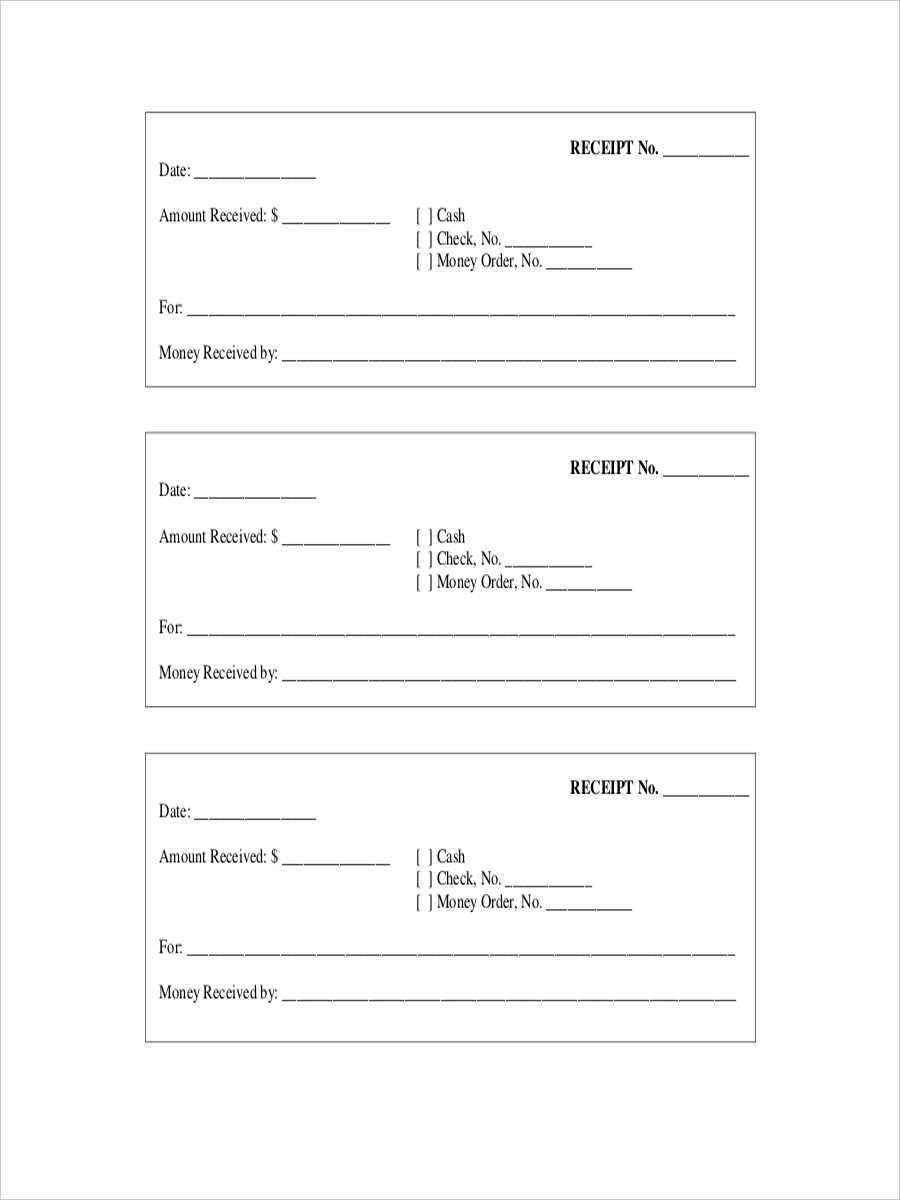

Begin with the header. A clear, concise title like “Receipt” helps the customer immediately identify the document. Include the date and time of the transaction for future reference.

Next, add the business details. List the company name, address, contact number, and email. This ensures the receipt has all necessary information in case of inquiries.

