If you’re a tenant looking for a simple way to keep track of rent payments for HRA (House Rent Allowance) claims in India, using a rent receipt template can make the process easier. A well-structured template ensures that all necessary details are included, helping both tenants and landlords stay organized. A receipt should clearly mention the amount of rent paid, the period, and the property details, making it easy to claim HRA deductions without any confusion.

Here’s a sample breakdown of what to include in your rent receipt template: tenant’s name, landlord’s name, address of the rented property, amount paid, payment date, and signature of the landlord. It’s also recommended to keep a copy of the receipt for both the tenant and the landlord’s records.

Rent receipts are necessary for employees who wish to claim tax benefits under Section 10(13A) of the Income Tax Act in India. Having a proper receipt with all the required details helps simplify the documentation needed for HRA tax exemptions. By using a template, you can easily customize it for each payment period and ensure it meets the standards required by the tax authorities.

Sure, here’s a revised version of the text, with repetitive words reduced while preserving the meaning:

To create a rent receipt template for India, ensure it includes key details such as the tenant’s name, the landlord’s name, the address of the rental property, and the amount paid. Mention the rental period and the date of payment. The receipt should also clarify the payment method used, whether by cash, cheque, or bank transfer.

Key Elements of a Rent Receipt

Include a unique receipt number for tracking purposes. Make sure the rent amount is written in both words and figures for clarity. Both parties should sign the document for authenticity. It’s also advisable to mention the due date and any late payment penalties if applicable.

Legal Considerations

Under Indian law, it’s not mandatory for landlords to provide rent receipts, but it can help avoid disputes and serve as proof for income tax purposes. Tenants should keep these receipts for their records, as they might be required for tax deductions or rental agreements in the future.

- HRA Rent Receipt Template for India

When drafting an HRA rent receipt in India, ensure it includes the following key elements to make it valid for both employee use and tax purposes:

Key Information to Include

- Tenant’s Name and Address

- Landlord’s Name and Address

- Receipt Date

- Amount of Rent Paid

- Period for which Rent is Paid

- Signature of the Landlord

- Landlord’s PAN Number (optional but recommended for tax filing)

Format Example

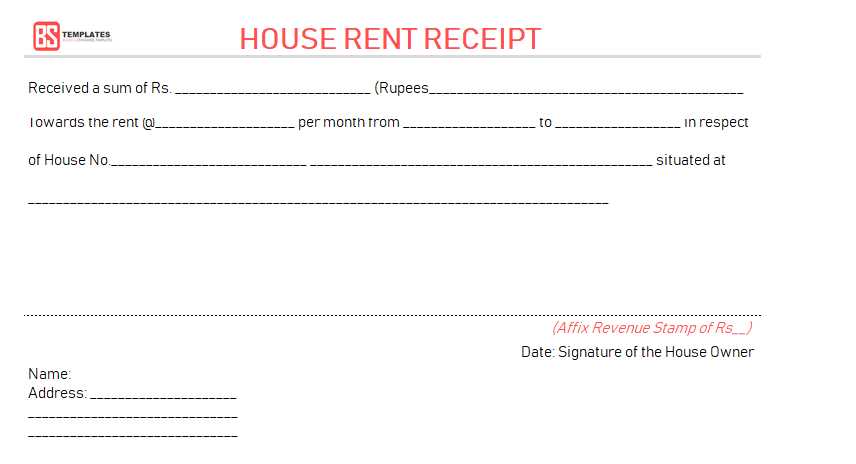

Below is a simplified template:

Rent Receipt Date: [Insert Date] Received from: [Tenant’s Name] Address: [Tenant’s Address] Landlord Name: [Landlord’s Name] Landlord Address: [Landlord’s Address] Rent for the month of: [Month, Year] Amount: Rs. [Amount] Mode of Payment: [Cash/Bank Transfer] Landlord's PAN: [Landlord’s PAN] Signature of Landlord: ___________________________

Ensure both the tenant and landlord have copies of this receipt for their records. The rent receipt serves as an official document for tax-related purposes for both parties involved.

An HRA rent receipt is a necessary document for claiming tax deductions under Section 10(13A) of the Income Tax Act in India. This receipt provides proof of rent paid by an employee to their landlord, which helps reduce taxable income. It is required to claim House Rent Allowance (HRA) benefits, offering relief from taxes on a portion of the HRA received by the employee.

