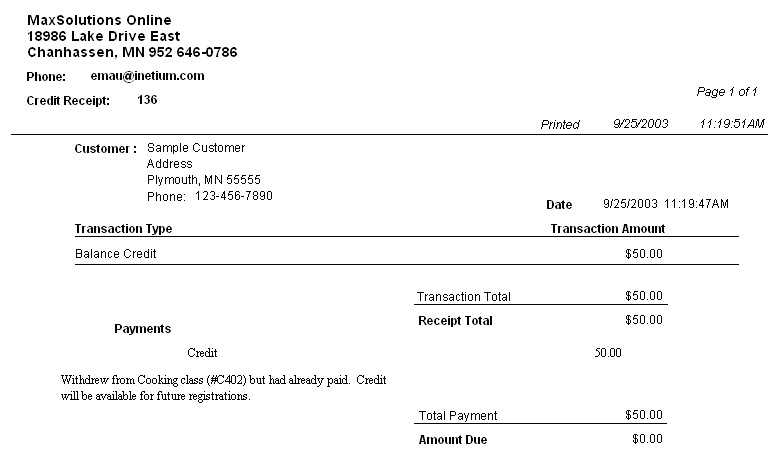

A generic credit card receipt template provides a quick and organized way to document transactions. It includes all the necessary information such as the cardholder’s name, transaction amount, merchant details, and date. Having a ready-to-use template can simplify both personal and business record-keeping.

Make sure your template includes clear sections for key details: card type, last four digits, transaction ID, payment method, and billing address. Keep this layout simple yet comprehensive for easy reference and verification in case of disputes or returns.

By using this template, you streamline the process of creating receipts and ensure that you consistently capture the relevant information every time. This helps avoid errors and keeps your records organized. Customize it with your business logo and contact details for a professional touch.

Here’s the revised version with reduced repetition:

To streamline your credit card receipt template, avoid redundancy in formatting. Focus on key details, including transaction information, cardholder name, and payment amount. A clean layout ensures that essential information is clearly visible without unnecessary repetition.

| Field | Description |

|---|---|

| Transaction Date | Record the exact date of the transaction. |

| Merchant Name | Include the name of the business where the purchase occurred. |

| Amount | Clearly state the total charged to the card. |

| Cardholder Name | List the name of the person associated with the credit card. |

| Transaction ID | Provide a unique reference number for the transaction. |

Reduce visual clutter by keeping only the necessary fields. This minimizes distractions and enhances readability. Stick to simple fonts, keeping the format user-friendly. Avoid extraneous decorative elements that don’t serve a practical purpose. The goal is to create a receipt that is easy to read and understand at a glance.

- Generic Credit Card Receipt Template

Use a simple and clear structure when creating a generic credit card receipt template. A well-organized layout ensures both customers and businesses can quickly find the necessary details.

Key Information to Include

- Transaction Date: Clearly state the date of the transaction.

- Merchant Information: Include the business name, address, and contact details.

- Cardholder Name: Display the name as it appears on the card.

- Transaction Amount: Specify the total charged, including taxes or additional fees.

- Credit Card Number: Include the last four digits of the card number for security purposes.

- Authorization Code: List the unique code generated for the transaction.

Design Tips

- Make sure the font is legible and the layout is clean.

- Use bold text for important details such as the transaction amount and authorization code.

- Keep the design minimalistic, avoiding unnecessary graphics or colors that can clutter the document.

