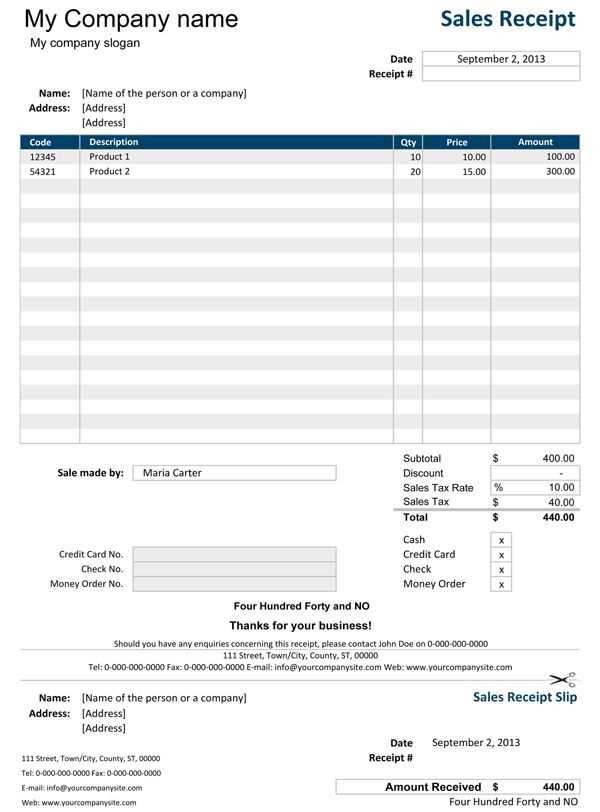

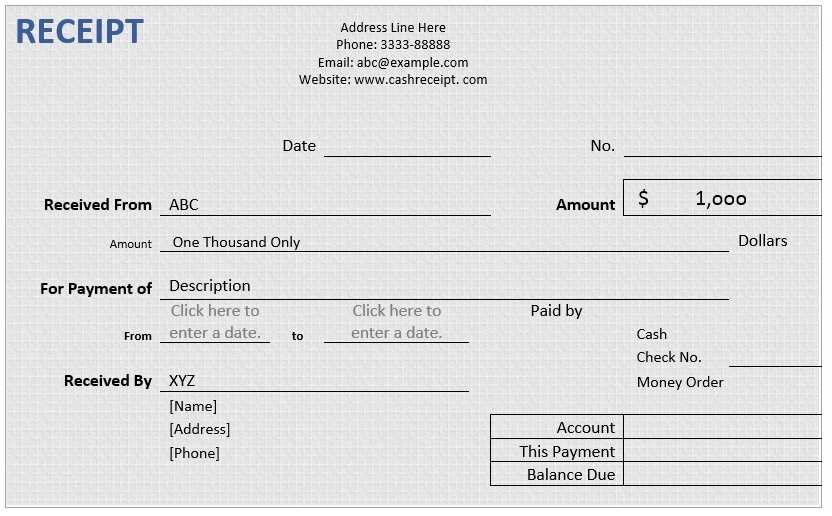

A receipt is a clear record of a transaction that helps both businesses and customers keep track of their purchases. By using a well-structured template, you can ensure that all key details are included without any confusion. A good template should capture essential information like item descriptions, quantities, and prices, as well as payment methods and the date of purchase.

