To ensure smooth business transactions and provide clarity to both clients and service providers, using a well-structured services receipt template is key. This simple document outlines the details of services provided, payment terms, and any relevant charges, offering transparency for all parties involved. A good template should include the service description, date of completion, amount paid, and payment method, all formatted clearly.

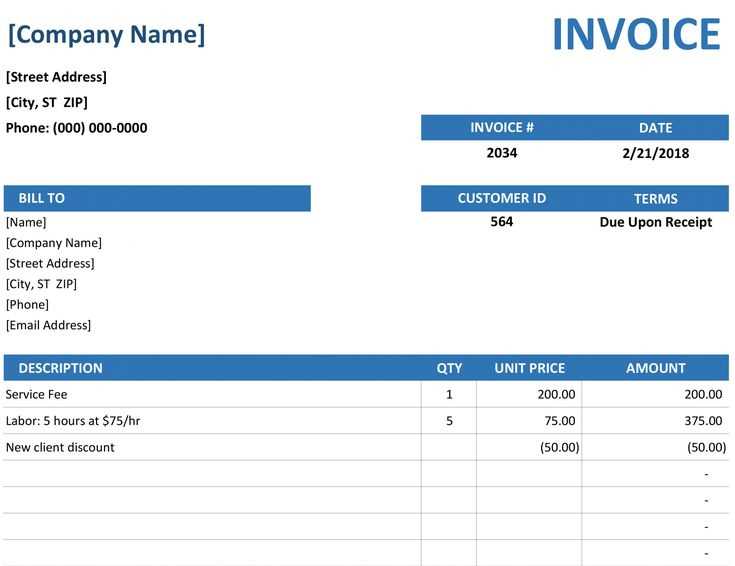

For a seamless experience, a service receipt should contain the exact service performed, ensuring there’s no ambiguity about what was delivered. Including an invoice number for each transaction is a great way to track payments and prevent confusion. Additionally, note the payment method used–whether it’s cash, credit card, or bank transfer, as it can help resolve any discrepancies later on.

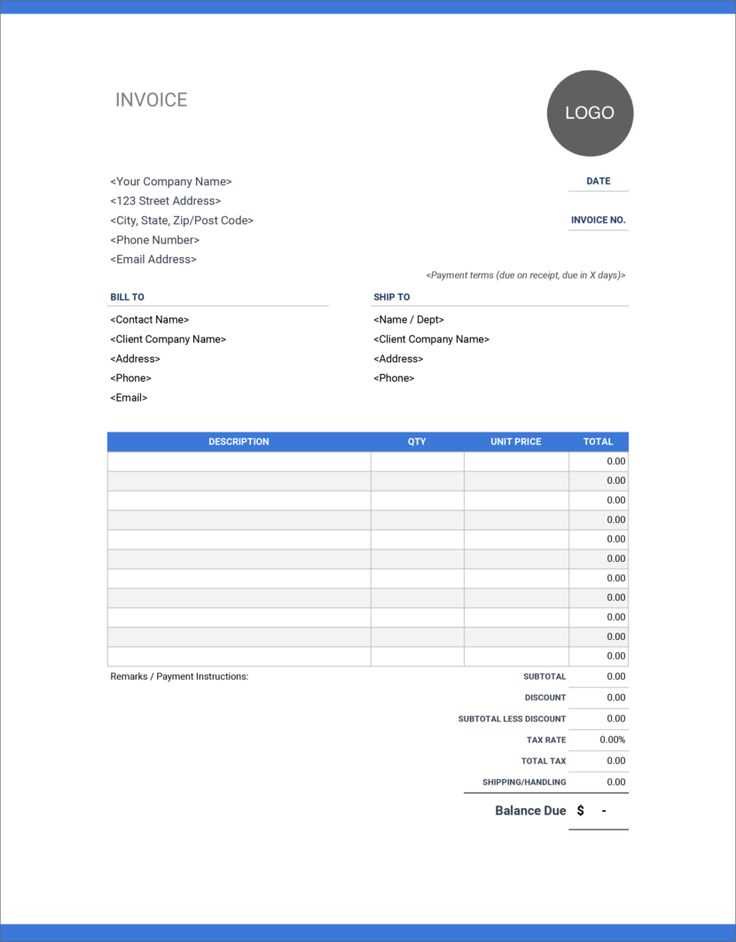

Ensure your template is easy to use and flexible. Include sections for business details such as the name, address, and contact information of the service provider. For added convenience, a section for client details should also be part of the template. This creates a complete and clear record of the transaction.

