Creating a Trapstar receipt template requires focusing on clarity and a professional layout. The design should provide all the necessary information without overcrowding. Include key elements like the transaction date, item descriptions, quantities, prices, and any applicable taxes. These details are crucial for maintaining accurate records and ensuring transparency with customers.

Use clean lines and easily readable fonts to enhance the template’s usability. Avoid unnecessary graphics or clutter that might distract from the essential information. Ensure that your branding is present, but not overpowering, by adding a simple logo or brand name at the top.

A well-structured receipt not only helps with inventory tracking but also ensures that your business operates smoothly. It’s a small but significant part of professional business operations, making it easier for customers to understand their purchases and for you to keep organized financial records.

Trapstar Receipt Template Guide

To create a professional and clear Trapstar receipt template, follow these key steps for a smooth and accurate layout.

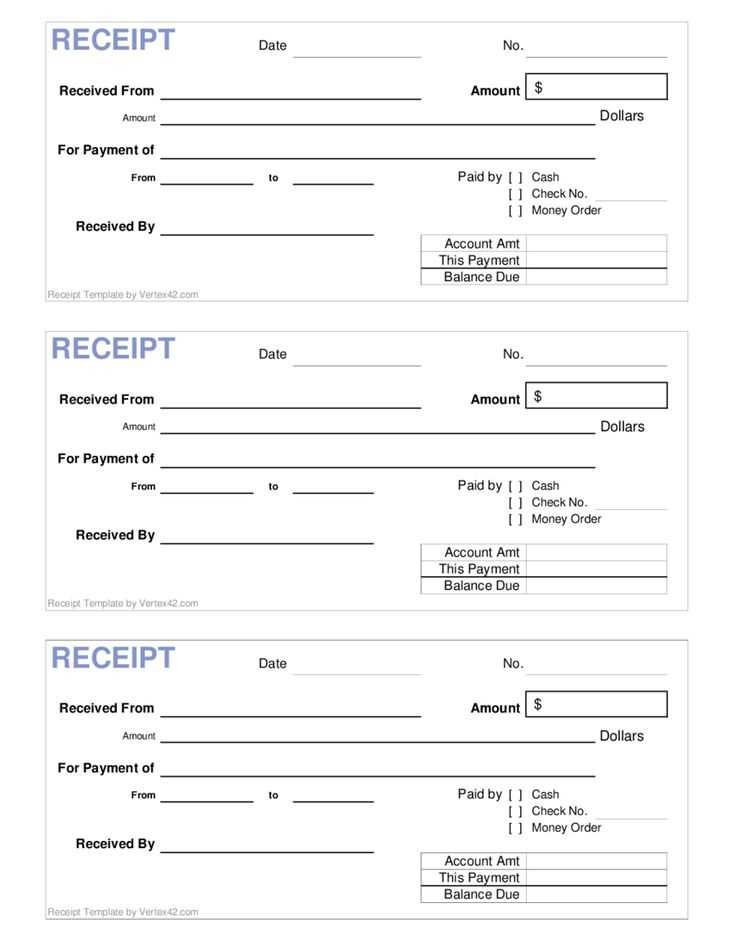

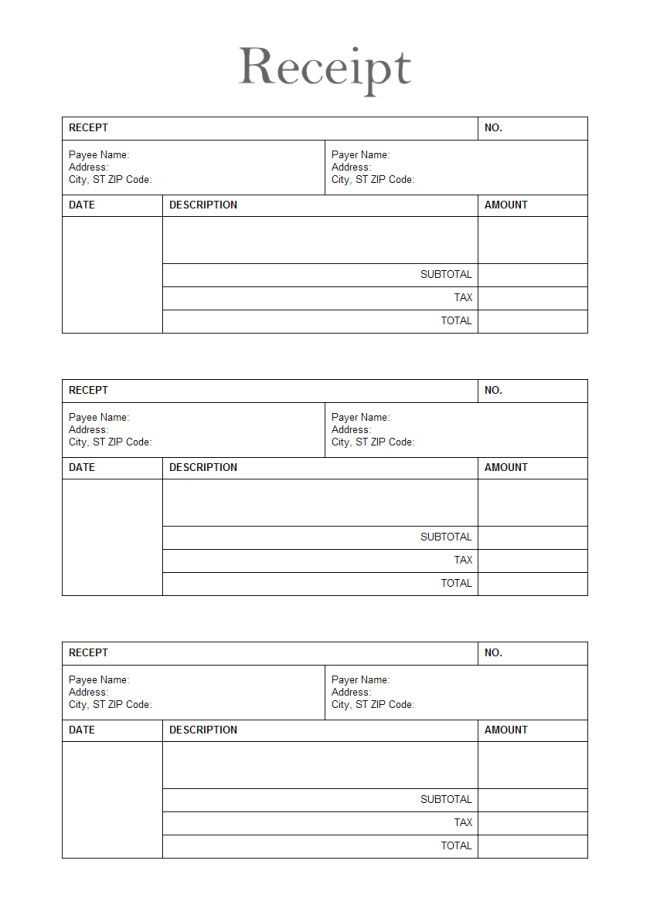

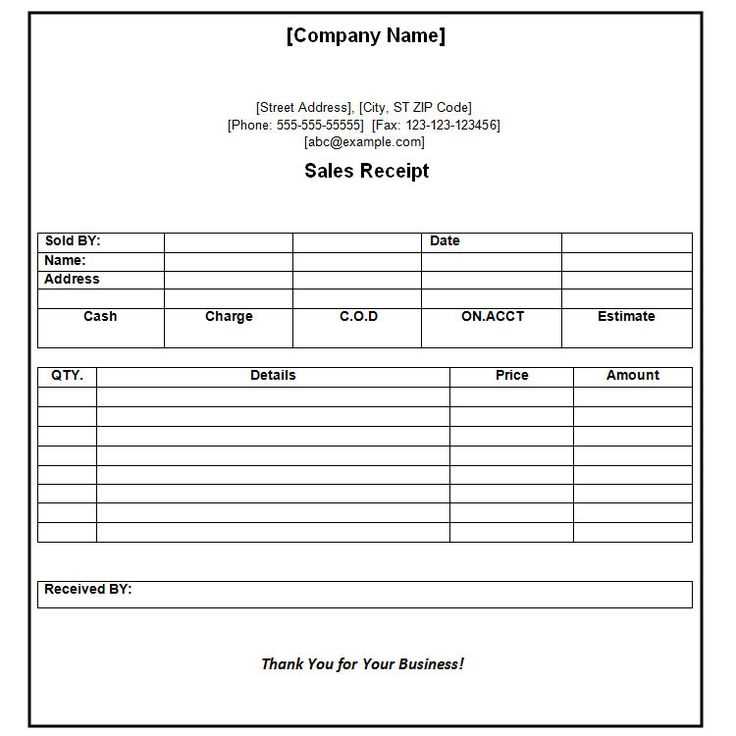

- Header Section: Include the business name, logo, and contact information at the top of the template. This provides quick identification and legitimacy to the receipt.

- Receipt Title: Clearly label the document with the word “Receipt” in a bold font. Make sure it stands out so the purpose of the document is immediately clear.

- Receipt Number: Assign a unique identifier for each transaction. This is useful for both tracking and referencing specific sales in the future.

- Date and Time: Include the exact date and time of the transaction. This is crucial for record-keeping and returns management.

- Items Purchased: List the purchased items or services, along with their prices. Make sure to include the quantity and unit price for each item. This breakdown enhances clarity and transparency.

- Subtotal and Tax Information: Show the subtotal before tax and include tax rates separately. This helps customers understand the full breakdown of their charges.

- Total Amount: Clearly highlight the total amount due, including any additional fees or discounts applied. This helps avoid any confusion at the time of payment.

- Payment Method: Specify how the payment was made (e.g., cash, credit card, or online payment). This adds to the completeness of the transaction record.

- Footer Section: Include any relevant notes such as return policies, customer service contact info, or a thank-you message. This leaves a positive impression and enhances customer experience.

