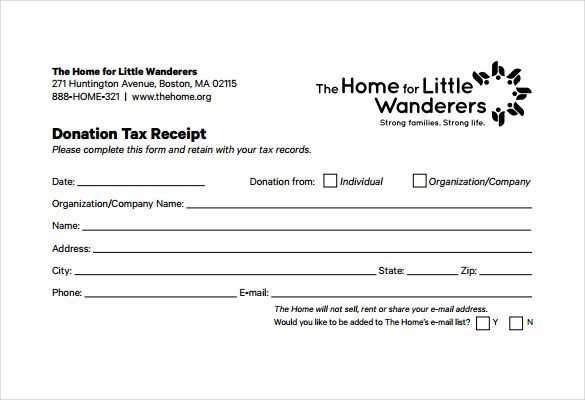

Nonprofits can simplify tracking in-kind donations with a well-structured gift receipt template. An in-kind gift receipt acknowledges the donation of goods or services rather than money. This helps donors claim their tax deductions and provides nonprofits with an accurate record of their contributions.

Key Components of an In-Kind Gift Receipt

- Donor Information: Include the donor’s full name and contact details to ensure proper recognition and tax reporting.

- Description of the Donated Items: List the donated goods or services with a clear description. Avoid assigning a value, as the donor is responsible for determining the fair market value.

- Date of Donation: Specify the date the gift was received to establish the timeline for tax purposes.

- Nonprofit Information: Include the nonprofit’s name, address, and tax-exempt number to verify the legitimacy of the organization.

- Statement of No Goods or Services Received: This statement confirms that no goods or services were exchanged for the donation. It’s required for tax deduction purposes.

