For accurate reporting and compliance with Canadian tax laws, creating a CRA tax receipt template is a practical step. This template ensures that all necessary information is included, making it easy for both individuals and organizations to provide clear and precise receipts to donors or clients. A well-structured tax receipt template simplifies the process of claiming deductions and guarantees transparency in financial documentation.

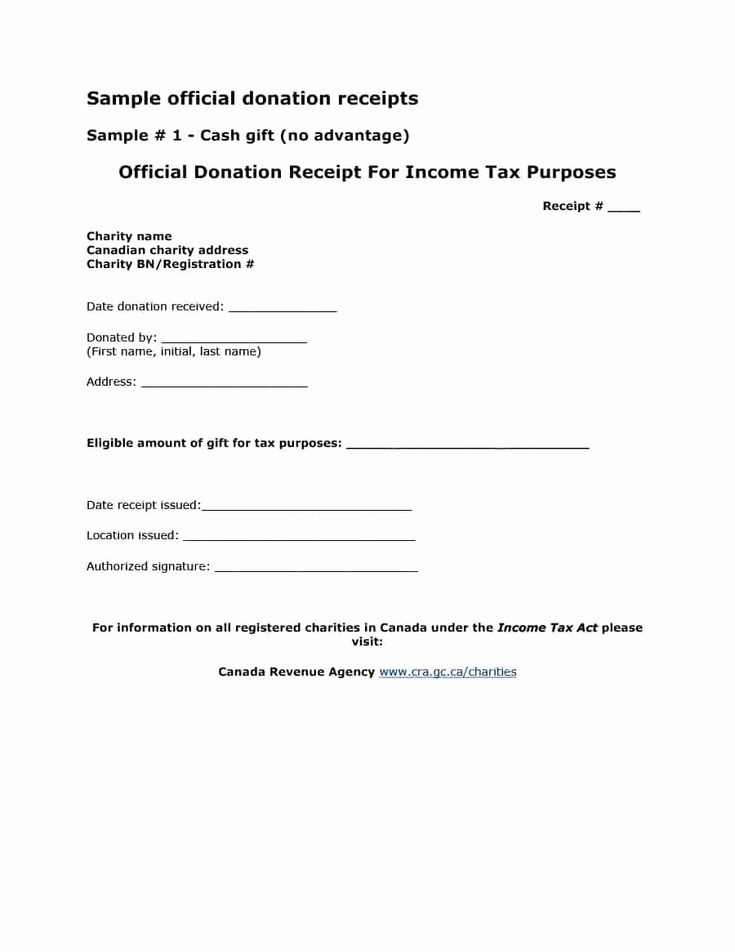

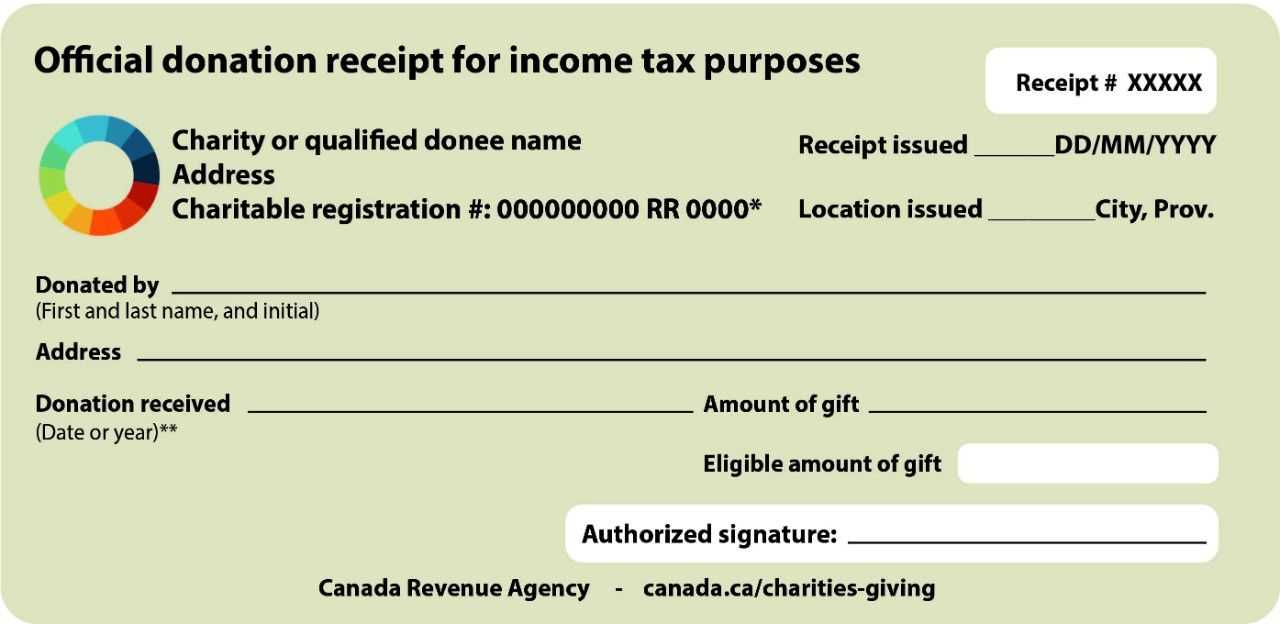

The CRA requires specific details to be included in every tax receipt, such as the name of the charity or organization, the date of the donation, the amount donated, and a unique receipt number. Additionally, the receipt must clearly state that no goods or services were provided in exchange for the donation if applicable. Using a standardized template ensures that these requirements are met every time a receipt is issued.

