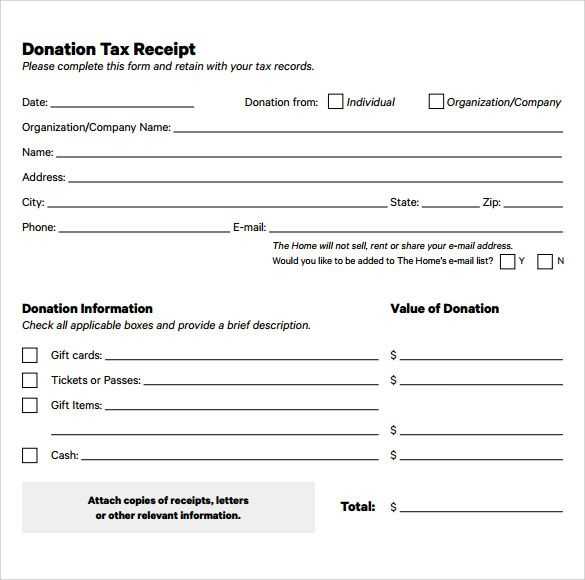

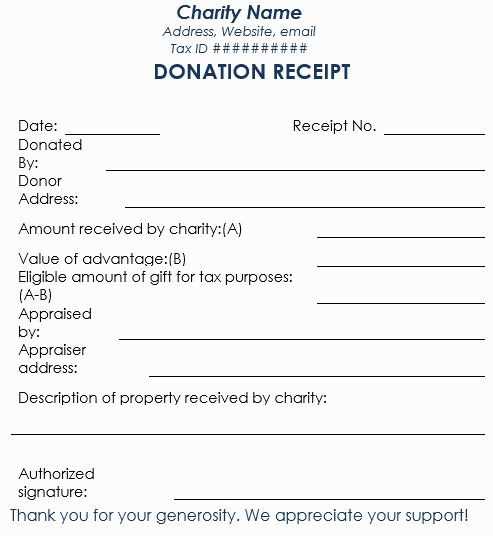

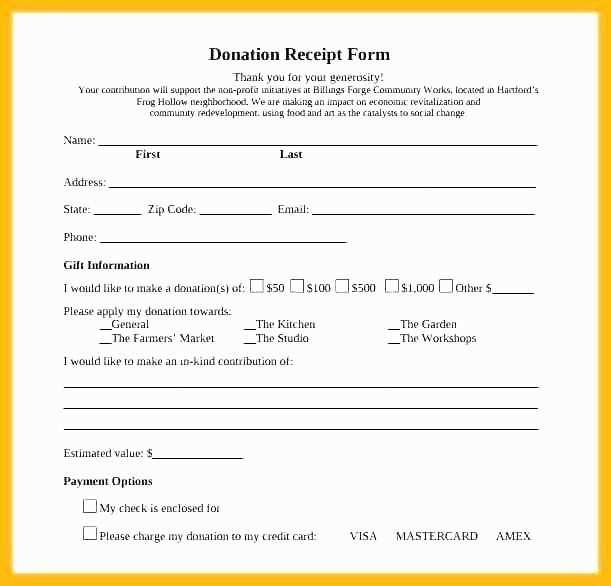

To create a proper tax donation receipt, ensure it contains all the necessary details to comply with IRS regulations. Begin with the donor’s name, address, and the donation amount or description of the items donated. Make sure to specify whether the donation is monetary or non-monetary. If it is property, include an accurate description.

