For anyone looking to streamline financial record-keeping, a cash receipt template in Word format is a practical and time-saving tool. It allows you to generate detailed receipts quickly, ensuring all necessary information is captured clearly. Whether you’re a business owner, freelancer, or conducting personal transactions, using this template helps maintain transparency and accountability.

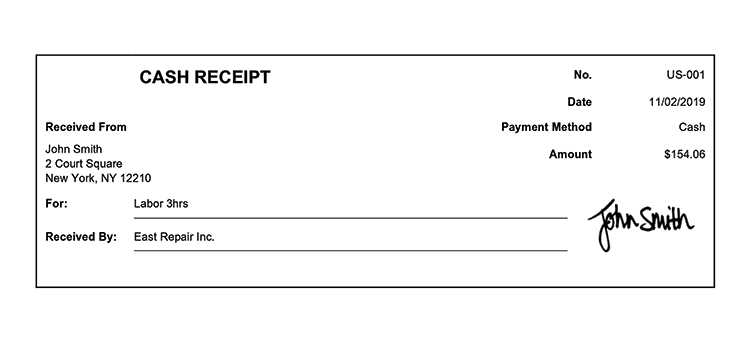

Make sure the template includes key details such as the payer’s name, the amount received, the date, and the purpose of the payment. This ensures that both parties have a clear understanding of the transaction. A well-structured receipt can also be beneficial for tax records and financial audits.

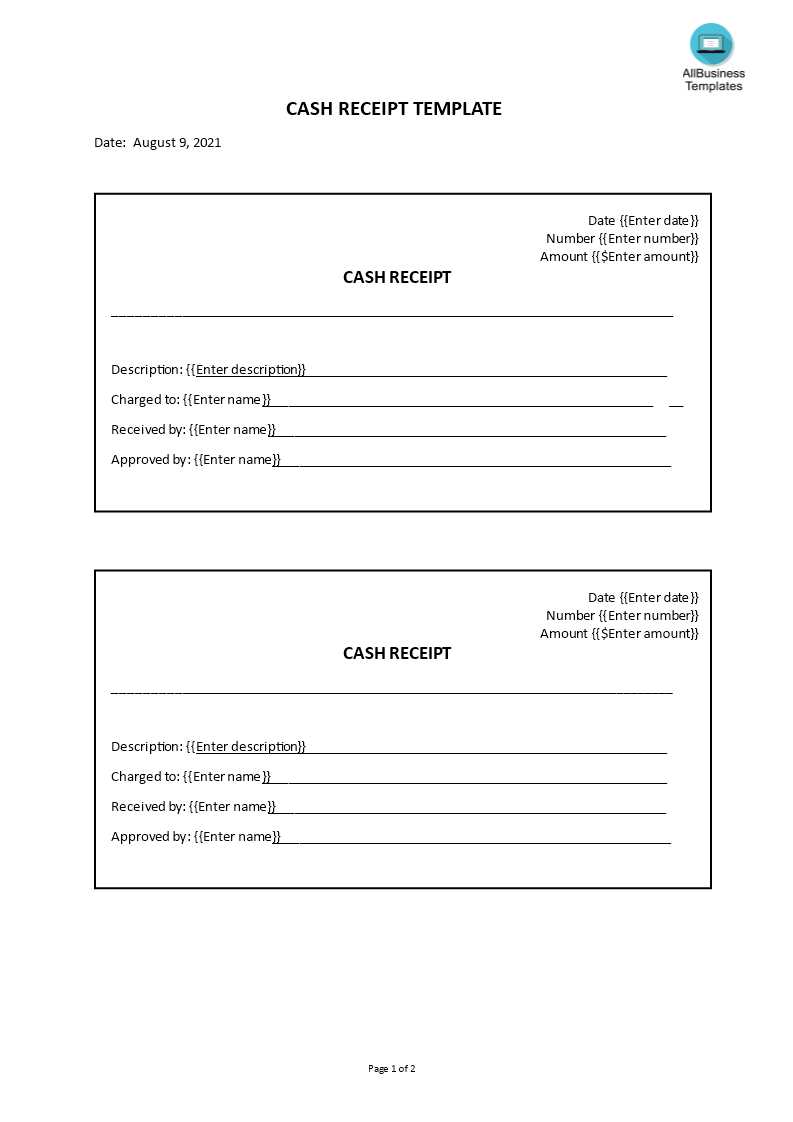

When customizing the template, ensure it aligns with UK standards for record-keeping. Adjust fields to include VAT numbers or other local requirements if necessary. Once set up, you’ll find it easy to issue receipts for any cash transaction, keeping your business or personal finances in order.

