To claim a tax deduction for donations in Australia, you must have a valid receipt from the charity or organization. The receipt should include specific details that meet the Australian Taxation Office (ATO) guidelines. This ensures the donation is recognized for tax purposes. Use a donation receipt template that includes all required elements to avoid any issues when filing your taxes.

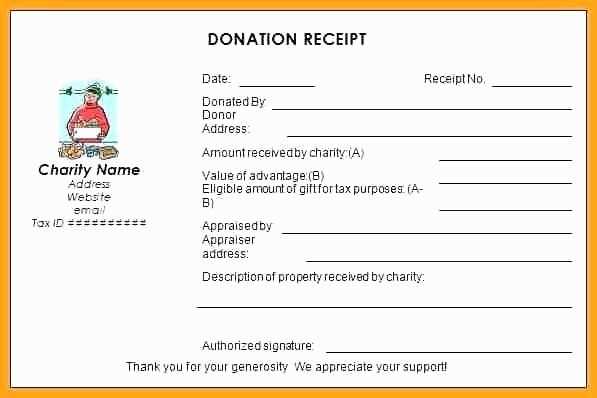

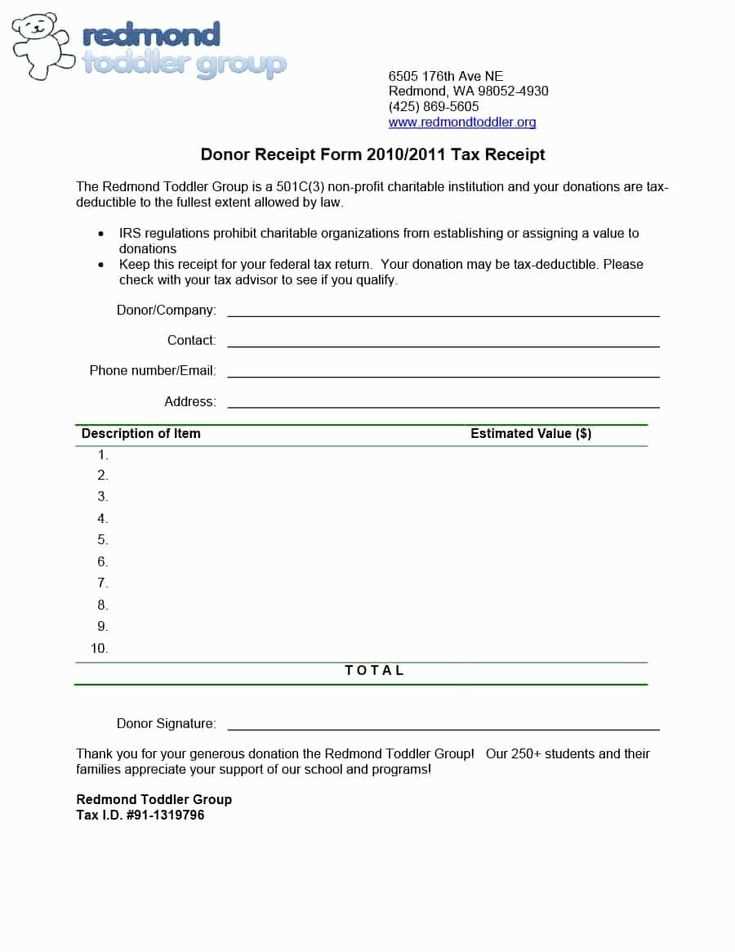

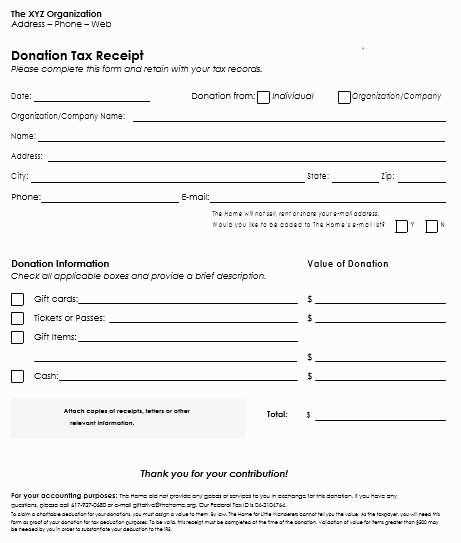

A standard tax-deductible donation receipt template should include the name and ABN (Australian Business Number) of the charity, the donor’s details, the amount donated, and a statement confirming that the donation is tax-deductible. The receipt must also include the date of the donation and a description of the item or service, if applicable.