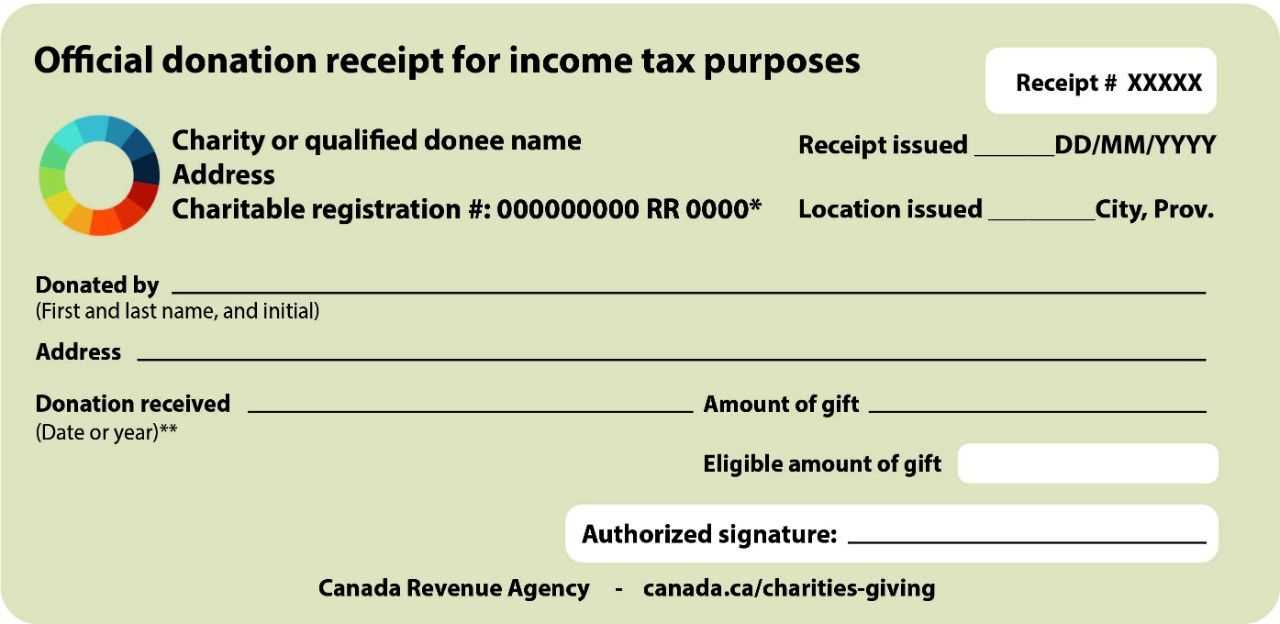

Include the donation date as this is critical for tax reporting. The organization’s name, address, and EIN (Employer Identification Number) should also be clearly visible. Add a statement confirming that no goods or services were exchanged for the donation, if applicable. This assures the donor that they are eligible for a tax deduction.

Ensure to mention any special terms or conditions related to the donation. For example, if the donation was restricted for a particular purpose, it should be noted. Use clear and concise language throughout the receipt for easy understanding.

Don’t forget the signature of an authorized representative of the organization, confirming the receipt of the donation. This adds authenticity and can help if the IRS ever requests documentation of the transaction.

Here are the corrected lines with minimal repetition:

Ensure clarity by using distinct terms for each section, avoiding redundancy. For instance, instead of repeating “donation” in each line, rephrase it to specify different aspects, such as “contribution” or “gift” based on the context.

- Clearly label the donor’s name, contribution amount, and date of donation in separate sections.

- Avoid repeating phrases such as “received from” by using “donor’s contribution” or simply “received” when referring to the donation.

- For the purpose, specify if the receipt is for a general or designated donation, rather than repeating “donation receipt” multiple times.

- In the acknowledgment section, highlight the tax-deductible nature of the donation once, and refer to it as “tax-exempt” only where necessary.

- Use “thank you for your support” at the end to avoid repeating expressions of gratitude within the same context.

By adjusting the structure, the content becomes more concise and easier to follow without unnecessary repetition.

- Template for Tax Donation Receipt

Ensure the receipt includes the donor’s name, address, and the donation amount. List the date of the donation and the name of the charity. If applicable, specify whether the donation was monetary or in-kind. Provide a clear statement confirming no goods or services were exchanged for the donation, if that’s the case. This confirmation is important for tax purposes.

Donation Details

Include the total value of the donation, the method of payment (e.g., check, online transfer), and the transaction number if available. This adds transparency and helps both parties maintain accurate records.