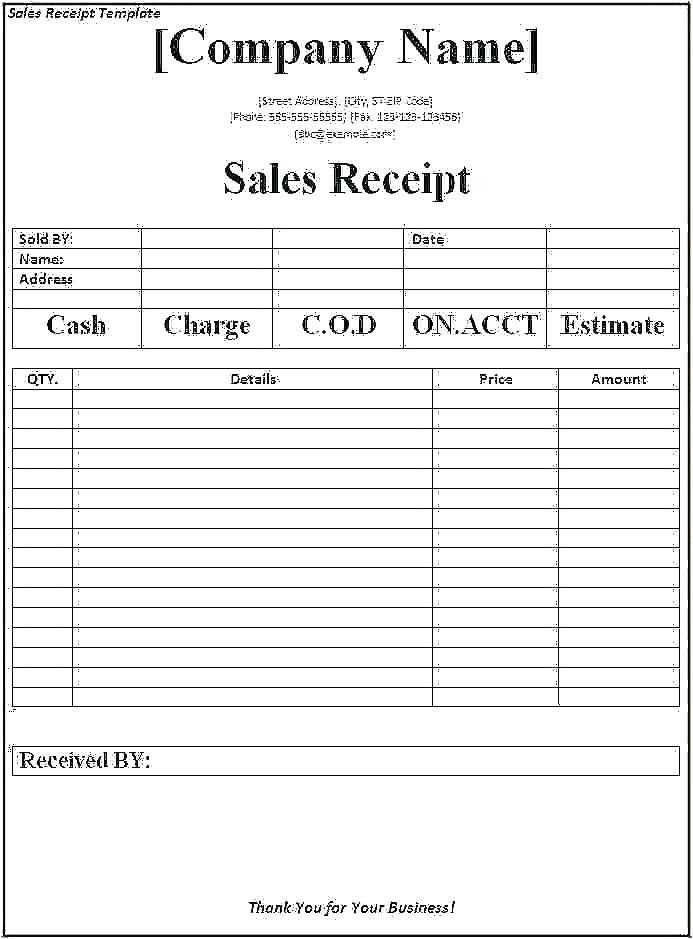

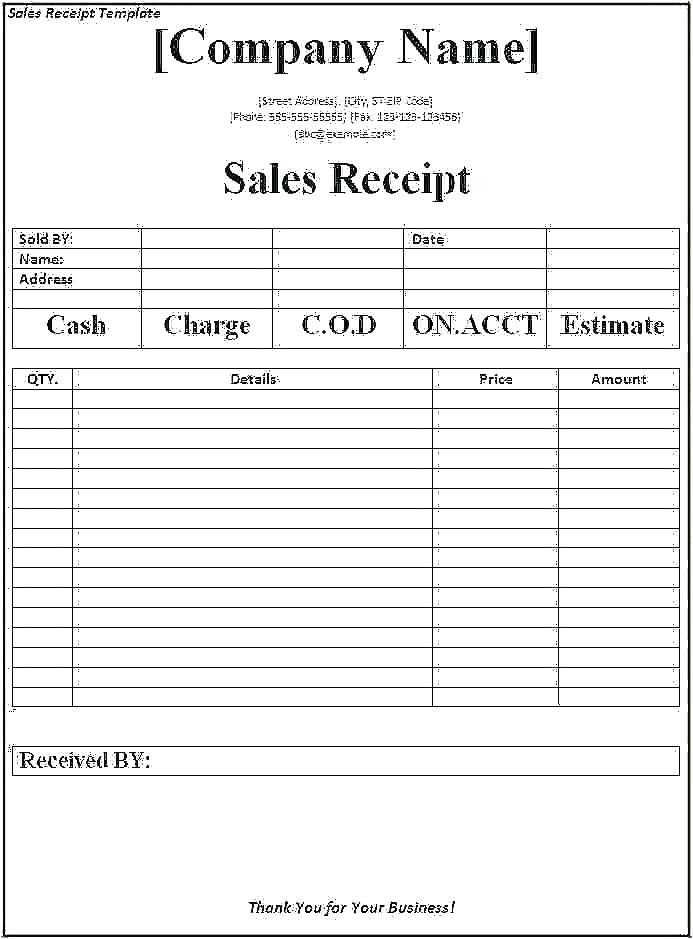

To streamline the process, you can create a customizable receipt template that suits your business needs. Including spaces for the company’s name, contact information, and transaction ID will make the receipt professional and easy to reference in the future. Make sure the layout is clean, with items listed logically and prices clearly visible to avoid any misunderstandings.

Tips: Organize the items in a table format, use clear fonts, and highlight the total amount to enhance readability. Adding payment method details like credit card number (last four digits) or cash will provide an accurate record for both parties. For added security, consider including a unique serial number for each receipt.

