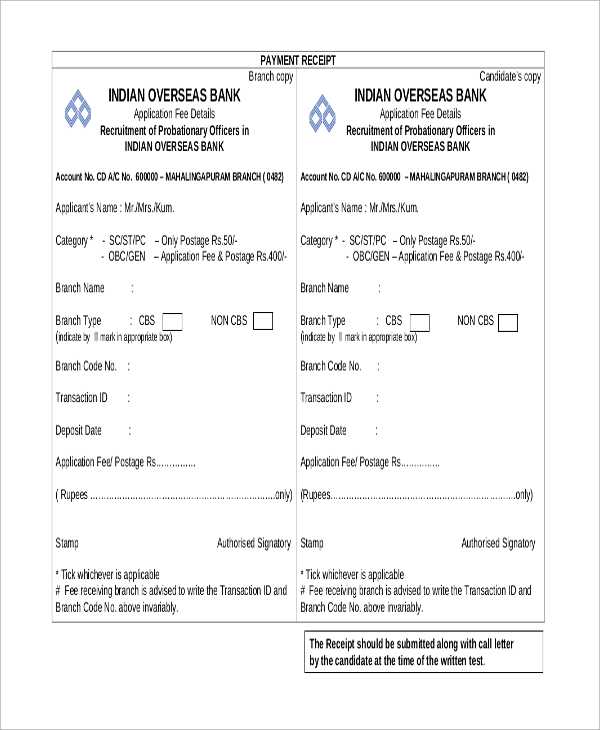

Creating a precise and clear bank payment receipt template is crucial for both personal and business transactions. It should capture all necessary payment details, ensuring both the payer and the recipient have a complete record of the transaction. This minimizes confusion and enhances trust between both parties.

Start by including the payment amount, payment date, and a clear description of the service or product paid for. The name and contact details of both the payer and the recipient are also important, as they help clarify who is involved. You should always include a reference number or transaction ID to allow for easy tracking in case of any future inquiries.

Finally, ensure that the bank’s name, address, and transaction method (e.g., bank transfer, credit card, or check) are included. This provides additional clarity and proves that the payment was processed through a reputable financial institution. Keep the format simple but professional, avoiding any clutter while ensuring that all necessary data is present and easily understood.

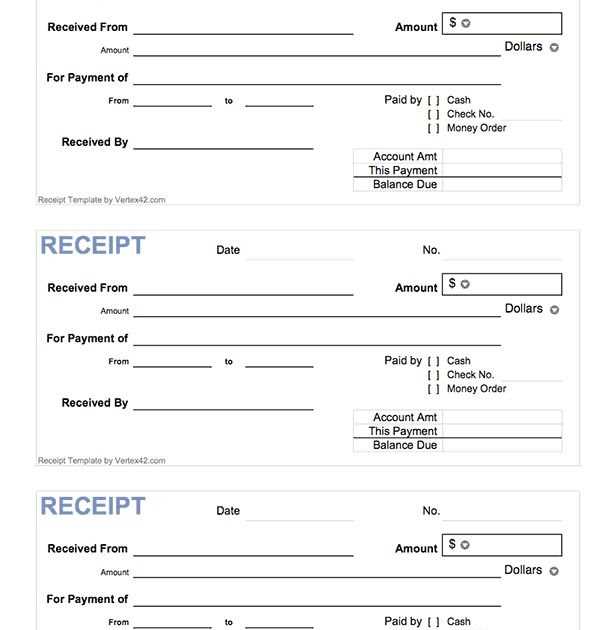

Here are the revised lines without unnecessary repetition:

Keep payment receipt lines clear and concise. Avoid restating payment method or details that are already included. Instead of repeating the total amount, mention it once with the relevant breakdown if necessary.

Examples:

Instead of: “The total amount of payment is $100. The payment amount is $100 for the product.”, use: “Total payment: $100 for the product.”

Consolidate the transaction date and method into one line. For instance, instead of: “The payment was made on February 6th, 2025. The payment method was by credit card.”, you can write: “Paid on February 6th, 2025 via credit card.”

Clarifications:

Focus on including only what the recipient needs to understand. For example, use specific references like invoice number or order ID rather than repeating product names and descriptions. Avoid redundant phrases that don’t contribute to the clarity or accuracy of the receipt.

