To create an organized and professional hoa dues receipt, start by clearly outlining the key information. Include the name of the association, the member’s details, the amount paid, and the payment date. This simple structure ensures that all relevant data is accessible at a glance.

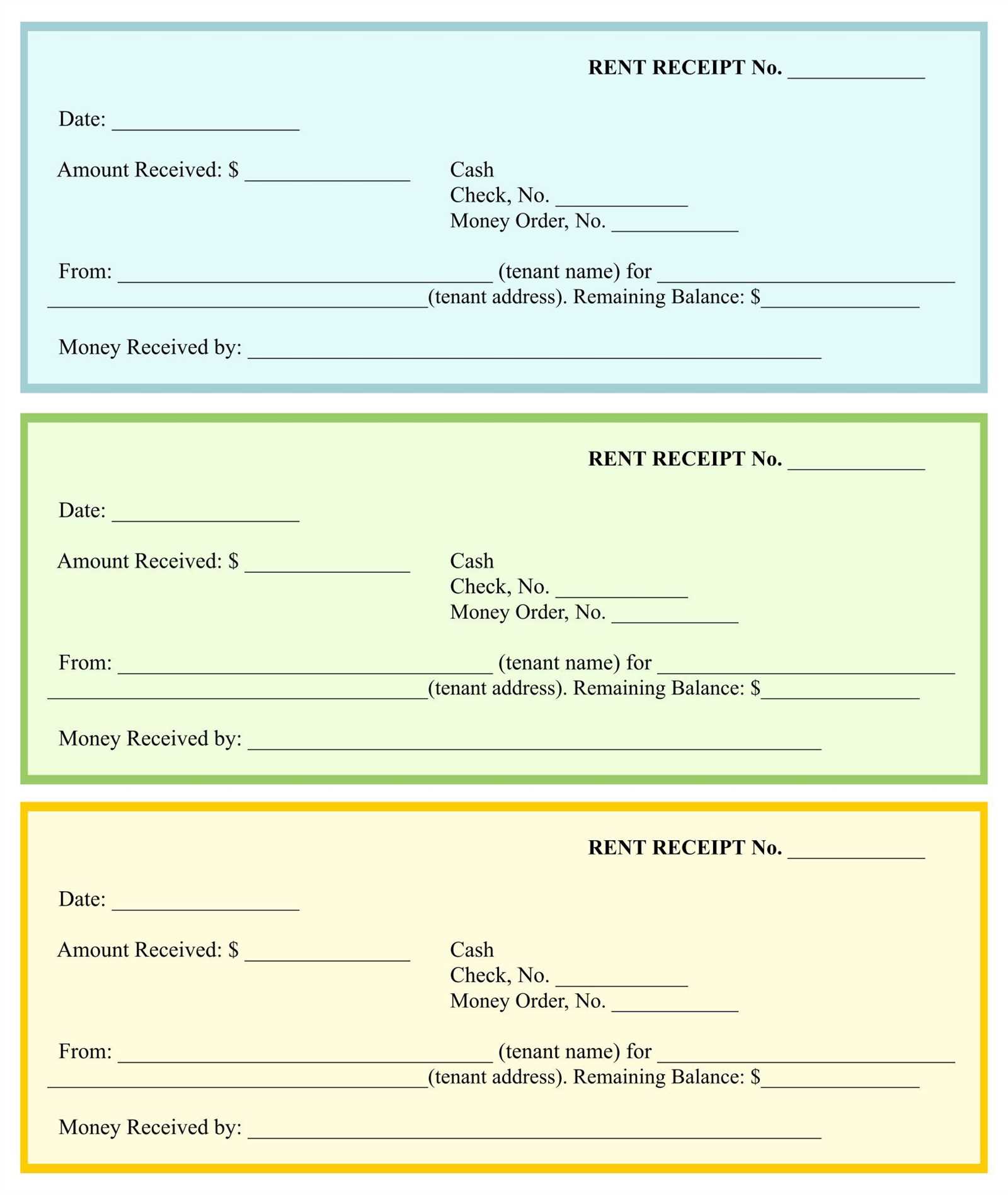

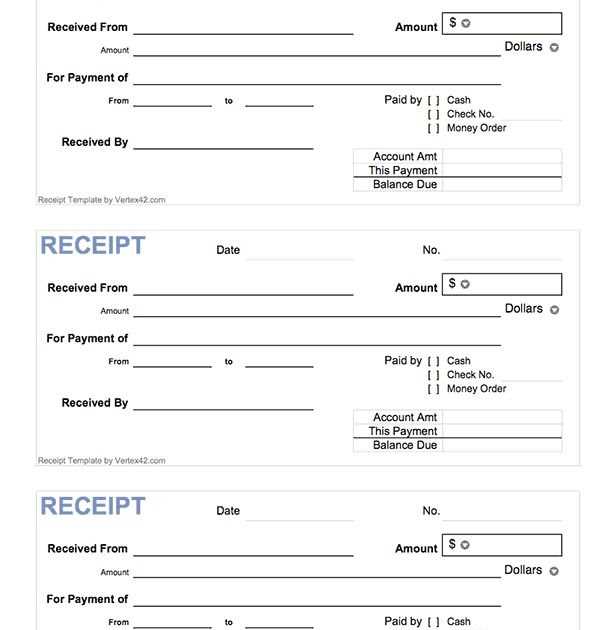

Format the receipt with consistency. Include a clear, easy-to-read section for the payment amount, and ensure that it’s easily distinguishable from other information. Listing the dues period, whether it’s monthly, quarterly, or annually, will help clarify any confusion and establish a clear payment record.

Consider adding a unique receipt number to each document. This will help track payments and prevent issues with duplicate records. This small addition can make managing records more manageable and efficient for both parties.

