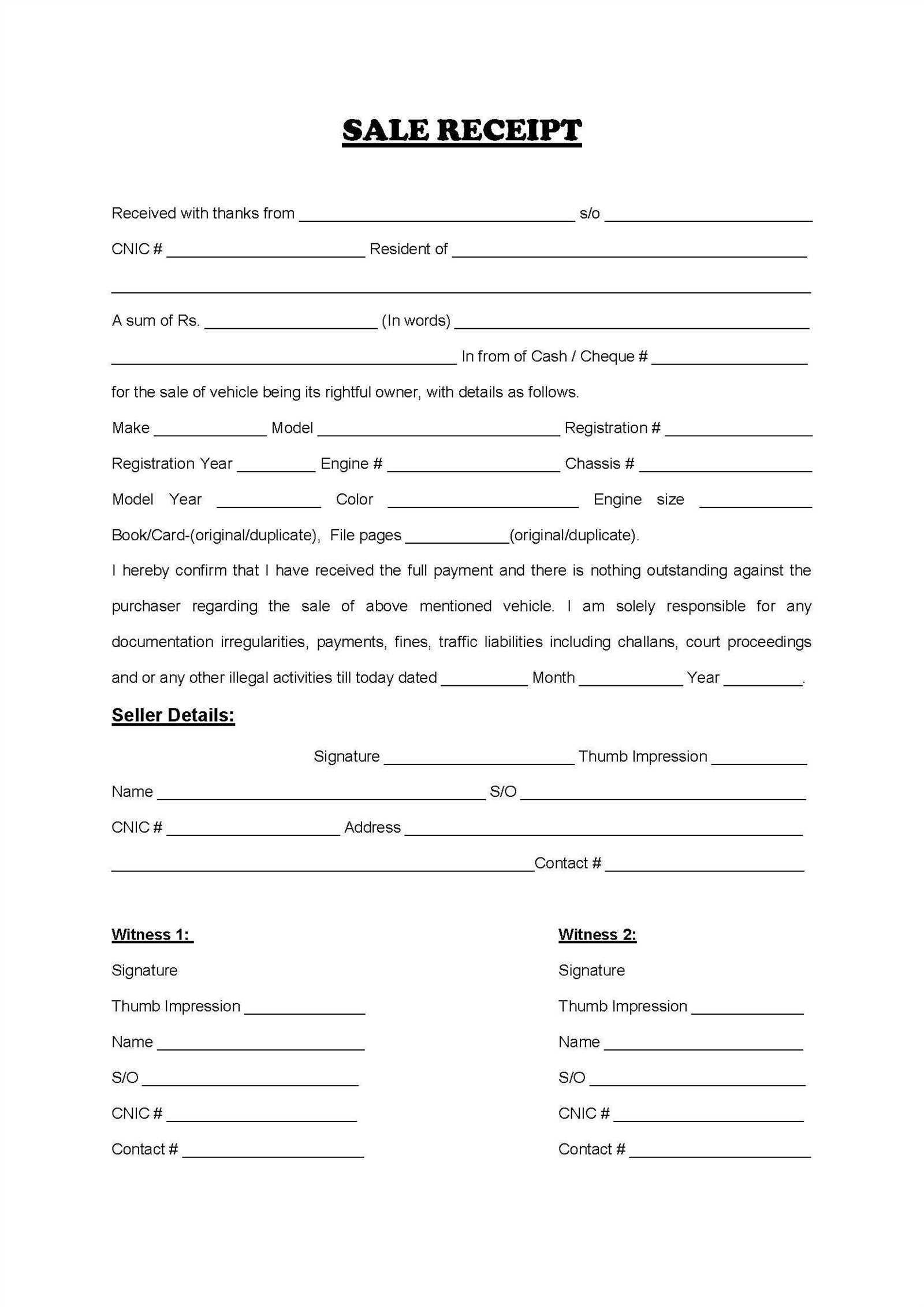

Creating a receipt of sale is a straightforward task, but it’s important to make sure that it includes the necessary details. A well-structured receipt protects both the seller and the buyer in case of disputes or misunderstandings. You should include the date of the transaction, the items or services sold, the agreed price, and the terms of the sale.

