For anyone dealing with rental agreements or property transactions in California, having a clear and precise deposit receipt is crucial. A well-structured receipt protects both the landlord and tenant by detailing the deposit terms and conditions, ensuring transparency in the transaction process.

The template for a California deposit receipt should include key information such as the date, amount received, the parties involved, and the purpose of the deposit. It’s important to specify whether the deposit is refundable, the conditions under which it can be withheld, and any deductions that may apply. Including these details helps avoid confusion and legal disputes down the line.

In addition to the basic elements, always make sure that the template complies with California’s legal requirements. This may include providing receipts in a specific format and listing all applicable laws or statutes governing the deposit. A legally sound deposit receipt can go a long way in preventing future misunderstandings.

Here’s the revised list with minimal word repetition:

To simplify the process of creating a California deposit receipt, follow these key steps:

- Include the full name and address of both the buyer and the seller.

- State the amount of the deposit, the payment method, and the date the deposit was made.

- Specify the property address and provide a description of the property, including key details like the type of transaction.

- Outline the contingencies that apply to the deposit, such as refund conditions in case of deal cancellation.

- Clarify the timeline for further payments and the terms of the contract, ensuring both parties understand the conditions.

- Ensure the document is signed by both the buyer and the seller, along with a witness if required.

This layout minimizes redundancy and ensures clarity for both parties. Keep the language direct and to the point while adhering to local regulations.

