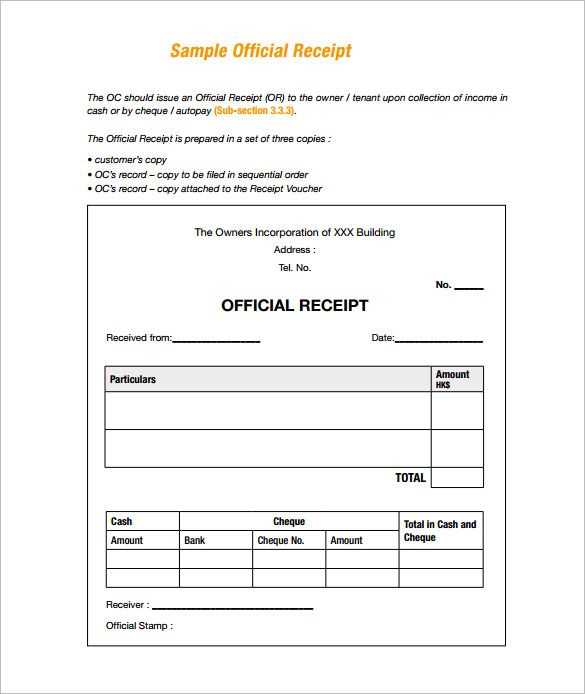

For any business or transaction, having a clear and accurate receipt is a must. An official receipt template can streamline this process, ensuring all the necessary details are included without missing anything important. Use a standardized template to avoid any confusion and provide a professional impression to your clients or customers.