Tax Information

State that the organization is a registered tax-exempt entity, and provide its tax identification number (TIN) for the donor’s reference. This allows the donor to claim the donation as a deduction on their taxes.

A tax deduction receipt must contain specific information to comply with requirements and ensure proper credit for donations. First, include the name of the donor and their contact details, such as address or email. This provides clear identification for the donation record.

Donation Amount and Description

Clearly state the amount donated or the fair market value of goods or services provided. If the contribution is non-cash, include a description of the items and their value. This allows for an accurate record of the donation and supports verification in case of an audit.

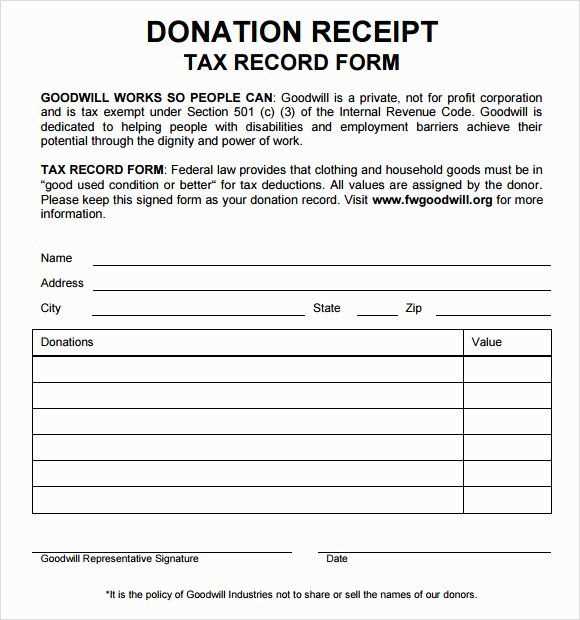

Tax-Exempt Organization Details

Include the name, address, and tax-exempt status of the organization receiving the donation. This assures that the contribution qualifies for a deduction and helps in the identification of the organization for both the donor and the IRS.

Also, make sure to specify whether any goods or services were exchanged for the donation. If so, the receipt must mention the fair market value of those goods or services to adjust the donation amount accordingly.

Organize the receipt with clear, easy-to-read sections. Begin with the organization’s name, logo, and contact details at the top. Make sure the text is legible, choosing a simple font like Arial or Helvetica in a size large enough for readability, but not overwhelming.

Provide a distinct section for the donor’s information. Include the full name, address, and donation date. Align this information to the left to keep it uniform and professional. Next, list the donation details–amount, type of contribution (cash, check, etc.), and any specific designation for the funds. This section should be concise but include all relevant data.

Use a table to separate and organize donation items, particularly for in-kind contributions. A clear breakdown with columns for the item description, quantity, and estimated value makes it easier to understand. Ensure the table has well-defined borders to separate the information clearly.

Include a summary section with the total donation amount at the end. Place this in bold or a slightly larger font to make it stand out. If applicable, add a thank-you note below the total to show appreciation.

Finally, leave space for signatures if required. This helps maintain formality and legitimacy. Make sure there’s enough spacing between sections to avoid clutter, and ensure the layout is balanced with consistent margins and padding throughout the document.

First, ensure that the organization you donated to is a registered tax-exempt charity, recognized by the IRS as a 501(c)(3) entity. You can confirm this by searching the IRS database of exempt organizations.

Check for Required Information

Your acknowledgment should include specific details, including the charity’s name, the date of the donation, the amount donated, and a statement confirming whether the organization provided any goods or services in exchange. Without these, your acknowledgment may not meet the IRS requirements for tax deductions.

Confirm the Donor Receipt’s Compliance

Ensure that your donation receipt includes a statement that it was given without any expectation of return benefits. This is a key element for the IRS’s determination that the donation is tax-deductible.

Lastly, verify that the acknowledgment is issued within a reasonable time frame, ideally before the end of the tax year, to ensure your donation can be included in that year’s tax return.

