Rent receipts with stubs are a practical solution for landlords to keep accurate records of rent payments. The stub serves as a valuable reference for tenants, ensuring both parties have a clear understanding of transaction history.

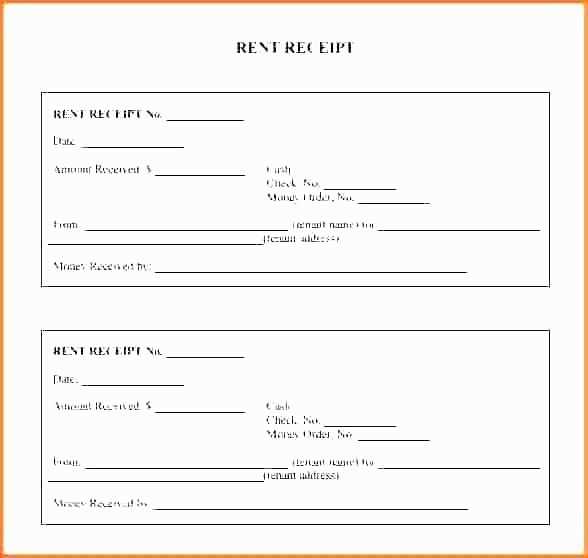

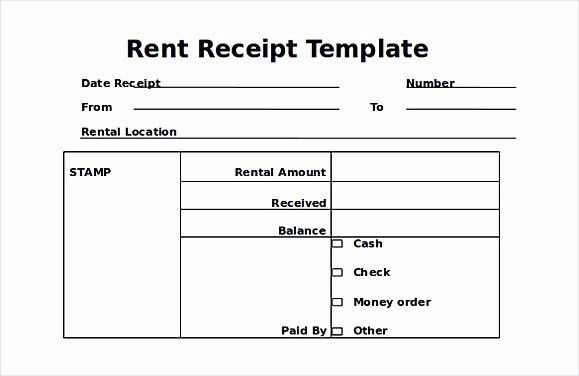

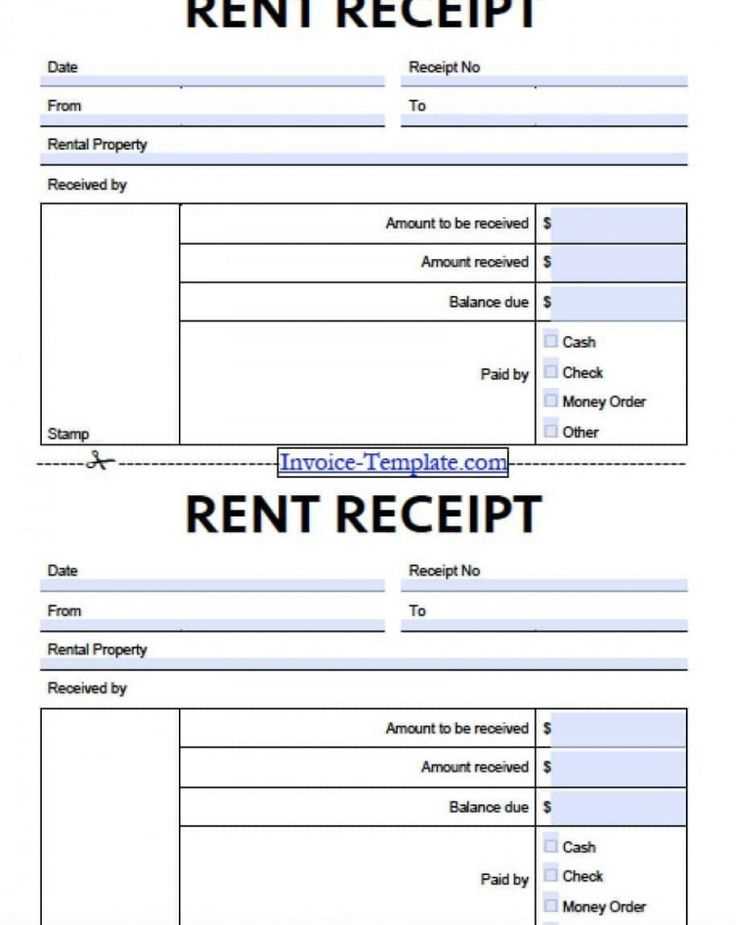

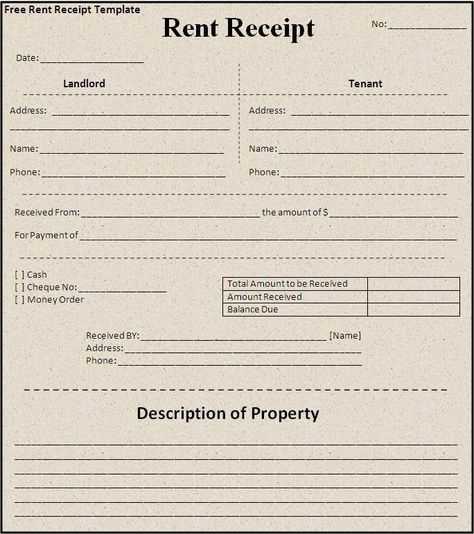

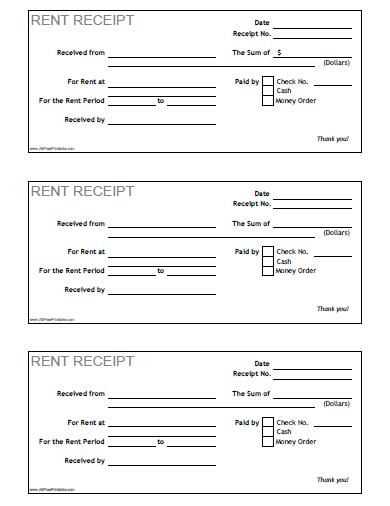

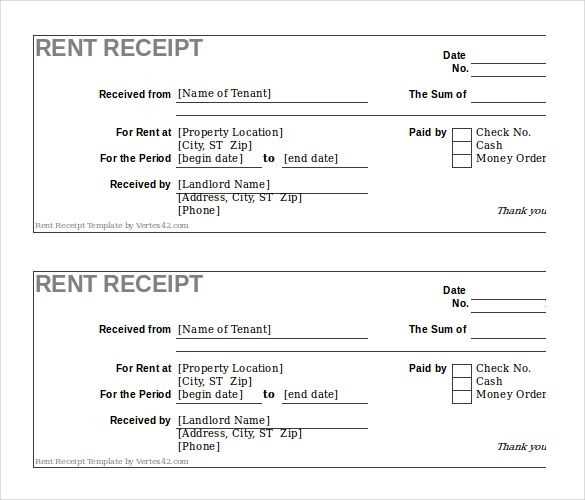

To create a rent receipt template, include fields such as tenant name, rental property address, date of payment, amount paid, and the payment method. The stub should mirror the main receipt but with additional space for tracking future payments. This structure makes it easy for both landlord and tenant to monitor payment history while maintaining organized records.

Ensure your template is easy to customize for each transaction. Keep it clear and straightforward, with enough room for signatures or additional notes. Using a digital template or form can streamline the process, allowing for quick updates and easy storage of receipts and stubs in one place.

Here is the revised version of the text, where each word is repeated no more than two or three times:

To create a rent receipt template with stubs, ensure that the format is clear and concise. Each section should contain the tenant’s name, rental amount, payment date, and address. Include space for both the landlord’s and tenant’s signatures. The stub should display a receipt number, payment details, and date of payment for reference. This format prevents confusion and provides a straightforward record for both parties.

When designing the template, prioritize simplicity. Avoid cluttering it with unnecessary information, focusing instead on what is required for a legal and valid receipt. Use legible fonts and an easy-to-follow structure. The amount paid should be clearly stated, as well as the outstanding balance, if applicable. Each receipt should be easy to locate for future reference, ensuring transparency in rental transactions.

For further clarity, consider adding a section for notes or special instructions, but keep it brief. This helps both the tenant and landlord address any additional terms or agreements outside of the regular payment cycle.

- Rent Receipts with Stubs Template: A Practical Guide