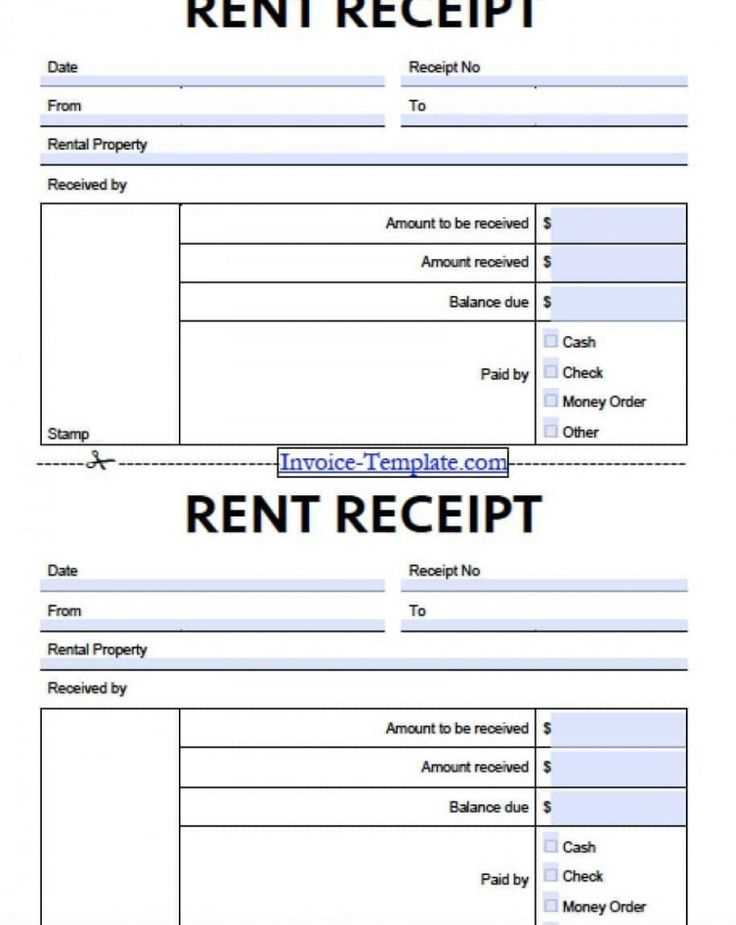

Tax Deduction Claim

To claim HRA, an employee must submit rent receipts to their employer as evidence of rent payments. The rent receipt is used by the employer to calculate the eligible amount of HRA deduction. Without this receipt, the employee may not qualify for a tax reduction, which would result in paying higher taxes.

Verification and Documentation

Rent receipts serve as official proof for income tax purposes. The receipt should contain the tenant’s name, landlord’s name, rental amount, and the period for which rent is paid. Without proper documentation, there could be disputes regarding the amount of rent paid or claims made for tax benefits.

- Rent receipts are necessary for tax verification during audits or assessments.

- They help in avoiding potential tax liabilities by providing transparency in rent-related claims.

- Proper receipts ensure compliance with legal requirements and reduce the risk of penalties.

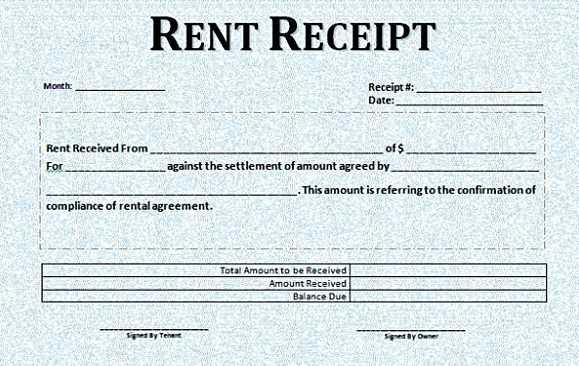

To create an HRA rent receipt in India, include the following key details: the name of the landlord, the tenant’s name, rental amount, rental period, payment mode, and the landlord’s address. This receipt serves as proof of rent payments, which is crucial for claiming House Rent Allowance (HRA) under Indian tax laws.

Step 1: Include Basic Information

Start with the full name and address of both the landlord and the tenant. Specify the rental amount for the given period, and mention the date of payment and the rental period (e.g., monthly or quarterly). Ensure that the date format is clear and consistent.

Step 2: Payment Details

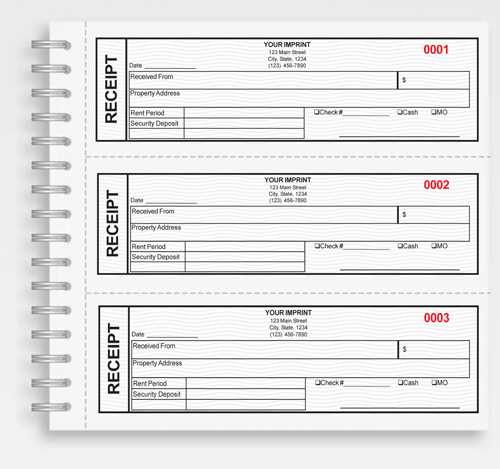

Record the mode of payment, such as cash, cheque, or bank transfer. If the payment is made through cheque or bank transfer, include transaction details like cheque number or bank transaction ID for easy reference.