- California Deposit Receipt Template

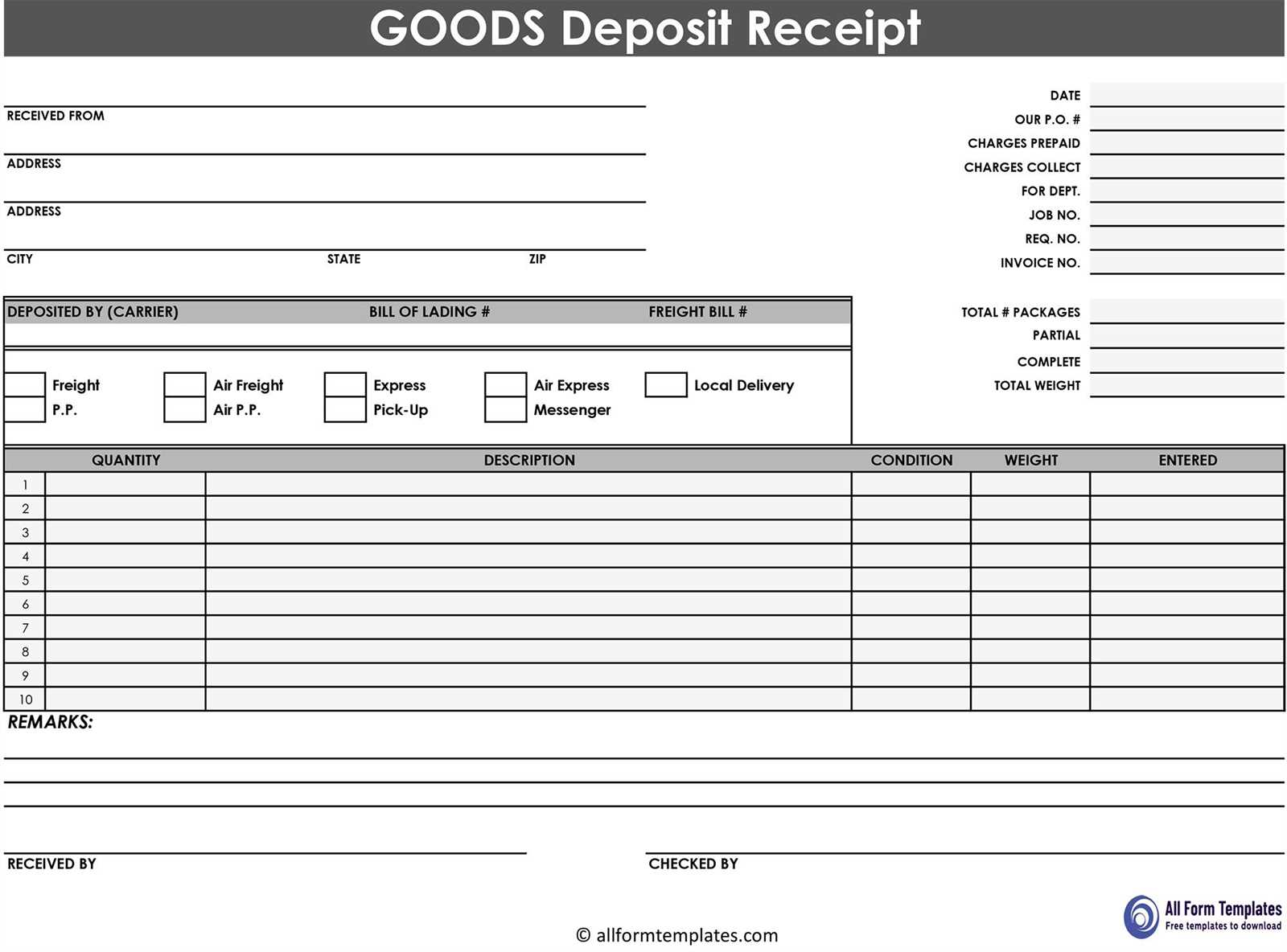

The California deposit receipt template should include key elements to ensure legal clarity and protect both parties involved. Here are the main components to incorporate:

- Transaction Details: Clearly state the transaction date, the amount of the deposit, and the purpose of the deposit (e.g., security deposit, earnest money, etc.).

- Parties Involved: Include the names and contact information of the buyer and seller, or the tenant and landlord, depending on the context.

- Payment Method: Specify how the deposit was made, whether by check, cash, or electronic transfer, to avoid misunderstandings later.

- Refund Terms: Clearly define the conditions under which the deposit will be refunded or retained, including any deductions for damages or non-compliance.

- Signatures: Ensure that both parties sign and date the document, acknowledging agreement to the terms.

- Additional Terms: If applicable, include any special agreements regarding the deposit, such as timelines for refund or specific actions required by either party.

Having these elements clearly outlined will help avoid disputes and make the document legally sound. Always keep a copy of the receipt for future reference or in case of disagreements.

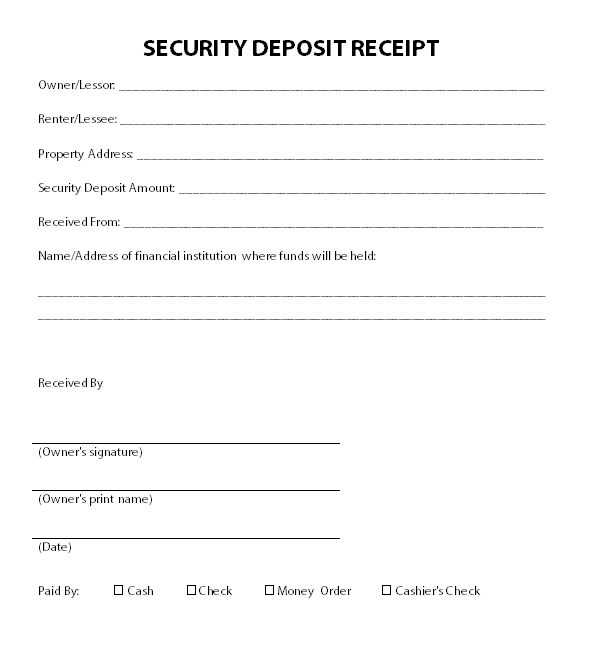

A California Deposit Receipt must include clear, specific information to protect both the buyer and seller. The document serves as proof that the buyer has provided a deposit toward the purchase of property and outlines the terms associated with that deposit. Here are the key elements to ensure the receipt is accurate and legally binding:

1. Identification of the Parties

Ensure the buyer’s and seller’s names, contact details, and roles are clearly stated. This confirms who is entering into the agreement and establishes the parties involved.

2. Property Details

Provide the address and legal description of the property being purchased. This clarifies what exactly is being bought or sold.

3. Deposit Amount

Specify the exact amount of the deposit made by the buyer. This section must also indicate whether the deposit is refundable or non-refundable under certain conditions.

4. Terms and Conditions

State any contingencies or conditions attached to the deposit. This includes whether the deposit is subject to the approval of financing, inspections, or other specified conditions. Outline the circumstances under which the deposit may be returned or forfeited.

5. Receipt Acknowledgment

The document must include an acknowledgment that the deposit was received, dated, and signed by the party receiving the deposit (usually the seller or their agent).

6. Buyer’s and Seller’s Signatures

Both the buyer and the seller, or their agents, must sign the receipt to confirm their agreement to the terms outlined. Without these signatures, the document may not be enforceable.

| Element | Details |

|---|---|

| Parties | Names and roles of buyer and seller |

| Property Information | Address and legal description of the property |

| Deposit Amount | Exact deposit amount, refundable or non-refundable conditions |

| Terms and Conditions | Contingencies, conditions for return or forfeiture |

| Receipt Acknowledgment | Date, signature of the receiving party |

| Signatures | Signatures of both buyer and seller or their agents |

When all these elements are included, the California Deposit Receipt will serve as a solid foundation for the transaction, reducing the potential for confusion or disputes between parties. Be sure to review the receipt thoroughly to avoid any oversight.