To create an efficient template, focus on including sections for the donor’s name, the amount given, and a declaration that the donation qualifies for a tax deduction under the Income Tax Act. Be sure to also add the charity’s registration number, as this is required for official documentation. This simple structure will allow you to quickly issue receipts that meet all CRA guidelines.

Here’s the improved version of your text with reduced repetition:

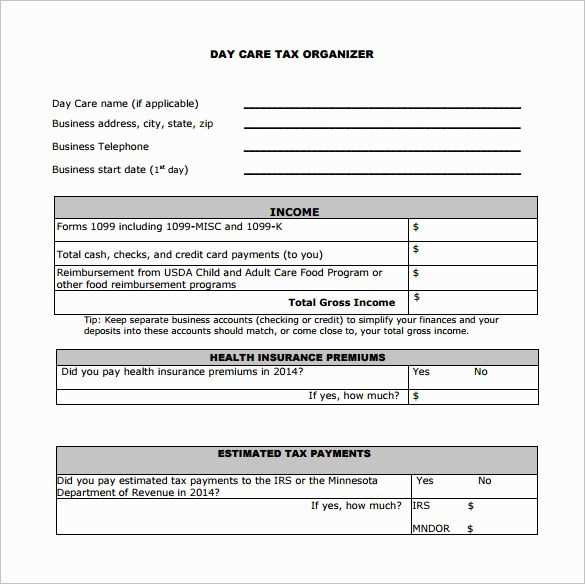

Begin by organizing the details clearly. Each section of the CRA tax receipt should highlight the necessary components without redundancy. Include the taxpayer’s information, the amount donated, and the charity’s registration number. This will ensure compliance with CRA regulations and provide clarity for both parties.

Key Elements of a CRA Tax Receipt

The following details are mandatory for a CRA tax receipt: donor’s name, the date of the donation, and the total amount contributed. Ensure these details are accurate and easy to locate on the document. The registration number of the charity should be listed prominently to validate the donation.