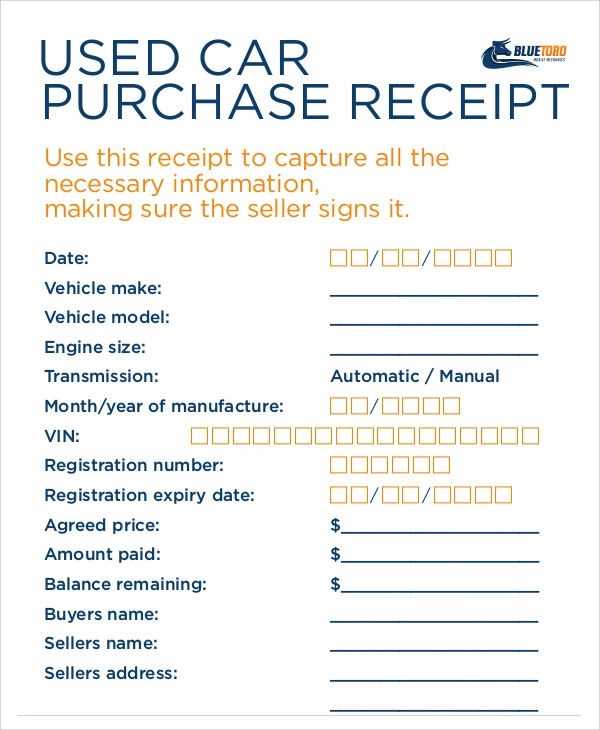

Receipt for Purchase Template

Use a clear and concise structure for your receipt template. Include key details to make it easy for both you and the customer to track the transaction.

Necessary Elements

- Receipt Number: Assign a unique number for every purchase.

- Transaction Date: Include the date of the purchase for reference.

- Buyer Information: Include the buyer’s name and contact details.

- Seller Information: List the business name, address, and contact information.

- Itemized List of Products/Services: Detail each product or service, including quantity and price.

- Total Amount: Clearly state the total amount paid, including taxes or discounts.

- Payment Method: Specify how the payment was made (credit card, cash, etc.).

Additional Tips

- Clear Formatting: Keep everything legible and easy to follow. Use sections with bold headings for quick identification.

- Optional Notes: Provide additional information, like return policy or warranty details, if applicable.

- Follow a Template: Use consistent formatting for every receipt to avoid confusion.

Designing a Clear Layout for Your Template

Ensure a structured flow by placing key elements in a logical order. Begin with the transaction details, such as the item description, price, and quantity, placed at the top for easy visibility. Keep a consistent format throughout, using a grid system to align text and numbers neatly.

Prioritize readability by choosing clear fonts and appropriate sizes. Avoid overcrowding by leaving sufficient space between sections, which helps to guide the reader’s eyes. Use bold or underlined text to highlight critical information, such as total amounts or dates.

Group related details together. For example, position the buyer’s and seller’s information in separate, clearly defined sections. This makes the receipt easier to scan, especially for individuals who may need to find specific data quickly.

Incorporate visual hierarchy by using contrasting colors or shading to distinguish headings from other text. This visual distinction helps customers locate important items like the total cost or payment method at a glance.

Finally, make the layout flexible. Ensure that the design can easily adapt to different devices or print formats without losing clarity or readability. A clean, organized structure will always enhance the user experience and promote trust in your business.

