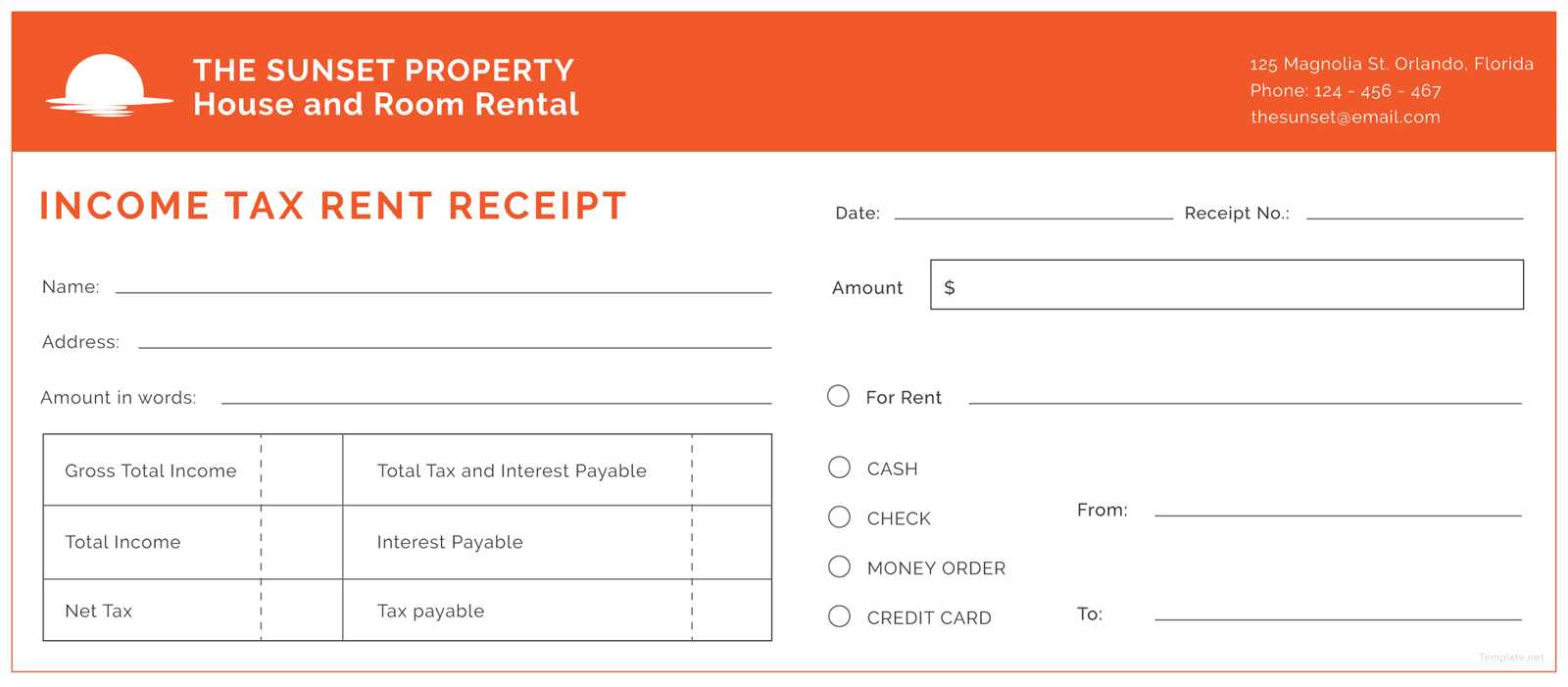

Creating a tax receipt for tenants is straightforward when you have the right template. The document should include key details such as the tenant’s name, rental property address, payment period, and the total amount paid. A simple format with these elements ensures that both you and your tenant can easily reference the receipt when needed.

The date of the payment is also important, as it establishes the timeline for tax purposes. You can include a section for any applicable discounts or late fees if necessary. Clearly stating these amounts ensures transparency between you and the tenant, making it easier for both parties to understand the transaction.

Once you have the basic information in place, you can add a section for your business details, including the name and contact information of the landlord or property management company. This adds legitimacy and clarity to the document, making it official for tax reporting purposes.

Pro tip: Always double-check the details before sending the receipt. Inaccuracies can lead to complications during tax filing or disputes. Keep the template simple, clear, and easily customizable for future use.

Here’s a revised version with fewer repetitions:

To simplify your tenant tax receipt template, include key details like the tenant’s name, address, rental amount, payment date, and landlord’s contact information. Avoid excessive descriptions or redundant information. Keep the layout clean and concise, using clear labels for each section. Ensure the tax year is clearly noted, especially if receipts span multiple periods. This streamlined format enhances clarity and helps tenants track payments efficiently.