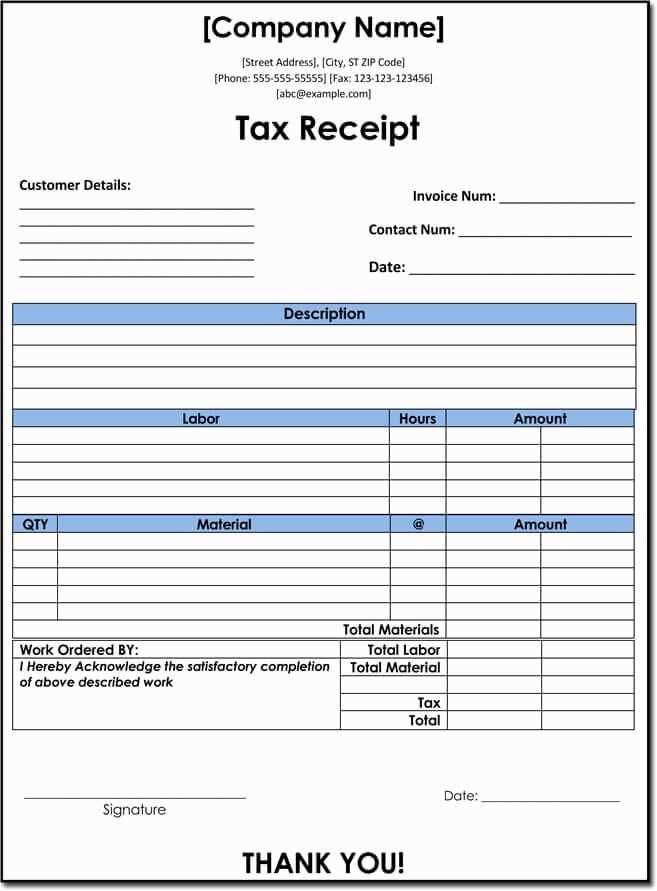

Formatting Considerations

Keep the layout clean. Use a readable font and a simple structure, avoiding unnecessary flourishes that could distract from key information. Make sure to align the data consistently, and use bold or italics for section headings where applicable.

By following these guidelines, you will create a tax receipt that meets all CRA standards while remaining straightforward for the donor.

CRA Tax Receipt Template Guide

What Information Should Be Included in a CRA Tax Receipt?

How to Format Dates and Amounts for Tax Receipts

Understanding the Role of CRA Receipts for Charitable Donations

How to Customize a Tax Receipt Template for Various Organizations

Common Mistakes to Avoid When Creating Tax Receipts

How to Submit or Keep Receipts for Tax Filing Purposes

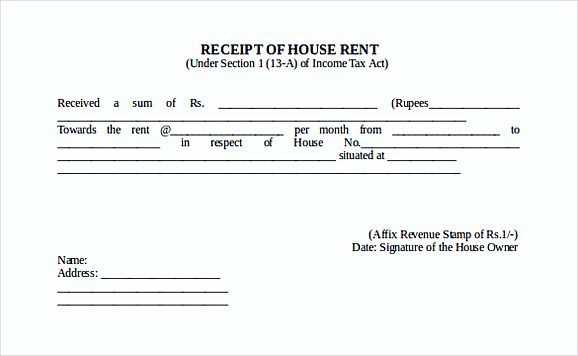

To create a CRA tax receipt, make sure to include the following details: the official name and address of the charity, its registration number, the donor’s name, the amount donated, the date of donation, and a statement that no goods or services were provided in exchange for the donation (if applicable). The receipt should clearly identify the amount that is eligible for tax deduction.

When formatting the date, follow the format: day, month, year (e.g., 06 February 2025). For amounts, always use a clear, numeric format (e.g., $250.00) and avoid unnecessary punctuation marks.

CRA tax receipts are crucial for confirming donations made to charitable organizations, which may be claimed on income tax returns. Keep track of all receipts and ensure the data is accurate, as the Canada Revenue Agency may audit your filings.

For customizing a template, ensure that your organization’s branding is included, but the required information remains legible and clear. Charities may adjust the design, but key elements such as the registration number and donation amount should always stand out.

Avoid common mistakes like failing to include the charity’s registration number or issuing receipts without verifying the donation details. These errors can cause delays or issues when filing taxes.

Once receipts are issued, store them securely for future tax filing. You can keep them digitally or in physical form. Make sure all receipts are organized by year to make the tax filing process smoother.