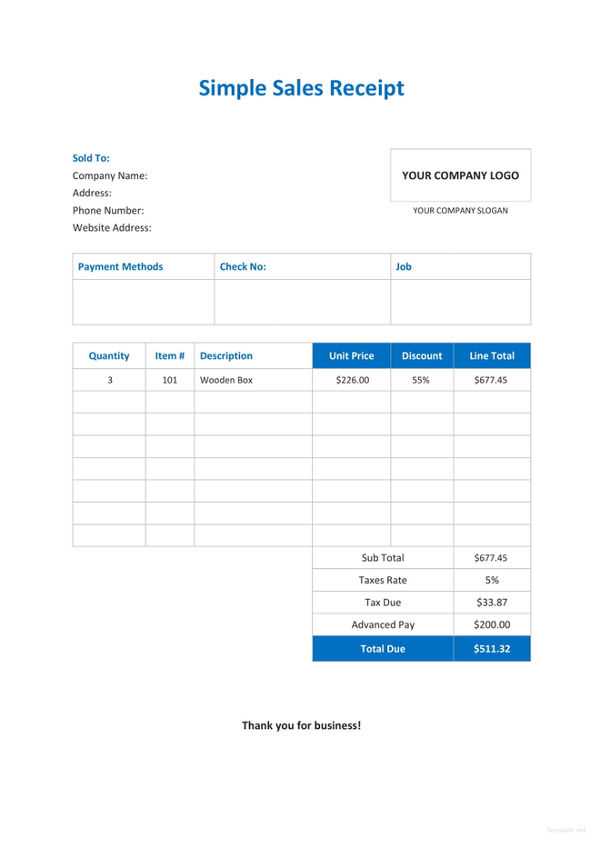

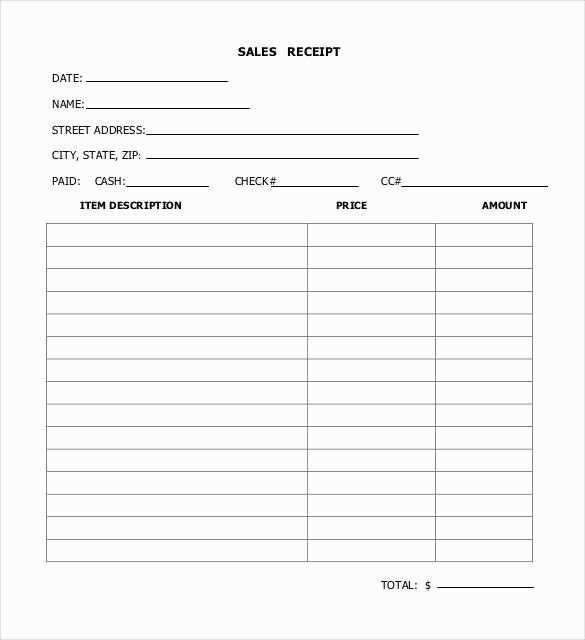

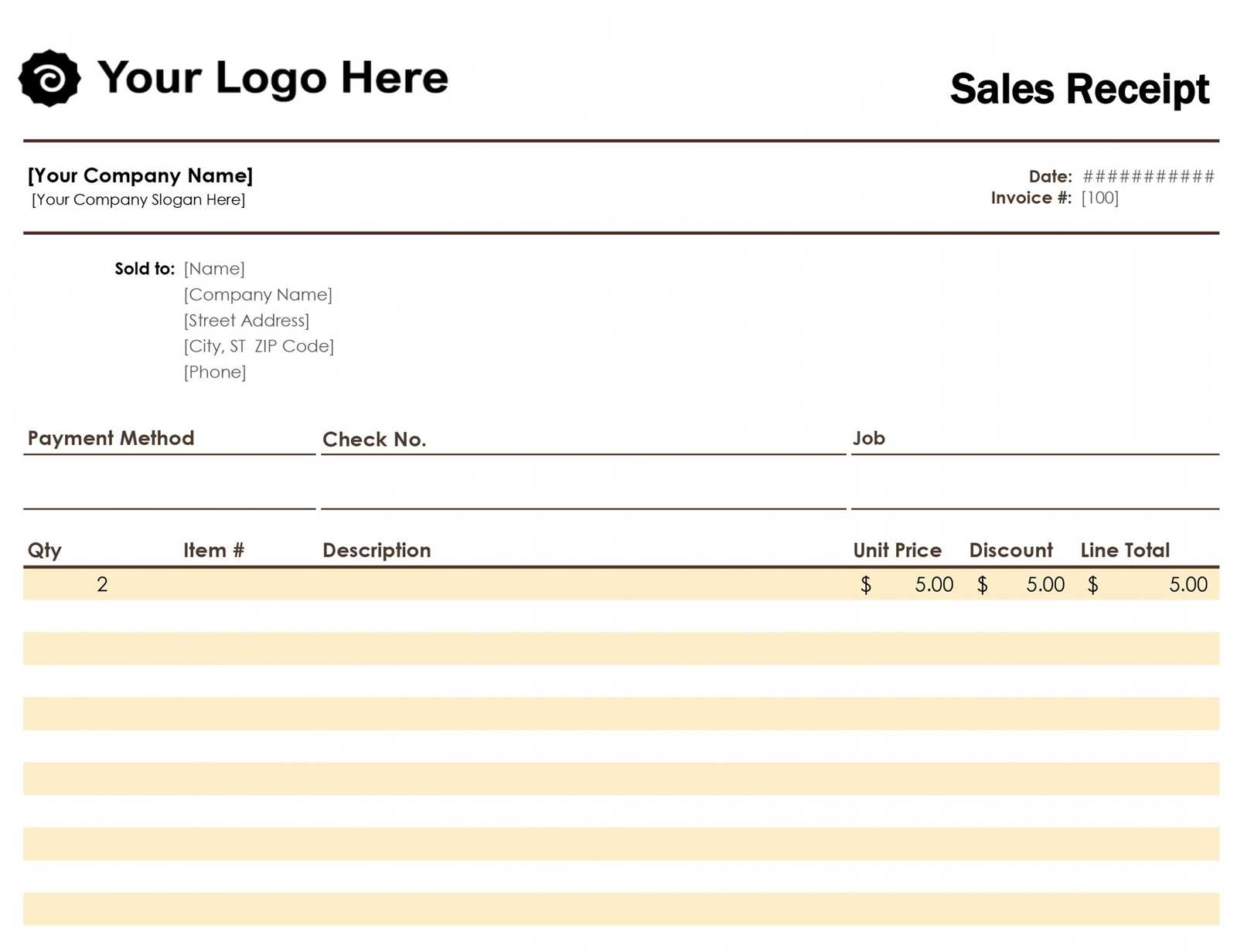

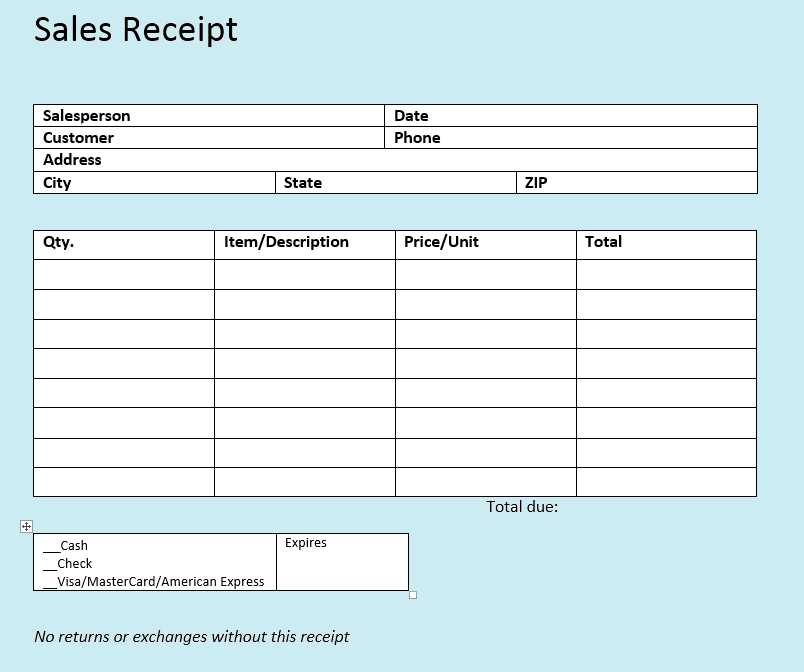

Key Elements: The receipt should have clear identifiers for both parties involved. The seller’s name, contact information, and tax identification number should be listed, along with the buyer’s details. Ensure the description of each item or service is specific, including the quantity and price.

Details like the method of payment, whether it was cash, credit card, or another form, are essential for transparency. Always make sure the total amount is clearly visible and matches the sum of the individual items or services listed.

Once you’ve included these elements, double-check for any necessary legal or regional requirements that might need to be added to your receipt template. Keeping it simple and clear ensures everyone involved has a copy of the agreement in a professional format.

Here’s a revised version with no word repeated more than two or three times:

When creating a sales receipt template, clarity is key. Start by clearly indicating the transaction details: item names, quantities, prices, and applicable taxes. Each section should be easy to find and understand for both parties involved.

1. Key Elements to Include:

- Seller Information: Company name, contact details, and address.

- Buyer Information: Name, address, and contact number.

- Purchase Details: List of products, including descriptions, quantities, and individual prices.

- Total Amount: Clear breakdown of the cost, including taxes, fees, and any discounts.

2. Design Tips:

