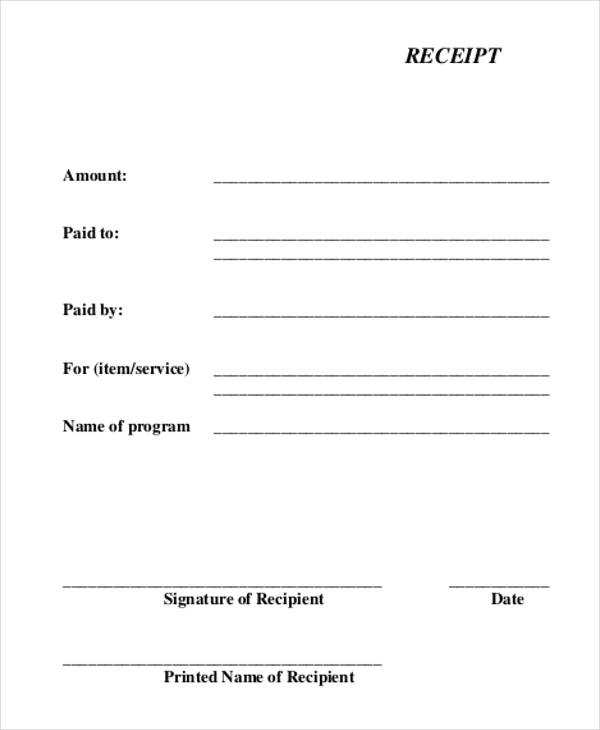

To create a reliable bond receipt, start by clearly stating the date of transaction. This detail ensures both parties have a consistent record of the exchange. Include the amount of the bond, specified in both the numerical value and written form to prevent any misinterpretation. Make sure to identify the bond issuer and the recipient’s full name for accurate tracking and future reference.

Next, list the terms of the bond, such as maturity date, interest rate, and any specific conditions attached to the bond. This helps both parties understand the agreement’s scope and expectations. Be sure to include a section for signatures of both parties to confirm mutual agreement. The signature line must be followed by the date of signing to establish a clear timeline.

Lastly, ensure that the receipt includes a reference number or unique identifier for easy record-keeping. This will make tracking and verifying the bond transaction seamless. A well-structured bond receipt avoids confusion and can serve as a vital document in future legal or financial situations.

Here is the corrected version:

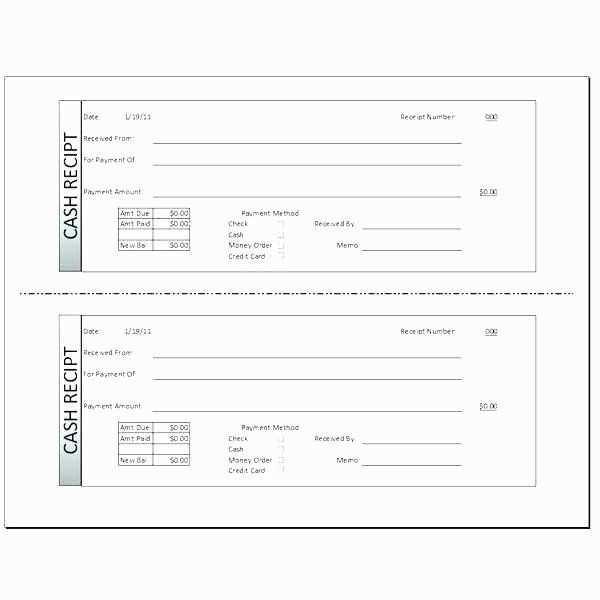

Ensure that the bond certificate includes the exact details of the issuing party, including their full legal name and address. The bond amount, interest rate, and maturity date must be clearly stated. If applicable, include any payment schedules for interest. The terms of redemption should be defined, specifying the conditions under which the bond can be repurchased before maturity. Double-check that the bondholder’s rights are outlined, particularly regarding transferability and claims in case of default. Be sure to use clear and precise language, avoiding ambiguity in legal terminology.

