For businesses and individuals who handle cash transactions, having a clear and organized receipt is a must. A cash payment receipt serves as proof of a transaction and ensures both parties are on the same page regarding payment details.

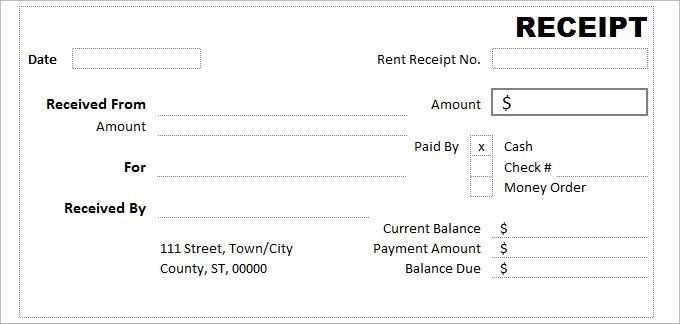

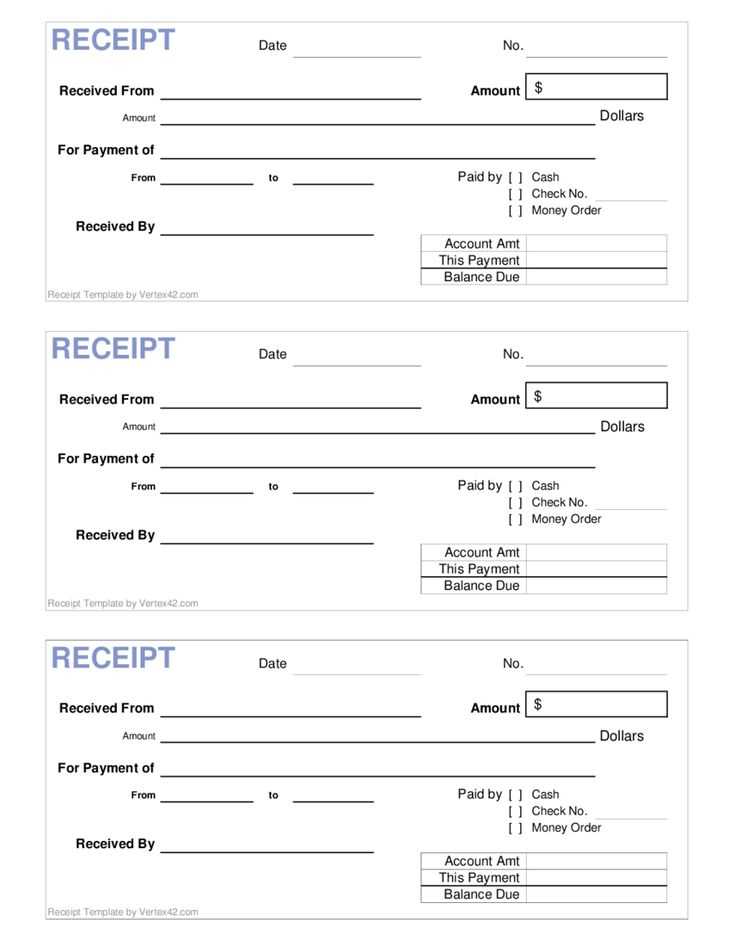

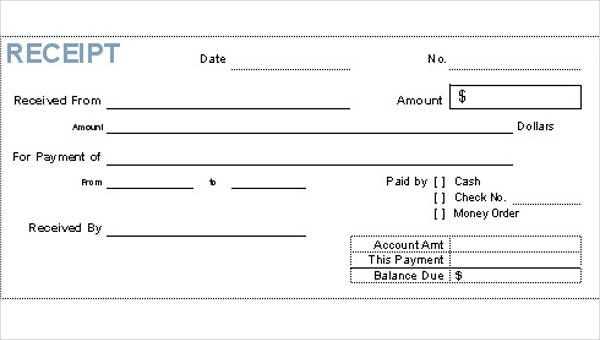

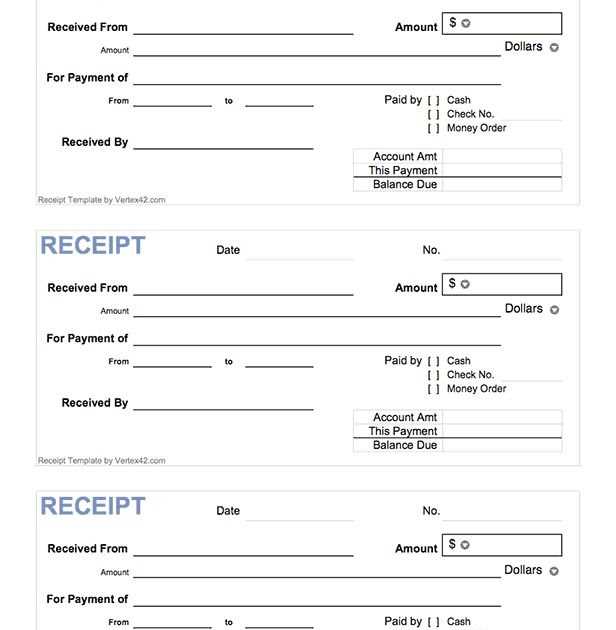

Use this free template to easily create professional receipts that capture all necessary information such as the payer’s details, payment amount, and transaction date. The template can be customized to suit different business needs, ensuring accuracy in every transaction.

Be sure to include the payer’s name, payment method, and the total amount received. A signature line can also add an extra layer of security, confirming that the transaction was completed. This simple tool will save time and help maintain transparent records for future reference.

Here are the corrected lines:

Ensure the header of the receipt includes clear details about the transaction, such as the date, the amount received, and the method of payment.

Verify that the recipient’s name and contact information are listed correctly to avoid future confusion.

The item or service description should be brief yet specific enough for easy identification. Avoid using vague terms like “goods” or “services.” Specify what was paid for.

Always include a reference number or transaction ID for tracking purposes. This is especially helpful for accounting or future inquiries.

Ensure that the total amount and any applicable taxes are clearly displayed and calculated accurately.

Below is an example of how a receipt should look:

- Transaction ID: 123456

- Amount Received: $150.00

- Payment Method: Credit Card

- Service/Product: Web Design Consultation

- Date: February 6, 2025

- Free Cash Payment Receipt Template

When creating a free cash payment receipt, focus on including key details such as the payment amount, the date of the transaction, the name of the payer, and the recipient’s details. This ensures clarity for both parties involved. Include a unique receipt number to track payments efficiently.

Make sure to state the purpose of the payment clearly, whether it’s for a service, goods, or any other transaction. This helps avoid any ambiguity in the future. Additionally, provide space for both the payer’s and recipient’s signatures, which act as confirmation of the payment.