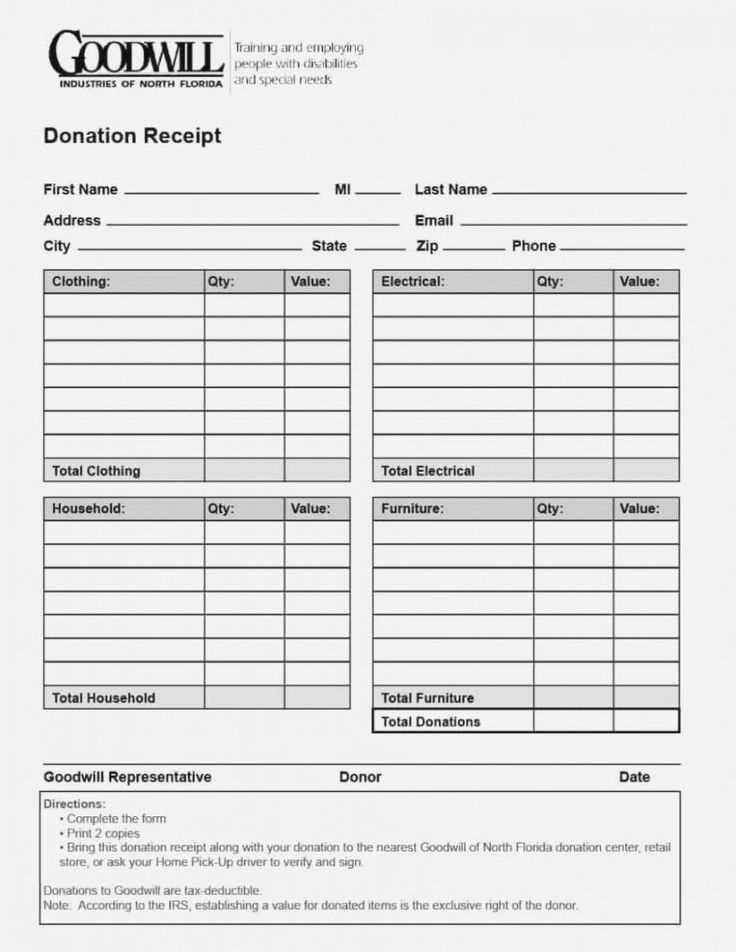

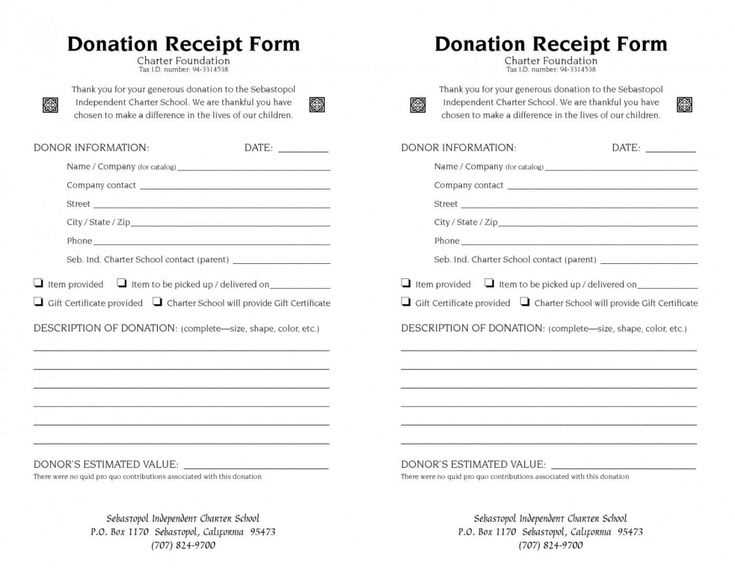

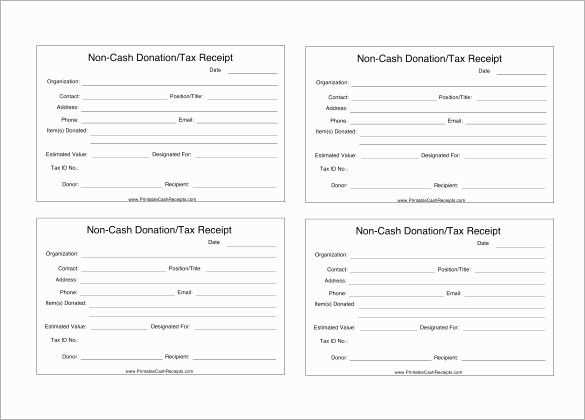

Ensure your template clearly separates monetary donations from non-cash contributions, such as goods or services. For non-cash donations, an accurate valuation of the items donated should be provided. If the charity receives any goods or services in return for the donation, this must be disclosed, as only the amount exceeding the value of the goods or services is deductible.

Creating and maintaining accurate receipts helps streamline the claiming process, protecting both the donor and the charity. By using a comprehensive template that meets these requirements, you can avoid unnecessary delays or complications during tax time.

Here’s the corrected text with repetitive words removed:

Ensure your tax-deductible donation receipt meets Australian standards by including key details. Include the donor’s name, the donation amount, and the date received. Clearly state that the donation is tax-deductible, and mention the charity’s ABN (Australian Business Number). The receipt should also specify whether the donation was monetary or in-kind.

To comply with regulations, always provide the donor with an official receipt for any donation over $2. Keep a copy of the receipt for your records. If the donation is more than $5,000, you may need to issue an additional statement confirming that the donor did not receive any material benefit from the donation.

For electronic receipts, ensure the email includes all required information, including the ABN and confirmation that the donation is tax-deductible. Make sure your system is set up to automatically issue receipts upon donation confirmation to avoid delays.

Accurate record-keeping is critical to ensuring your donors can claim their deductions and your charity complies with tax requirements.

Tax Deductible Donation Receipt Template Australia

How to Format a Tax Deductible Donation Receipt

Required Information for a Valid Receipt in Australia

How to Include Donation Amount and Tax-Exempt Status

What to Include for Non-Monetary Contributions

Legal Requirements for Charities Issuing Receipts

How to Ensure Donor Privacy and Security on Documents

