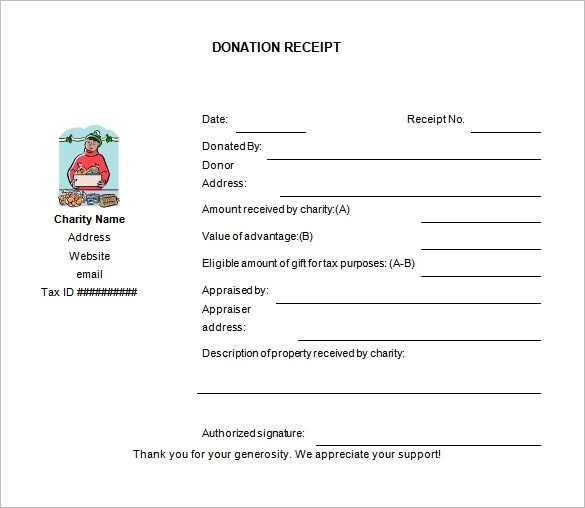

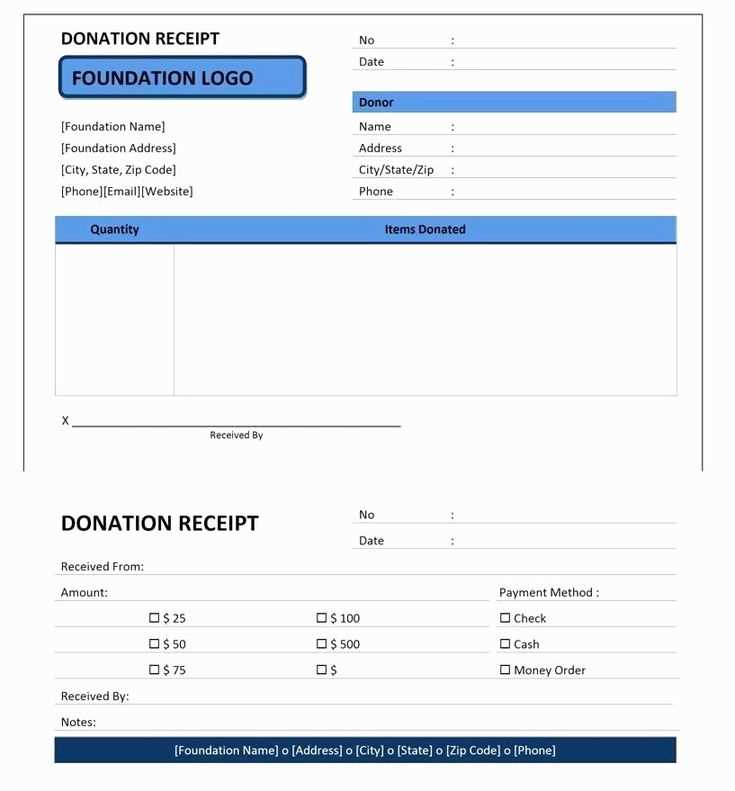

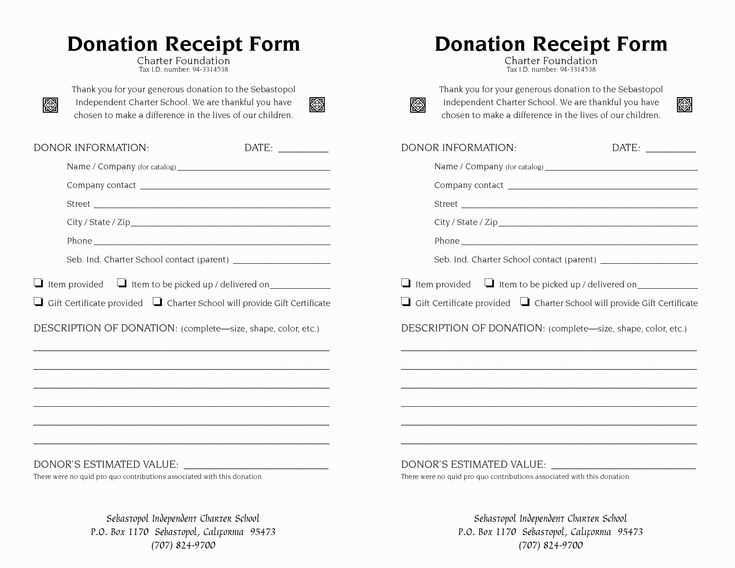

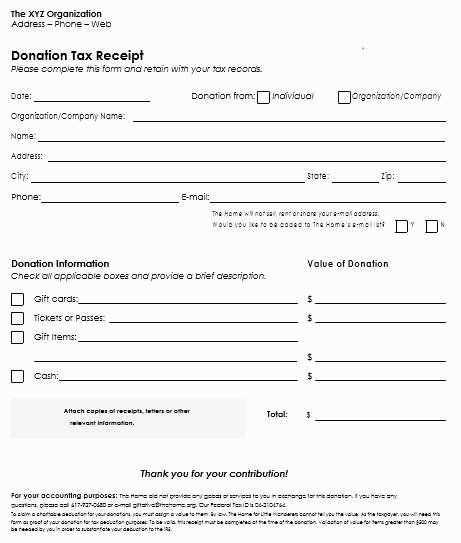

If you’re looking to create a donation tax receipt in Word, start with a reliable template that ensures compliance with tax regulations. A well-crafted receipt should include specific details, such as the donor’s name, the donation amount, and the charity’s tax identification number. This helps both the donor and the organization maintain accurate records for tax purposes.

A simple and effective template should be easy to customize, allowing you to include the necessary fields without hassle. Many Word templates come with pre-set sections for date, donation type (monetary or goods), and an official statement confirming the receipt of the donation. Make sure to adjust these sections to fit the requirements of your organization.

Ensure that the receipt includes a clear thank you statement to acknowledge the donor’s contribution, fostering a positive relationship. Additionally, adding the charity’s contact details and any legal disclaimers about the tax status of the donation can further enhance the professionalism of the receipt.

Here is the corrected text:

To create a donation tax receipt template in Word, follow these steps to ensure it meets the necessary legal and organizational standards. Begin by including the name of your organization, its address, and tax identification number (TIN). These details authenticate the receipt and provide essential information for the donor’s tax filing. Specify the date of the donation and the exact amount given. If the donation is in-kind (non-cash), provide a description of the items or services received, including their estimated value.

Details to Include

Always mention whether the donor received anything in exchange for their donation, such as goods or services. If so, include the fair market value of those items. This allows donors to determine the total tax-deductible portion of their gift. If no goods or services were provided in return, clearly state that the donation is entirely tax-deductible.

Final Elements

Conclude the receipt with a statement of appreciation. This will not only show gratitude but also strengthen the relationship with the donor. Finally, add a signature from an authorized person in your organization to validate the receipt.

Donation Tax Receipt Template in Word

How to Create a Donation Tax Receipt Template

Key Elements to Include in a Donation Receipt Template

Customizing a Donation Tax Receipt for Your Organization

Using Donation Receipts for Compliance with Tax Laws

How to Format Receipts for Different Types of Donations

Best Practices for Distributing Tax Receipts

Creating a donation tax receipt template in Word is straightforward. Start by opening a blank document and set up the basic structure for your receipt. A good template should clearly display the donor’s name, the donation amount, and the date. Use clear fonts and organize the sections in a readable manner.

