A well-organized sales receipt helps create a clear and professional record of furniture transactions. Use a template that includes all necessary details like the buyer’s information, description of the items purchased, the total cost, and the payment method. This ensures both parties have a reference for the transaction and can resolve any potential issues quickly.

Include Itemized Details: Be specific about each piece of furniture sold. List the product name, quantity, unit price, and total cost. This gives the buyer clarity on what they are paying for and helps avoid misunderstandings later on.

Make Payment Information Clear: Note the payment method used (e.g., cash, credit card, or financing). Include any payment terms if applicable, such as deposits or installment plans. This transparency protects both the seller and the buyer in case of disputes.

Consider Adding Return or Warranty Policy: It’s a good idea to provide a brief summary of your return policy or any warranty information on the receipt. This reassures customers and sets clear expectations regarding product returns or exchanges.

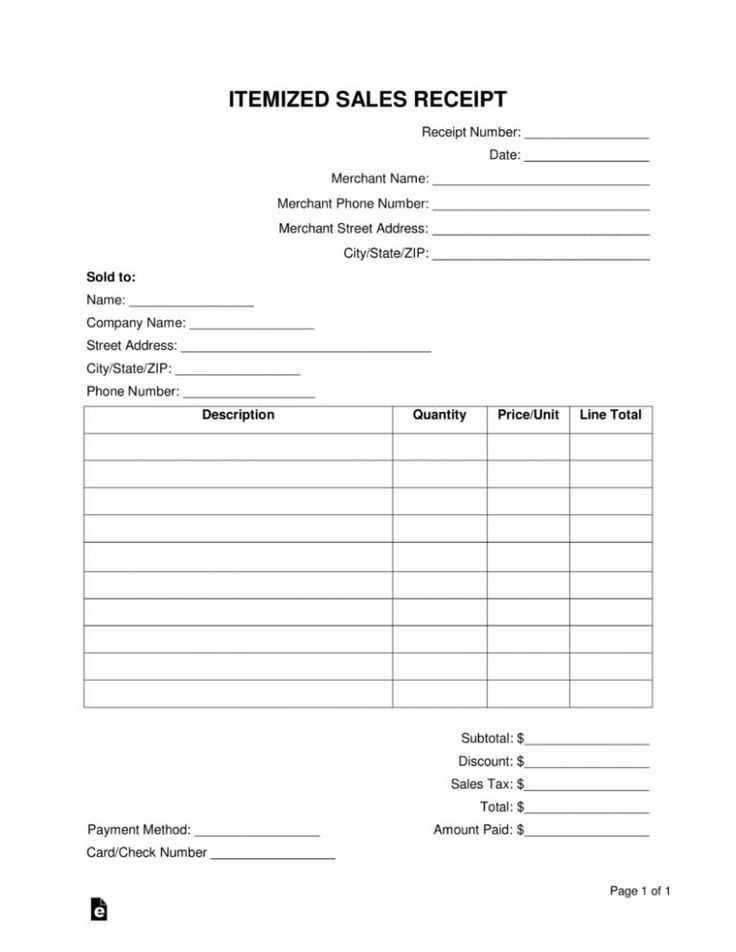

Furniture Sales Receipt Template

To create a professional furniture sales receipt, ensure the document is clear and detailed. Include the following key elements:

- Store Information: Display the name, address, phone number, and email of the business for easy contact.

- Customer Information: Record the buyer’s full name and contact details to ensure proper communication.

- Date of Purchase: Include the exact date of the transaction to provide a clear record.

- Itemized List of Purchased Furniture: Break down each item bought, including quantity, description, and unit price.

- Subtotal: Add the cost of all items before tax.

- Sales Tax: Clearly calculate and display the applicable sales tax.

- Total Amount: Sum the subtotal and sales tax to show the total payment amount.

- Payment Method: Note how the payment was made, whether via cash, card, or financing.

- Return Policy: Briefly include the store’s return or exchange policy for clarity.