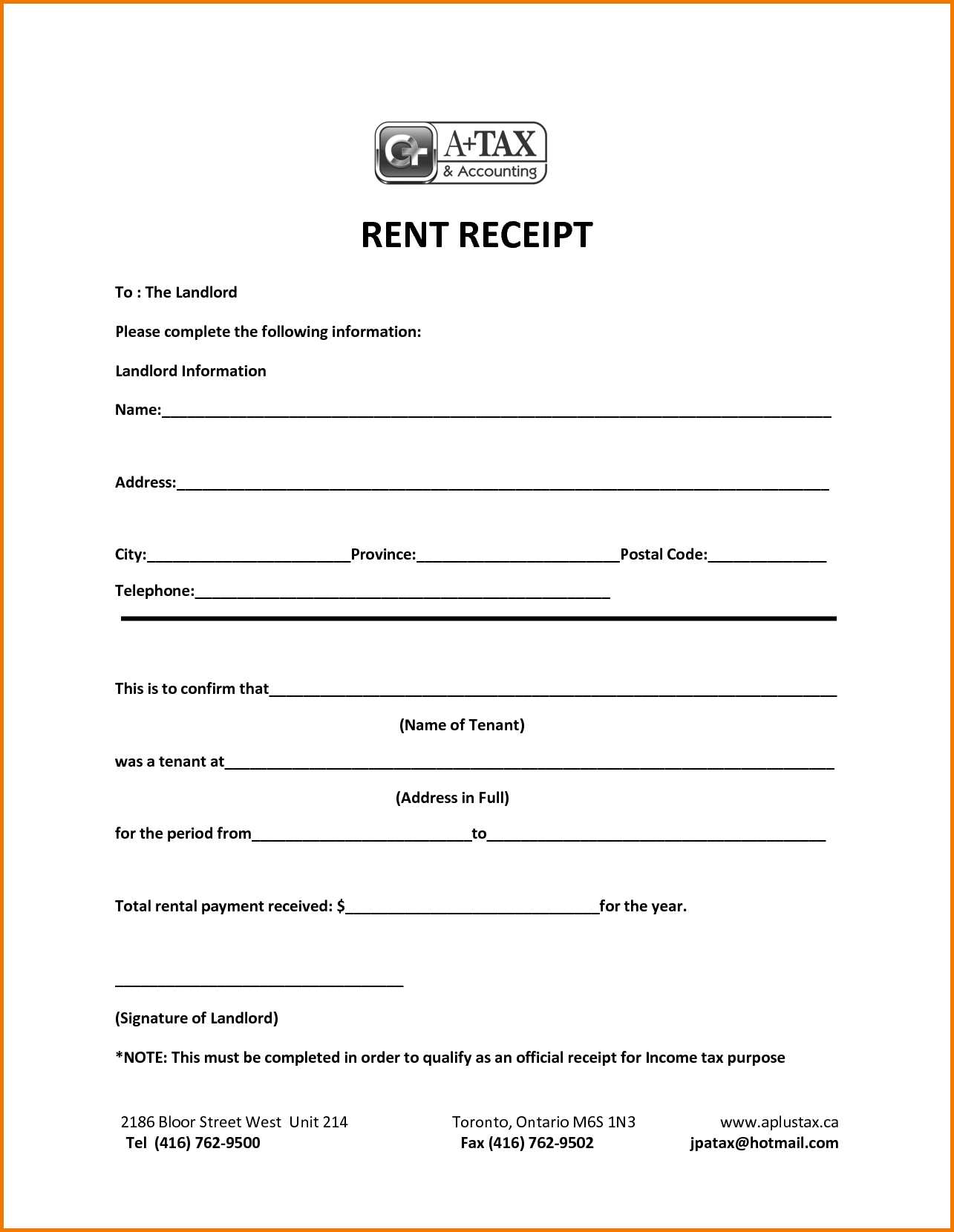

- Bank Payment Receipt Template

When creating a bank payment receipt template, make sure to include the following key elements to ensure clarity and completeness:

1. Receipt Number: Include a unique number to identify the payment receipt for future reference. This helps maintain accurate records.

2. Payment Date: The date when the payment was made should be clearly visible. This confirms when the transaction took place.