- Keep text legible and organized. Use readable fonts and plenty of white space.

- Ensure the layout directs attention to the most critical information first.

- Incorporate a clean, professional design that reflects your business style.

Finally, include a section for payment details, including method and any reference numbers. This ensures both parties have a record of the completed transaction. Keep the template simple, but make sure all necessary information is present.

- Template for a Sale Receipt

A sale receipt should clearly capture all necessary transaction details. Begin with your business name, address, and contact information at the top. This provides the buyer with a quick reference for any future inquiries.

Transaction Information

Include the date of sale, receipt number, and the name or ID of the employee handling the transaction. This information ensures both parties can easily track the sale for records or returns.

Itemized List of Goods or Services

Each item or service sold should be listed individually, along with a description, quantity, unit price, and total price. This ensures clarity for both you and your customer, avoiding any confusion later.

At the bottom of the receipt, include the total amount paid and the payment method (e.g., cash, credit card). A space for taxes, discounts, or other adjustments should also be included to provide a full breakdown of the final price.

Include the transaction date. This helps both the buyer and seller track the timing of the purchase. Make sure it’s clear and visible, ideally at the top of the receipt.

List the name of your business. Include the legal name, as well as any relevant trade name or logo, if applicable. This ensures your customer knows exactly where the sale occurred.

Provide the buyer’s details. Include their full name or contact information if necessary, especially for high-value transactions or services requiring follow-up.

Item Description and Price

Each item or service should have a clear description, including the quantity and unit price. This makes it easy for the customer to identify what they purchased and verifies the charges.

Tax and Total Amount

Clearly state the tax applied to the purchase, if applicable. Then, list the final amount due, including both the subtotal and the tax. This transparency builds trust and avoids confusion.

Finally, include any return or exchange policies. This provides the customer with clear expectations should they wish to make changes after the sale.

List each item clearly with its name, quantity, and price on the receipt. Start with the name of the product or service, followed by the quantity purchased and the price for each unit. Include any applicable discounts or promotions directly under the item for transparency. If taxes are applied, show the tax amount for each item separately or as a total at the bottom.

For example:

Product A – 2 units – $5.00 each

Subtotal: $10.00

Sales Tax: $0.80

Total: $10.80

Ensure the pricing format is consistent throughout the receipt. If the transaction includes multiple items, organize them in a straightforward list format, allowing easy reference. Highlight the total cost at the bottom for quick visibility.

Finally, include any return or refund policies after the itemized details to provide customers with useful post-purchase information.