Tailor your donation receipts based on the type of contribution. For monetary donations, include the total amount donated, the date, and a clear statement acknowledging the donor’s generosity. If the donation is a specific item, list each item individually along with a description and estimated value, if available. This ensures transparency for both the donor and the organization. For recurring donations, indicate the frequency of the contribution and the total amount contributed to date. A simple breakdown of each installment will help maintain clarity.

Handling In-kind Donations

In-kind donations require precise documentation. Include detailed descriptions of the items donated, their condition, and an estimate of their fair market value. If possible, avoid vague terms like “miscellaneous items” and be specific to maintain accurate records. This will also help donors claim tax deductions based on the actual value of their gifts.

Non-monetary Contributions

For non-monetary contributions such as volunteer hours, consider specifying the number of hours contributed along with an approximate value per hour. This approach not only supports accurate record-keeping but also ensures that the donor can account for their non-financial contribution when claiming deductions.

Verify all donation details before submitting them for tax reporting. Double-check the donor’s name, address, and the donation amount to ensure they align with your records.

- Cross-reference donation receipts with bank statements or payment systems to confirm the transaction dates and amounts.

- Check that any non-cash donations are valued correctly. If you’re unsure, seek an independent valuation to ensure accuracy.

- Ensure that tax-exempt organizations are properly listed in your receipts to avoid discrepancies.

- Include the donor’s acknowledgment of receiving no goods or services in return for the donation, as required by tax laws.

- Consult the IRS guidelines on acceptable donation documentation to guarantee you’re meeting all reporting standards.

Review the total donation amounts regularly throughout the year to avoid any end-of-year surprises. An organized, up-to-date system will help make tax filing smoother.

For donation acknowledgment, organizations must choose between digital and physical formats. Each has its advantages depending on the goals and resources available.

Digital Acknowledgments

Digital receipts are quick, easy to distribute, and environmentally friendly. They offer instant delivery to donors, making them ideal for large-scale campaigns. With automated systems, organizations can send personalized thank-yous, reducing administrative costs. However, digital formats may lack the personal touch that physical letters offer. Some donors may feel that a digital receipt doesn’t adequately convey the appreciation they deserve.

Physical Acknowledgments

Physical receipts are more tangible, often valued for their personal touch. Donors may feel more appreciated when they receive a handwritten note or printed certificate. This format also provides a lasting reminder of the contribution, which can be displayed. The downside includes higher costs for printing and mailing, and slower delivery times, which can frustrate donors who expect faster communication.

| Aspect | Digital Acknowledgment | Physical Acknowledgment |

|---|---|---|

| Speed | Instant delivery | Slower, due to mailing |

| Cost | Lower, no printing or postage | Higher, due to printing and postage costs |

| Environmental Impact | Eco-friendly, paperless | Less eco-friendly, uses paper and postage |

| Personal Touch | Less personal, may feel automated | More personal, often handwritten |

For smaller organizations with limited resources, digital acknowledgments provide a cost-effective and efficient option. Larger organizations with more budget flexibility might combine both formats, offering physical receipts for major donors while relying on digital formats for smaller contributions.

Ensure your donation receipt template includes clear and concise details for both the donor and the organization. Begin by listing the donor’s name, the donation amount, and the date of the donation. This information will help both parties track contributions accurately.

Next, include the organization’s name, tax identification number, and a statement confirming that no goods or services were provided in exchange for the donation, if applicable. This is a common requirement for tax-deductible donations.

| Donation Details | Information |

|---|---|

| Donor’s Name | [Insert Donor Name] |

| Donation Amount | [Insert Amount] |

| Donation Date | [Insert Date] |

| Organization Name | [Insert Organization Name] |

| Tax ID Number | [Insert Tax ID] |

| Statement of No Goods/Services Provided | [Insert Statement] |

Lastly, ensure the receipt is signed by an authorized representative of the organization. This adds credibility and authenticity to the document, which is necessary for tax purposes.