3. Bank Information: Include the name and address of the bank from which the payment was made. This provides context for the transaction.

4. Payer Information: Include the payer’s full name, address, and contact details. This confirms who made the payment.

5. Amount Paid: Specify the exact amount paid, both in numbers and words. This removes ambiguity in the transaction.

6. Payment Method: Mention the payment method (e.g., wire transfer, credit card) to clarify how the payment was made.

7. Recipient Information: Include the recipient’s details such as name, address, and any additional relevant information for clarity.

8. Transaction Reference: Include the transaction reference or ID from the bank to ensure the payment can be tracked easily.

9. Signature: Include a space for an authorized signature, confirming the payment has been processed and received.

10. Additional Notes: If applicable, provide any further details about the payment, such as payment for a service, invoice number, or due date.

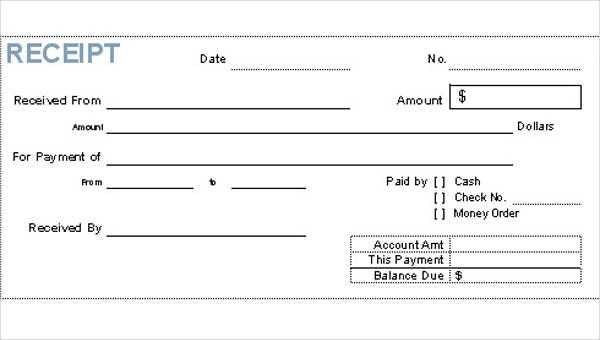

Focus on clear organization and readability when designing a payment receipt template. Here’s how to approach it:

- Header Information: Include the company name, logo, and contact details at the top. This makes the receipt easily recognizable and adds a professional touch.

- Receipt Title: Label the document as “Payment Receipt” or something similar to distinguish it from other types of documents.

- Payment Details: Include the date of payment, transaction number, and payment method. This helps the recipient verify the payment if needed.

- Amount Received: Clearly state the amount paid in both numerical and written form to avoid confusion.

- Sender and Recipient Information: List the payer’s and payee’s names, addresses, and any relevant reference numbers for future tracking.

- Description of Goods or Services: Briefly mention what the payment was for. This is especially helpful in case of any discrepancies.

- Tax or Additional Charges: If applicable, include any taxes or additional charges, with a breakdown of each item.

- Signature: Leave space for an authorized person to sign if necessary, adding credibility and formality to the receipt.

Keep the layout simple and ensure the font size is legible. A well-structured design with these key elements will make your payment receipt clear and professional.

A payment receipt should include clear and accurate details to ensure both the buyer and the seller have a solid record of the transaction. Focus on the following components for a well-organized and useful receipt.

Transaction Details

Always list the payment date, transaction ID, and the amount paid. Specify the currency and payment method used (credit card, bank transfer, etc.). This creates a clear reference for both parties.

Vendor and Customer Information

Include the name and contact details of both the seller and the buyer. This ensures that the payment can be traced to the correct parties in case of discrepancies. It’s helpful to include a brief description of the goods or services purchased, which adds context to the transaction.

By adding these key components, a payment receipt becomes an effective record, offering transparency and accountability for both parties.

Customize receipts based on transaction types for a clearer, more organized record. For a purchase, include the product details, quantities, and unit prices. If the transaction is a deposit, list the deposit amount and account number. For withdrawals, make sure to mention the withdrawal amount and the account balance after the transaction.

Adjusting Receipt Elements

Modify key sections like the header, payment method, and transaction summary. For online payments, add fields such as order ID and shipping address. In contrast, in-store payments should show the point-of-sale details and cashier information. When handling refunds, highlight the original transaction ID and the refund amount clearly to avoid confusion.

Including Additional Information

For transactions involving services, indicate service dates, hours worked, and any applicable taxes. For donations, ensure a section dedicated to the donor’s name and the amount donated, along with a tax-exemption note if necessary. Including these details helps provide transparency and a better user experience.

Set up an automated system using invoicing software that integrates with your payment gateway. This ensures that as soon as a transaction is completed, a receipt is generated and sent to the customer without manual input. Choose a solution that allows you to customize receipt templates to match your brand and ensures that all relevant details, such as payment method, amount, and date, are included.

