If you are renting out property, providing a rent receipt in pounds helps both you and your tenants maintain clear financial records. A well-structured rent receipt can avoid misunderstandings and serve as a formal acknowledgment of payment. It’s crucial to include specific details that make the receipt legally sound and easy to track.

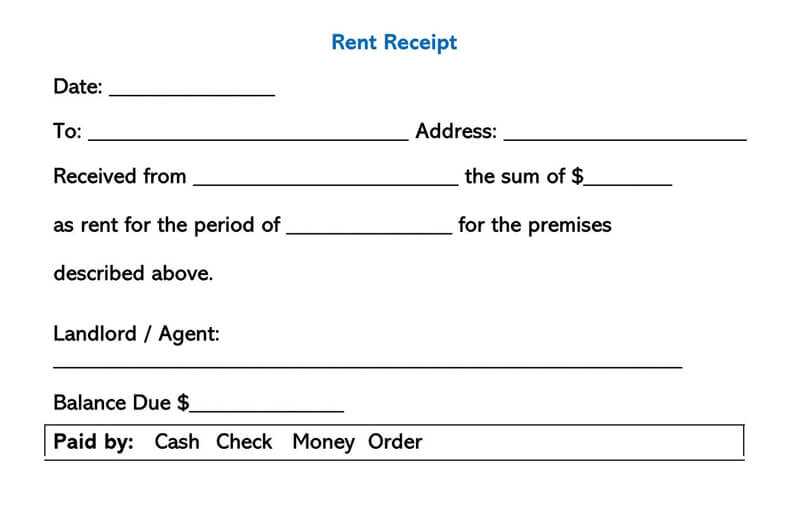

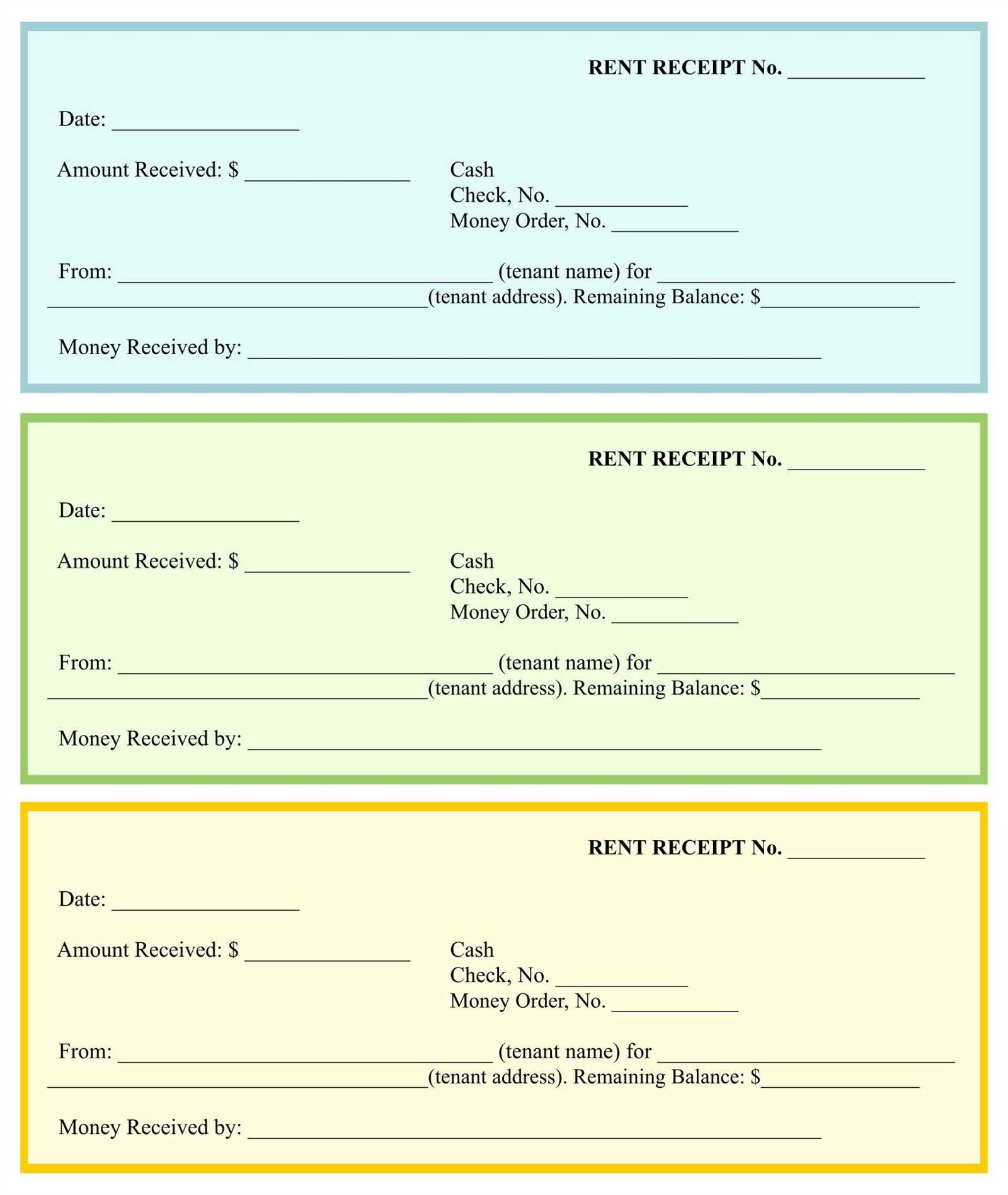

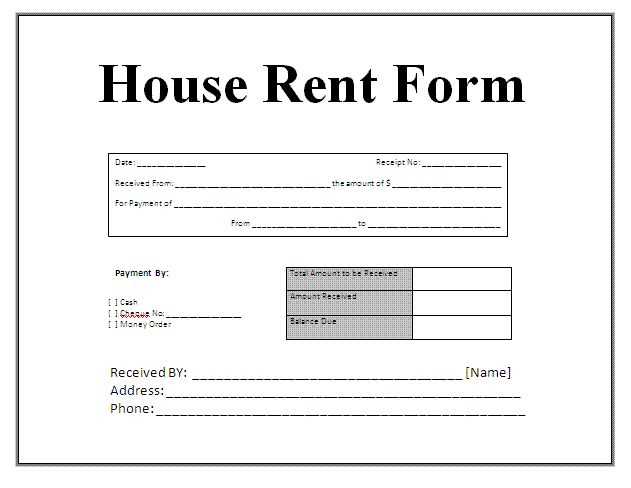

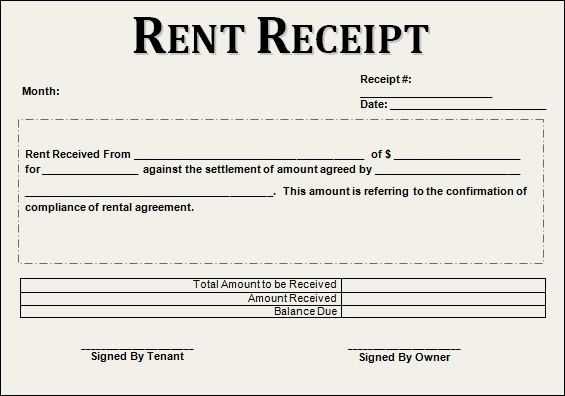

The key components of a rent receipt template include the tenant’s name, rental period, amount paid, property address, payment method, and the landlord’s contact details. These elements help ensure that all parties have a clear record of the transaction. Be sure to include the date of payment and a unique receipt number for better reference.

For landlords dealing with payments in pounds, it’s important to specify the currency in the receipt. This avoids any confusion, especially if you have international tenants or manage multiple properties in different locations. A simple format with all necessary details will save time and prevent any future disputes.