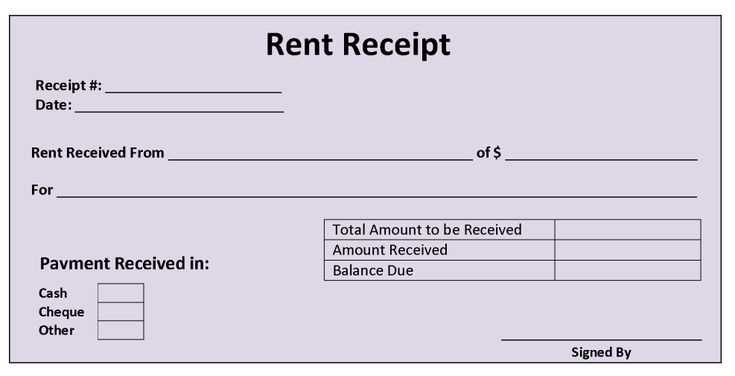

In the payment section, list the amount paid, method of payment, and the transaction date. If there are any deductions or adjustments, include a separate line for each, ensuring the final amount matches the payment received. This reduces confusion and maintains transparency for both parties.

Lastly, make sure the receipt includes a statement confirming that the tenant’s payment was received in full. A brief summary at the bottom of the receipt can provide a final confirmation, ensuring the document serves both as a record and a reminder of the transaction.

Here’s a detailed HTML plan for an article on “Tenant Tax Receipt Template” with 6 practical and specific headings:

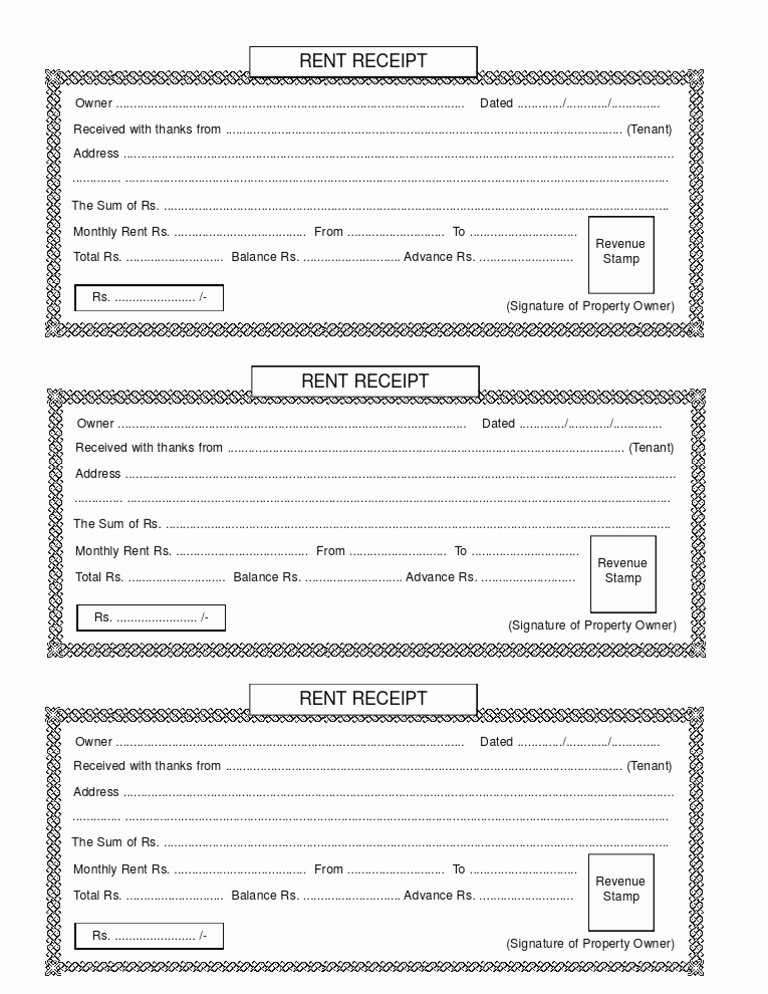

To create a clear and concise tenant tax receipt template, it’s crucial to include all necessary details to ensure accuracy. Start with the date the payment was received, followed by the tenant’s name and rental property address. This provides clarity and eliminates confusion when tenants refer to their receipt for tax filing purposes.

1. Include Tenant Information

Begin by entering the tenant’s full name and the rental property address. These details help identify the payer and the property in question. Be sure to format them clearly, ensuring there’s no ambiguity about the tenant’s identity or the address.