Here is the revised version with no more than 2-3 repetitions of the same word, maintaining clarity and correctness:

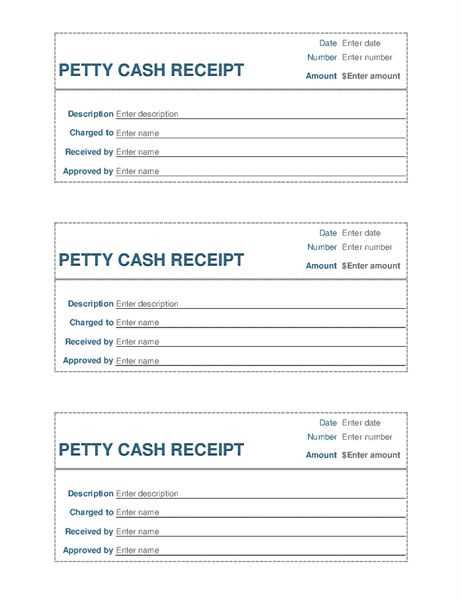

Ensure that the cash receipt template is clear and concise. Include the date, amount, and the payer’s details. Keep the language simple to avoid confusion. Include a reference number or receipt ID to help track payments easily.

Always format the total amount in bold, making it stand out. Clearly label the payment method used, whether cash, cheque, or card. Double-check the spelling of the payer’s name to avoid errors.

Finally, leave a space for both parties to sign. This confirms the transaction and adds authenticity to the receipt. Consider providing a copy for the payer as a record.

Cash Receipt Template UK Word: Practical Guide

Creating a Cash Receipt Form in Word

Customizing the Template for Business Requirements

Including Essential Information on a Receipt

Ensuring Compliance with UK Tax Laws

How to Utilize the Template for Daily Transactions

Saving and Printing Receipts in Word Format

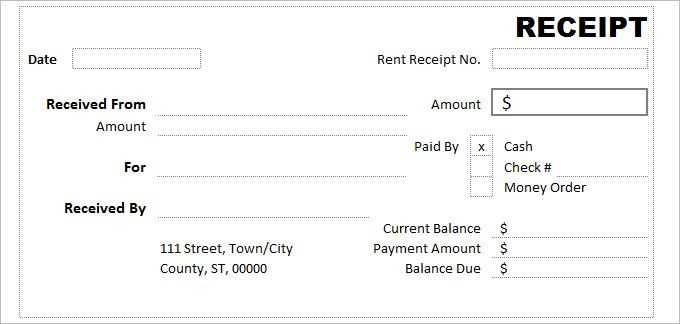

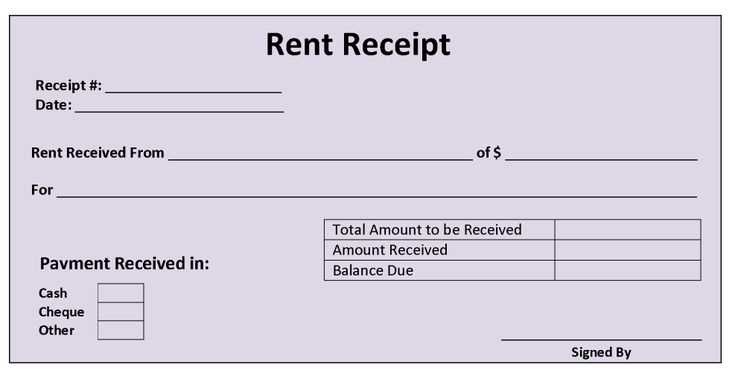

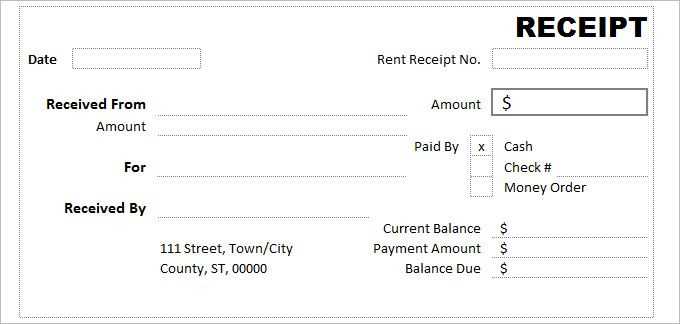

Start by selecting a simple template or creating a custom one in Microsoft Word. The receipt should include key details such as the date, the name of the payer, amount received, payment method, and the purpose of the payment. These fields ensure clarity for both the payer and the recipient.