Note: It is important for both parties to sign the receipt to confirm the details are correct. The tenant can use this receipt to claim HRA deductions while filing income tax returns.

To create a valid HRA receipt, you must include specific details that ensure its authenticity. This includes the name of the landlord, the address of the rented property, and the period for which the rent is paid. Accurate figures are crucial, so mention the rent amount, along with any applicable taxes or additional charges, in clear terms. The receipt should also include the tenant’s name, along with the landlord’s signature or stamp, confirming the transaction.

Details to Verify

Ensure that the rent amount is correctly stated and corresponds with the rental agreement. Any rent paid for the period should be listed with clarity, indicating the dates that the payment covers. If the landlord is receiving payment via cheque, bank transfer, or cash, this should be specified in the receipt. Avoid vague terms, and confirm the transaction method to ensure transparency.

Landlord and Tenant Information

For a receipt to be credible, the landlord’s and tenant’s details must be accurate. Full names, contact information, and the official property address help verify the legitimacy of the receipt. If the landlord is an entity or company, include their official business name, registration number, and address. This prevents any confusion and assures that both parties are recognized in the rental agreement.

Rent receipts in India must contain specific details to ensure compliance with the law. The receipt should include the full name and address of both the tenant and the landlord, along with the rental amount, the rental period, and the date of payment. The document must clearly state whether the payment is for a full month or a part of the month. Additionally, if the payment is made by cheque, it should be mentioned along with the cheque number and bank details.

The rent receipt should be signed by the landlord or their authorized representative to confirm its authenticity. For tenants, retaining a rent receipt is important, as it serves as evidence of payment. This is especially relevant in cases where tenants need to claim deductions for rent paid under Section 80GG of the Income Tax Act. Without a rent receipt, tenants may find it challenging to substantiate their claims for tax exemptions or other legal matters.

While it is not mandatory to have a rent receipt notarized, it is recommended for better legal protection. Rent receipts are crucial in property disputes and also for ensuring that both parties have a clear record of the agreed terms and payments made. By adhering to these guidelines, both landlords and tenants can ensure smooth transactions and protect their interests.

A standard HRA receipt template offers clarity and ensures smooth processing for both tenants and employers. It eliminates confusion by providing all necessary information in a structured manner. With a clear format, both parties can quickly verify the accuracy of the details provided, which reduces the chance of errors during tax calculations.

Time-saving

By using a pre-designed template, you save time as there’s no need to manually create a receipt from scratch each time. A ready-to-use format ensures you can fill in the required information quickly, helping tenants and employers meet deadlines without delays.

Tax Compliance

Using a standard template simplifies the process of meeting tax requirements. It ensures that the required fields such as rent amount, landlord details, and rental period are included, helping to maintain accuracy in HRA claims.

| Key Benefits | Description |

|---|---|

| Clarity | Clear and consistent formatting ensures easy validation and review. |

| Time Efficiency | Quick to fill out, saving time compared to creating a new receipt every month. |

| Compliance | Helps meet tax guidelines by including all necessary information. |

| Accuracy | Reduces the risk of missing key details, ensuring proper HRA claims. |

Customize your rent receipt by including details that are relevant for tax filing. Start with the full name and address of both the landlord and tenant. Include the rental property’s address and the rent amount paid for the specific month. Be sure to mention the payment method used, such as cash, cheque, or bank transfer.

Make sure to add a unique receipt number for each transaction. This helps in tracking payments easily during tax filing. If applicable, note any deductions or adjustments, like maintenance fees or utilities, that were included in the payment amount. Include a clear statement confirming that the rent was paid for the specified period.

Ensure your rent receipt mentions the GST (if applicable) and the GSTIN number of the landlord. For tax purposes, it is crucial to specify whether the rent payment is subject to GST or exempt based on the nature of the property.

Lastly, provide your tenant with a digital or physical copy of the rent receipt for their records. This will be valuable when they file their taxes and claim deductions, ensuring everything is accurately documented for both parties.

To create a valid HRA rent receipt in India, include the following key elements:

- Tenant’s Name: Clearly mention the tenant’s full name.

- Landlord’s Details: Include the landlord’s name, address, and contact information.

- Property Address: Specify the rental property address where the tenant resides.

- Rent Amount: State the rent amount paid by the tenant along with the period it covers (monthly or quarterly).

- Receipt Number: Assign a unique number for each receipt issued for record-keeping purposes.

- Payment Date: Mention the exact date when the rent payment was made.

- Signature: The landlord should sign the receipt to confirm the rent payment was received.

Ensure that the rent receipt is printed on a letterhead or a plain paper with these details clearly visible. You may use online templates to streamline the process but make sure to include all the essential elements for accuracy.