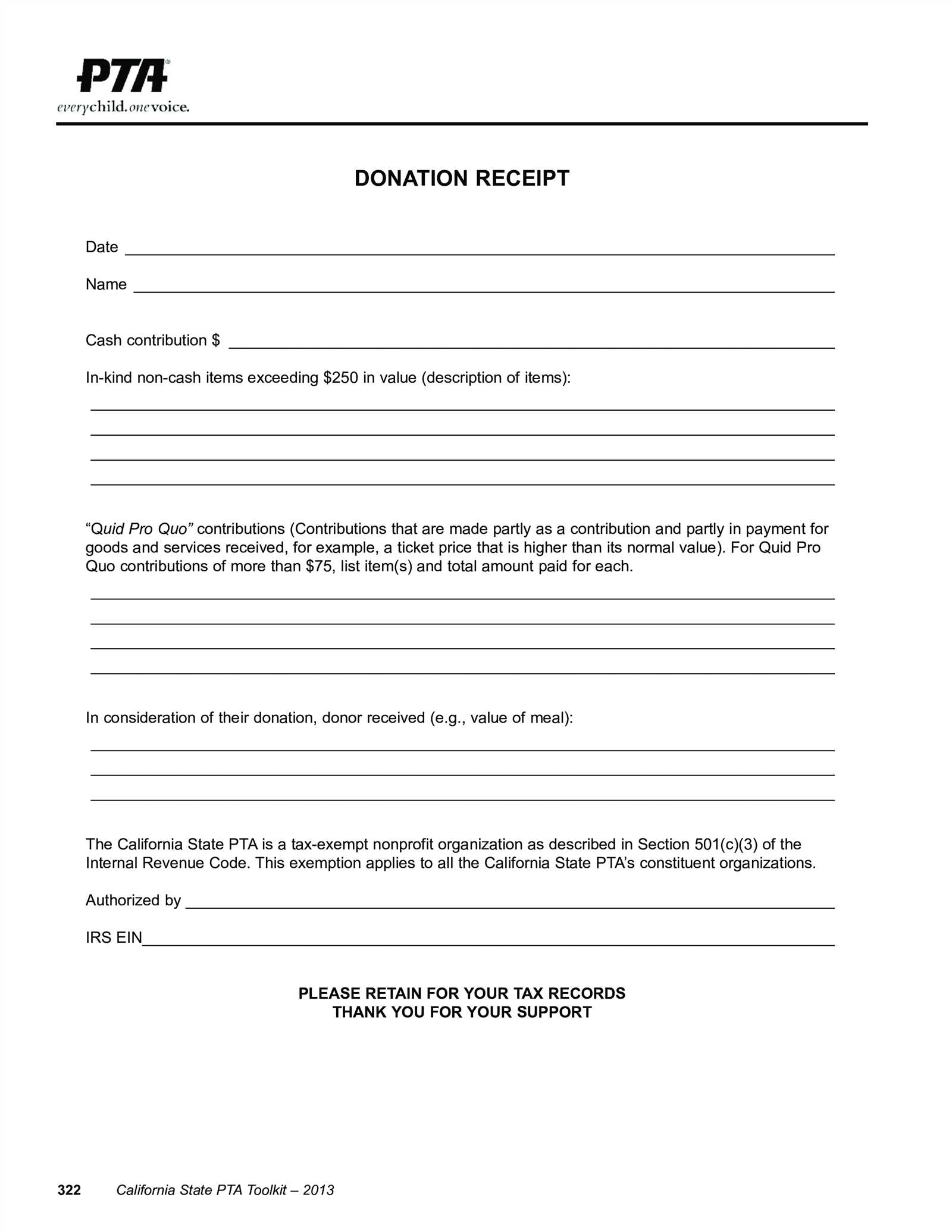

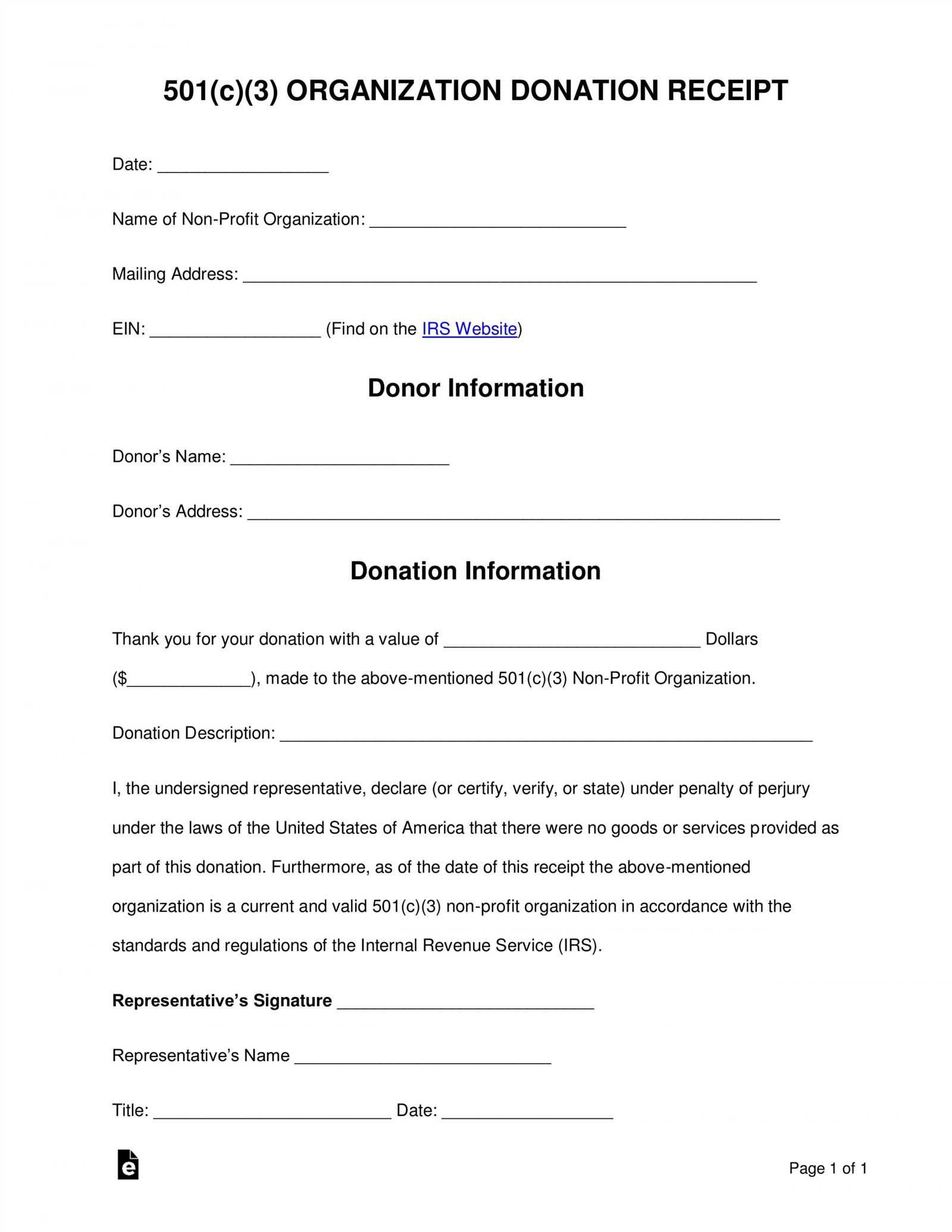

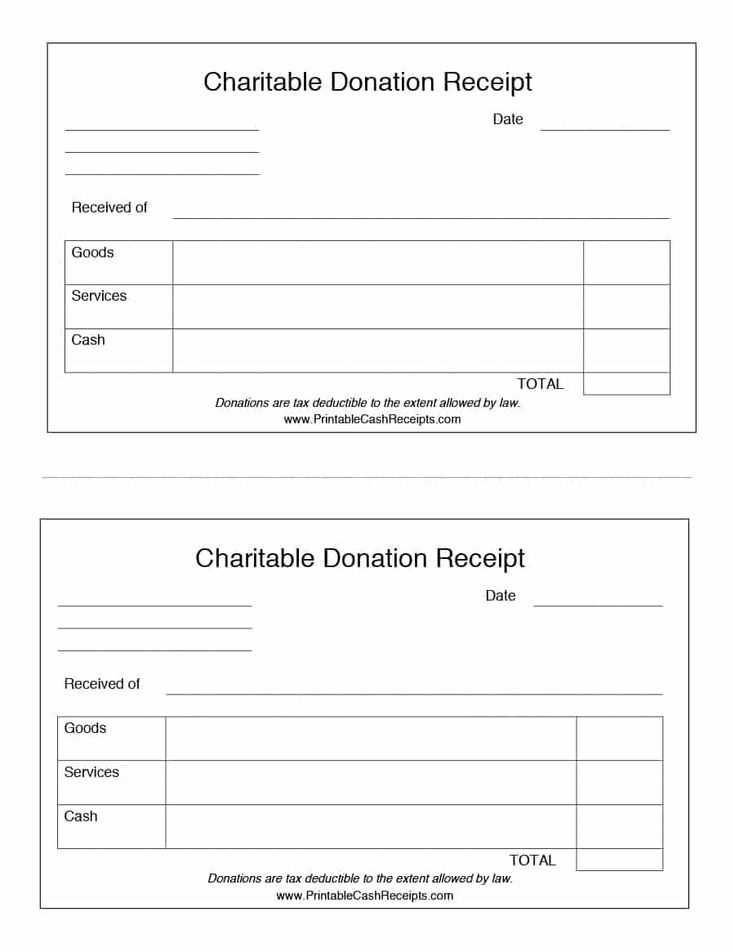

Template Example

Here’s a sample in-kind gift receipt template:

Donor Name: [Full Name] Address: [Address Line 1], [City, State, Zip Code] Phone: [Phone Number] Email: [Email Address] Donation Date: [MM/DD/YYYY] Description of Donated Items: - [Item 1] - [Item 2] - [Service: [Details of service provided]] Tax-exempt Organization: [Nonprofit Name] [Nonprofit Address] [Tax-Exempt Number] No goods or services were provided in exchange for this donation. Signature: ________________________

Best Practices for In-Kind Gift Receipts

- Issue Receipts Promptly: Donors appreciate receiving receipts quickly after their donation. It helps them file taxes efficiently.

- Maintain Accurate Records: Keep a detailed log of all in-kind donations for your nonprofit’s accounting and auditing purposes.

- Consult with Tax Experts: Ensure your receipts comply with IRS requirements, and seek advice if needed to avoid mistakes.

In-Kind Gift Receipt Template for Nonprofit Organizations

Understanding Legal Requirements for In-Kind Gift Receipts

Key Information to Include in an In-Kind Receipt

How to Assign Fair Market Value to Donated Goods

Formatting Guidelines for a Professional Gift Receipt

Handling Non-Monetary Donations from Businesses and Individuals

Record-Keeping and Tax Reporting for In-Kind Gifts

Nonprofits must meet specific legal requirements when issuing in-kind gift receipts. These receipts acknowledge the donation of non-monetary goods, allowing donors to claim a tax deduction. It’s vital that organizations adhere to IRS guidelines to avoid complications during audits. The receipt should clearly outline the type of goods donated, their fair market value, and the nonprofit’s tax-exempt status. Without this information, the donor may not be eligible for tax deductions.

Key Information to Include in an In-Kind Receipt