For better organization, consider using a template with predefined fields for these details. Templates help standardize your receipts and make the process quicker. Customize the design to suit your business or personal needs while keeping it professional and easy to understand.

Finally, always keep a copy of the receipt for your records. This simple habit will help with future tracking and can be useful for tax or legal purposes. Use a clear, readable font to ensure all information is easy to reference later.

First, include the receipt title at the top, such as “Payment Receipt,” to clearly identify the document’s purpose. Right below the title, add the payment details, like the date and payment method used, whether it’s cash, credit, or bank transfer.

Basic Information to Include

Include the payer’s name, the amount paid, and a brief description of what the payment covers. It’s important to also add the seller’s name or company details and any reference number if applicable.

Payment Confirmation

Make sure to include a statement confirming that the payment was received. A simple “Paid in full” or “Payment received” works. Don’t forget to sign the receipt if necessary or include an electronic signature.

Lastly, keep the format clean and professional. Avoid clutter by using clear sections and adequate spacing between each part of the receipt. This helps make it easy to read and understand.

List all key details on a payment receipt to ensure clarity and prevent misunderstandings. This includes the following:

| Information | Description |

|---|---|

| Receipt Number | A unique identifier for each receipt, making it easier to reference or track payments. |

| Date of Payment | The exact date the transaction occurred, which helps with tracking and verifying payment timelines. |

| Payer’s Name | The full name or business name of the person making the payment. |

| Amount Paid | Clear indication of the amount paid, including any applicable taxes or discounts. |

| Payment Method | Details such as whether the payment was made by cash, check, credit card, or another method. |

| Transaction Description | A brief explanation of what the payment was for, ensuring transparency. |

| Seller’s Information | The seller’s name, contact information, and business details for easy reference. |

Always ensure that these details are clear and accurate for both parties to avoid future disputes or confusion.