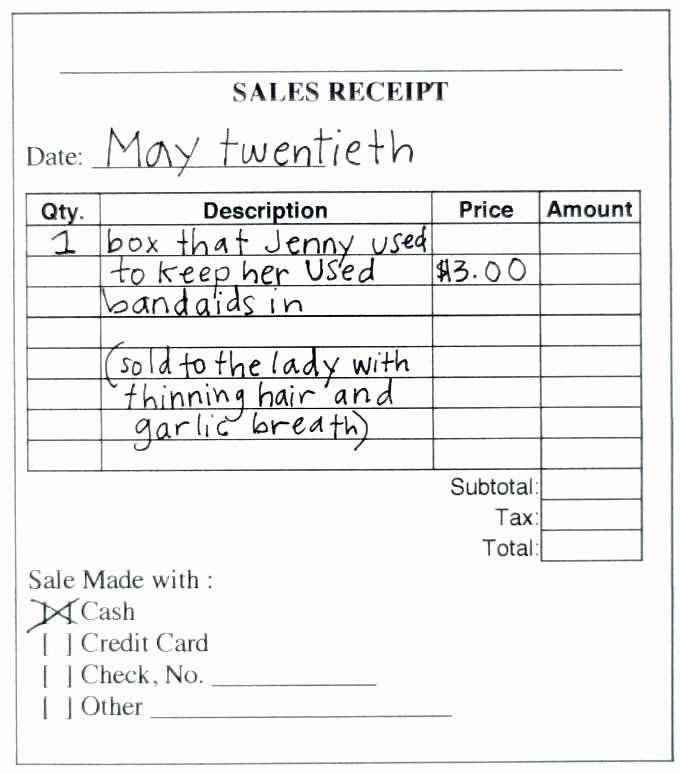

List the items purchased or services rendered. For each item, specify the description, quantity, unit price, and total price. This section should be simple and easy to read, helping both you and the customer keep track of the transaction.

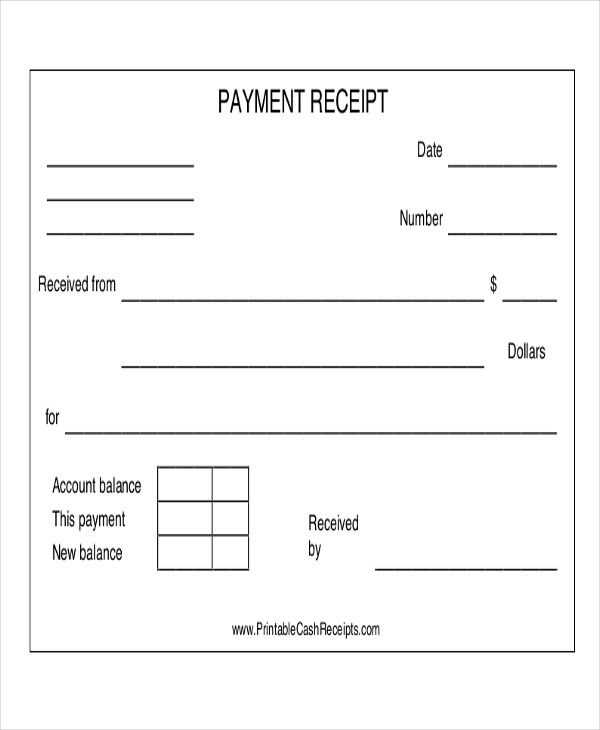

Don’t forget the payment details. Specify the payment method used, whether it was cash, credit card, or another form. If applicable, include any taxes, discounts, or additional fees that apply to the purchase.

Lastly, include a thank you note or reminder of your return policy at the bottom. A polite closing can encourage customer loyalty and make the transaction feel more personal.

Here’s the corrected version:

To create a clear and functional receipt template, focus on these key components:

- Header: Include the business name, logo, and contact information at the top for quick reference.

- Date and Time: Clearly state the date and time of the transaction for record-keeping purposes.

- Transaction Details: List the items purchased, along with quantities, prices, and any applicable taxes.

- Total: Display the total amount clearly at the bottom, including any discounts, taxes, and fees.

- Payment Method: Indicate how the transaction was paid (e.g., credit card, cash, etc.).

- Footer: Provide any necessary disclaimers, return policies, or additional information about the transaction.