- Receipt Number: Assign a unique identifier to the receipt for tracking and record-keeping.

By including all of these elements, you create a well-organized receipt that serves both as proof of purchase and a helpful reference for the customer.

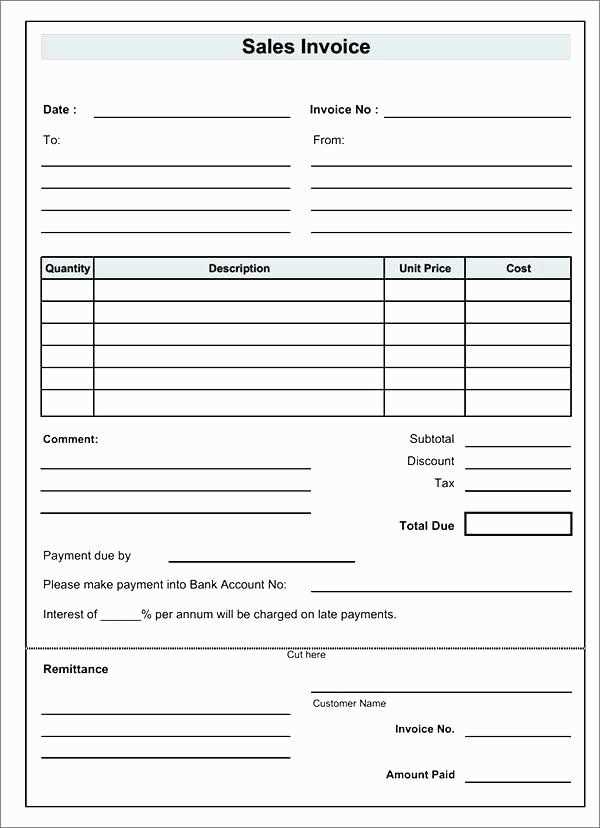

Understanding the Key Components of a Sales Receipt

Each sales receipt contains several critical elements that provide both the buyer and seller with clear information about the transaction. Below is an overview of the key components to include in any sales receipt:

1. Transaction Date and Time

The date and time of the purchase should be clearly listed. This provides an accurate record of when the transaction occurred, which is helpful for both warranty purposes and return policies.

2. Buyer and Seller Information

Include the name and contact details of both the buyer and the seller. This can range from the seller’s business name and address to the buyer’s name and, if applicable, email address or phone number. This helps in case follow-up communication is necessary.

3. Itemized List of Purchased Goods

Each item should be listed separately with its description, quantity, and price. This transparency ensures the buyer can confirm what they purchased and for what price.

4. Total Amount Due

The total amount, including taxes and discounts, should be displayed clearly. This makes it easy to verify the total cost of the transaction.

5. Payment Method

Specify the method of payment used, whether it is cash, credit card, or another form of payment. This helps both parties keep track of how the transaction was completed.

6. Return or Refund Policy

Briefly include the seller’s return or refund policy. This helps clarify the terms under which a customer can return or exchange purchased items.

7. Receipt Number or Transaction ID

Assign a unique receipt number or transaction ID for record-keeping. This helps to track and reference specific transactions in the event of disputes or customer inquiries.

8. Taxes and Additional Fees

- List the amount of tax applied to the purchase.

- Include any additional service fees or shipping charges, if applicable.