Ensure the layout is simple but informative, with no excess wording or complicated formats. Use a straightforward font, clear section headers, and space out the content for readability. Having all payment details easily accessible will save time for both the recipient and the association in the long run.

Hoa Dues Receipt Template

When creating a Hoa dues receipt template, be sure to include specific details that clearly outline the transaction for both parties involved. A well-organized template can simplify record-keeping and ensure transparency in the payment process.

Key Information to Include

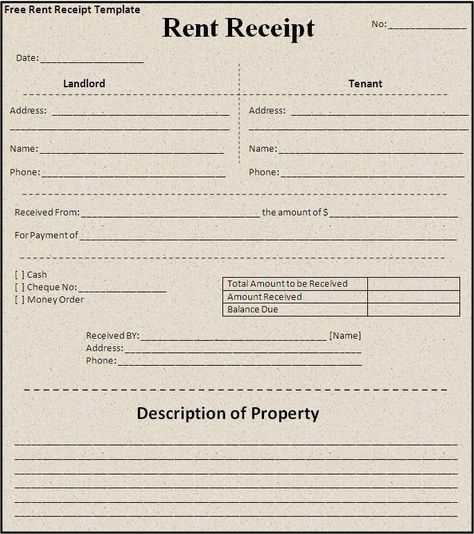

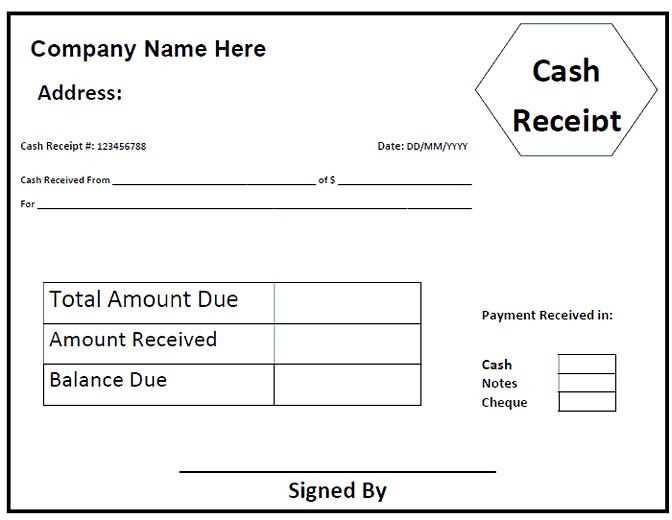

Start with the community name and payment period, followed by the name of the resident or homeowner. This provides clear context for the payment. Include the payment amount, due date, and the date received to confirm the transaction details. The payment method (e.g., check, credit card, cash) should also be noted to clarify how the payment was made.