Ensure that all text is easy to read and aligns neatly on the template. You can use software tools like Microsoft Word or Google Docs to create the template, or employ design platforms for more customization options. Keep the template simple and to the point for the best results.

Customizing Your Trapstar Receipt Template

Modify your Trapstar receipt template to match your brand’s identity. Adjust the layout and design for a polished, professional look that reflects your business style. Here’s how you can personalize your template effectively:

1. Update Your Branding Elements

Incorporate your logo, color palette, and fonts into the receipt design. Replace the default template with your logo in the header and choose colors that align with your branding. Consistency is key for creating a strong visual identity.

2. Edit the Information Fields

Customize the details to fit your specific needs. Modify the fields for product names, quantities, prices, and any other data relevant to your business. This ensures your receipt template includes the information that’s most important for your customers.

- Product Description

- Item Price

- Sales Tax

- Total Amount

By tailoring these sections, you’ll ensure your receipts are clear and professional, enhancing customer trust.

3. Add Custom Text and Notes

Personalize the footer section with custom messages. You might want to thank your customers, provide contact info, or add a return policy. This small touch can boost customer satisfaction and promote loyalty.

- Thank You Message

- Return and Refund Policy

- Contact Information

Adding personalized messages makes the receipt feel more personal and helps reinforce your business’s commitment to customer care.

4. Adjust Layout for Clarity

Ensure the receipt layout is easy to read. Adjust the spacing between sections and text for better organization. A clutter-free design helps customers quickly grasp the details of their purchase.

Experiment with different fonts and sizes to make key information, like totals or taxes, stand out. Prioritize readability by choosing simple, clean fonts.

Design Elements for a Professional Look

Focus on simplicity and clarity when creating a receipt template. A clean layout ensures that all necessary details are easy to read and well-organized. Avoid overcrowding the design with unnecessary elements, which can distract from the important information.

Typography plays a major role in the professional appearance of your receipt. Choose fonts that are simple and legible, such as sans-serif types like Arial or Helvetica. Keep the font size consistent and use bold or italics sparingly to highlight key information such as totals and dates.

