you track everything effectively, follow these steps:

1. Set Up a Standard Format

Choose a receipt template with consistent fields for the date, amount, payer’s information, and payment method. This uniformity makes it easy to cross-reference and find details later. Standardize your format to avoid confusion and ensure all necessary details are captured every time.

2. Record Payments Immediately

As soon as a payment is received, document it in your template. This reduces the risk of forgetting or misplacing important details. Make a habit of entering each transaction before moving on to the next task. This helps maintain real-time tracking of all payments.

3. Categorize Payments

- Use categories to group payments by type (e.g., cash, check, credit card).

- If your business receives payments for different services, group them accordingly for easy tracking.

This way, you can quickly spot any discrepancies or trends in your finances.

4. Maintain a Physical and Digital Backup

While physical receipts are useful, digital backups ensure no data is lost. Consider scanning and storing copies of receipts in a cloud storage system for easy access and to free up space. Ensure both copies are regularly updated to reflect new entries.

5. Reconcile Payments Regularly

Set a schedule to review your records weekly or monthly. Compare your payment receipts with your bank statements or accounting software. This helps identify errors or missed transactions early on.

Common Mistakes to Avoid with Cash Receipt Templates

Always double-check the date and time before completing any receipt. Missing or incorrect dates can lead to confusion, making it harder to track transactions. This mistake is easily avoidable but can cause issues with future reference and audits.

Incorrect Information on the Amount

Ensure the payment amount is accurate. Miscalculating the total, especially when adding tax or discounts, can create discrepancies. Review every entry before finalizing the receipt to avoid potential misunderstandings later.

Not Including Contact Information

Omitting the sender’s or receiver’s contact details on the receipt is a frequent mistake. Including phone numbers or emails ensures you can easily follow up if there’s a need for clarification or a refund request.