Using a receipt template for contractors is an excellent way to ensure that all transactions are documented clearly and professionally. A simple, customizable template helps create accurate records, reducing the risk of errors or confusion when it’s time for payments or audits.

Include basic information like the contractor’s name, contact details, service description, payment terms, and the agreed amount. Make sure to break down the services provided and the associated costs so that both parties understand exactly what the payment covers.

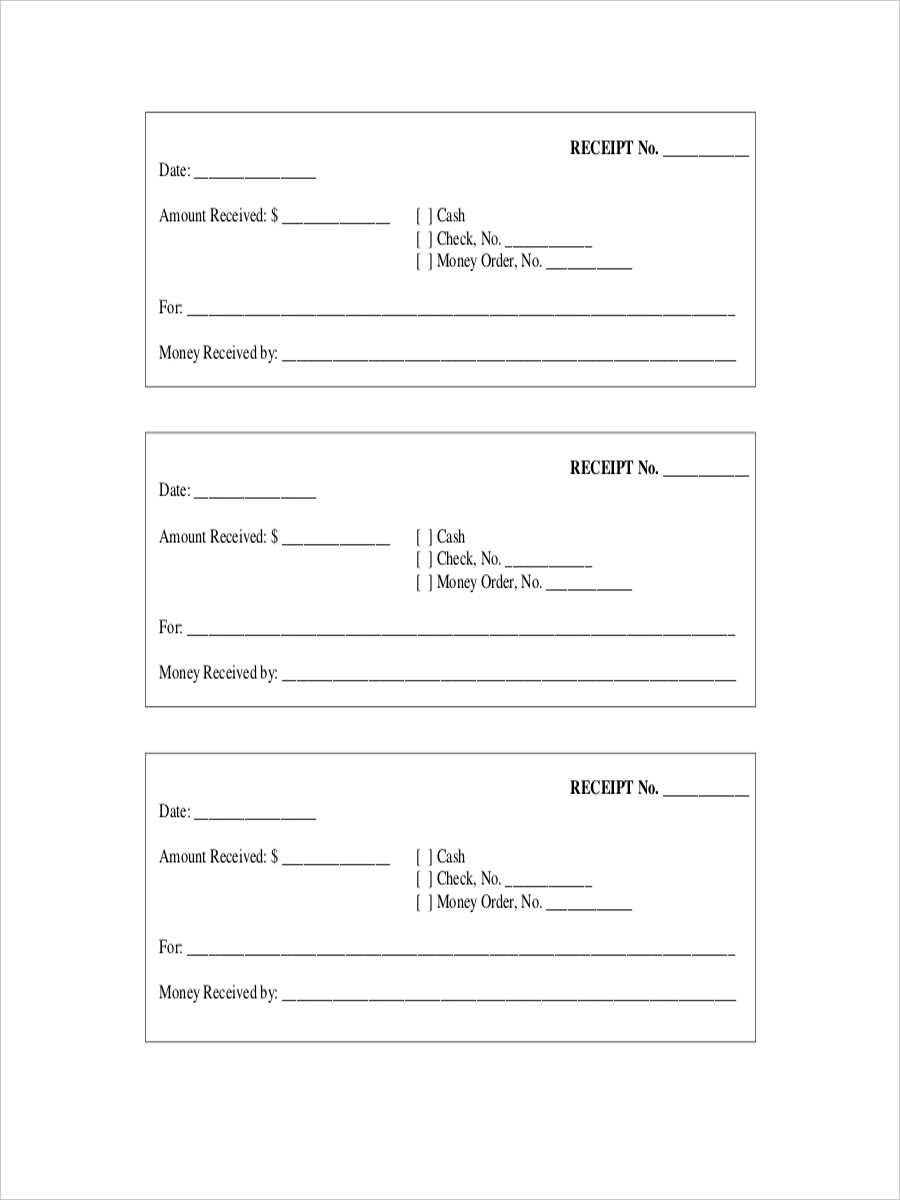

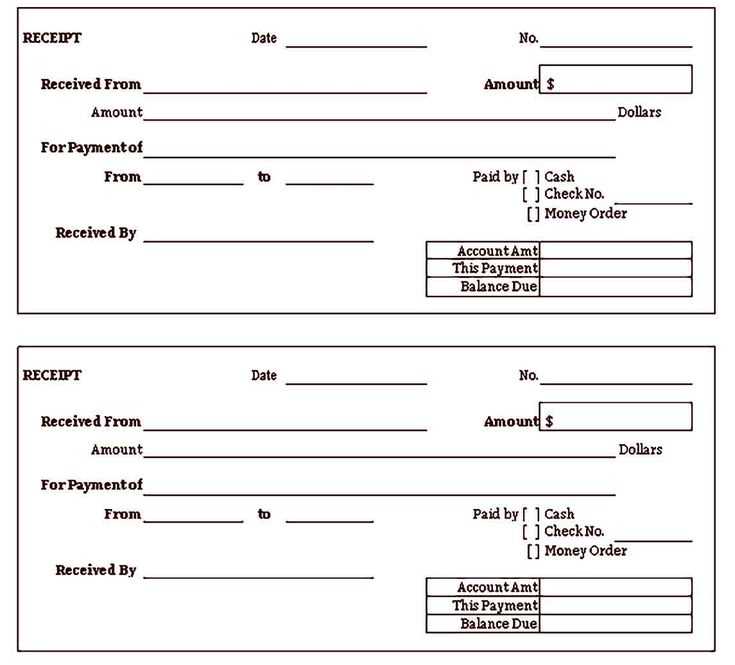

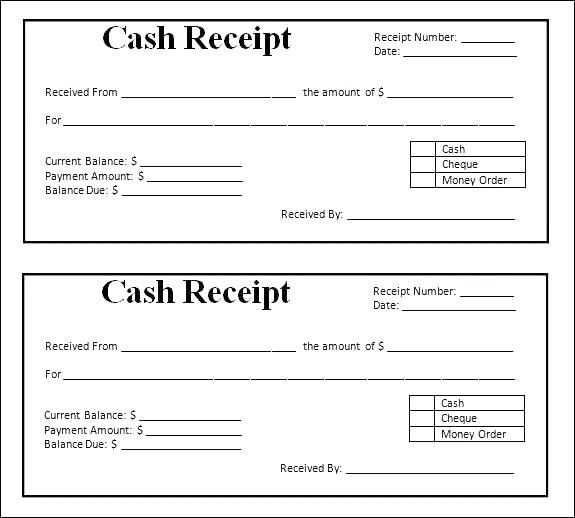

A well-structured template will also feature spaces for tax information and a unique receipt number, allowing easy reference for both contractors and clients. Adding a payment due date or a section for payment methods is equally important to maintain clarity on the transaction status.

By keeping the receipt format straightforward and consistent, contractors can stay organized and ensure transparency in all business dealings.

Sure! Here’s the modified version of your list, with minimal repetition:

To create a streamlined and efficient contractor receipt template, focus on key elements that are necessary for accurate documentation and clarity. Consider including the following components:

- Contractor Information: Name, business name (if applicable), and contact details.

- Receipt Number: Unique identifier for each receipt.

- Date: The date the work was completed or services rendered.

- Description of Work: A brief description of the tasks completed or services provided.

- Amount Charged: The agreed-upon amount for the services rendered.

- Payment Terms: Payment method, due date, and any applicable terms regarding late fees.

- Signature: Space for both the contractor’s and client’s signatures to acknowledge the receipt of services.

Keeping the structure clear and concise ensures both the contractor and client understand the transaction. A well-designed template helps prevent confusion and ensures smoother financial transactions.

- Receipt Template for Contractors (Blank)

Use this blank receipt template for contractors to ensure smooth documentation of transactions. Include key details such as the contractor’s name, services provided, payment amount, and date of completion. This clear structure guarantees both parties are on the same page regarding the work completed and the agreed-upon terms.