Here’s the updated text with reduced repetition:

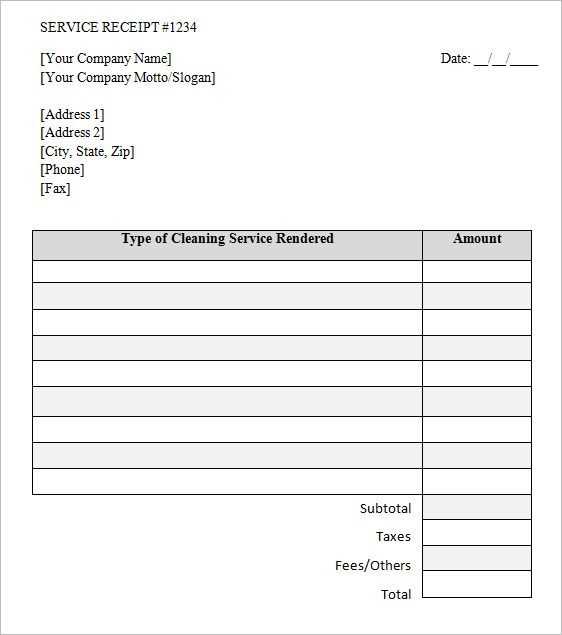

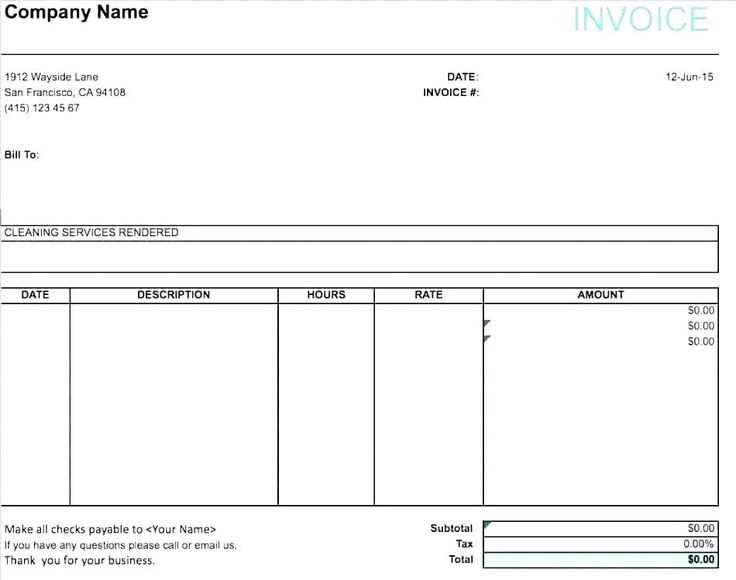

To create a clear and functional service receipt template, prioritize key information such as service description, date, price, and client details. This streamlines the layout and minimizes clutter. Ensure the format is easy to understand and visually appealing for both parties.

Key Sections to Include

In your template, include the following sections to ensure it’s effective:

- Service Details: A brief description of the service rendered.

- Client Information: Name, address, and contact details.

- Service Date: Date of service completion.

- Payment Information: Total amount due and payment method.

- Terms and Conditions: Any relevant policies or guidelines for both parties.

Table Layout for Service Receipts

Using a table format helps present the information clearly and ensures consistency. Here’s an example:

| Service Description | Quantity | Price | Total |

|---|---|---|---|

| Consultation | 1 | $100 | $100 |

| Repair | 2 | $50 | $100 |

| Total | $200 | ||

By following these guidelines, the receipt will be both functional and easy for the recipient to understand. Avoid excess detail that might complicate the process.