Make sure all sections are aligned for easy reading and that the font is legible. Use simple and consistent formatting to avoid confusion.

If your business offers frequent promotions or discounts, consider adding a section for special offers or loyalty points, ensuring these details are always clearly visible.

- How to Write a Receipt Template

Begin with a clear header that states the document is a receipt. This can simply be labeled as “Receipt” or “Sales Receipt”.

Include the date of the transaction. This gives the receipt a specific timestamp for future reference.

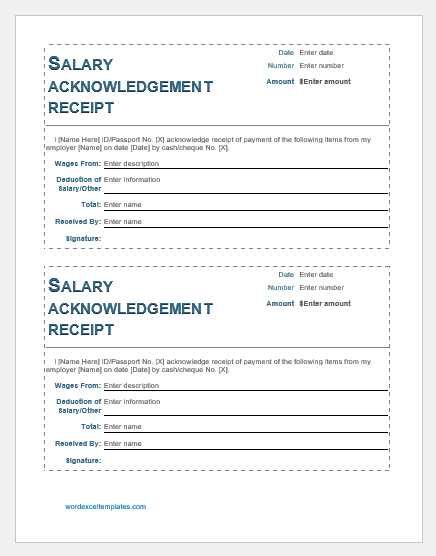

Identify the business or individual issuing the receipt. Include the name, address, and contact information such as phone number or email.

List the items or services purchased. Each item should have a description, quantity, unit price, and total cost. Be concise and ensure all figures are accurate.

Add a subtotal before taxes to show the cost of items before any adjustments. Include any applicable taxes with a brief description (e.g., “Sales Tax”).

If necessary, show any discounts or promotions that apply to the transaction. This can be written as “Discount Applied” or similar terms, with the discount amount clearly stated.

Finally, calculate and display the total amount due. This is the sum of the subtotal, tax, and any additional charges or discounts.

Include payment details such as the method of payment (credit card, cash, etc.), and if applicable, the transaction or authorization number. For credit card payments, consider adding the last four digits of the card number.

End with a thank-you note or a brief message of appreciation for the business. This adds a personal touch without being overly formal.

For a clean and professional receipt, prioritize clarity and simplicity. Select a format that accommodates all necessary details without overwhelming the customer. Focus on these key elements:

| Element | Recommendation |

|---|---|

| Header | Include your business name, address, and contact information. This ensures the receipt is easily traceable back to your company. |

| Date & Time | Display the transaction date and time for record-keeping and reference purposes. |

| Transaction Details | List each item or service purchased, along with prices, quantities, and any discounts. Use a table format for easy reading. |

| Total | Make sure the final amount is clearly visible, with a breakdown of taxes, tips, or additional fees if applicable. |

| Payment Method | State the payment method used, such as cash, credit card, or digital payments. This is helpful for both parties in case of discrepancies. |

Consider digital or printed options based on your business’s needs. A digital receipt allows for easy storage, while a printed one provides a tangible record for the customer. Both formats should maintain readability and structure.

Include the date of the transaction. This serves as a record for both the buyer and the seller, and it helps in tracking purchases or services provided.

Ensure the seller’s contact information is clearly visible. This includes the business name, address, and phone number. It makes it easier for customers to reach out if there’s an issue or inquiry after the purchase.

List the purchased items or services with their quantities and prices. Providing a clear breakdown avoids confusion and ensures transparency in the transaction.

Specify the total amount paid, including any taxes or additional charges. This should be highlighted to prevent misunderstandings regarding the final cost.

State the payment method used, such as cash, credit card, or online payment. This confirms how the transaction was completed and helps in resolving any disputes if needed.

Include a unique receipt or transaction number for tracking purposes. This number allows for easy reference in case of returns, exchanges, or warranty claims.

For returns or exchanges, include the store’s return policy. Make sure customers know how to proceed with returns and any time constraints involved.

Ensure the layout is clean and easy to read. Use a clear, legible font, such as Arial or Helvetica, in a reasonable size (10-12pt) to make the content accessible. Avoid overly decorative fonts that can distract from the information.