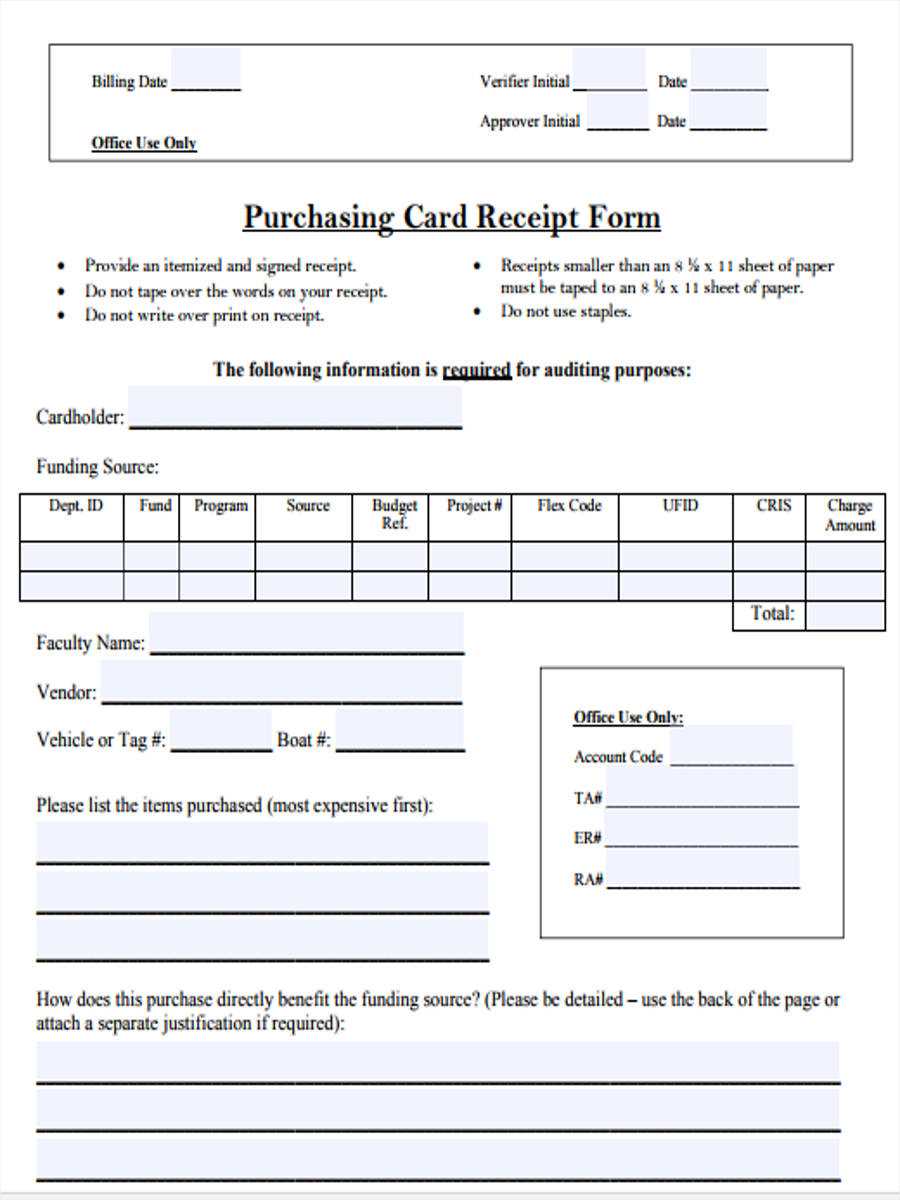

Incorporating Legal and Tax Information

Include any relevant legal information on the receipt to ensure compliance with local laws. This can involve displaying business registration numbers, tax ID numbers, or licensing information. If your business operates in multiple regions, make sure the legal details reflect the specific requirements of each area.

For tax purposes, clearly show the tax rate applied to the purchase and the amount of tax collected. This helps customers understand how taxes are being handled and ensures that both the buyer and seller comply with tax laws. You might also want to add a statement about tax exemptions, if applicable.

Don’t forget to mention any applicable refund policies or warranty information that is required by law in your jurisdiction. Clear communication of such details protects both your business and the customer in case of disputes or returns.

Lastly, if your business is required to provide receipts in a specific format for tax audits, ensure the template reflects these requirements. This will avoid complications during inspections or audits.

