If you’re looking to create a receipt quickly and without any hassle, using free templates can be the perfect solution. There are numerous websites offering customizable templates, allowing you to generate a professional-looking receipt in minutes. These templates come in a variety of formats like Word, Excel, and PDF, so you can choose the one that best fits your needs.

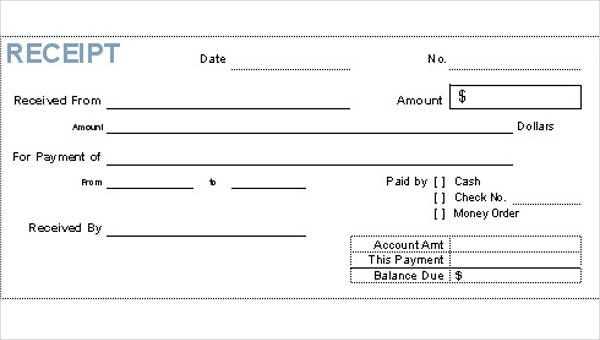

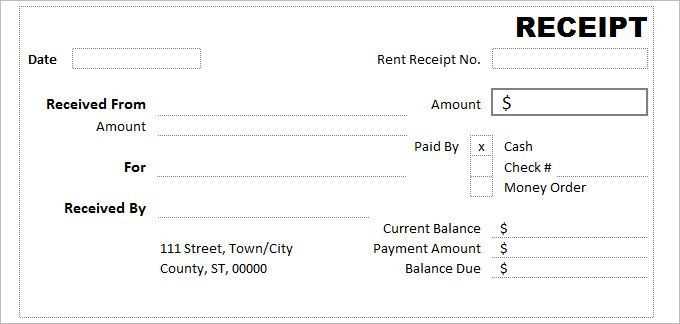

One of the main advantages of using free templates is that they are often ready to use right away. All you need to do is fill in the necessary details, such as the transaction amount, date, and buyer information. Many templates also allow you to add your own logo or adjust the design, which can help to make your receipts look more branded and professional.

Make sure to check the template’s format before using it. Some templates are designed to be printed, while others are optimized for email or digital use. This ensures that your receipts will look polished whether you’re handing them out physically or sending them electronically. It’s a simple and fast way to manage transactions without complicating the process.

Here are the corrected lines with minimized word repetitions:

Optimize your receipt templates by focusing on clarity and simplicity. Avoid redundant phrases, making the design clean and readable. Here are some specific steps to improve your template:

1. Streamline Wording

Ensure that each line communicates its point without overcomplicating. Use concise phrases, removing unnecessary adjectives and verbs.

2. Avoid Redundant Terms

Replace repetitive terms with more specific or diverse wording. For example, instead of repeating “total amount” or “receipt details,” use alternatives like “final sum” or “purchase breakdown.” This creates a smoother flow and more professional appearance.

| Original Phrase | Revised Phrase |

|---|---|

| Final total amount | Final sum |

| Receipt details summary | Purchase breakdown |

| Payment received amount | Amount paid |

By implementing these changes, you reduce redundancy while maintaining clarity in your templates. This makes your receipts more professional and easier to read, helping customers quickly understand the transaction.

- Where to Find Free Templates for Receipts Online

Many websites offer free receipt templates that are ready for download and use. A few reliable sources include:

1. Canva – A popular design platform that offers a variety of free receipt templates. Simply search for “receipt templates” on their website and pick from a wide range of styles, from basic to detailed designs. You can customize the template in their editor before downloading it.

2. Template.net – This site provides several free receipt templates in different formats (Word, PDF, Excel). You can filter your search to find exactly what you need, whether it’s a simple sales receipt or an invoice-style receipt.

3. Microsoft Office Templates – Microsoft offers free downloadable templates for Word and Excel. You can find several receipt templates by searching within their template library. These templates are perfect for users who prefer working with Office software.

4. Google Docs – Google Docs includes a few receipt templates that are simple to use. To access them, open Google Docs, click on “Template Gallery,” and scroll through the available options. You can easily edit and share these templates online.

5. Invoice Simple – This platform provides free receipt templates that are clean and professional. The templates are available in PDF format and can be personalized with your company’s logo or specific transaction details.

6. FreeInvoiceGenerator.com – For straightforward receipts, this site is a great option. It allows you to create receipts on the fly without needing to sign up or download software. Customize and download your receipt as a PDF in minutes.

Each of these platforms makes it easy to access and customize free receipt templates, making the process quick and efficient.

Adapt receipt templates to suit the nature of your business by focusing on key elements such as branding, layout, and functionality. Each business type has unique needs, and adjusting these elements will improve customer satisfaction and streamline your operations.