To issue a tax-deductible donation receipt in Australia, ensure that your document complies with the Australian Taxation Office (ATO) requirements. The receipt must clearly reflect the donation details and include specific legal information for the donor to claim tax deductions.

How to Format a Tax Deductible Donation Receipt

The receipt should be clear and easy to read. Organize it with a logical flow, including all necessary details. Start with the charity’s name and ABN (Australian Business Number), followed by the donation date, amount, and a statement confirming the donation is tax-deductible.

Required Information for a Valid Receipt in Australia

A valid tax-deductible donation receipt must include the following:

- Charity’s full legal name and ABN.

- Amount donated or a description of the donated item(s) with an estimated value for non-cash donations.

- Date of the donation.

- Statement confirming that the donation is tax-deductible.

- Donor’s details, such as name and address (optional for anonymity).

- Details of any goods or services provided to the donor in exchange for the donation (if applicable).

For non-monetary donations, such as goods, a description of the items and their value must be included. If an estimation is made, it should be clear and reasonable.

Tax-Exempt Status should be indicated with a clear statement such as “This donation is tax-deductible under Division 30 of the Income Tax Assessment Act 1997” to make it easy for the donor to claim deductions.

What to Include for Non-Monetary Contributions

If the donation is in kind (non-cash), such as furniture or goods, it is essential to include a detailed description of the items donated. While the charity can estimate the value, it must be a reasonable figure and can be based on current market value or a professional valuation.

Legal Requirements for Charities Issuing Receipts

Charities must follow specific legal guidelines to maintain their Deductible Gift Recipient (DGR) status. The receipt must be issued in a format that allows donors to use it for tax claims. Non-DGR entities cannot issue tax-deductible receipts.

How to Ensure Donor Privacy and Security on Documents

Ensure that the donor’s personal information is protected. Do not disclose unnecessary details on the receipt, such as financial information. Use secure methods to store and send receipts, especially for electronic formats. Encryption and secure access should be in place to protect sensitive data.