Make sure to format the bond’s serial number consistently throughout the document. Confirm that both the bondholder and the issuer sign the document in the designated areas. For legal compliance, the bond should be notarized if required by jurisdiction. Finally, ensure that the document is free of errors to avoid future disputes.

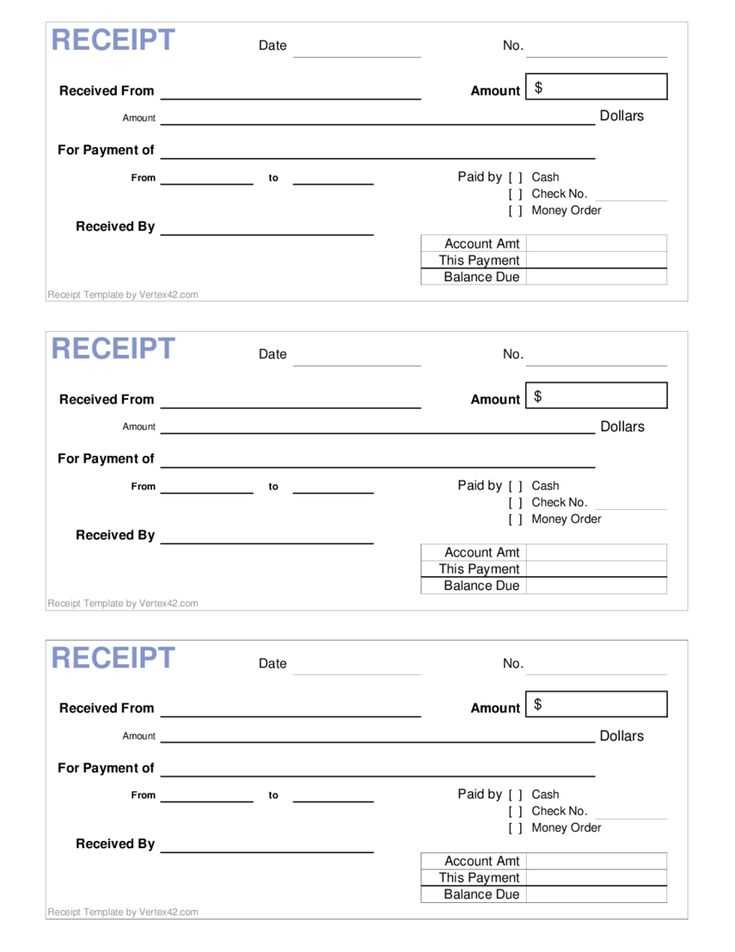

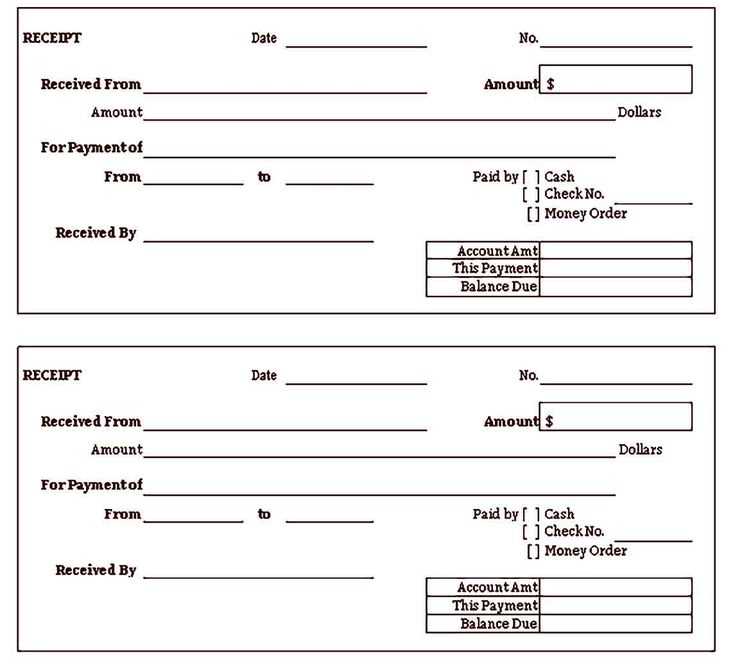

Receipt of Bonds Template

How to Draft a Legal Bond Acknowledgment

Key Information to Include in a Bond Acknowledgment

Formatting a Bond Acknowledgment for Legal Compliance

Verifying the Validity of Bond Documents

Common Mistakes to Avoid in Bond Creation

Adjusting the Bond Acknowledgment for Different Jurisdictions

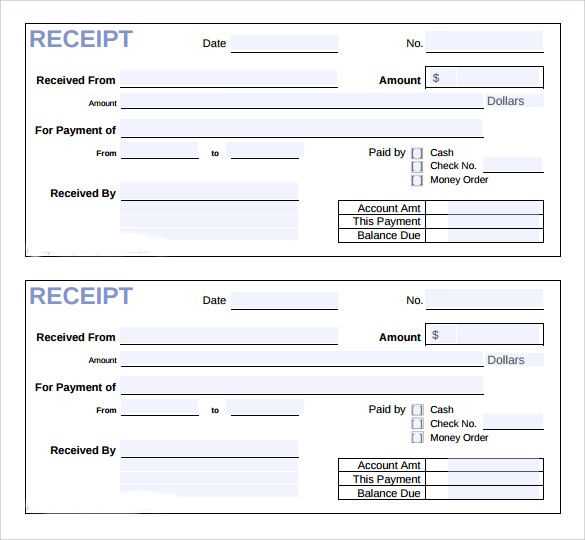

Start by clearly identifying the parties involved in the bond agreement. Include the full legal names of the obligor (the party owing the debt), the obligee (the party receiving the benefit), and any third-party sureties, if applicable. Ensure these names match the legal documents and are free from abbreviations.

The bond amount should be clearly specified in both numeric and written form. This helps eliminate confusion or disputes regarding the exact value of the bond. Double-check the figure for accuracy to avoid any legal complications.