Adjust the California deposit receipt template to reflect the unique terms of each transaction. For a standard real estate deal, ensure fields for property address, sale price, and buyer/seller details are included. Add sections to capture the escrow company’s information and payment schedule for more complex agreements.

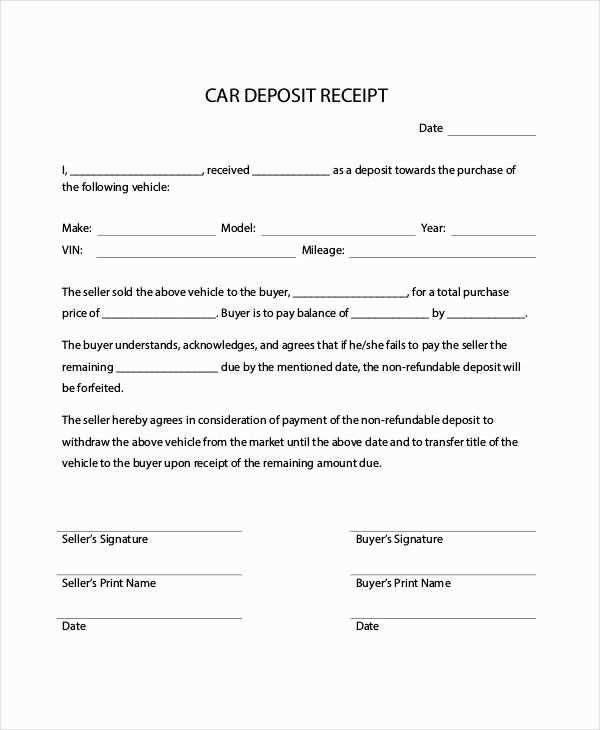

Real Estate Transactions

In real estate, a deposit receipt should specify whether the deposit is refundable or non-refundable, along with the due date and conditions for refund. Customize the template to specify the terms of contingencies, inspection periods, and any repair agreements. Be sure to include a section for the agent’s commission and closing date as well.

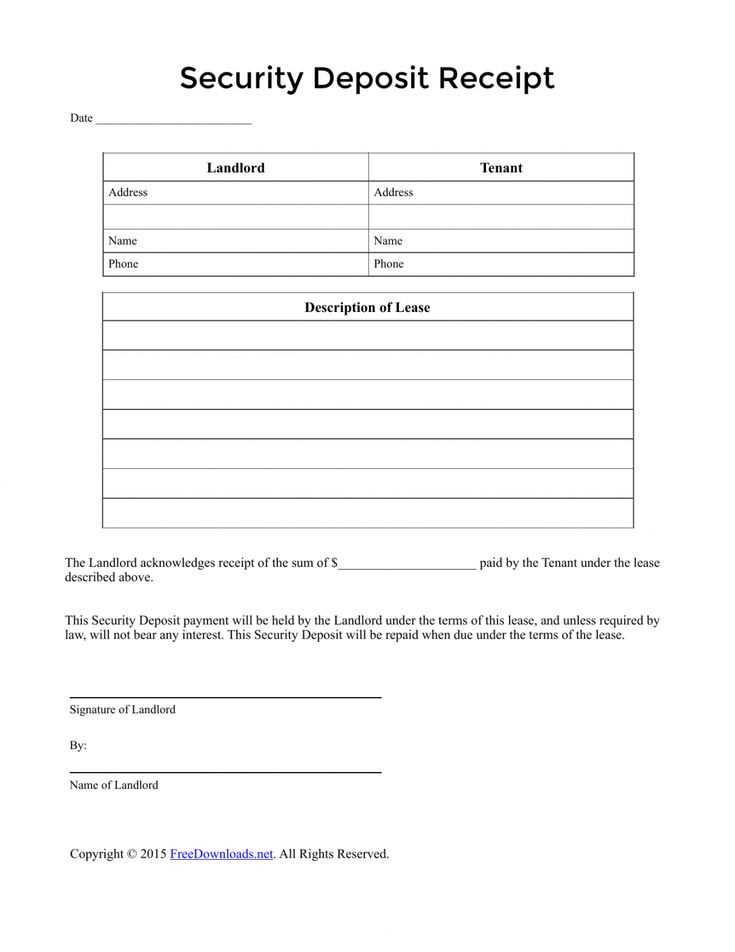

Rentals and Lease Agreements

For rental transactions, add fields that address the rent amount, security deposit, and lease duration. If there’s an option to purchase the property, include a clause related to this. Adjust for different scenarios, like whether the deposit will apply toward the first month’s rent or be held separately.