Opt for a format that aligns with your needs while ensuring clarity and simplicity. A digital or printed receipt should clearly display key information: payment amount, date, payer, and purpose. A text-based format is best for simplicity and quick processing, while a PDF offers the advantage of easily sharing and storing receipts securely.

If your receipt is intended for tax or business records, consider including a detailed breakdown of the payment. For personal use, a concise format suffices, but it should still contain all necessary elements, such as the transaction method and relevant parties involved.

For ease of use, choose a format that integrates with your existing systems, whether that’s accounting software or a manual filing system. This ensures receipts are easily stored and retrieved when needed.

Adjust the layout and design of the receipt to reflect your brand’s identity. Replace default logos with your own, choose a color scheme that aligns with your company, and update the font to match your style guide.

Modify Fields for Accurate Details

Customize fields to ensure they capture all the necessary information for your business. Add sections like your company’s VAT number, payment terms, or any relevant notes that apply to each transaction. Adjust the positioning of these elements to ensure clarity and ease of use.

Set Up Tax and Discount Calculations

For businesses offering discounts or charging tax, make sure your template includes calculations that apply to each transaction automatically. This eliminates the risk of human error and helps streamline your operations.

Lastly, save your custom template for future use. This ensures consistency across all receipts and simplifies the process of issuing them for every transaction.

Ensure that your receipt includes the correct details to avoid any legal complications. It must clearly state the payment amount, date, and description of the transaction. This helps confirm that both parties agree on the terms of the payment.

Clear Identification of Parties

Include both the payer’s and the recipient’s full names or business names. This ensures that there is no ambiguity about who is involved in the transaction.

Payment Method and Terms

- Clearly specify the method of payment, whether it’s cash, check, or electronic transfer.

- Include any relevant terms, such as payment deadlines or installments, if applicable.

Refund Policy

Outline any refund or return policies related to the transaction. This protects both the buyer and the seller in case a dispute arises after the payment.

Tax Considerations

If applicable, state any taxes that are included in the total payment. This ensures transparency and compliance with tax laws.

Record Keeping and Legal Compliance

- Keep a copy of the receipt for your records. This is important for both tax filing and resolving potential future disputes.

- Follow local laws regarding receipt issuance, especially in terms of the information that must be included to meet regulatory requirements.

Begin by selecting a digital payment platform that offers receipt generation. These platforms often send receipts automatically after transactions, ensuring you have a record of payments without additional effort. Keep your receipt in a secure app or cloud storage for easy access when needed.

Ensure the receipt includes all required details like transaction amount, date, and merchant information. Most digital receipts are more detailed than paper ones, offering added convenience for tracking and accounting purposes.

Use the search and filter functions in your receipt storage app to quickly find specific transactions. This can save time when managing finances or verifying past payments.

| Feature | Benefit |

|---|---|

| Automatic Generation | Saves time by providing a record without manual input |

| Detailed Information | Helps keep track of every transaction with full details |

| Secure Storage | Prevents loss of receipts and simplifies access |

For further organization, consider categorizing your receipts by payment method or purpose within your digital storage. This will help you stay organized, especially when reviewing monthly expenses or filing taxes.

To create a free cash payment receipt template, start by outlining the key elements required for the document. Ensure the template includes the payer’s name, the recipient’s name, the amount paid, the date of the transaction, and the method of payment. Clearly state the purpose of the payment, such as for goods or services rendered. This will help avoid ambiguity in future references.

Layout Considerations

Arrange the fields logically, beginning with the payer’s and recipient’s details at the top, followed by the amount paid. Include space for any transaction reference numbers or notes that might be helpful for record-keeping.

Customizing the Template

Tailor the template to your specific needs by adding fields such as tax information or terms of service if necessary. This ensures the document is versatile and suitable for various types of payments.