2. Specify Payment Amount

Clearly state the amount received for rent. This section must be detailed, indicating whether the payment covers monthly rent or any additional charges. If the tenant has made partial payments, this should be reflected, showing the balance due or the full amount paid.

3. Date of Payment

The date when the payment was received is critical for tax records. Make sure the receipt lists the exact date of payment to match the tenant’s tax filings. This will ensure both the landlord and tenant maintain proper documentation for tax purposes.

4. Payment Method

List the payment method used, such as cash, check, bank transfer, or online payment. This allows for clear tracking and verification of the payment method, which can be useful for both parties if any discrepancies arise.

5. Lease Term and Rental Period

Include the lease term and the specific rental period that the payment covers. This helps to confirm the exact duration of the tenancy for which the payment was made. Specify whether the payment covers a week, month, or another defined period.

6. Landlord’s Contact Information

Provide the landlord’s contact details, including name, phone number, and email address. This section ensures that tenants can reach out if they need further clarification regarding their payment or receipt.

- How to Create a Tenant Tax Receipt Template from Scratch

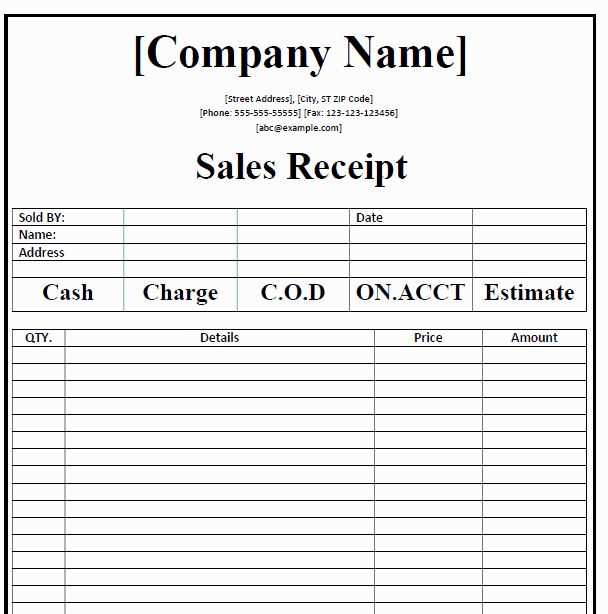

Design your template with clarity by organizing the necessary details into distinct sections. Include fields for both the landlord and tenant information. You should also include the rental property address and rental payment details.

Key Sections to Include

Focus on the following core components:

- Landlord’s Name and Contact Information

- Tenant’s Name and Contact Information

- Rental Property Address

- Payment Amount and Date

- Receipt Number

- Tax Information (if applicable)

Example Template Layout

| Section | Details |

|---|---|

| Landlord Name | John Doe |

| Tenant Name | Jane Smith |

| Rental Property Address | 123 Main Street, City, ZIP |

| Payment Amount | $1,000.00 |

| Payment Date | February 1, 2025 |

| Receipt Number | TXR-00123 |

Once the sections are laid out, format the template clearly. Add a section for tax information if necessary. Keep the layout simple and easy to understand. Customize it for your specific needs, ensuring it includes all legal and relevant information.

A tenant tax receipt should clearly outline the key details that validate the payment for tax purposes. This ensures transparency and helps both the tenant and landlord manage their financial records accurately.

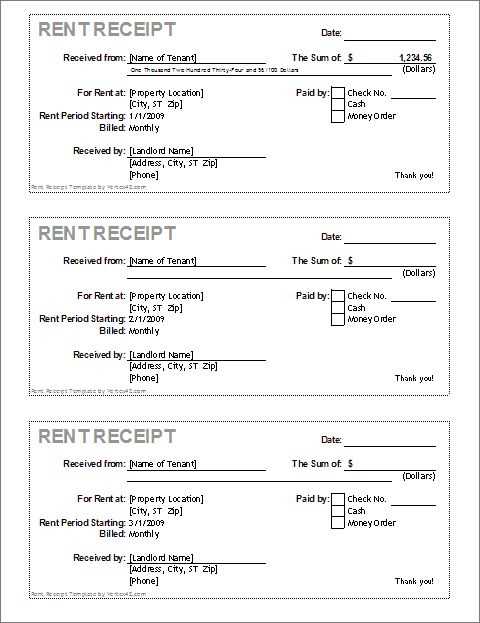

Payment Information

The receipt must specify the total amount paid, the date of payment, and the payment method. Include any relevant transaction ID or reference number, as this helps track the payment in case of future inquiries.