Include a section that outlines the terms of the bond, including the bond’s duration, payment schedule, and conditions for release or forfeiture. These terms must align with the governing laws to prevent future legal challenges. Be specific about any conditions under which the bond can be called upon.

To maintain legal compliance, make sure that the bond acknowledgment includes a signature section. This should include the signature of all parties involved and be witnessed, if necessary. The notary or witnessing agent must include their credentials, date, and place of signing.

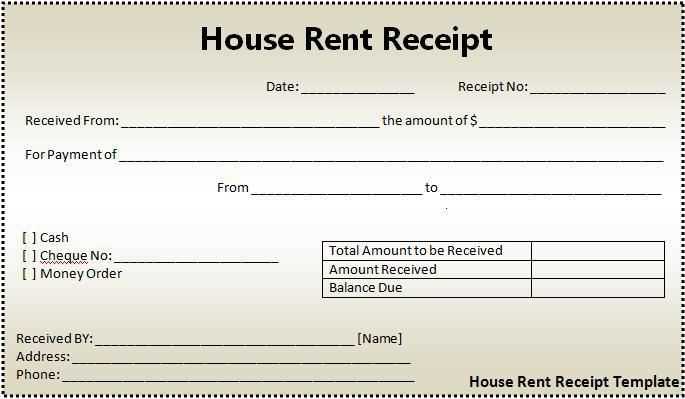

Verify the validity of all bond-related documents before finalizing the acknowledgment. This includes ensuring that the bond issuer is authorized to issue bonds, the bond is properly executed, and the terms are consistent with the applicable regulations. Cross-check the bond against local or national bond-issuing regulations to ensure compliance.

Avoid common mistakes such as using unclear language or leaving out important details like the bond’s expiration date, renewal clauses, or conditions for enforcement. Omitting such critical information can lead to disputes or render the bond unenforceable.

In jurisdictions with specific bond laws, adapt the acknowledgment format to meet local requirements. Some jurisdictions may require additional signatures, notarial procedures, or specific language. Always consult with a local attorney to confirm your bond acknowledgment aligns with local regulations.