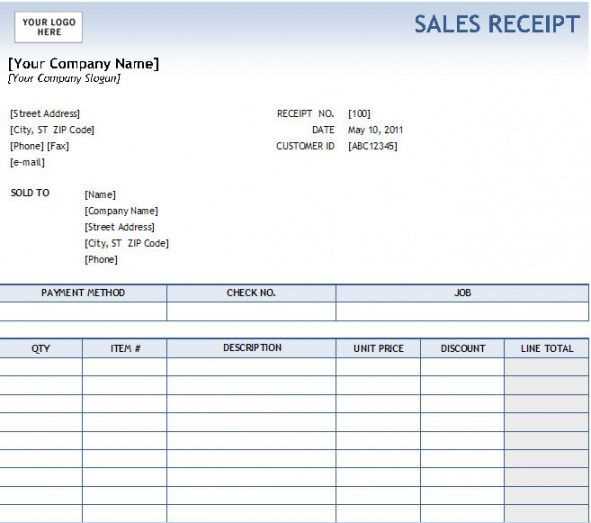

How to Design a User-Friendly Receipt Layout

Make sure the most important details are easy to spot. Position the store’s name and contact info at the top, followed by the transaction details such as the date, items purchased, and total amount due. Use a clear, readable font and avoid cluttering the space with unnecessary information.

Keep Information Well-Organized

Group related information together. For instance, list the purchased items under clear headings, followed by their prices, quantity, and totals. Include a subtotal before tax and then clearly display the tax amount and final total at the bottom. Keep a consistent structure to help the customer process the information quickly.

Incorporate Clear Branding

Incorporating your store’s branding, such as a logo and color scheme, adds a professional touch while making the receipt memorable. Ensure the branding doesn’t overpower the content–balance is key. Keep the design minimal and focus on legibility.

Provide a space for additional notes or promotions to personalize the receipt without overcrowding it. If needed, allow room for a return or exchange policy, but keep this secondary to the transaction details.

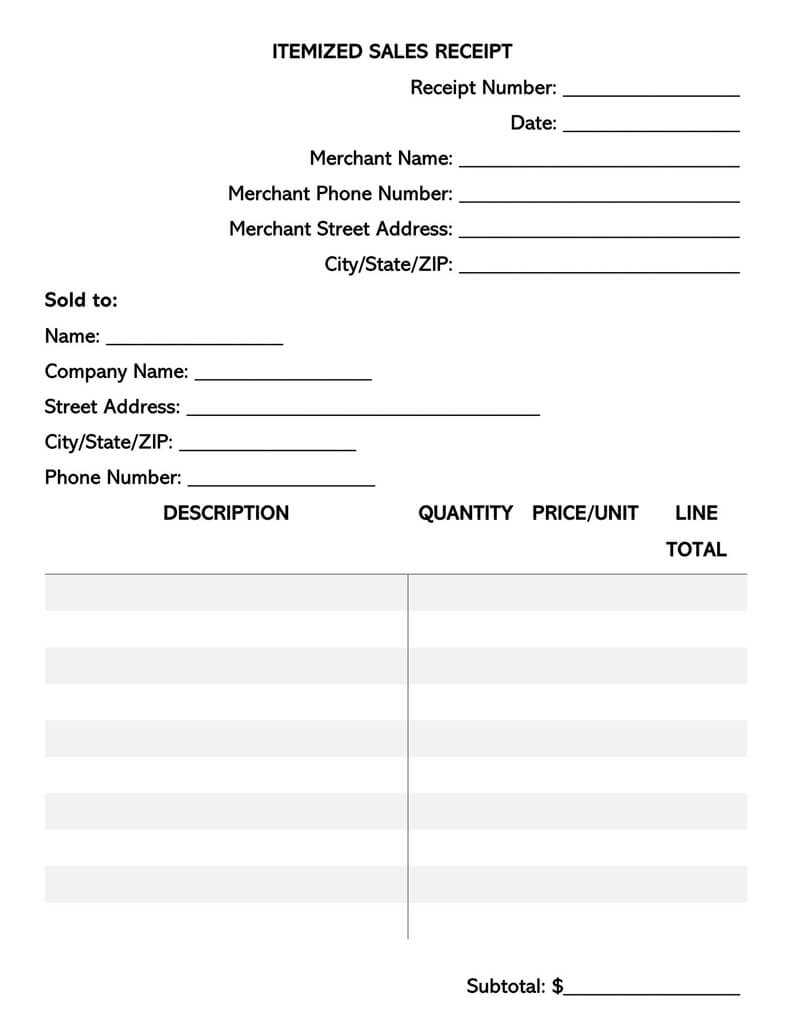

What Information Should Be Included in a Template?

