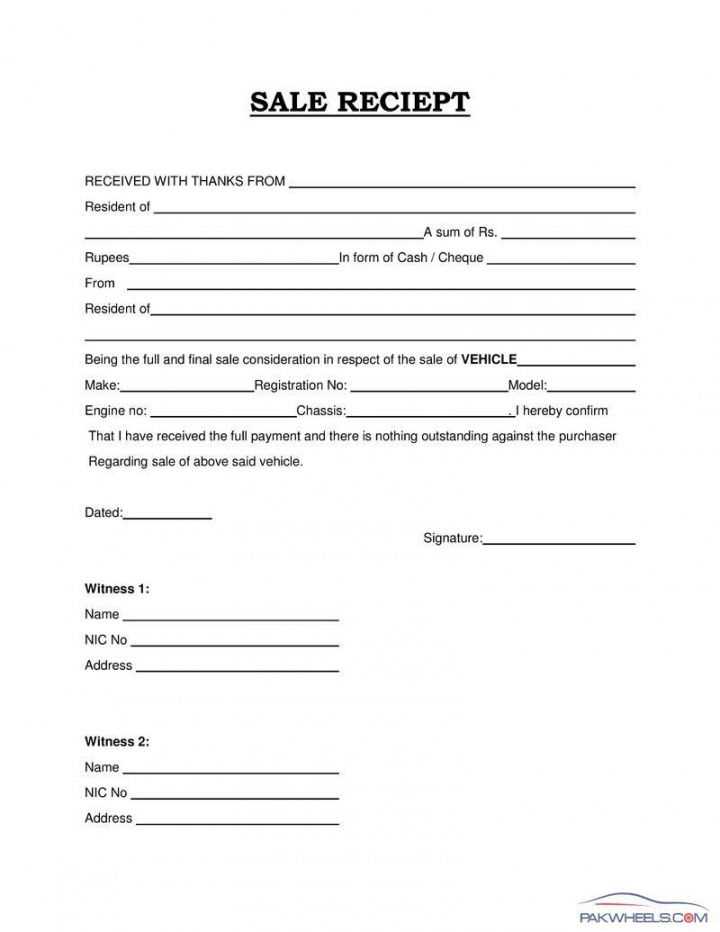

A well-drafted car sale receipt can save time and prevent potential disputes for both buyers and sellers in India. Ensure your document includes accurate details like the buyer’s and seller’s names, vehicle information, and transaction specifics. This simple but effective template can protect both parties legally by confirming the transfer of ownership.