Here’s the corrected version without repetitions:

Use a clear and simple format for the rent receipt template to avoid confusion. Start with the tenant’s name, followed by the address of the rented property. Include the payment date and the exact amount paid. Specify the payment method, whether it’s via bank transfer, cash, or another method. Always state the rental period covered by the payment to ensure clarity for both parties.

Next, include a section for the landlord’s contact details. This helps the tenant in case of any future communication. Add a brief description of the payment, such as “Rent for [month/year]”. This keeps the records organized and straightforward. The template should conclude with a space for both the landlord and tenant signatures, confirming the transaction.

Ensure there are no repeated phrases in the template. Keep the language direct and avoid unnecessary information that might clutter the document. The goal is to make the receipt clear and useful for both parties involved.

- Rent Receipt Template in Pounds

Ensure your rent receipts are clear and professional by using a simple yet informative template. A well-designed receipt should include the landlord’s name, tenant’s name, property address, payment date, and the amount in pounds (£). Use a clean format with headings for each section, such as “Amount Paid,” “Date of Payment,” and “Receipt Number.” For added clarity, include the rental period being covered by the payment (e.g., “Rent for January 2025”).

Make it a habit to list payment methods, such as bank transfer, cheque, or cash, alongside the amount. This helps both parties keep accurate records. Ensure the total amount is clearly shown in bold or a larger font to make it stand out. If applicable, include any late fees or discounts applied to the rent payment for full transparency.

End the receipt with both the landlord’s and tenant’s signature lines for verification. While this isn’t legally required in every case, it provides extra assurance for both parties.

To create a rent receipt in pounds, include the following key details: the tenant’s name, the landlord’s name, the rental amount, the payment date, and the rental period. Ensure each element is clear and accurate for legal clarity.

Key Information to Include

Start by listing the tenant’s full name and address, followed by the landlord’s contact information. Clearly state the rent amount paid in pounds, and be specific about whether it’s a weekly, monthly, or other rental payment. Include the payment date to confirm when the transaction occurred. Specify the rental period covered by this payment–whether it’s the full month or another time frame.

Formatting the Receipt

Write the amount in both words and numbers for clarity. For example, “£500 (Five Hundred Pounds)” helps avoid any confusion. Add a unique receipt number to make it easy to reference the transaction later. Lastly, include a signature field for both parties to confirm the payment was received and processed.

By following these steps, you’ll create a clear and straightforward rent receipt that serves as proof of payment and helps maintain a transparent relationship with your tenant.

Provide a clear description of the payment. List the amount received, including any applicable rent or fees. Specify the payment method (cash, check, bank transfer, etc.). Make sure the payment date is noted for reference.

Tenant and Landlord Details

Include the full name of both the tenant and the landlord. This helps avoid confusion if there are multiple rental agreements or tenants involved. You should also add the rental property address for clarity.

Period Covered by the Payment

Clearly state the period the payment covers (e.g., January 2025). This helps in confirming the exact dates for which the rent was paid.

Lastly, ensure you include a unique receipt number for each transaction to track payments and resolve any potential disputes.

Ensure the payment amount is accurate. Double-check the rent payment and any additional fees or deposits. Mistakes here can lead to confusion or disputes later. Always match the amount on the receipt with the payment actually made.

Clearly state the payment method. Whether it’s cash, bank transfer, or another form, be specific. This helps both the tenant and landlord maintain clear financial records.

Include the correct date of the payment. Mistakes with dates can lead to issues with rental periods or late payment fees. Always verify the transaction date before issuing the receipt.

Don’t forget to list the rental period covered. The receipt should specify the exact dates for which the rent payment applies, avoiding ambiguity and ensuring clarity for both parties.

Be mindful of your contact details. Inaccurate or missing information about the landlord or property manager can make it difficult for the tenant to reach out if they need clarification or have issues with the payment.