- Services Receipt Template

A well-structured services receipt template ensures clarity and accuracy when documenting transactions. Start with the header that clearly identifies the receipt as a service receipt. Include the service provider’s name, contact details, and the recipient’s information right below it. This helps keep things organized and transparent for both parties.

Key Elements

- Provider’s Information: List the service provider’s full name, address, phone number, and email.

- Recipient’s Information: Include the name and contact details of the customer or client receiving the service.

- Service Description: Specify the type of service rendered, the date, and a brief description of the work done.

- Amount Charged: State the price for the service, including any taxes or discounts if applicable.

- Payment Method: Document how the payment was made (e.g., credit card, cash, check, etc.).

- Receipt Number: Provide a unique reference number for easy tracking and future reference.

Additional Tips

- Use clear and easy-to-read fonts for better readability.

- Include both itemized breakdowns for complex services and lump sum totals for simpler transactions.

- Provide space for both signatures to acknowledge receipt of the service and payment.

Begin by adding your business logo at the top of the receipt. This gives it a professional look and ensures customers can easily identify the business. Make sure the logo is clear but not too large–adjust the size to fit neatly in the header area.

Include Your Business Details

Display your business name, address, phone number, and email address. Ensure this information is prominently placed at the top of the receipt, so customers can quickly contact you if needed. Adjust font size for clarity and space efficiency.

Personalize Itemized Information

Customize the sections that describe the items or services sold. Use clear descriptions, and if possible, include product codes or SKU numbers for easy reference. Add a line for quantity and price, making the pricing structure transparent for the customer.

Consider including fields for discounts, taxes, or any other additional charges. This helps ensure that all financial details are clear and leaves no room for confusion.

Ensure the footer includes payment information. If you accept multiple payment methods (credit cards, mobile payments, etc.), list these options in the footer section, which can make it easier for customers to keep track of their payment method.

Finally, test the template. Print out a sample receipt to verify that all the necessary information is properly formatted and easy to read. Adjust spacing, margins, or font size if needed to make the receipt both functional and visually appealing.

Ensure the receipt template includes the following details for clarity and accuracy:

- Business Information: Display your business name, address, contact number, and email. This helps customers identify the source of the transaction.

- Date of Transaction: Always record the exact date and time when the transaction occurred. This helps track purchases and serves as proof in case of disputes.

- Receipt Number: Assign a unique receipt number to each transaction. It makes it easier to reference and find specific transactions in the future.

- Customer Information (Optional): For more personalized service, include the customer’s name or details, especially for loyalty programs or warranty claims.

- Itemized List of Products/Services: Break down the purchased items or services with a description, quantity, price, and any applicable taxes. This ensures transparency and helps customers understand the cost breakdown.

- Total Amount Paid: Clearly state the total amount the customer paid, including any discounts, taxes, or fees. This reduces confusion and confirms the final price.

- Payment Method: Include the method of payment (e.g., credit card, cash, online payment). This verifies the payment type and helps with accounting.

- Return/Refund Policy: If applicable, briefly mention your return or refund policy, or include a link to the full policy. This gives customers the necessary information in case they need to make a return.

With these details in your receipt template, you enhance transparency, improve customer experience, and streamline your business operations.

Incorrectly listing service details can lead to confusion. Always specify the type of service provided with clarity. Instead of vague terms like “consultation,” use precise descriptions such as “one-hour financial consultation.” This helps prevent any disputes about what was delivered.

Missing or Incorrect Contact Information

Including the wrong business or customer contact details is a common error. Double-check the names, addresses, and phone numbers before issuing a receipt. Accuracy is key to avoiding problems if the customer needs to follow up.

Incorrect Pricing or Taxes

Incorrectly stating the price of the service or failing to add applicable taxes can create confusion. Make sure to clearly list the price of each service and any taxes or fees. Verify the tax rate before issuing the receipt to ensure compliance with local regulations.

Omitting a receipt number is another mistake to watch for. This simple reference number helps organize records and ensures that the transaction is traceable. Make sure each receipt is assigned a unique identifier.