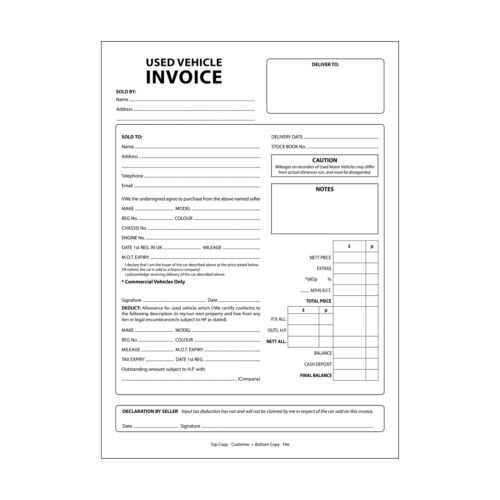

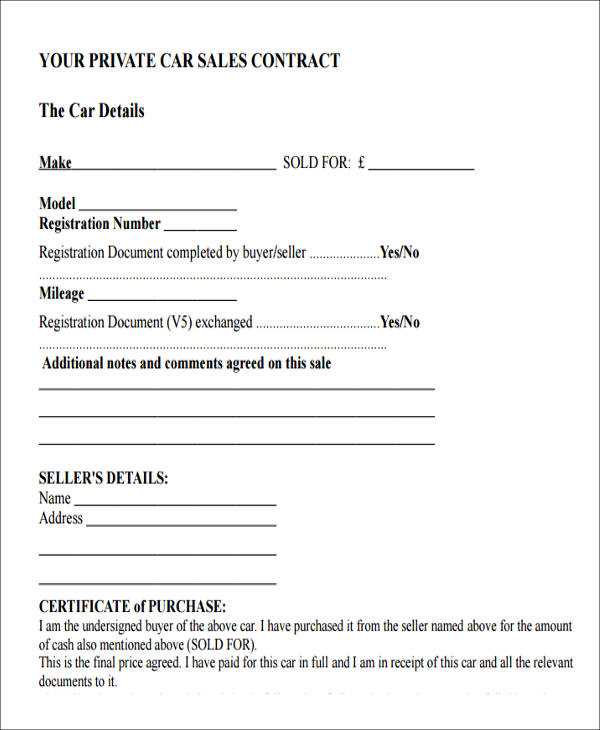

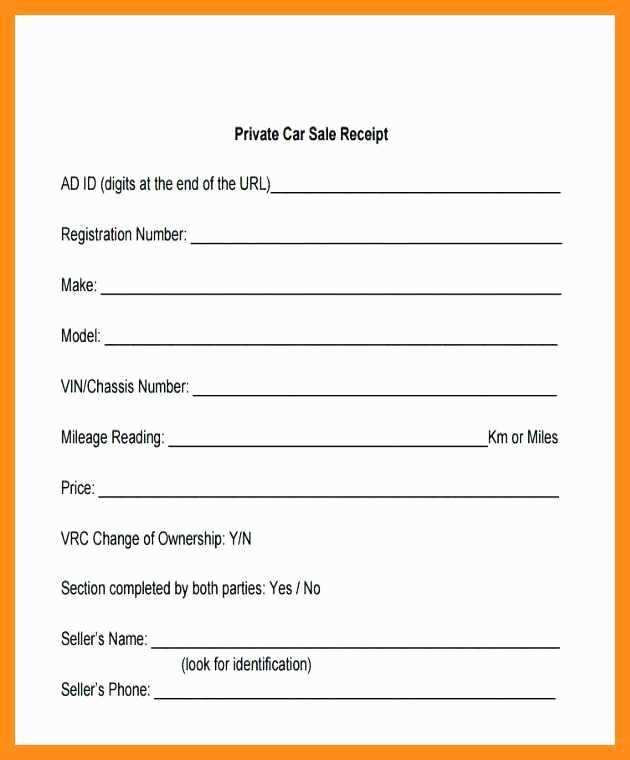

The receipt should clearly outline the car’s make, model, year, registration number, and chassis number. It must also specify the sale price, any payment method used, and the date of the transaction. Make sure to note whether the car is sold as-is or with warranties. If the car has any previous damages or issues, it’s best to list them for transparency.

For both the buyer and seller, a properly filled-out receipt serves as proof of transaction and can be referred to in case of disputes related to the sale. Be sure to sign the document, and have a witness if necessary. Keeping a copy of the receipt for future reference is always a good idea. Use this template to streamline the process and ensure clarity for both parties involved.

Here are the revised lines based on your request:

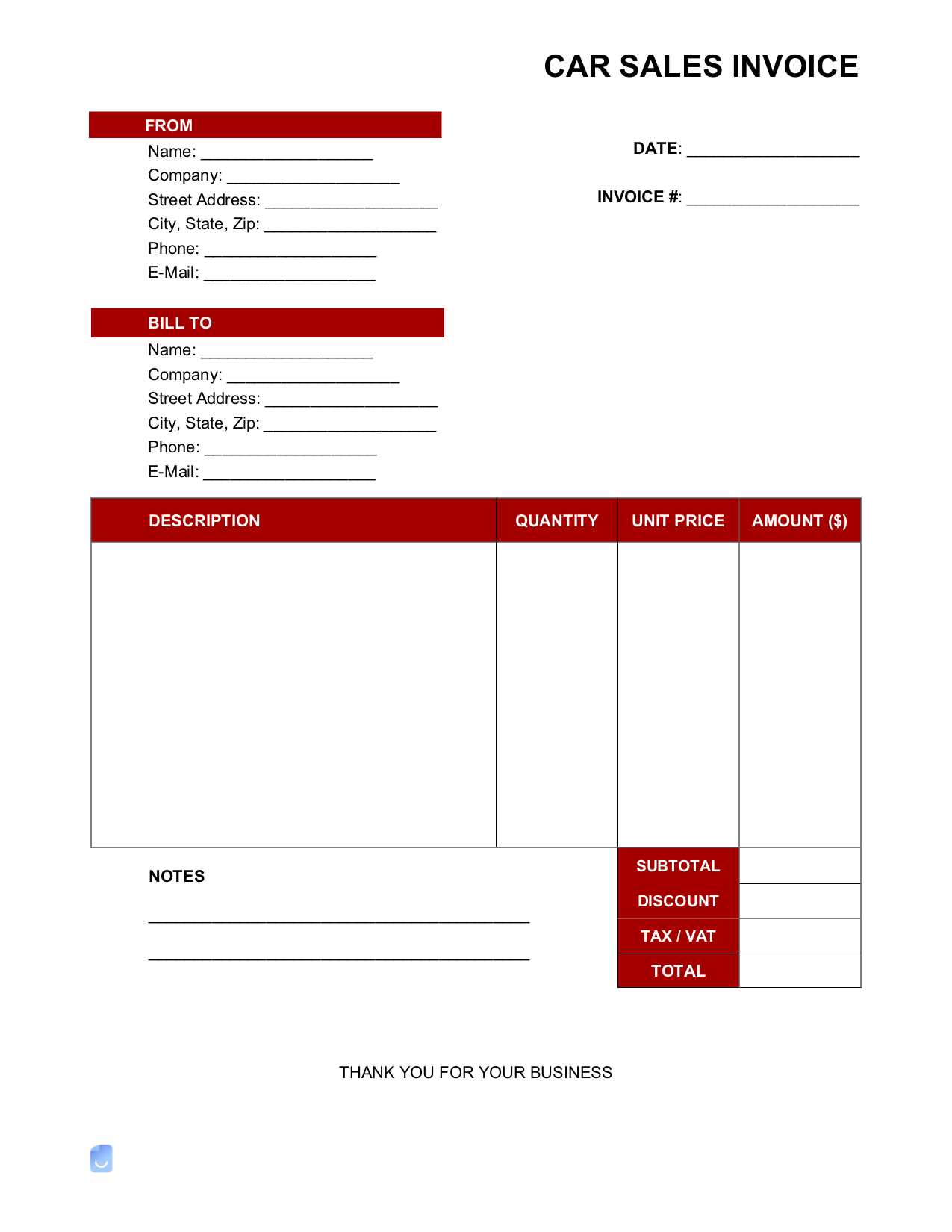

When drafting a car sale receipt in India, ensure that the document includes the seller’s name, address, and contact details, along with the buyer’s information. This provides clarity and transparency for both parties.

Seller’s and Buyer’s Information

Include full names, addresses, and phone numbers for both the seller and the buyer. This is important for verification and follow-up communication if required.

Car Details

Clearly mention the car’s make, model, year of manufacture, registration number, and Vehicle Identification Number (VIN). This helps avoid any confusion regarding the car’s identity.

Specify the amount paid, including any taxes or extra charges, to ensure both parties are aware of the final sale price. Make sure to mention the date of payment, the method (cash, cheque, etc.), and any installment plans, if applicable.

Don’t forget to include a clause regarding the transfer of ownership, which will help the buyer initiate the process with the Regional Transport Office (RTO).

Lastly, a signature line for both parties at the bottom of the receipt confirms the authenticity of the transaction.

- Car Sale Receipt Template India

A car sale receipt is a legal document that proves the transfer of ownership of a vehicle. In India, it is essential for both the buyer and seller to have a clear and detailed receipt that includes all necessary information. Here’s a simple template you can use to create a valid car sale receipt.

Basic Information

The receipt must include basic details of the transaction, such as:

- Buyer’s Name: Full name and address of the buyer.

- Seller’s Name: Full name and address of the seller.

- Vehicle Details: Make, model, year, color, and VIN (Vehicle Identification Number).