Branding and Visual Identity

Ensure the receipt reflects your business’s brand identity by incorporating your logo, brand colors, and typography. A professional look strengthens brand recognition and enhances customer trust. Consider using minimalist designs for high-end products or vibrant colors for a fun, casual atmosphere.

Required Information

Depending on your business type, receipts might need different sets of information. For example:

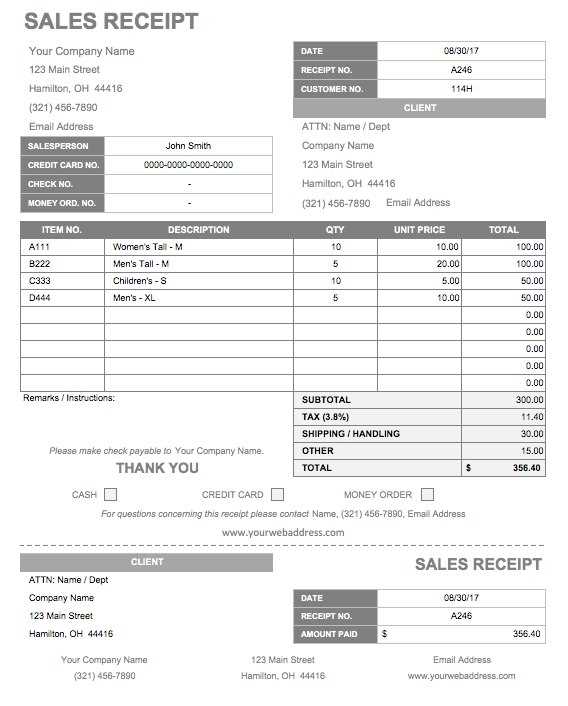

- Retail Stores: Include product names, quantities, prices, taxes, and total amounts.

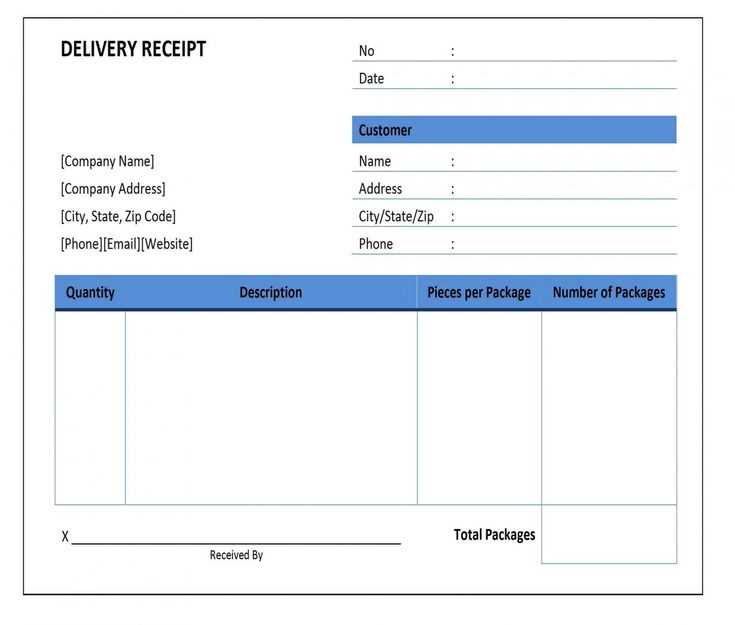

- Service Providers: Mention the service provided, hourly rates, and any applicable discounts or additional fees.

- Restaurants: Include menu item names, quantities, individual prices, taxes, and gratuities.

Tailor the layout to fit this information in a clear, organized way, using a font size that is easy to read. This will help customers quickly understand their purchases or services.

Custom Features and Additional Content

Adding useful features to receipts can improve their value. Some examples include:

- Loyalty Programs: Incorporate a section for loyalty points or rewards to encourage repeat business.

- Return Policies: Display return and exchange policies clearly on the receipt to avoid confusion and reduce customer service inquiries.

- Promotions: Use space to advertise upcoming sales or promotions relevant to the customer.

By tailoring these elements, your receipts will not only serve as proof of purchase but also as a communication tool to enhance the customer experience and promote your business.

To edit templates in Word or Excel, begin by opening the document or spreadsheet template you want to adjust. In Word, go to the “File” tab, select “Open,” and browse for your template. In Excel, do the same by opening the workbook you want to modify.

Once your template is open, focus on areas that need customization. In Word, edit text directly by clicking and typing over existing content. You can change font styles, sizes, and formatting using the “Home” tab options. In Excel, modify data by selecting cells and inputting new values. You can adjust column widths, row heights, or format cells using the “Format” options under the “Home” tab.