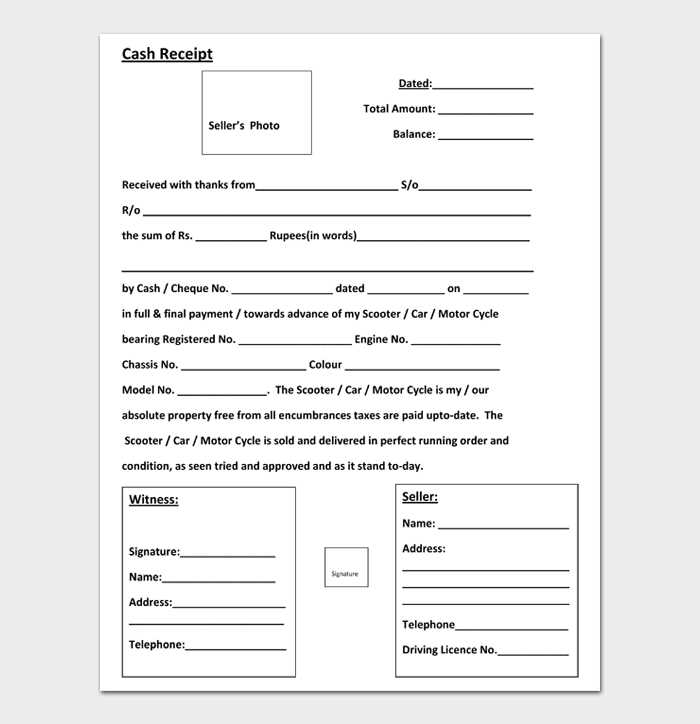

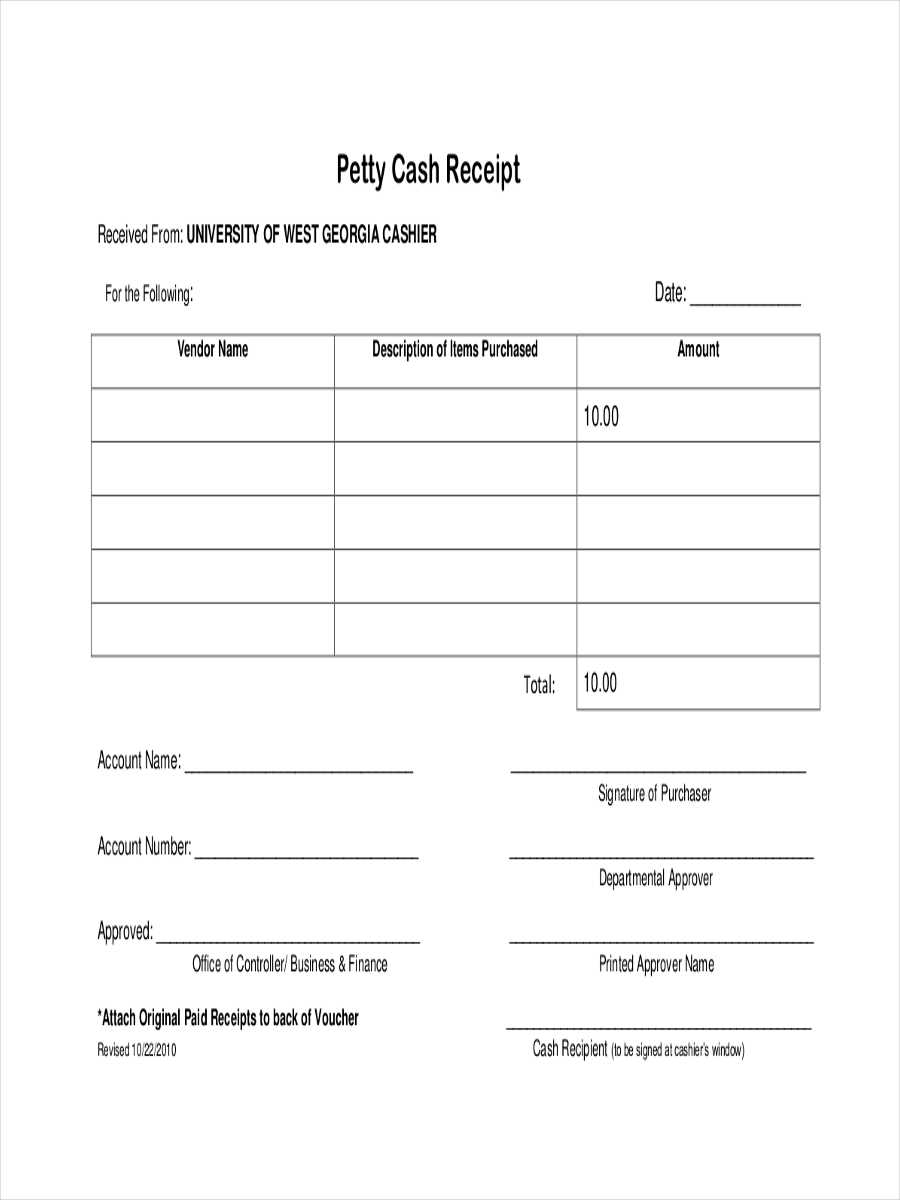

Customizing the Template for Business Requirements

Tailor the template to reflect your business needs. Add company details like logo, contact information, and registration number if necessary. If your business operates in a specific sector, consider including relevant payment references or VAT identification to meet regulatory requirements.

Including Essential Information on a Receipt

A receipt should always include the following:

1. Date of the transaction

2. The full name of the payer

3. Total amount received

4. Payment method (cash, bank transfer, cheque, etc.)

5. Purpose or description of the transaction

6. Signature of the recipient or authorized personnel

Always make sure that these details are accurate to maintain transparency in financial records.

Ensure your receipt complies with UK tax laws, especially regarding VAT if applicable. UK businesses must provide VAT receipts that show the VAT amount for taxable sales. If VAT is not applicable, make sure this is clearly stated on the receipt.

Use the template daily to streamline your cash transactions. Customize the fields for different types of payments and keep the process simple for quick access during transactions.

Once completed, save the file in Word format for easy retrieval and future use. You can print receipts directly from Word or save them electronically to send to customers. This makes record-keeping straightforward and efficient.