Include the donor’s name, address, and the nonprofit’s tax-exempt status. A description of the donated goods must be provided. If possible, avoid assigning a dollar amount to the donation, as only the donor is allowed to determine the fair market value. This prevents the nonprofit from overestimating the value for tax purposes. If the donation consists of property or services, be sure to mention that no goods or services were provided in exchange, as required by the IRS for tax deduction purposes.

How to Assign Fair Market Value to Donated Goods

Fair market value is the price the goods would sell for on the open market, in their current condition. Donors should perform their own assessment, using tools such as online marketplaces or third-party appraisal services for items of higher value. For example, books or clothing may have a widely known resale value, while antiques or collectibles might need a professional appraisal to determine their worth accurately.

For businesses donating goods, it’s critical to record the fair market value similarly, ensuring a proper evaluation of the goods without inflating their worth. Nonprofits must keep accurate records of these donations for tax reporting and auditing purposes.

Formatting Guidelines for a Professional Gift Receipt

Design your in-kind receipt in a professional and easy-to-read format. It should clearly list the donor’s information, the description of the goods, and the nonprofit’s details. The date of donation should be highlighted, and a statement should confirm that no goods or services were provided in return. Keep the receipt simple, but make sure all the necessary components are present to ensure compliance with IRS regulations.

For businesses and individuals making non-monetary donations, it’s crucial to maintain thorough records. These records will help with proper tax filings and ensure the nonprofit meets all reporting obligations.

In conclusion, a well-documented in-kind gift receipt is a straightforward but essential tool in managing non-monetary donations. It enables both donors and nonprofits to stay compliant with tax laws, ensuring a smooth donation process for all parties involved.