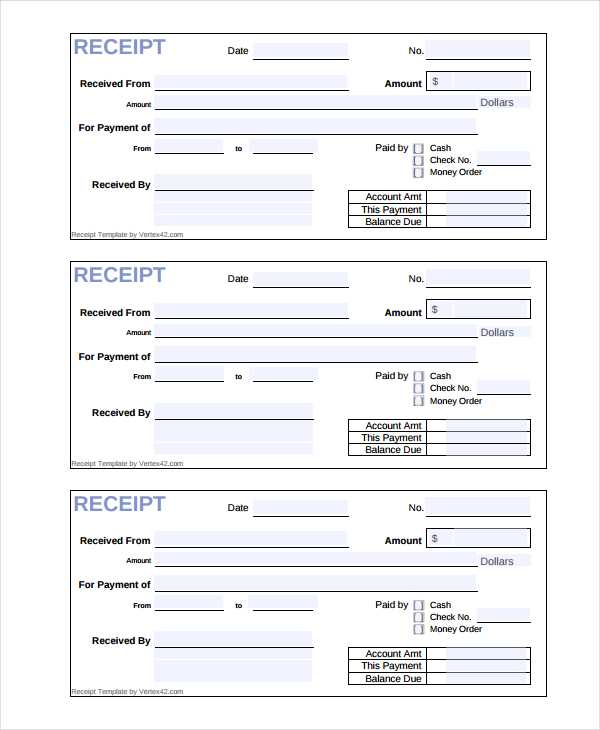

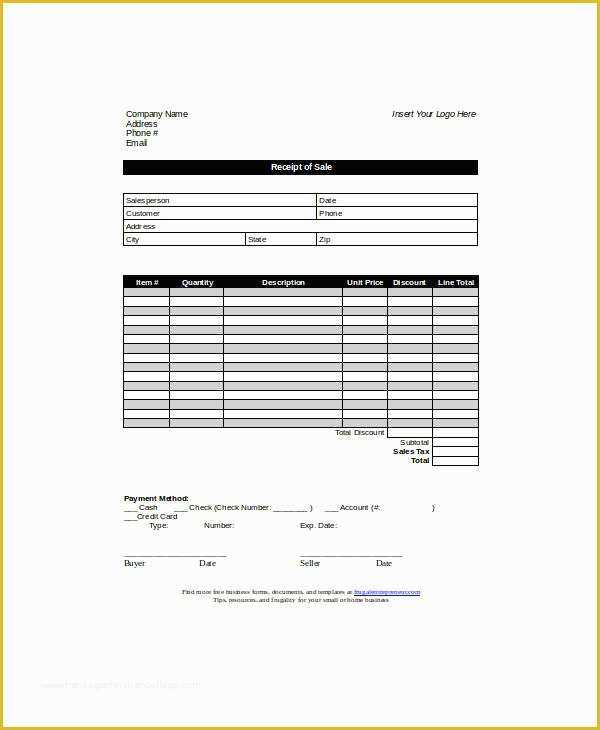

To create a basic credit card receipt, include the following key elements:

- Merchant Information: Include the name, address, phone number, and website of the business issuing the receipt.

- Receipt Number: Assign a unique identification number to each receipt for record-keeping and reference.

- Date and Time of Transaction: Clearly state when the purchase was made to avoid any confusion in the future.

- Itemized List of Products or Services: Include a description of each item or service purchased along with their individual prices.

- Total Amount Charged: Clearly display the total amount, including any taxes or fees that may apply.

- Credit Card Information: Only include the last four digits of the credit card number for security reasons, along with the type of card (e.g., Visa, MasterCard).

- Authorization Code: Include the unique authorization code provided by the payment processor for the transaction.

Formatting Tips

- Ensure the receipt is clear and easy to read with a logical layout.

- Use a professional font and adequate spacing between sections.

- Make sure the amounts are formatted correctly (e.g., currency symbols and decimal points).

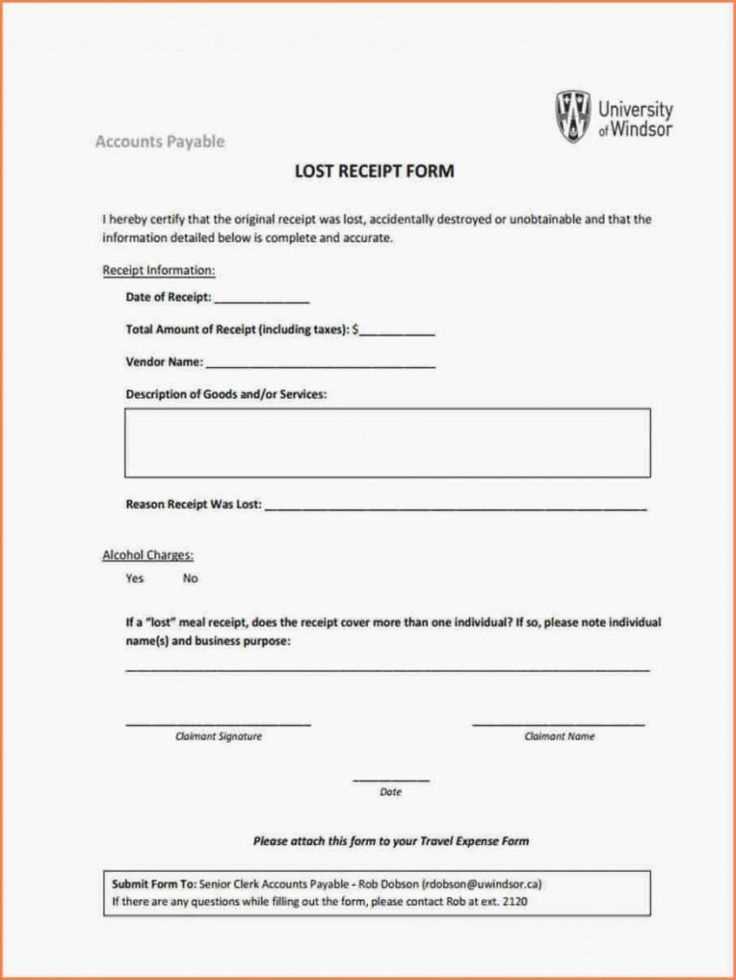

Additional Considerations

- Ensure the receipt includes the return or refund policy if applicable.

- If the receipt is issued electronically, ensure that it is delivered securely and can be easily accessed by the customer.

Include the transaction date and time to provide a clear record of the purchase. This detail helps both parties keep track of when the transaction occurred. Include the name of the merchant and contact information, like a phone number or email, for customer inquiries or future reference. List the items purchased or services rendered, including their quantity and price. This makes the receipt transparent and serves as proof of the purchase.