Avoid using vague descriptions. A general statement like “Rent paid” doesn’t provide enough context. Instead, describe the payment in detail, including what it covers–rent, utilities, or other fees–to ensure full transparency.

Choose a rent receipt format that is clear, professional, and easy to understand. Avoid clutter and ensure all key details are easy to locate. Here’s what to include:

- Landlord and Tenant Details: Clearly state both parties’ names and addresses. This identifies who is involved in the rental agreement.

- Date of Payment: Indicate the exact date the rent payment was received. This prevents confusion over the payment period.

- Amount Paid: Include the exact sum paid in pounds (£), breaking it down if necessary (e.g., rent plus late fees).

- Payment Method: Specify whether the payment was made by bank transfer, cheque, cash, etc. This helps track transactions.

- Rental Period: Clearly mention the start and end dates of the rent period covered by the payment.

- Signature: Both parties should sign the receipt to confirm that the transaction is accurate and complete.

If you’re creating the receipt digitally, consider using a template that automatically populates these fields to save time. If it’s printed, ensure the design looks professional and readable, using a clean font and sufficient spacing.

Landlords are not legally required to issue rent receipts unless the tenant requests one. However, it’s a good practice to provide receipts for every payment made. The receipt should include the amount paid, the date of payment, the rental period it covers, and both the landlord’s and tenant’s details. For landlords who do not provide receipts, tenants can ask for one as proof of payment.

If the rent is paid in cash, it’s particularly important for the landlord to issue a receipt. This provides both parties with a clear record of the transaction and can prevent disputes. Rent receipts should also specify the property address and any reference number related to the payment, especially for tenants with multiple rental properties.

For tenants receiving housing benefit, landlords must provide a rent receipt upon request, showing the amount received from the local authority. In cases where rent is paid by cheque or bank transfer, the bank statement often serves as sufficient proof of payment, but providing a formal receipt is still recommended for clarity and record-keeping.

Customize your rent receipt template by adjusting it to reflect the payment method used. For cash payments, include a note indicating that the amount was paid in cash and specify the exact date of receipt. For bank transfers or checks, add transaction details like the bank name or check number. This ensures both parties can verify the transaction accurately. If the payment was made through an online platform, include the platform’s name and transaction ID for future reference.

To accommodate different payment methods, structure the receipt to capture relevant details clearly. Below is an example of how to format your rent receipt for various payment methods:

| Payment Method | Details to Include |

|---|---|

| Cash | Amount paid, date of payment, and signed by both landlord and tenant (if necessary). |

| Bank Transfer | Bank name, transfer reference number, date of payment, and amount paid. |

| Cheque | Cheque number, bank name, date of payment, and amount. |

| Online Payment Platform (e.g., PayPal, Venmo) | Transaction ID, platform name, date of payment, and amount. |

By tailoring your receipt template to match the payment method, you provide clarity and transparency for both the tenant and landlord, reducing any chances of disputes later on.

Rent Receipt Template: Key Elements to Include

To create a clear and professional rent receipt template, ensure the following components are present:

- Tenant Information: Include the tenant’s name and address to avoid confusion. This ensures both parties are clear on who made the payment.

- Landlord Information: Provide the landlord’s name, address, and contact details for reference.

- Payment Details: State the exact amount received, payment method (e.g., cash, cheque, bank transfer), and the date it was made.

- Rental Period: Clearly specify the period the payment covers, such as monthly rent from January 1 to January 31.

- Receipt Number: Use a unique number to identify the receipt for record-keeping.

- Signature: Both landlord and tenant signatures are helpful for confirming the transaction.

Additional Information to Include

- Late Fees: If applicable, mention any penalties or late fees charged.

- Security Deposit: Note any deductions from the deposit or that it was returned in full.

- Remarks: Add any special agreements, like prepayment or rent reductions.

With these elements, the rent receipt becomes a helpful tool for both landlords and tenants to keep a record of transactions.