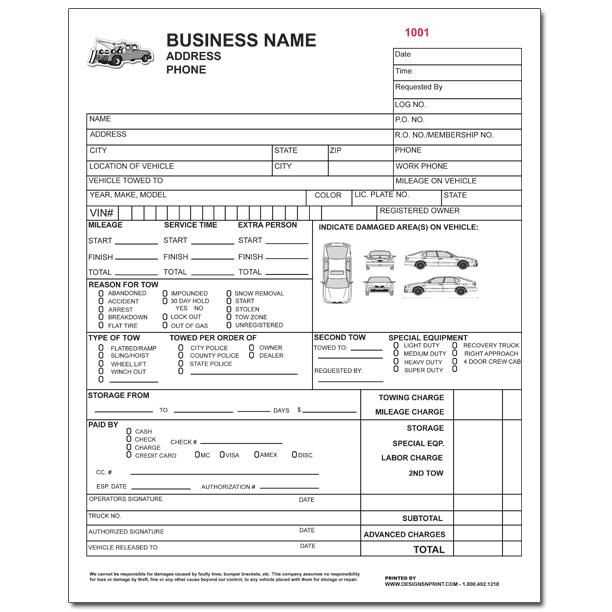

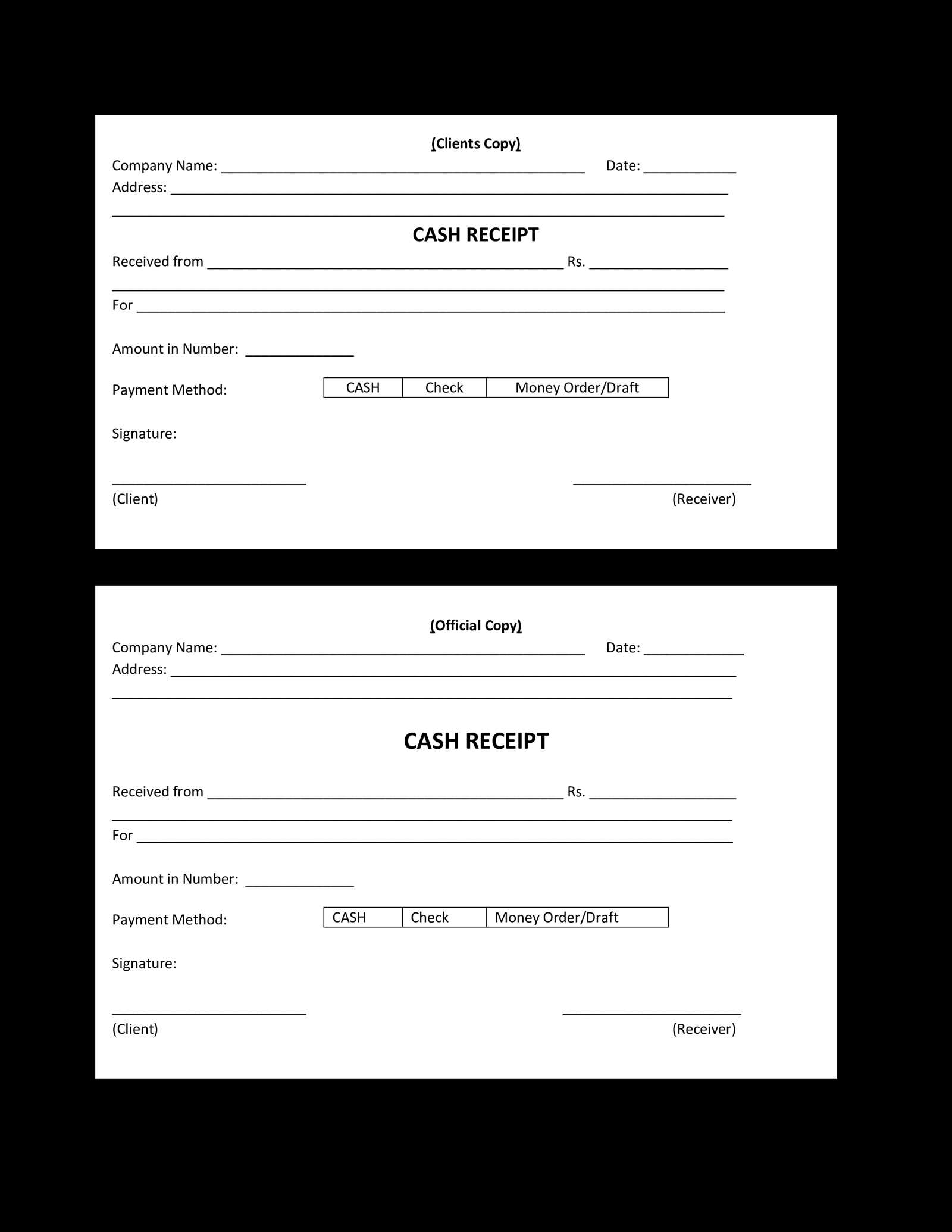

Start with the contractor’s full name or company name, followed by contact information. Include a description of the services rendered, including any specific tasks completed, materials used, and time worked. Specify the total amount paid and any relevant tax information. Always provide a unique receipt number for tracking purposes.

