Having a simple rent receipt template at hand helps maintain clear and professional documentation for rental transactions. You can quickly create a receipt that covers all the necessary details with just a few lines of information. This template ensures transparency and provides your tenants with a record they can reference for future needs.

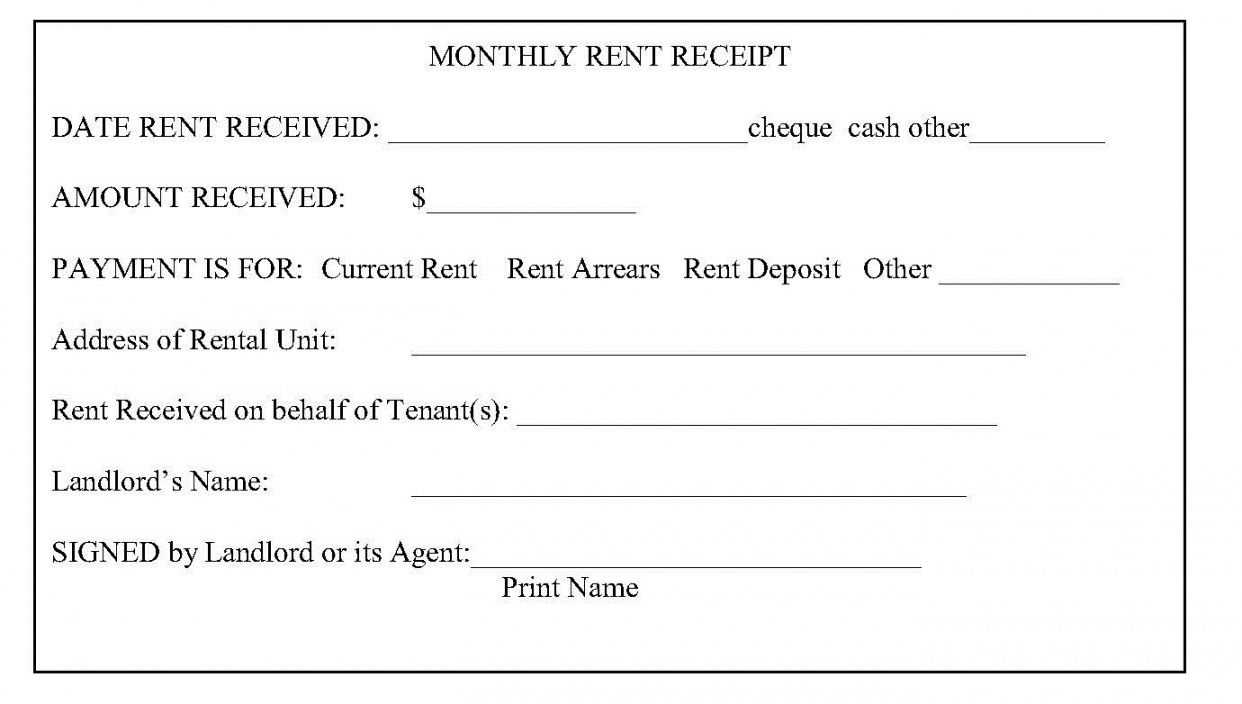

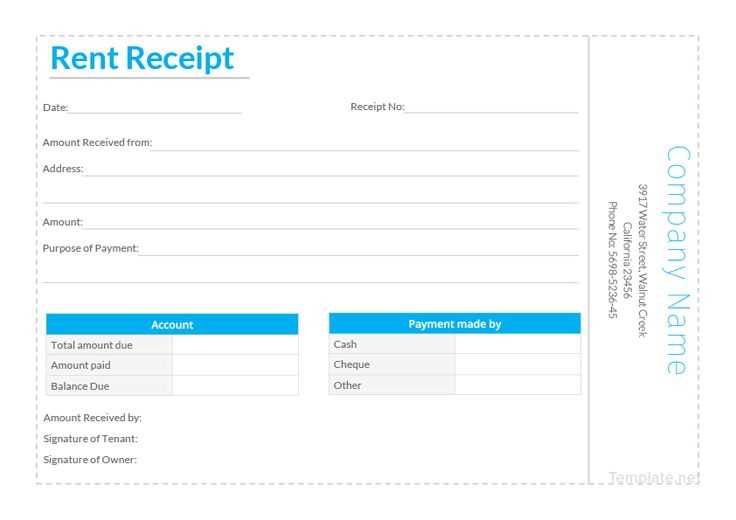

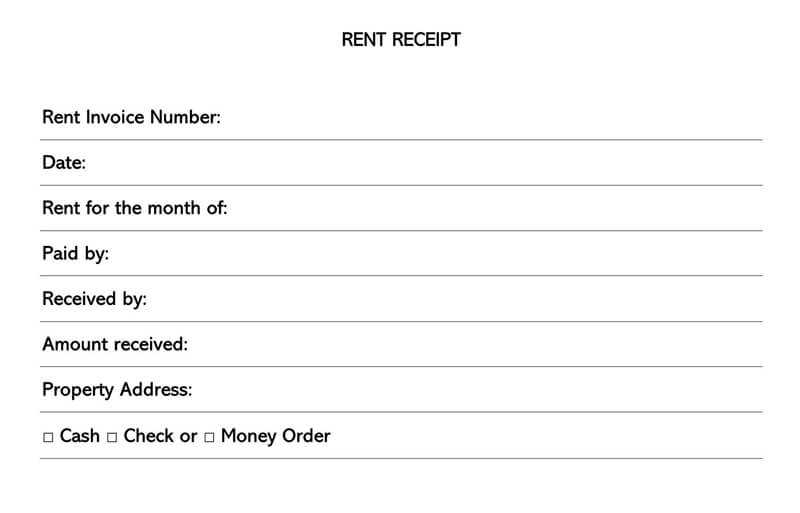

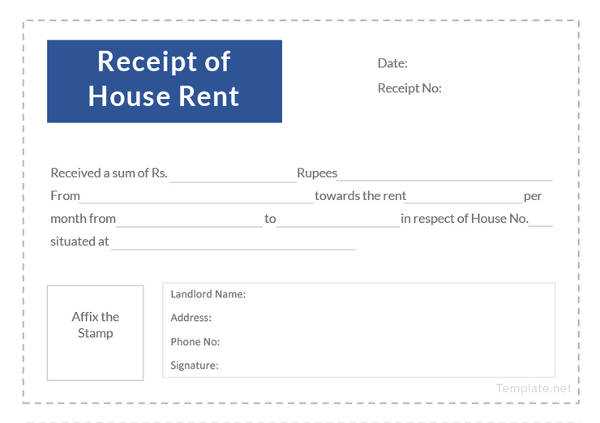

To get started, include the basic elements: the tenant’s name, the rental property address, the amount paid, and the payment date. You should also mention the payment method and any additional fees if applicable. A well-organized format makes it easy to understand the transaction at a glance.

If you’re renting multiple properties or working with several tenants, consider adding a unique receipt number or tracking system to help organize records. This way, both you and your tenants can easily refer back to specific payments when needed.

Here’s the revised version with minimal repetition of words:

For creating a rent receipt template, focus on clear, concise information. Include the tenant’s name, rental property address, rent amount, payment date, and payment method. Ensure the document includes the landlord’s name and contact details for reference. Avoid unnecessary descriptions, stick to the facts. You may also want to specify the rental period covered by the payment. The format should be simple, making it easy for both parties to understand and access details quickly. Keep the layout clean and structured for professional appeal.

To improve readability, use bullet points for key information such as rent amount, payment date, and terms. This allows the renter to easily review the transaction details. If you prefer a more personalized touch, adding a section for additional notes or terms is helpful. Be sure the document is well-organized, avoiding clutter or confusion.

Consider using a digital format for easy sharing and record-keeping. A PDF file works well, ensuring compatibility across devices. After completing the template, save it for future use. This reduces the time spent on generating new receipts while maintaining consistency and professionalism.

Easy Rent Receipt Template