Include your business name, address, and tax identification number (TIN) on the receipt. This information is typically required for legal purposes, ensuring transparency and accountability. If applicable, make sure to add your VAT number, especially if your business operates in regions where VAT is mandatory.

Clearly state the transaction details, including the date of purchase, item description, quantity, price, and total amount paid. This ensures that the receipt acts as an accurate record for both your customer and your business.

If you charge taxes, include a breakdown of the tax amount and the tax rate. Some jurisdictions require you to show how the tax is calculated, so it’s essential to make it clear on the receipt.

Ensure that the receipt contains a refund policy or terms of service, where applicable. This helps protect your business by informing customers of the conditions under which returns or exchanges are allowed.

Use a template that includes all mandatory elements for your specific location. Some regions have specific rules about receipt formats, and using a standard template can help avoid legal issues.

Review local laws to determine if electronic receipts are acceptable or if a physical copy is required for certain transactions. In some jurisdictions, you may need to retain a copy for tax or audit purposes.

Opt for a format that matches your business needs and customer preferences. PDF and Excel are two of the most popular formats due to their wide compatibility and ease of use. PDF is ideal for professional-looking, fixed layout receipts, ensuring the content stays consistent across devices. Excel, on the other hand, is great for businesses that need to track multiple transactions or analyze receipt data later on. Choose a format that allows your receipts to be easily accessed, saved, and shared by both you and your customers.

Consider Your Industry and Audience

Different industries may benefit from different formats. Retail businesses often prefer PDF for clean, print-ready receipts, while service-based businesses may lean toward Excel or CSV for tracking. Consider whether your customers need a hard copy or if an electronic version will suffice. If you offer digital receipts, make sure the format is compatible with popular email clients and devices to guarantee a smooth experience.

File Size and Accessibility

Smaller file sizes are easier to manage, especially for high-volume businesses. PDF files are typically smaller than images or scanned receipts, making them easier to send and store. Ensure your chosen format is easily accessible across different devices and operating systems to avoid compatibility issues, particularly if you plan on sending receipts via email or providing them through an online portal.

Digital tools make it simple to create receipts quickly. You can use software or online platforms to customize and automate receipt generation. Here’s how to get started:

- Choose a Receipt Generator Tool – Pick a platform like QuickBooks, Zoho, or Invoice Ninja. These tools offer pre-designed templates and customizable options for different business needs.

- Input Transaction Details – Enter key information such as the buyer’s name, date, items or services purchased, prices, and taxes. Most tools automatically calculate totals and taxes.

- Customize the Design – Adjust colors, fonts, and logo placement to match your branding. Many tools allow easy edits for a professional look without technical skills.

- Review and Confirm the Details – Double-check the receipt before finalizing. Ensure that the details are correct and the format suits your requirements.

- Download or Send the Receipt – After reviewing, download the receipt as a PDF or email it directly to the customer. Some platforms offer cloud storage for easy access anytime.

Using these tools streamlines receipt creation, ensuring you can provide customers with clear and accurate proof of transactions instantly.

I’ve reduced the repetition of “Services” and diversified the phrases while keeping their meaning intact.

To create a more streamlined and engaging services receipt, consider focusing on the key elements that provide clarity. Begin with a concise header that highlights the nature of the transaction. Rather than repeatedly using “services,” alternate with terms like “work provided,” “tasks completed,” or “service rendered” to avoid redundancy. This ensures the text stays fresh while clearly communicating the details.

Be Specific in Descriptions

Offer clear descriptions of each service, ensuring they are easy to understand. Use action verbs to convey what was delivered without unnecessary filler. For example, instead of stating “services performed,” specify “design work completed” or “consultation session held.” This enhances transparency and gives recipients a better grasp of what they are paying for.

Utilize Effective Structuring

Organize the receipt in a logical, easy-to-follow format. Group similar items together and present them with bullet points or numbered lists. This not only reduces repetition but also makes the document easier to read. By structuring your content well, you ensure that recipients can quickly locate specific services or tasks without confusion.

By making these small adjustments, you can create a professional, user-friendly receipt that communicates everything clearly without overusing terms like “services.” Focus on variety, clarity, and logical flow to improve the overall presentation.