Provide clear and concise details about the payment method used in the transaction. Always include the payment method type (e.g., credit card, PayPal, bank transfer) along with the last four digits of the card number, if applicable. This helps both the seller and buyer identify the transaction easily.

Specify Payment Timing

Clearly state when the payment is made, whether it’s immediate, scheduled, or pending. This information will help avoid confusion, especially for future reference or disputes.

Secure Payment Details

Never include full credit card numbers or sensitive payment information in the receipt. Use encryption or tokenization to keep this data secure and ensure that privacy is maintained.

Ensure that receipts specify the transaction method for refunds or disputes, and always provide a contact point for payment-related queries.

Include the tax amount separately on the receipt. Clearly list the percentage and amount of tax applied to the total price. This transparency is required in many jurisdictions, helping both the buyer and seller keep track of tax obligations. Make sure to specify whether the tax is inclusive or exclusive of the total price. For example, “Tax (10%): $5” or “Price: $50 + Tax: $5”.

Depending on your location, certain legal information should also be included. This may involve your business registration number, tax ID, or VAT number, especially if the sale is subject to VAT. Check your local regulations for the necessary legal details. For instance, a business in the EU must show the VAT number, while a U.S. business might need to display the sales tax rate and the amount.

If there are any specific terms about warranties, returns, or refunds, list them clearly on the receipt. This ensures that the buyer understands their rights and obligations. Additionally, consider including a note about the governing law or jurisdiction in case of disputes, which is often required for legal compliance.

Include your logo and contact information at the top of the receipt. This creates a professional look and makes it easy for customers to reach you if needed. Use a clear font for your business name, address, and phone number, ensuring that it stands out without being overly large.

Customize the item description section to match your product or service. You can add columns for specific details, like quantity, unit price, and product codes. This helps customers quickly identify what they’ve purchased.

Make sure to include tax rates and other charges clearly. Customers appreciate transparency, so listing taxes separately from the total amount makes the transaction easier to understand. If you provide discounts, show the discount clearly to avoid confusion.

Set up a unique invoice number for each receipt to help with record-keeping and tracking. This will simplify accounting and allow you to find any receipt if customers need a copy or have questions in the future.

Add a payment method field to record how the transaction was paid. Whether it’s by cash, card, or another method, it ensures complete documentation of the payment process.

Include a return policy at the bottom of the receipt. This lets customers know their options in case they want to return the product. Keeping it brief but clear is key–customers should easily find and understand the policy.

To generate and print a receipt automatically, use a combination of a template, data entry, and a print command in your system. Here’s how you can set it up:

1. Choose a Receipt Template

Select or design a receipt template with placeholders for necessary information like date, items, amounts, and customer details. You can create a template in HTML or use pre-designed formats in programs like Word or Google Docs.

2. Use a Scripting Language for Automation

Write a script using JavaScript or Python to dynamically fill in the receipt details. The script should capture key information such as items purchased, quantities, prices, and total amounts. This data can be retrieved from your sales system or form inputs.

- For JavaScript, use functions like

window.print()to trigger printing after filling in the receipt details. - In Python, libraries like

reportlabcan help generate a PDF receipt that can be printed directly.

3. Automate the Printing Process

Once the receipt is generated, set up the system to automatically send it to the connected printer. For instance, in a web application, configure your browser or server to send the print command after the receipt is rendered.

- For web applications, integrate the

window.print()function within your script to allow seamless printing. - If using a desktop solution, use libraries such as

pywin32in Python to access printer functionalities and automate printing.

List all the items involved in the transaction within an organized structure to avoid confusion. Make sure each item has its own row with a clear description, quantity, and price. This method keeps the receipt clean and easy to follow.

| Item Description | Quantity | Price |

|---|---|---|

| Product A | 2 | $20.00 |

| Product B | 1 | $15.00 |

Ensure the total amount is clearly displayed at the bottom of the table, followed by any taxes or discounts that apply. This keeps the calculation transparent.

| Total Before Tax | $55.00 |

| Tax (5%) | $2.75 |

| Total Amount | $57.75 |