Use color strategically. A neutral color palette–black, white, or gray–ensures the receipt remains professional. You can add a small amount of color for highlights, such as the company logo or payment totals, but keep the overall tone subtle and balanced.

Spacing is another key factor. Ensure there is enough white space between sections so that the receipt doesn’t feel cramped. Adequate margins, as well as well-defined sections for products, prices, taxes, and totals, will enhance readability.

Alignment is important for a neat, orderly look. Ensure all text and elements are aligned properly. The use of tables can help with this, providing structure to the layout and making sure all entries are visually consistent.

| Element | Recommendation |

|---|---|

| Font | Choose simple, sans-serif fonts like Arial or Helvetica |

| Color | Neutral colors with minimal use of accent color |

| Spacing | Provide enough white space for clarity |

| Alignment | Use tables for consistent layout and clean structure |

By focusing on these elements, you’ll create a receipt that communicates professionalism while remaining user-friendly and easy to read. A well-structured design reinforces trust and confidence in your business.

Incorporating Payment Methods and Transaction Details

Clearly display all accepted payment methods on your receipt. This ensures transparency and helps customers understand how they can settle their purchases. Include popular options like credit/debit cards, PayPal, and digital wallets, along with any specific methods unique to your business.

Transaction Breakdown

List the transaction details with precision. Include the total amount, taxes, discounts, and itemized charges. Break down each fee to avoid confusion, especially for larger purchases. The customer should be able to see exactly what they’re paying for and the calculations behind the final amount.

Confirmation of Payment

Provide a payment confirmation, such as the authorization number or transaction ID. This assures the customer that the payment was processed successfully. Ensure this detail is visible and clearly labeled so it can be referenced later if needed.

Incorporate both the date and time of the transaction. This is useful for future reference and potential returns or exchanges. Keeping this information accessible can prevent disputes and improve customer service.

Legal Requirements for Trapstar Receipts

Trapstar receipts must include specific details to comply with local legal standards. The primary requirement is that all receipts should display the transaction date, the business name, and the location of the transaction. It’s crucial that the receipt clearly states the items purchased along with their respective prices. A breakdown of taxes should also be included if applicable, ensuring customers know the exact amount they are being charged.

Mandatory Information

The receipt should list the method of payment, whether cash, credit, or any other method. For businesses operating in regions that require VAT or sales tax, it is mandatory to provide the tax rate and the total amount paid in taxes. Additionally, a unique transaction number or reference code should be included to help track and verify the purchase if needed.

Retention and Compliance

Ensure receipts are kept for the legally required duration, typically ranging from one to five years depending on local laws. Failure to provide a detailed receipt may result in penalties or legal complications. If the receipt is issued electronically, it must be accessible and printable for the customer upon request.

How to Integrate Your Template with Point-of-Sale Systems

To integrate your Trapstar receipt template with a Point-of-Sale (POS) system, begin by ensuring the template is compatible with the system’s software. Most modern POS systems support custom receipt templates in formats like HTML, XML, or JSON. Choose the format that works best with your POS software.

Prepare Your Template

Adapt your template by following the specific guidelines provided by your POS provider. Pay attention to the required fields such as the transaction details, itemized list, prices, tax calculations, and any promotional messages. This ensures that the receipt includes all necessary information without any format issues.

Implement the Template

After finalizing the template, upload or import it into your POS system’s settings. Most systems will allow you to do this through an admin interface where you can either upload the file or paste the template code. Test the integration by completing a few sample transactions to confirm that the receipts are printed correctly.

If the POS system provides an API, you may need to interact with it to ensure seamless integration. Some systems also allow you to customize the printing process, such as adjusting fonts, margins, or adding logos to your receipts. Make adjustments as needed to match your branding.

Managing and Storing Receipt Data for Future Use

Organize receipt data systematically by using folders and subfolders for easy retrieval. Group receipts by categories such as “business,” “personal,” or “shopping,” and sort them by date within each folder. This method prevents clutter and simplifies access when needed later.

For digital receipts, store them in cloud services with strong encryption, ensuring they remain secure and accessible. Popular options include Google Drive, Dropbox, or OneDrive. Make sure to label the files with clear names, such as “receipt_2025_01_01_MyStore.pdf,” to improve searchability.

Use receipt management apps that automatically capture and organize digital receipts. Apps like Expensify and Shoeboxed scan and store receipts, making future reference easy. Take a photo of paper receipts and upload them to the app for instant digital storage.

Consider using spreadsheets for tracking expenses. Record important details like the date, store name, and amount spent. This allows you to easily filter and analyze your receipts when preparing for tax filing or budgeting.

Back up all digital receipt data regularly. Use an external hard drive or a secondary cloud storage option to safeguard against accidental deletion or data corruption.

Keep receipts for a minimum of three years for tax and warranty purposes. For longer-term storage, convert physical receipts to digital formats, such as PDFs, to reduce physical space and prevent deterioration.

Review your stored data periodically to ensure everything is properly archived and accessible. Regularly update your storage systems to prevent future problems, like file format incompatibility or corrupted data. Keep everything organized and easily retrievable for future reference.