Rent receipts with stubs are a straightforward and useful tool for both landlords and tenants. The stub provides a way to track payments while the receipt itself serves as proof of the transaction. Create an easy-to-use template with the following key elements:

- Landlord and Tenant Information: Include the names and addresses of both parties for clear identification.

- Date of Payment: Specify the date the rent was paid to avoid confusion over payment periods.

- Amount Paid: Clearly state the rent amount, ensuring both parties are in agreement.

- Payment Method: Note how the payment was made (e.g., cash, check, bank transfer) for transparency.

- Rental Period: List the dates the rent payment covers to confirm the period being paid for.

- Receipt Number: Add a unique number for reference, especially useful for bookkeeping and record-keeping.

- Signature Line: Include a space for the landlord’s signature or a statement confirming the receipt of payment.

Ensure the stub has enough space for the tenant to track subsequent payments. This makes it easy for tenants to keep records of their rent payments. Adjust the layout and design to meet the specific needs of both parties.

- Customization: If needed, customize the template with any additional terms or details relevant to the lease agreement.

- File Formats: Offer the template in various formats like PDF or Word for convenience and easy printing.

By organizing receipts with stubs clearly, you avoid potential disputes and maintain a professional record-keeping system. It also simplifies tax season for both landlords and tenants.

Creating a rent receipt template with a stub is straightforward. The receipt should be clear, concise, and easy to use for both landlords and tenants. Follow these simple steps to create a professional and functional template:

- Start with the header: Include your name or business name, address, phone number, and email at the top.

- Include tenant details: Add the tenant’s name, address, and contact details just below the header.

- Detail the payment information: Write down the date of payment, rental period, amount paid, and payment method. Ensure this information is clearly displayed for easy reference.

- Add a unique receipt number: Numbering receipts helps with organization and tracking. It also serves as a quick reference in case of disputes.

- Provide a stub: Create a detachable portion for the tenant to keep. This stub should include the payment amount, date, and receipt number for the tenant’s records.