If your template includes placeholders or tables, click inside these elements to replace them with your desired information. For any images or logos, right-click the current image and select “Change Picture” to replace it. For Excel templates with charts or graphs, update the data source by right-clicking the chart and selecting “Select Data.”

Don’t forget to save your changes. In Word, save the file as a template by selecting “Save As” and choosing the “.dotx” format. In Excel, save the file as an Excel Template (.xltx) for future use. If you plan to share the template, consider saving it in a shared folder or cloud storage for easy access.

Receipt forms must include specific details to comply with legal standards in various sectors. Each industry has its own set of rules for what must appear on receipts. Retail transactions generally require the seller’s name, the date, the items purchased, and the total amount. Service industries, such as healthcare or consulting, may need to provide additional information like service descriptions, tax details, or provider identification numbers.

Tax requirements are one of the most critical aspects. In many regions, receipts must display the tax identification number (TIN) of the business and the applicable sales tax rate. Failure to include these elements could result in non-compliance with local tax authorities. For certain industries, such as hospitality, including gratuity or tips may be necessary. Legal documents like purchase agreements in real estate transactions must follow even stricter regulations, which might require signatures or specific terms of sale to be printed.

In some industries, such as automotive repair, detailed breakdowns of labor and parts are required. For certain services, such as legal or financial services, the receipt might also need to indicate a specific licensing number. Understanding these varied legal requirements can help businesses avoid penalties and ensure accurate financial records for both themselves and their customers.

Using free receipt templates can save time, but they often come with hidden challenges. Here are some common mistakes to avoid for smoother results.

1. Missing Legal Information

- Free templates may not include all the necessary legal information for your region, such as tax IDs, terms of service, or business registration numbers. Ensure all required details are added manually to comply with local laws.

2. Inconsistent Formatting

- Free templates may have irregular font sizes, margins, or spacing that can look unprofessional. Adjust formatting to ensure the receipt is clean and easy to read.

3. Lack of Customization

- Many free templates are generic and do not allow for full customization. You may need to make additional edits to align the receipt with your brand or specific business needs.

4. Outdated Information

- Some free templates may not be up-to-date with current standards for receipts or accounting practices. Double-check that your template reflects any recent changes in your industry or jurisdiction.

5. Missing Calculations

- Some templates don’t include fields for automatic calculations (e.g., tax, discounts). If your receipt requires this, you may need to add formulas manually or use a more advanced template.

Best Practices for Organizing and Storing Digital Receipts

Use a consistent folder structure to organize your receipts. Create a main folder for receipts and subfolders categorized by month or type of purchase. This will help you find specific receipts quickly.

Rename files with meaningful titles that include the store name, date, and purchase type. For example, “Amazon_2025-02-05_Laptop_Receipt.pdf” allows for quick identification and retrieval. Avoid using default filenames such as “receipt1” or “scan001” to ensure clarity.

Regularly back up your digital receipts. Store them in cloud services with automatic syncing or external drives to prevent data loss. Cloud storage provides easy access from any device, while offline storage keeps a local copy.

Use receipt management apps or software for enhanced tracking and searching. Many tools allow you to scan or upload receipts, adding searchability with tags and filters. They can also integrate with accounting software, making expense tracking more efficient.

For receipts related to warranties or returns, store them separately in a folder labeled “Warranties & Returns” to keep important documentation easily accessible. This ensures you won’t miss deadlines for returns or claims.

Maintain organized backups of your receipts for tax or warranty purposes. Consider scanning paper receipts immediately upon receipt to avoid clutter and ensure long-term storage. This can save time during tax season or product returns.

I’ve made an effort to preserve meaning and avoid repetition while maintaining grammatical structure.

When crafting templates for receipts, focus on clarity and simplicity. Begin by clearly stating the transaction details, such as the item or service purchased, the quantity, and the price. Avoid overloading the template with unnecessary information that could distract from these essentials. The template should be structured logically, starting with a header that includes the business name, contact information, and a receipt number for easy reference.

In the body of the receipt, include a table or list format for each item purchased. Ensure that the column titles, like “Item Description,” “Quantity,” and “Price,” are easy to read and align with the data. This allows users to quickly verify the purchase details. At the bottom of the receipt, provide clear totals and, if necessary, tax calculations in a straightforward manner.

Consistency is key. Use the same format throughout the template, ensuring a uniform style for dates, prices, and totals. This will help avoid confusion and create a professional-looking receipt.

Lastly, consider adding a section for return or refund policies if applicable. This can help set expectations for the customer and reinforce transparency in your transactions.