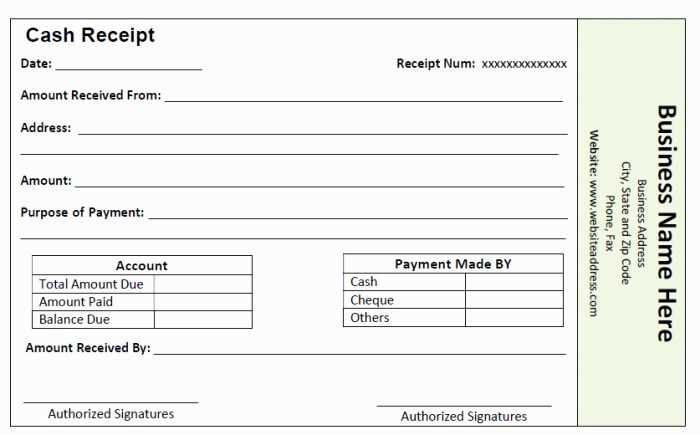

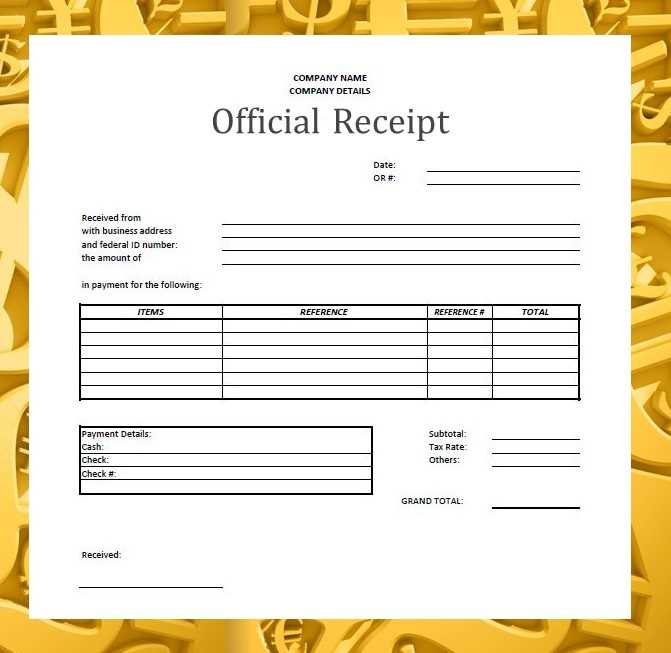

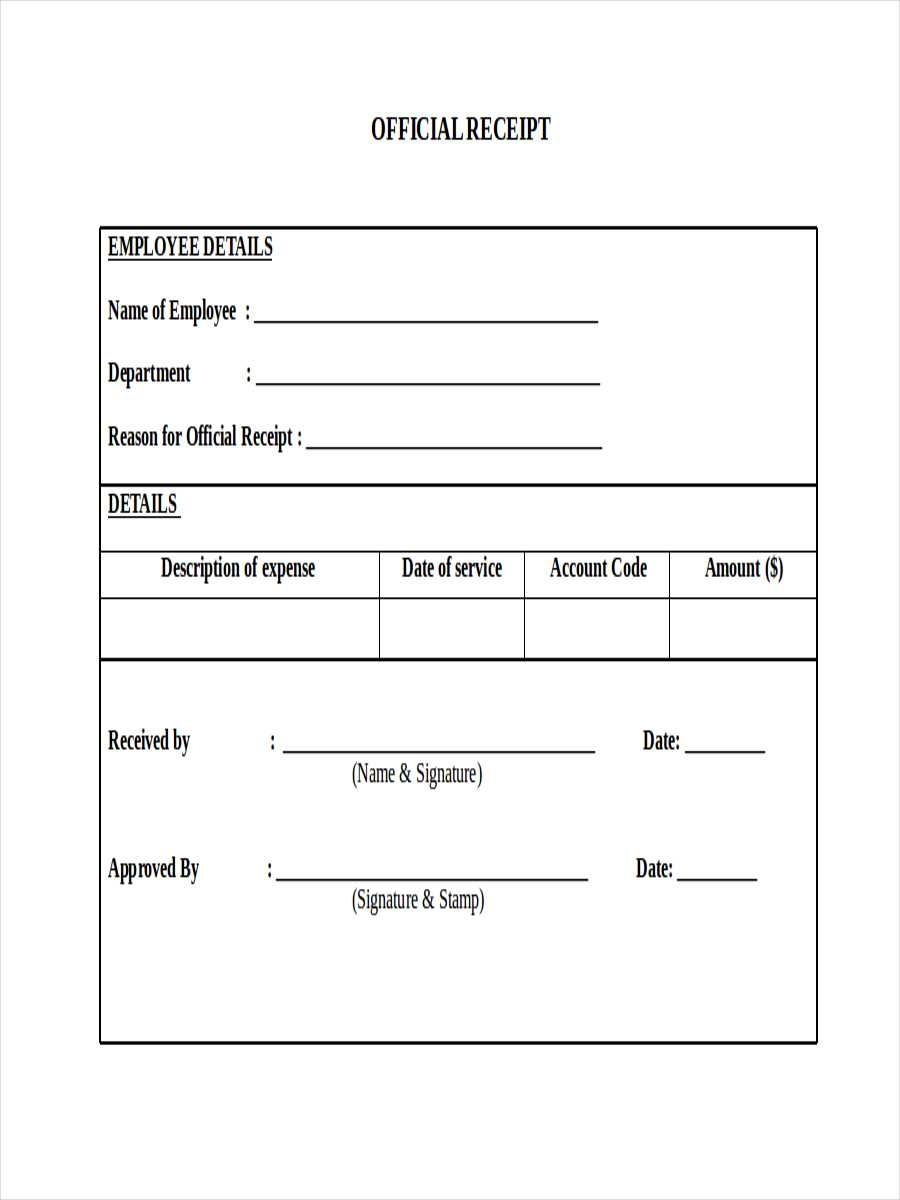

Start by incorporating the key components: the receipt number, date, seller and buyer details, description of the transaction, and payment method. Including these data points ensures that the receipt meets legal and business requirements. Many businesses use a customizable template that allows quick adjustments based on the nature of the transaction.

To create a template that works for your business, consider the layout and design. Make sure it’s clean, simple, and easy to read. This not only enhances the customer’s experience but also prevents potential issues related to unclear or incorrect information on receipts.