- Specify due dates and payment terms: Include any relevant payment due dates and late fee policies if applicable.

- Include a space for signatures: Both parties should sign to confirm the transaction. This can be optional if using digital receipts.

Once these elements are included, your rent receipt template with a stub will be both functional and professional. Save the template in a format that can be easily customized for each transaction.

Include the tenant’s full name and the property address on every rent receipt. Specify the payment amount and the period it covers. This provides a clear record of the transaction. The date of payment and the method used (such as cheque, cash, or transfer) should be noted as well, offering clarity on how the payment was made.

Breakdown of Charges

If applicable, list any extra charges, such as late fees or utilities, to avoid confusion. Make sure the total paid is clearly visible, indicating whether it was a full or partial payment. A receipt number or reference code can help keep track of multiple payments or transactions.

Landlord’s Contact Information

Include your contact details in case there are any questions about the payment or discrepancies. Having this information ensures both parties can resolve any issues quickly without miscommunication.

Using a template for rent receipts with stubs ensures accuracy and consistency. It eliminates the risk of human error when manually creating receipts, saving both time and effort. The structured format helps landlords maintain clear, organized records for each transaction, simplifying bookkeeping and tax preparation.

With pre-designed templates, you can quickly issue receipts without needing to start from scratch. This efficiency reduces administrative workload, especially for landlords managing multiple properties. The template also provides a professional look, enhancing trust and transparency with tenants.

Templates offer customization options, allowing you to add specific details like tenant names, rent amounts, and due dates. This flexibility ensures that each receipt meets your unique requirements. The stubs included in the template help tenants track payments, which promotes clear communication and reduces confusion.

| Feature | Benefit |

|---|---|

| Accuracy | Minimized risk of errors in payment details |

| Efficiency | Quickly generate receipts for multiple tenants |

| Organization | Easy record-keeping for tax or legal purposes |

| Professionalism | Improved credibility with tenants |

By adopting a template, you streamline the receipt process, enhance organization, and maintain a professional appearance for both parties involved. The inclusion of stubs makes tracking payments straightforward for tenants and reduces disputes over payment history.

Ensure accurate date and amount entries on receipts. Mistakes in these details can lead to confusion for both the recipient and the issuer. Always double-check these fields before issuing a receipt to prevent future disputes.

Incomplete or Illegible Information

Failing to include the necessary details, such as the recipient’s name, the payment method, or the service provided, creates ambiguity. Ensure all sections of the receipt, including the stub, are fully filled out with clear, legible information. This ensures both parties have a record that is easy to understand and reference.

Wrong or Missing Receipt Number

Receipt numbers must be unique and consecutive. Skipping numbers or duplicating them can cause confusion and make tracking payments more difficult. Always maintain a sequential order for receipt numbers to stay organized and avoid discrepancies.

Tailor your rent receipt template by adjusting the layout to meet specific requirements. For example, add custom fields such as lease term or tenant contact information if needed. This makes your receipts clearer and more suited for specific transactions.

Use clear labels for payment details. If you’re dealing with multiple payment types, include separate sections for rent, deposits, and additional charges. Label these clearly to avoid confusion.

If you need to track payment frequency, consider including a date range on your receipt, especially for tenants who pay rent quarterly or annually. This helps to specify exactly which period the payment covers.

For a more formal touch, you can incorporate your business logo or include a space for a signature to authenticate each receipt. These small details make the receipt look professional and add credibility.

Finally, ensure your template includes an itemized breakdown for tenants who request more transparency. This can include rent, utilities, or maintenance fees, and it will be particularly useful for tax purposes.

Rent receipts with stubs are legally required in many regions to ensure transparency and protect both landlords and tenants. Depending on the location, these receipts must contain specific information, such as the date, amount paid, landlord’s name, tenant’s name, and rental period. Some regions also mandate a unique receipt number to help track payments. It’s important to familiarize yourself with local regulations to remain compliant and avoid disputes.

United States

In the United States, rent receipts are required in some states for cash payments, especially for tenants who request them. Some jurisdictions mandate the use of receipts with stubs for tenants to verify payments in case of future disputes. The receipt typically includes the rental amount, the payment method, and the property address. In states like California, the law is stricter, requiring landlords to provide receipts for all rent payments if the tenant requests them.

United Kingdom

In the UK, there is no nationwide law that requires landlords to issue rent receipts with stubs, but landlords are still encouraged to do so. In cases where rent is paid in cash, providing a receipt is considered good practice. The receipt should include the payment amount, date, landlord details, and a breakdown of any charges. If the tenant disputes a payment, having a receipt helps resolve the issue quickly and fairly.

Rent Receipts with Stubs Template

Ensure your rent receipts are easy to track and organized by including stubs. This helps both landlords and tenants keep clear records. The stub should contain details like the payment date, amount, and tenant’s name. It is also helpful to number the stubs for quick reference. Design the stub to match the receipt, but leave space for additional notes or payment methods if necessary. Include a section for tenant signature and date to confirm the payment was received. Keep receipts simple and legible to avoid confusion or errors. A well-structured template ensures all required details are captured every time a payment is made.