Incorporate payment details, noting whether it was cash, check, or another method. Specify if the full amount was paid or if there’s a remaining balance. Include payment terms and dates, along with any necessary signatures from both parties.

Finish by clearly stating that the payment has been received in full. Ensure there’s a space for the recipient’s signature, confirming the transaction was completed satisfactorily. The receipt should be clear, concise, and free of ambiguity to protect both the contractor and the client.

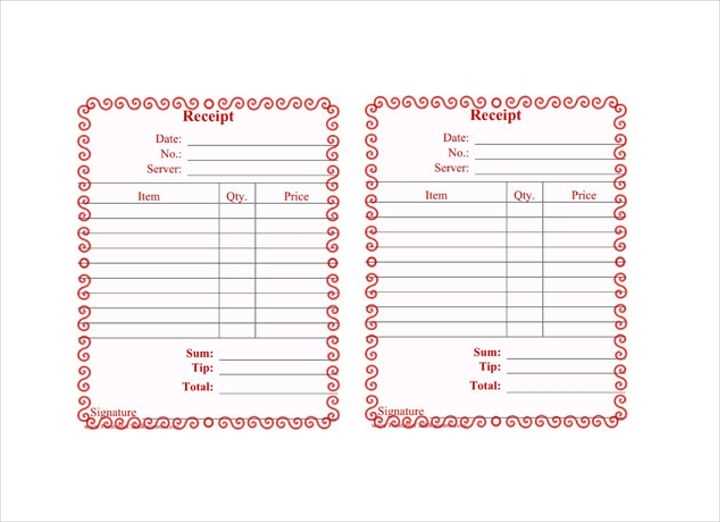

Begin by choosing a clean, organized layout. Use clear headings for each section, such as “Date,” “Items,” and “Total.” Ensure the font is legible and the design is easy to follow.

Start with a header that includes the business name, address, and contact details. This provides the recipient with important reference information right at the top. Below this, leave space for the date and receipt number, as these are key for future reference.

In the main body, list the items or services provided, their quantities, unit prices, and totals. Use tables for neat alignment, ensuring the data is easy to scan. A simple table with columns for item description, quantity, price per unit, and total cost is often enough.

Finish by calculating the subtotal and applying any taxes or discounts. Display the total amount clearly at the bottom, making it stand out for quick identification. Don’t forget to add a thank you note or a reminder for payment, depending on the purpose of the receipt.

Lastly, ensure your design is printable and adjusts to different screen sizes, ensuring clarity on both digital and paper formats.

Focus on clarity and consistency when designing a receipt template for contractors. Ensure that all necessary details are easy to identify and understand for both parties. Below are the key components to include:

1. Contractor’s and Client’s Information

Clearly display both the contractor’s and client’s names, addresses, and contact details. This helps prevent any confusion in case of disputes or future communication.

2. Invoice Number and Date

Assign a unique invoice number to each receipt. This will help with tracking and organizing past transactions. Include the date the receipt was issued as well.

3. Description of Services Provided

Provide a detailed breakdown of the services delivered. Include the type of work, number of hours worked (if applicable), and any other relevant details to avoid misunderstandings.

4. Payment Terms

State the payment terms clearly, such as due dates and acceptable methods of payment. Make sure there are no ambiguities about when and how payment should be made.

5. Amount Due

Include the total amount due, broken down by each service or item listed. This ensures transparency and eliminates confusion about the payment amount.

6. Taxes and Additional Charges

List any applicable taxes, surcharges, or other fees that are part of the total cost. These should be clearly separated to give a full understanding of the total charge.

7. Signature or Approval Section

A section for the client to sign or approve the receipt adds an extra layer of professionalism and clarity. This also confirms acceptance of the services and the terms outlined.

8. Payment Confirmation

Once payment is made, mark it clearly on the receipt. This could include a stamp or note confirming payment to avoid any future disputes about whether the invoice has been settled.