Tenant and Landlord Details

Include the tenant’s full name and the landlord’s or property manager’s contact information. This establishes the parties involved and provides a direct point of contact for any clarification.

| Element | Description |

|---|---|

| Amount Paid | Total payment amount, including any applicable taxes or fees. |

| Date | The exact date the payment was made. |

| Payment Method | Cash, check, bank transfer, etc. |

| Tenant Name | Full legal name of the tenant who made the payment. |

| Landlord Information | Full name and contact details of the landlord or property manager. |

Landlords must provide tenants with tax receipts that comply with local and state laws. These receipts should include key information: tenant’s name, rental address, amount paid, and the period covered. The landlord’s business details should be clear, and the receipt must indicate whether the payment was for rent, services, or other charges. Be sure to use the correct date format and maintain records for verification. In many areas, keeping receipts for at least three years is required. Regularly check local regulations to stay compliant with any updates or changes in tax laws.

Adjust your template to reflect different payment methods clearly. Modify sections for check payments, bank transfers, credit cards, and digital wallets. Each method requires unique details for accurate recordkeeping.

For Check Payments

- Include fields for the check number and issuing bank.

- Leave space for the payment date and the recipient’s signature.

- Highlight the amount and provide a clear breakdown of charges paid via check.

For Bank Transfers

- Request the bank transaction reference number and payment date.

- Make sure to include the payer’s bank details for clarity.

- Designate a section for additional notes or transaction details to avoid confusion.

For Credit Cards

- Include a space for the credit card type (Visa, MasterCard, etc.) and the last four digits of the card number for verification.

- Provide an area for the transaction date and amount.

- Ensure there’s a box for the approval code, if applicable, for credit card processing systems.

For Digital Wallets

- Include the name of the digital wallet used (PayPal, Venmo, etc.).

- Space for transaction ID and payment date.

- Highlight any additional fees charged by the service.

To create digital tax receipts for tenants, first ensure that your accounting or property management software supports receipt generation. Many systems allow you to customize receipt templates by entering tenant details, payment amount, and date. If your software lacks this feature, you can use online receipt generators to manually enter information and save receipts as PDFs.

Step 1: Collect Necessary Information

Gather tenant information, including their name, address, rent amount, and payment date. Double-check that all information is correct before entering it into the receipt template. This reduces errors and ensures accuracy in the final receipt.

Step 2: Choose a Template or Software

Select a pre-designed template or use accounting software that auto-fills most of the required details. These templates will typically include fields for the tenant’s name, rental property address, total rent, payment period, and the landlord’s contact information.

Tip: Customize the template to include a unique receipt number for each transaction, which will help both you and your tenant keep track of payments.

Step 3: Issue and Share the Receipt

Once generated, save the receipt as a PDF to preserve the formatting and content. Email the digital receipt to your tenant with a message confirming the details and reminding them of any relevant deadlines for tax filing.

Bonus Tip: Consider using a service that allows tenants to access receipts anytime, like a tenant portal, for added convenience.

Ensure all the required information is correctly filled out. Missing details can cause delays or errors in processing tax documents. Double-check the following:

- Tenant’s Information: Confirm the tenant’s full name, address, and rental period are accurate. An incorrect name or address can lead to confusion when the tenant claims deductions.

- Incorrect Amounts: Verify the rental amount is precise, including any additional fees that need to be itemized. A rounded figure or missing fee details may raise questions during audits.

- Misunderstanding Deductible Expenses: Only include expenses that are allowable under local tax laws. Avoid listing non-deductible items, as this can cause the receipt to be rejected.

- Dates and Rental Period: Ensure the rental dates match the actual period for which the tenant is being taxed. Incorrect dates may invalidate the receipt.

- Signature and Authorization: Some receipts require signatures or stamps for validation. Failing to include these can make the receipt unenforceable.

Check for spelling and formatting errors. Typos or inconsistent formatting can raise doubts about the document’s authenticity. Always review the receipt for accuracy before submitting it.

To create a tenant tax receipt template, focus on clarity and organization. The receipt should include specific details to ensure it meets the necessary legal and tax requirements.

- Include the full name and address of the tenant.

- Specify the rental period covered by the receipt (e.g., month and year).

- List the amount paid, clearly stating the currency.

- Provide a breakdown of any additional charges (if applicable), such as maintenance or utilities.

- Ensure the landlord’s contact information is visible, including the business name, address, and phone number.

- Include a receipt number for tracking purposes.

- Sign and date the document to confirm the payment was received.

Use simple and straightforward formatting. Keep the layout consistent, with sections clearly separated for easy reading. Avoid unnecessary information, focusing solely on what’s required for tax purposes.