A furniture sales receipt template should capture all relevant details about the transaction to ensure clarity and accuracy. The following elements must be included:

1. Seller Information

The seller’s name, business name, contact information, and address should be clearly displayed at the top. This establishes the origin of the sale and provides the customer with the necessary details for any future communication or warranty inquiries.

2. Buyer Information

Record the buyer’s full name, address, and contact details. If applicable, include a reference number for customer accounts or specific purchase orders.

3. Item Details

List each item purchased along with its description, quantity, unit price, and total cost. This section should also note any applicable discounts or special offers.

4. Transaction Summary

Include the total amount paid, including taxes and fees. Clearly separate the subtotal from the tax, and list any shipping or delivery charges, if applicable.

5. Payment Method

Specify how the buyer paid, whether through credit card, cash, check, or another method. For card payments, note the last four digits of the card number to avoid privacy concerns.

6. Date and Time

Include the exact date and time of the purchase. This can serve as a reference for returns, exchanges, or warranty claims.

7. Return/Refund Policy

Clearly outline the store’s return, refund, and exchange policy to avoid confusion later. This is essential for both the buyer’s and seller’s protection.

8. Signature Lines

Offer space for both parties to sign the receipt. This confirms the buyer’s acknowledgment of the sale and the seller’s agreement to provide the purchased items under the stated terms.

9. Invoice or Receipt Number

Assign a unique number to the receipt. This helps with future reference and organizing transactions for both bookkeeping and customer service purposes.

Best Practices for Including Terms and Conditions

Clearly outline payment terms, including methods, due dates, and any late fees. This helps customers understand their responsibilities and avoids confusion.

Specify the return and refund policies in detail. Include conditions under which items can be returned, timeframes, and if customers will bear return shipping costs.

Include Limitations and Liability Clauses

Define any limitations regarding warranties, product defects, and customer obligations. Address who is responsible in case of product malfunction or customer misuse.

Be Transparent About Data Usage

State how customer data will be used, stored, and shared, especially if it’s relevant to order fulfillment or marketing purposes. Include a link to your privacy policy if applicable.

| Term | Description |

|---|---|

| Payment Terms | Clearly define payment methods, due dates, and late fees. |

| Return/Refund Policy | Detail the process for returns, including any time limits and costs associated with returns. |

| Liability Limitations | Specify your liability regarding product defects or customer misuse. |

| Data Usage | Clarify how customer data is used and stored, with a reference to your privacy policy. |

How to Format Payment Details for Clarity

Clearly break down each payment item with labels like “Product Price,” “Tax,” and “Shipping Fee.” Use easy-to-read formatting such as bold text for each section and a clear distinction between costs. For example, display the subtotal before tax and shipping, then list the total amount due at the bottom. This helps customers quickly see how the final price is calculated.

Use consistent currency symbols and include the total amount in words if it’s a legal or formal document. Avoid clutter by keeping the payment section concise, using bullet points if necessary for each charge. If applicable, specify payment methods like credit card or PayPal under the payment section to reduce any confusion.

Align the payment details to the right to maintain a clean, organized look. Ensure that each line is easy to follow with a logical flow from top to bottom. Avoid excessive detail or extraneous information that could distract from the key numbers on the receipt.

Legal Requirements for Furniture Sales Receipts

Each furniture sales receipt must include specific details for it to be legally valid. Ensure the receipt contains the date of the transaction, the name of the business, and a unique transaction number. Itemize each product sold, listing descriptions, quantities, and individual prices.

Tax Information

Clearly show the total amount charged for sales tax. This must be listed separately from the item prices and reflect the correct tax rate based on local regulations. Failing to provide accurate tax details can lead to compliance issues.

Return and Warranty Policies

Include any return or warranty policies in the receipt. Mention the duration of the return period and whether restocking fees apply. This helps protect both the buyer and seller in case of disputes or returns.