Leverage APIs from payment processors like Stripe or PayPal to automate this process. These tools can directly trigger receipt creation once a payment is processed, reducing manual errors and saving time. Ensure that your system supports various payment types, whether credit card, bank transfer, or digital wallets.

Implement cloud-based solutions for easy access and data backup. This allows you to store receipts securely while also enabling retrieval from anywhere. Set reminders for periodic audits to ensure your automated system is functioning properly and that receipts are being delivered to customers as intended.

Finally, integrate the automated receipt generation system with your accounting software. This streamlines your financial tracking, making it easier to generate reports, reconcile transactions, and keep accurate records of your business’s finances.

Ensuring Legal Compliance in Payment Receipts

Start by including all required information in the payment receipt. In most jurisdictions, receipts must clearly display details such as the full name of the payer, the amount paid, the payment method used, and the date of the transaction. Check local legal requirements for specific documentation rules.

Required Information for Legal Compliance

Ensure the receipt contains the following elements to meet legal standards:

| Element | Purpose |

|---|---|

| Payer’s Full Name | Identifies the person or entity making the payment |

| Payment Amount | Verifies the value of the transaction |

| Payment Method | Details how the transaction was completed (e.g., bank transfer, credit card) |

| Transaction Date | Serves as proof of when the payment occurred |

| Vendor’s Contact Information | Ensures the payer can contact the business if necessary |

Additional Compliance Tips

Consider including an invoice or transaction reference number. This helps track the transaction in case of disputes. Keep records of all receipts for a specified period, as required by tax and audit authorities.

Store receipts in a centralized location, whether physical or digital, to prevent misplacement and confusion. Digital receipts are easy to manage and can be backed up, reducing the risk of loss.

1. Organize by Categories

- Group receipts by category such as utilities, purchases, and travel expenses. This makes it easier to retrieve specific receipts when needed.

- If you’re storing digital receipts, consider using folders or tags within your file management system to categorize them accordingly.

2. Implement a Clear Filing System

- For physical receipts, use a filing cabinet or box with clear labels. Ensure each category has a dedicated section for quick access.

- For digital receipts, create a folder structure that reflects the categories and dates of the receipts. This will make searching for a specific receipt faster.

3. Set a Review Schedule

- Review receipts on a regular basis. This ensures nothing is overlooked, and it gives you a chance to discard unnecessary items.

- For example, set aside time each month to go through the receipts, verify their accuracy, and archive them if needed.

4. Keep Backup Copies

- Store backup copies of your digital receipts on a cloud service or external hard drive. This reduces the chances of data loss due to technical issues.

- For physical receipts, consider scanning them before storing them away, so you have an extra digital copy in case the physical one fades or gets damaged.

5. Make Use of Receipt Management Apps

- Leverage apps designed for receipt tracking. Many of these apps can scan, categorize, and store receipts in a digital format for easy access and searchability.

- Ensure your app of choice allows you to upload receipts from various sources such as email, direct uploads, or scans for convenience.

Bank Payment Receipt Template

To create a clear and professional bank payment receipt, include these key elements:

- Header: Specify the payment type, such as “Bank Payment Receipt” or “Payment Confirmation”. This helps immediately identify the document’s purpose.

- Receipt Number: Assign a unique reference number for each receipt. This makes tracking and record-keeping more manageable.

- Date: Include the date of the transaction. This is important for both parties for future reference.

- Sender Information: List the sender’s name, bank account number, and contact details to clarify who made the payment.

- Recipient Information: Include the recipient’s details, such as the name, bank account number, and contact information. Ensure accuracy to avoid any confusion.

- Amount Paid: Specify the exact amount paid in both numerical and written form. This eliminates any potential misunderstandings.

- Payment Method: Mention the payment method used (e.g., wire transfer, bank deposit, etc.), so both parties are clear on how the payment was made.

- Transaction Reference: Include any relevant transaction IDs or reference numbers from the bank for traceability.

- Signature: Have a designated person sign the receipt if applicable, especially for official transactions or agreements.

- Terms and Conditions: If necessary, briefly mention any terms relevant to the payment, such as refund policies or service agreements.

By following this structure, you’ll ensure that all necessary details are captured, and both parties have a clear record of the transaction.