How to Customize a Rent Receipt for Your Needs

Key Information to Include in a Rent Payment Receipt

How to Use a Rent Receipt for Tax Purposes

Designing a Receipt Template for Both Landlords and Tenants

Common Errors to Avoid When Creating a Rent Receipt

How to Digitally Sign and Distribute Rent Receipts

To customize a rent receipt for your needs, adjust the template with specific fields such as the tenant’s name, payment amount, and rental period. Include a section for payment methods (e.g., cash, bank transfer, check) to keep clear records. You can also add a unique receipt number to maintain a proper sequence of transactions for easy reference.

Key Information to Include in a Rent Payment Receipt

A rent payment receipt must have key details: the landlord’s name, tenant’s name, rental property address, payment date, amount paid, and the rental period covered. This ensures both parties have accurate records. It’s also helpful to include a brief description of the payment (e.g., “January rent payment”) and any late fees, if applicable.

How to Use a Rent Receipt for Tax Purposes

Rent receipts serve as proof of income for landlords. Keep a copy of each receipt to report rental income during tax filing. For tenants, receipts can confirm expenses, especially if the property is a business-related rental. Store them securely in case the IRS requests verification of payments.

Design the receipt template to accommodate both parties. The landlord’s details should be clear at the top, followed by the tenant’s information and the breakdown of the payment. Make sure the design is simple but legible, using enough space between sections to prevent confusion. If you’re using an online tool, customize the fields to fit the needs of both parties.

Common errors include missing dates, incorrect amounts, and missing signatures. Always double-check the payment amount and dates, and verify tenant information. Avoid generic receipts without specific details that are necessary for tax records or future disputes.

If you’re distributing rent receipts electronically, use a digital signature tool to add authenticity. You can email the receipt as a PDF, ensuring the file is not editable to maintain integrity. Make sure to offer both printed and digital options for tenant convenience.