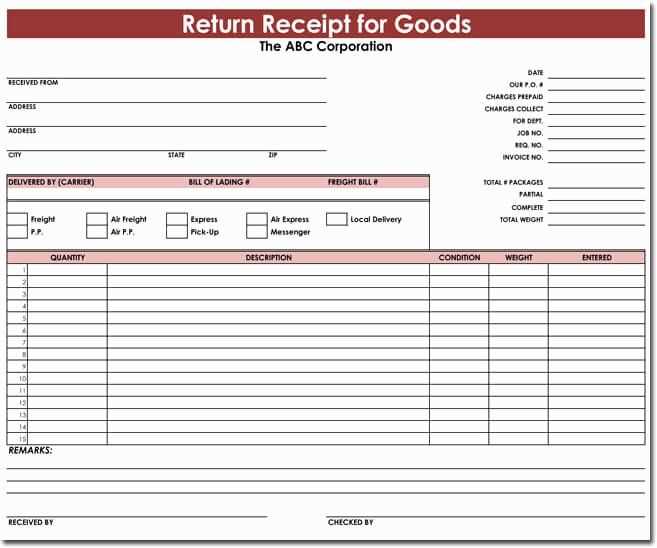

How to Include Product or Service Details

List each product or service clearly with a precise description. Include key attributes such as size, color, model, or flavor for products. For services, mention the specific tasks performed or features included in the service package.

Item name should be listed first, followed by a short description that captures its unique qualities. Include any identifying codes (e.g., SKU, product ID, or service reference number) to avoid confusion.

Include quantities and unit prices for products, and specify any timeframes for services. For instance, if you offer a subscription, state the duration (e.g., 6 months, yearly) and renewal terms.

For clarity, group related items or services together. For example, list different sizes of the same product under one heading, or include optional add-ons separately but clearly linked to the main item or service.

Incorporate any special offers or discounts, making sure to clearly state how they affect the final price, if applicable. Avoid ambiguity by explicitly stating the conditions under which the discount applies.

Customizing Fields for Customer Information

Adjust customer fields based on the specific needs of your business. You can modify default templates to capture only relevant data, keeping your receipts clear and concise. Here’s how to tailor your receipt template for customer details:

| Field | Description |

|---|---|

| Customer Name | Ensure this field is mandatory for all transactions to personalize the receipt. |

| Email Address | Including an email address allows customers to receive a digital copy of their receipt for future reference. |

| Phone Number | Adding a phone number field helps for follow-up communications, such as delivery updates or promotional offers. |

| Address | If necessary, add an address field to include shipping details for e-commerce transactions. |

| Loyalty Program ID | Customizing this field can help track customer purchases and apply discounts or rewards. |

Only include the most pertinent fields to avoid clutter and ensure customers see the key details immediately. Modify the layout of your template to prioritize essential information, and remove unnecessary sections. This will streamline the customer experience while still gathering the necessary information for your business operations.

Formatting Payment Methods and Amounts

Present payment methods and amounts clearly to avoid confusion. Use consistent formatting for each payment method and its corresponding amount. For example, display credit card payments, cash payments, and digital wallet transactions in the same format for ease of understanding.

Payment Methods

- Credit Card: Format with the last four digits only, e.g., “Visa ending in 1234.”

- Cash: Simply label as “Cash” or “Cash Payment.”

- Digital Wallet: Indicate the specific wallet used, such as “PayPal” or “Apple Pay.”

- Bank Transfer: List the bank name and transaction ID for reference.

Amount Formatting

- Use a clear currency symbol before the amount, e.g., “$100.00” or “€50.00.”

- Separate the currency symbol and amount with a space when necessary, e.g., “€ 50.00” or “£ 40.00.”

- Include cents for precise calculations, especially when dealing with exact amounts.

- For large sums, break the amounts down using commas to indicate thousands, e.g., “$1,000.00” for clarity.

Ensuring Compatibility with Different Accounting Systems

To ensure seamless integration with various accounting systems, focus on using standardized formats for receipt data. Many accounting software platforms support formats such as CSV, JSON, or XML. By adhering to these standards, you avoid compatibility issues and simplify the data transfer process. It’s also helpful to structure the receipt template with clear and consistent field labels, so the accounting software can easily map the data to corresponding fields.

Before finalizing the receipt template, test it with multiple accounting systems. This proactive approach helps identify potential mismatches early on. Consider including data fields like tax rates, itemized charges, and payment methods in formats that most accounting systems recognize. Regular updates to the template may also be necessary to align with new software versions and evolving standards in the accounting industry.

Consider offering customization options in your template that allow users to adjust the format or structure based on the specific accounting system they use. This flexibility can enhance compatibility and minimize manual data entry errors. Ensure that the template remains user-friendly while providing all the required information for accurate accounting records.