- Sale Price: The total amount agreed upon for the car.

- Payment Method: Whether the payment was made in cash, through bank transfer, or any other method.

- Date of Sale: Exact date of the transaction.

- Registration Details: Vehicle registration number and RTO (Regional Transport Office) details.

Other Details

It’s also important to include the following:

- Condition of the Vehicle: A brief description of the car’s condition at the time of sale, including any damages or repairs.

- Warranties/No Warranties: Clarify if the sale includes any warranty or if the car is sold “as-is” without any warranties.

- Signatures: Both buyer’s and seller’s signatures to confirm the authenticity of the transaction.

- Witnesses: If applicable, include witness signatures to validate the transaction.

After filling in all necessary details, ensure both parties have copies of the receipt. This document will serve as proof in case of any future disputes.

Include the full names and addresses of both the seller and the buyer. This identifies the parties involved and provides proof of transaction.

State the vehicle’s make, model, year, VIN (Vehicle Identification Number), color, and odometer reading. This confirms the exact car being sold and prevents future disputes.

Detail the sale price agreed upon by both parties. Specify whether it’s the full amount or includes any deposits or down payments. Mention the payment method used (cash, bank transfer, etc.).

Include the date of sale and the location of the transaction. This is key for record-keeping and helps establish the timeline of ownership transfer.

Note the car’s condition, including any warranties or “as is” clauses. If the car is sold with no warranty, state it clearly to avoid future liability.

Include both parties’ signatures along with the date of signing. This legally validates the transaction and signifies mutual agreement on the terms of the sale.

Include basic details such as the buyer’s and seller’s full names, addresses, and contact information at the top. The receipt should clearly state the make, model, year, and registration number of the vehicle. Include the Vehicle Identification Number (VIN) to ensure proper identification of the car.

Next, specify the sale amount in Indian Rupees (INR), detailing the payment method (cash, bank transfer, cheque, etc.). If applicable, mention any advance payments made and the outstanding balance, along with the due date for the remaining amount.

Ensure you include the date of sale and the location of the transaction. The receipt should outline any warranties, conditions, or agreements made between the parties. If there are any items or accessories included with the car, list them as well.

At the bottom of the receipt, provide space for both the buyer and seller to sign, confirming that the details are correct. You may also want to include a clause stating that the vehicle is sold “as-is,” if no warranty is offered.

Finally, ensure both parties receive a copy of the receipt for their records. This serves as a legal proof of the transaction for both parties.

In India, a car sale receipt must clearly include specific details to ensure its legal validity. The receipt should mention the complete names and addresses of both the buyer and the seller, along with their identification details such as PAN or Aadhaar numbers. It is important to state the exact make, model, year of manufacture, and registration number of the vehicle being sold.

The sale price must be documented clearly, with any applicable taxes (GST, road tax, etc.) separately mentioned. The receipt should also indicate the mode of payment, whether it is a cheque, bank transfer, or cash. The date of transaction must be recorded to confirm the sale date.

To comply with Indian laws, the sale receipt should include a declaration from the seller, confirming that the vehicle is sold free from any encumbrances or legal disputes. The document must be signed by both the buyer and seller. For an added level of security, a witness signature may be included.

Finally, the receipt should reference the transfer of ownership to the buyer, specifying that the seller has completed the formalities related to the transfer with the relevant Regional Transport Office (RTO). Without these critical details, the receipt might lack legal strength if disputes arise.

Adjust your receipt template based on the specifics of the transaction. For car sales, ensure you include key details like the make, model, year of the car, VIN, and registration information. If the transaction involves a down payment, clearly separate the amounts paid upfront and the remaining balance. This transparency avoids confusion in future dealings.

- Private Sale: For a private car sale, include the full name and address of both the seller and the buyer. Since there might not be a formal dealership involved, note the “sold as is” statement to protect both parties.

- Dealer Sale: When selling through a dealership, add the dealer’s contact information, including the license number. A section for any warranties or services provided should also be included, especially if the car comes with a dealership-backed warranty.