Ensure the payment method is indicated. Specify whether the transaction was made using a credit card, debit card, or another method. Include the last four digits of the card number for verification purposes. If applicable, include the amount of tax charged, as this is a key part of the financial record.

Lastly, don’t forget to include the total amount paid, which consolidates all charges, taxes, and discounts. It should be clear and easy to find at the end of the receipt.

| Information Type | Details |

|---|---|

| Transaction Date and Time | Exact date and time of the transaction |

| Merchant Information | Merchant name, address, and contact details |

| Items or Services | List of items/services, quantity, and price |

| Payment Method | Type of payment (e.g., credit card, debit card) |

| Tax | Amount of tax applied to the transaction |

| Total Amount | Total price after taxes and discounts |

Adjust the layout to reflect your brand’s identity. Include your business logo, contact information, and a consistent color scheme that matches your website or physical store design. This simple step enhances brand recognition and makes the receipt look professional.

Include Key Transaction Details

Modify the template to display all necessary transaction data, such as the transaction ID, payment method, and itemized list of purchased goods or services. Make sure the date and time are clearly visible to avoid confusion later on.

Set Up Automatic Tax and Discount Fields

If your business applies taxes or offers discounts, create fields that auto-calculate these amounts. This not only saves time but also reduces human error. Include a clear breakdown of taxes and discounts on the receipt for transparency.

Consider adding a space for customer feedback or a thank-you note at the bottom. This helps build customer loyalty and encourages repeat business. A personal touch goes a long way in customer retention.

Include all required details: business name, address, and contact information. Make sure the transaction date and time are clearly visible. Specify the items or services purchased, including quantities, descriptions, and prices. Include the total amount, taxes, and payment method used. If your business is registered for VAT or sales tax, ensure the relevant tax information is listed. Keep the receipt legible and easy to understand for both parties.

Verify that the receipt format complies with local laws. Some jurisdictions require certain disclaimers or specific formats for receipts. Check with local authorities or legal resources to confirm requirements. Avoid including excessive or irrelevant information that could cause confusion.

Ensure the receipt is provided at the time of transaction or shortly after, as required by law. Electronic receipts are acceptable in many regions, but they must meet the same standards as printed versions. Ensure your system is capable of generating receipts that meet legal requirements automatically.

To save a receipt template in PDF format, first ensure that the template is ready and complete. Most software applications allow you to save or export documents directly as PDFs. Look for the “Save As” or “Export” option in the file menu, then select “PDF” as the desired format.

After saving the template, sharing it is straightforward. You can attach the PDF file to an email, upload it to a cloud storage service like Google Drive or Dropbox, or use file-sharing platforms to send the file securely to others. Ensure that the recipients have the necessary software or access to open and view PDFs.

For easy management, consider renaming the PDF file with clear identifiers like date, purpose, or transaction details, so it’s simple to locate later. You can also compress the PDF if the file size is too large for convenient sharing.

Ensure that all the fields are filled in correctly. Leaving sections like the total amount, date, or payment method blank is a mistake that can cause confusion. Double-check that each section is properly completed before finalizing the receipt.

1. Forgetting to Include Payment Method Details

Always include the payment method on the receipt. Whether it’s cash, credit card, or another form of payment, missing this detail can create issues for both you and the customer. If the payment method is omitted, it could lead to disputes or difficulties in tracking transactions.

2. Using Inconsistent Formatting

Maintaining a consistent format throughout the receipt is crucial. Using different fonts, sizes, or styles can make the receipt look unprofessional and hard to read. Stick to a simple, clean design to keep everything easy to understand.

3. Omitting Contact Information

Always include your contact information on the receipt. This is helpful if there are questions or concerns about the transaction. Missing this key detail could cause unnecessary delays in resolving any issues that may arise.

4. Not Updating the Template Regularly

Ensure your template is always up-to-date with current legal and business requirements. Outdated templates may not meet the latest standards or could contain errors that could lead to problems down the line. Keep your template fresh and compliant with the latest regulations.

5. Neglecting to Add Terms and Conditions

Adding terms and conditions, return policies, or any relevant disclaimers is often overlooked. These are essential to clarify the terms of the transaction and protect both parties involved. Make sure to include them in the template to avoid confusion later on.

Use clear and concise labels for each field in your generic credit card receipt template to avoid confusion. Ensure that the header includes key details like the merchant’s name, transaction date, and total amount. Below that, list the individual items or services purchased, with the price for each. The receipt should also include a transaction number for easy reference. Be sure to format the receipt clearly, leaving enough space between each section to make it visually readable.

Transaction Details

Under the transaction section, include the payment method (e.g., credit card, debit card), the card type (Visa, MasterCard), and the last four digits of the card number for reference. Avoid displaying the full card number to ensure security. Providing this information adds transparency to the transaction, making it easier for customers to verify their purchases.

Merchant Information

Don’t forget to include contact details for the merchant, such as a phone number or email, in case the customer has questions or needs to make a return. A physical address can also be helpful, especially if the transaction occurred in-store. This provides the customer with all the necessary details for follow-up communication.