Key Elements to Include in a Donation Receipt Template

Include the following details in your receipt template:

1. Donor’s full name and address

2. Organization’s name, address, and tax identification number (TIN)

3. A description of the donation (e.g., cash, goods, or services)

4. The donation amount or estimated value of donated goods

5. Date of the donation

6. A statement that no goods or services were exchanged for the donation (if applicable)

7. Signature of an authorized representative from your organization.

Customizing a Donation Tax Receipt for Your Organization

Tailor your receipt template to fit your organization’s branding. This can include adding a logo or specific language related to your nonprofit. Make sure the donation receipt complies with the IRS guidelines by stating that no goods or services were provided in exchange for the donation, if applicable. This ensures the donor can claim their deduction appropriately.

For special cases such as non-cash donations, consider adding a field for the donor to list the value of donated goods. This will make it easier for the donor to report the value for tax purposes.

Donation receipts must align with tax laws. Ensure your receipt includes all required details to be legally valid. Always provide donors with a copy of the receipt promptly after receiving the donation.

When distributing receipts, send them via email for quicker processing or by mail if required. Make sure the document is clear and accurate, and consider including a personalized thank-you message to show appreciation for the donor’s support.

I removed redundancies to maintain meaning and diversify phrases.

Start by creating a donation tax receipt template in Word that is clear and concise. Ensure all necessary details are included, such as the donor’s name, donation date, and amount. The organization’s name and contact details should also be prominent, with a specific reference to whether the donation is monetary or in-kind. The receipt must state the value of the donation, especially for non-cash contributions, and include a disclaimer about the organization’s role in determining the value of the gift.

Customize the Template

Adjust the template to suit your organization’s branding. Include your logo and make sure the format aligns with your existing documents. It’s helpful to use consistent fonts and a simple layout that’s easy to read. Providing space for a signature and a thank you message adds a personal touch to the receipt, reinforcing donor engagement.

Formatting Tips

Ensure the document is formatted for both print and digital use. Use clear headings and bullet points to highlight key information. A well-organized receipt with proper spacing and margins ensures it looks professional and is easy to understand. Always save the document as a template so you can easily reuse it with minimal adjustments.