Organize information logically. Place the company name, address, and contact details at the top, followed by the transaction details. Align dates, amounts, and other figures neatly, with sufficient space between sections to prevent clutter.

Use a grid layout to structure the receipt, with clear divisions between sections. For example, position item descriptions and prices in columns to maintain balance. Ensure these columns have adequate width for clarity.

Incorporate a consistent color scheme. Use subtle contrasts to highlight key information like totals and dates, without overpowering the overall design. Stick to two or three complementary colors for a professional look.

Make use of borders or lines to separate different sections. For example, a line beneath the item list helps differentiate it from the total and payment sections, making the receipt easier to navigate.

Keep the design minimalist. Avoid unnecessary elements, such as excessive logos or images, which can distract from the primary purpose of the receipt.

Tailor your receipt template based on the transaction type. For cash payments, include a section for cash tendered and change given. This helps both parties track the financial exchange clearly.

For Product Sales

For product transactions, list the items, quantities, unit prices, and total price. If applicable, provide a breakdown of taxes and discounts. This ensures customers can verify their purchases and understand the final cost.

For Services

When selling services, specify the service provided, the rate, and the duration. If the service is billed by the hour, make sure to show the hourly rate and total hours worked. Adding a field for tips or gratuities can also be useful in these cases.

For online transactions, make sure to add transaction IDs, shipping information, and delivery date estimations to help customers track their purchases. You can also include a return policy or customer support contact if relevant.

Ensure each template variation is easy to update, especially for tax rates or pricing changes, so you can quickly adapt to different transaction types without needing to redesign the whole template.

Utilizing software tools to automate receipt generation simplifies the process and increases accuracy. These tools often provide customizable templates that can be tailored to specific needs.

- Choose an appropriate software: Look for software that offers receipt templates with the option for customization. Some popular tools include Microsoft Excel, Google Sheets, and specialized receipt generator apps.

- Set up automated fields: Automate common fields such as date, total amount, customer name, and item descriptions. This minimizes the risk of manual errors and saves time.

- Link to a database: For businesses with frequent transactions, link your receipt generator to a database. This enables automatic population of data such as customer details and purchased items directly into the template.

- Integrate with accounting software: Many receipt generators can be linked to accounting software like QuickBooks or FreshBooks. This integration allows for seamless record-keeping and financial tracking.

By adopting automated tools, you can streamline receipt generation, reduce administrative workload, and enhance operational efficiency.

Ensure that your receipt template includes all legally required information. This typically includes the business name, address, and tax identification number. Depending on your location, the receipt must also clearly state the transaction date, total amount paid, and applicable tax details. Keep in mind that certain jurisdictions may require specific formats or additional fields on receipts. For example, some regions mandate the inclusion of a VAT number for businesses that charge VAT.

Maintain Transparency with Clear Descriptions

Provide clear descriptions of the products or services purchased. This helps prevent misunderstandings and ensures the receipt meets local legal standards. If your business is subject to specific regulations, such as health or safety compliance, make sure the receipt reflects relevant details about the transaction, such as product certifications or warranties.

Stay Updated with Local Regulations

Review local laws regularly to ensure your receipt template aligns with any updates. Failing to comply with changing laws can lead to penalties. Depending on your region, businesses may need to follow specific rules for electronic receipts or provide customers with certain rights related to returns and refunds. Keep your receipt format flexible to adapt to these changes quickly.

Ensure the receipt template starts with clear identification details. Include the name of your business, address, contact information, and any other identifying features like logos or business registration numbers.

List the products or services provided in a structured way. Use columns for description, quantity, unit price, and total. This allows customers to easily verify the charges. For clarity, break down any taxes or discounts applied to the final total.

Include the payment method used. Whether the customer paid with cash, credit card, or another method, specifying this enhances the transparency of the transaction.

Indicate the receipt’s date and a unique receipt number. This will help both you and your customer track the transaction. Ensure the format is consistent for easy reference.

Conclude with a thank-you note or reminder, reinforcing a positive interaction. A brief message showing appreciation or offering customer support can build rapport for future business.