Table Example

| Item Description | Quantity | Unit Price | Total |

|---|---|---|---|

| Service 1 | 10 hours | $50 | $500 |

| Service 2 | 5 hours | $60 | $300 |

| Subtotal | $800 | ||

| Tax (10%) | $80 | ||

| Total Due | $880 | ||

Use a clean, simple font like Arial or Calibri to ensure clarity. Stick to a font size between 10 and 12 points for readability. Avoid decorative fonts that can make the document look cluttered.

Ensure proper alignment of text. Keep the contractor’s name, company, and contact details aligned to the left, while the dates and totals can be right-aligned for a balanced layout.

Incorporate consistent spacing throughout the document. Leave enough room between sections to separate headings, lists, and totals, giving the document a tidy appearance.

Use bold for headings and important figures, like the total amount due or due date, to draw attention. However, avoid excessive bold text, as it can create a visual overload.

Utilize tables for organized sections, such as itemized lists or payment schedules. This makes information easier to digest and prevents the document from looking too busy.

Always include clear and concise headings for each section. Keep them short but informative, so it’s easy to navigate through the document.

Avoid unnecessary borders or backgrounds. A simple, white background ensures the content stands out and maintains a professional appearance.

Finally, make sure margins are consistent throughout the document, typically 1 inch on all sides, to ensure a clean and polished presentation.

Contractor invoices must contain specific legal details to ensure they are valid and enforceable. Include your business name, address, and any registration number that applies to your business. This establishes the legal identity of the contractor and meets local or national regulations. Avoid using generic titles; ensure that the invoice is clearly marked as such.

Invoice Content Requirements

Include the date of the service, the agreed-upon payment terms, and any relevant contract references. Specify a detailed description of the work completed, including hourly rates or flat fees. Avoid vague language or unitemized charges; clarity prevents disputes. Always state the due date for payment, and ensure that the payment method is clearly outlined to avoid confusion later.

Tax Obligations

Contractors must adhere to tax regulations by including applicable tax rates and amounts on the invoice. Depending on local tax laws, VAT or sales tax may need to be added. Check the legal requirements in your jurisdiction to ensure accurate tax calculations and avoid penalties.

Modify the layout and sections of the template to suit the specific needs of each project. Start by adjusting the header and project description fields to match the unique scope of work. Different projects may require different levels of detail, so customize the content fields accordingly.

- Update payment terms: Tailor the payment structure for the project at hand. Whether the payment is hourly, fixed-rate, or milestone-based, ensure the terms reflect the agreement.

- Include specific deliverables: Customize the section on deliverables to reflect the agreed-upon work and timeline. Specify what will be completed and the deadlines.

- Modify contractor and client details: Make sure the contact information for both parties is correct and relevant to the current project.

- Adjust terms and conditions: Depending on the nature of the project, include or exclude clauses related to project scope, confidentiality, or warranties. Customize the legal language as necessary.

Adapt these sections based on the requirements and specifics of each contract to ensure the template is fully aligned with the particular project. This approach ensures clarity and accuracy in the document, improving communication between contractor and client.

After creating a receipt design, save it in a commonly used file format like PDF or PNG. These formats maintain the layout and ensure compatibility across various devices. If you used a template, make sure to save your custom version separately to avoid overwriting the original.

For sharing, use cloud storage services like Google Drive or Dropbox. This allows quick access and easy sharing with clients or team members via a simple link. If sending via email, ensure the file size is optimized for faster uploads and downloads.

If you’re working with a design tool that supports sharing directly, take advantage of that option. It speeds up collaboration and makes the process seamless. Always double-check the design before sharing to avoid sending an incomplete version.

Ensure the receipt template for contractors includes clear sections for both parties’ names, dates, and a detailed list of services or products provided. Start by specifying the contractor’s full name and contact information at the top, followed by the client’s details. This helps maintain transparency and proper identification.

Invoice Details

List all items or services provided, including quantity, rate, and total amount for each. This section should be formatted clearly to avoid any confusion. Add the payment terms, specifying due dates and any applicable taxes or additional fees. If applicable, include a payment method section to indicate how the client can pay.

Signatures and Confirmation

At the bottom of the receipt, leave space for both the contractor’s and client’s signatures. This confirms that both parties agree to the details presented in the document. It’s also recommended to include a note indicating any future payment schedules or milestones, depending on the scope of work.