Here’s the revised version of the text:

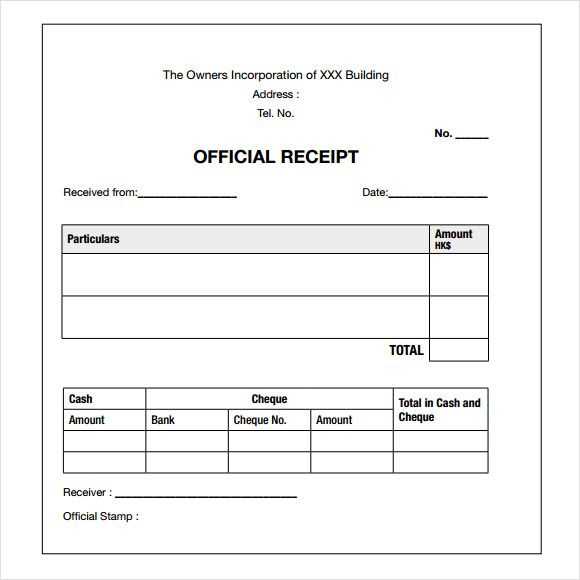

Ensure that the template you use for official receipts includes all the necessary details for clarity and transparency. Start by adding the company’s name, address, and contact information at the top. This ensures the recipient knows who issued the receipt immediately. Follow with a unique receipt number for tracking purposes.

Next, clearly state the date of the transaction. This serves as a record for both parties. Include the name and contact details of the individual or business receiving the payment. For the itemized list, mention each product or service sold, along with its quantity, unit price, and total amount. The breakdown should be easy to read, with a clear distinction between subtotal, taxes, and any additional charges.

At the bottom of the receipt, provide the total amount paid, followed by the payment method used (e.g., cash, credit card, bank transfer). It’s also a good idea to include a thank-you note or a reminder of any relevant terms or warranties if applicable.

Ensure that all text is legible and properly aligned to avoid confusion. Keep the design simple and professional, with no unnecessary elements that might distract from the important information.

Official Receipts Template: A Complete Guide

How to Create a Professional Receipt Template

Key Elements to Include in an Official Receipt

Customizing Your Receipt Template for Various Businesses

How to Ensure Tax Regulation Compliance with Official Receipts

Common Mistakes to Avoid When Using Receipt Templates

How to Use and Store Receipts for Record-Keeping

Creating a receipt template involves incorporating the right elements that ensure clarity, professionalism, and compliance with tax regulations. Start by including your company name, contact details, and a unique receipt number. Each receipt should also contain the date of the transaction, the buyer’s information, a breakdown of the purchased items or services, and the total amount paid. Be sure to specify the payment method used, such as cash, card, or bank transfer.

Key Elements to Include in an Official Receipt

Key elements are non-negotiable when crafting a receipt template. These include:

– Receipt number for easy tracking

– Date of transaction

– Vendor and buyer details

– Itemized list of goods or services

– Total amount paid and applicable taxes

– Payment method used

– Signature or approval mark (if required by law).

Customizing Your Receipt Template for Various Businesses

Customizing your receipt template for your specific business type is crucial for professionalism. For example, retail businesses might prioritize space for a list of items, while service-based businesses will focus more on describing the service provided. Consider adding your logo and business slogan for branding. Some sectors, such as hospitality or education, may require additional fields like room numbers or course codes, depending on their specific needs.

Ensure that your template aligns with your region’s tax laws. This includes ensuring that tax rates are accurately reflected, as well as complying with any specific receipt requirements set by tax authorities. In many cases, you may need to keep digital or printed copies for audit purposes. Storing receipts securely is key for both record-keeping and possible refunds or returns.

Some common mistakes to avoid include leaving out vital information, using vague item descriptions, or failing to include the correct tax rate. Always double-check your template before printing to ensure consistency and compliance.

Lastly, storing receipts requires an organized system. Digital receipts should be backed up and labeled correctly, while physical receipts must be stored in a secure, organized filing system for easy access and reference.

Here I reduced word repetition while maintaining their quantity and meaning.

To create an official receipt, choose a template that includes key details such as the business name, transaction date, amount, and service or product provided. Use a clean layout to ensure all information is easy to read. Position the company’s logo at the top for clear branding and provide contact information beneath it. This ensures the recipient can quickly reach out if needed.

Important Elements

Ensure your template has space for the following: transaction number, payment method, and tax information. These details provide both transparency and clarity for the recipient. Always double-check for accuracy before issuing the receipt.

Customization Tips

Personalize your template to suit your business style, but avoid unnecessary decoration that could distract from the content. Keep your branding simple and professional, using colors and fonts that match your company’s identity.