When using the template for business transactions, include clear details on deposit amounts, due dates, and refund policies. Add provisions for any custom arrangements, such as product delivery dates or milestones. A solid template will allow for easy modifications tailored to each unique agreement, minimizing potential disputes.

California law requires that deposit receipts clearly outline the terms of the transaction, providing essential information to both parties. A deposit receipt must specify the amount of the deposit, the date it was received, and the names of the buyer and seller. If applicable, it should include the conditions under which the deposit is refundable or non-refundable. Additionally, California’s Civil Code mandates that a deposit receipt contain a clear description of the property or goods involved in the transaction.

For real estate transactions, the deposit receipt must detail whether the deposit is part of the total purchase price or a separate agreement. If the buyer defaults, the contract must specify the seller’s right to retain the deposit. Likewise, the agreement should clearly state any contingencies that might affect the deposit’s return, such as the buyer securing financing or completing inspections.

Failure to adhere to these legal requirements could lead to disputes over the deposit or the contract’s enforceability. Make sure the deposit receipt is carefully reviewed, especially in cases of disputes or enforcement, to ensure it complies with California’s legal standards.

Double-checking the amount recorded is the first step in avoiding mistakes. Incorrect deposit amounts can cause confusion and potential disputes. Ensure the exact deposit is written clearly and matches the funds received.

Missing or Incorrect Party Information

Another common mistake is failing to accurately list the involved parties. The buyer’s and seller’s names, addresses, and contact details should all be carefully entered. An error in contact information could lead to communication issues later on.

Not Including Specific Terms and Conditions

Without clearly defined terms, a deposit receipt can become ambiguous. Include the purpose of the deposit, any deadlines, and what will happen if the deal doesn’t go through. This can prevent confusion in the future.

Ensure that the receipt is signed by both parties. A lack of signatures can render the document unenforceable if a dispute arises.

Store deposit receipts in a safe, organized manner to ensure quick access and proper tracking. Use a dedicated folder or file system to categorize receipts by date or transaction type. Consider digital storage for easy retrieval and backup, scanning paper receipts for added security.

Physical Storage

If storing paper receipts, keep them in a clean, dry place to avoid damage. Use labeled envelopes or folders for different types of deposits, such as security deposits or rent payments. Store these files in a filing cabinet or safe for added protection against loss or theft.

Digital Management

For digital storage, choose a reliable cloud service with encryption. Organize receipts into folders by transaction date or type, and use naming conventions for easy searching. Regularly back up your files to prevent data loss and ensure long-term availability.

Ensure that every receipt clearly displays the date of the transaction. This helps to avoid confusion if disputes arise later. Accurate timestamps are vital for both legal and record-keeping purposes.

Include Full Transaction Details

List all items purchased or services provided, including quantities, descriptions, and individual prices. This provides transparency for the buyer and makes it easier to confirm the transaction if necessary. Additionally, show the total amount, any taxes, and additional fees separately to provide a clear breakdown.

Use Clear Language

Avoid using jargon or ambiguous terms on the receipt. Make sure that the customer can easily understand what each line item refers to. A receipt should be easy to read and free from errors to prevent confusion or misunderstandings.

For receipts issued electronically, ensure that all required information, including the business name and contact details, is present in an easily accessible format. This is especially important for online transactions, where buyers may refer back to the receipt for warranty claims or returns.

Thus, words are not repeated more than 2-3 times, but the original meaning and sentence accuracy are preserved.

For a clear and concise California deposit receipt template, focus on structure and precision. Begin with the essential details such as the names of the parties involved, the property address, and the amount of the deposit. Follow this with a clear description of the terms and conditions under which the deposit is being made, ensuring that it reflects the agreement between the parties. Keep the language straightforward to avoid any confusion later on.

Next, specify the payment method and due date, outlining when the deposit should be made and the form it should take. Include a statement indicating that the deposit will be applied to the final purchase price or returned if certain conditions are not met. Ensure that both parties sign and date the document to confirm the transaction.

To prevent any ambiguities, avoid using vague terms. Be specific in the wording, especially regarding refundable deposits, deadlines, and conditions tied to the agreement. Clarity in your terms will safeguard both parties and minimize disputes down the line.

Finally, review the document for completeness. Ensure that all required information is included, and check for any potential errors before both parties finalize the receipt. A well-organized and accurate deposit receipt serves as a useful reference in any future transactions.