- Trade-In: If a car trade-in is part of the transaction, note the car’s trade-in value separately. This helps clarify the new price after the trade-in credit is applied.

- Financed Purchase: For financed sales, include the loan amount, interest rate, payment schedule, and any down payment received. This makes it easier for both parties to track the financial terms.

- Refunds and Cancellations: In case of a cancellation or refund, modify the template to reflect the refund amount and reason for the cancellation. This should be separate from the original sale information to ensure clarity.

Tailoring the receipt to the specific sale scenario reduces future disputes and builds trust with your customers.

When selling a car in India, tax implications play a critical role in the sale documents. The buyer and seller must be aware of Goods and Services Tax (GST) rates, especially if the transaction involves a dealer. GST on car sales typically ranges from 12% to 18%, depending on the car’s classification and whether it’s new or used. The seller is responsible for ensuring the correct GST rate is applied, and this should be clearly reflected in the sale receipt.

GST on Used Cars

If the car is sold privately without a dealer’s involvement, GST is not applicable unless the seller is a registered business dealing in second-hand cars. In such cases, the seller must provide a valid GST invoice. For private sales, the sale receipt should indicate whether GST was included or not. If no GST is charged, it’s advisable to clarify the sale as a private transaction.

Transfer of Ownership and Tax Filing

The transfer of ownership of the car must be updated with the Regional Transport Office (RTO), which may require submission of the sale receipt. Both the buyer and seller should ensure that any pending road tax or outstanding dues are settled before completing the transaction. If there are any state-specific taxes, such as road tax or vehicle registration fees, they should be mentioned in the document as these may impact the final sale value.

One of the most frequent errors is failing to mention the correct Goods and Services Tax (GST) rate. Always ensure that the receipt clearly shows the GST applied, especially for vehicle sales, as it is a requirement under Indian tax laws. If the GST rate is incorrect or omitted, the transaction may be considered invalid, leading to legal complications.

Incorrect Information on the Buyer and Seller’s Details

Double-check the buyer’s and seller’s names, addresses, and contact details. Any discrepancies between the provided information and official records can lead to confusion and potential disputes. Ensure that the correct details are entered before finalizing the receipt.

Failure to Include Vehicle Information

When selling a car, include specific vehicle details such as the make, model, registration number, engine number, and chassis number. Omitting these details could cause future issues in verifying ownership or in legal disputes. A detailed description ensures clarity and a smoother transfer of ownership.

Omitting Payment Method Details

It is essential to record how the payment was made, whether it was through cash, bank transfer, or cheque. This information helps avoid future disputes and provides transparency for both parties involved.

Leaving Out the Date and Signature

Always add the date of the transaction and ensure both parties sign the receipt. The lack of these key elements can lead to questions about the legitimacy of the transaction and could result in problems if either party needs to prove the agreement at a later time.

| Common Mistake | Consequences |

|---|---|

| Incorrect GST rate or omission | Potential invalid transaction and tax issues |

| Incorrect buyer or seller information | Disputes regarding ownership or transaction |

| Missing vehicle details | Issues with verifying vehicle ownership |

| Failure to include payment method | Confusion about the transaction and lack of proof |

| Omitting date or signature | Challenges proving the transaction’s legitimacy |

I’ve worked to maintain the meaning while varying the phrasing so that the word “receipt” is not repeated more than twice per sentence.

When creating a car sale receipt template for India, ensure it includes key details such as the vehicle’s make, model, registration number, and the buyer’s and seller’s contact information. These elements are crucial to validate the transaction and provide clarity to both parties.

Key Components

- Transaction date

- Sale price

- Payment method (cash, cheque, bank transfer, etc.)

- GST or applicable taxes, if any

- Vehicle inspection details or condition note

Ensure the document clearly states the transfer of ownership, including signatures from both the buyer and the seller. This helps avoid disputes in the future. It’s also advisable to include a section confirming that the vehicle is sold as-is unless otherwise agreed upon.

Additional Tips

- Use clear and simple language to avoid confusion.

- Ensure the document is signed and dated by both parties.

- If applicable, mention any warranties or return policies.