Formatting Tips

Make sure the template is structured in a way that allows quick reference. For readability, include a clear receipt number and provide space for the authorized signature of the HOA representative or cashier. A footer with the HOA’s contact information and payment instructions will be helpful in case the resident needs to follow up.

Customizing the Template for Your Community’s Needs

Modify the layout to match your community’s identity by including a logo or specific color scheme. Ensure these design elements align with the community’s vision and branding.

- Adjust the Payment Details: Clearly define the payment amount, due dates, and accepted payment methods. These should reflect your community’s policies and current financial setup.

- Include Contact Information: Make sure to add a section with contact details for inquiries. This could be an email, phone number, or both, depending on your community’s preferred communication method.

- Add Community-Specific Sections: If there are any special assessments, fees, or discounts, include them in the receipt. Tailor these sections based on what applies to your particular association.

- Personalize for Residents: Add personalized fields for resident names, addresses, and unit numbers. This helps create a more individualized experience for the recipient of the receipt.

After adjusting the design, ensure the template remains clear and concise. Keep the language simple and professional while ensuring that all the relevant information is included and easy to find.

Including Required Legal and Financial Information

Clearly outline payment details, including the amount due, payment methods, and due date. This helps avoid confusion about transaction terms. Make sure to specify if the payment is a one-time fee or part of recurring dues, and the frequency of such payments (monthly, quarterly, etc.).

Legal Considerations

Include a statement that confirms the legal obligations of the payer, such as the agreement to the terms of the association or membership. This is often a brief clause that links to the governing documents of the HOA or community association.

Financial Transparency

Ensure clarity on how the funds will be used. This can be a simple note referencing the budget, such as “Dues contribute to maintaining community amenities and services.” Being transparent about the purpose of the funds helps build trust with members.

Be sure to include any applicable late fees for overdue payments. List the penalties clearly to avoid disputes. If you offer discounts for early payments, make that known with specific terms and dates.

Setting Up Payment Confirmation Details

Ensure the payment confirmation section includes clear information such as the payment amount, date, and method. Include a reference number for easy tracking and verification. List the recipient’s details to avoid confusion about where the payment was sent. Double-check the spelling and formatting of the recipient’s name and address.

Adding Payment Method Information

Specify the payment method used (e.g., check, bank transfer, online payment) to prevent ambiguity. If applicable, include the last four digits of the account or card number to ensure accurate verification. Keep it concise but specific enough to avoid any confusion.

Including Additional Details for Clarity

If applicable, add a breakdown of charges or any adjustments made. This helps clarify the payment details and avoids questions about discrepancies. Include the contact information for any follow-up queries, ensuring that users can reach the correct department or individual.

Designing for Easy Readability and Accessibility

Choose a simple, clean font like Arial or Helvetica for clarity. Ensure that the font size is large enough to be legible on both desktop and mobile devices, typically no smaller than 12px for body text. Use appropriate line spacing to prevent overcrowding, typically 1.5x the font size for readability.

Set high contrast between text and background. A light background with dark text, or vice versa, works best. Avoid using color combinations that may be difficult for individuals with color blindness to distinguish, such as green and red.

Break text into digestible sections with headers and bullet points. This allows readers to quickly scan the document for key information. Organize content in a logical, consistent manner, following a natural flow that helps guide the reader’s eye through the document.

Provide alternative text for images and graphics. Screen readers will read these descriptions, making your receipt accessible to visually impaired individuals. Ensure the alt text is clear and concise, describing the function of the image, not just its appearance.

Ensure that the template is navigable by keyboard for users with mobility impairments. Properly label form fields and use skip links to jump directly to the main content. These adjustments help improve accessibility for users relying on keyboard navigation.

Test the design with various accessibility tools to ensure it meets WCAG guidelines. This includes checking the color contrast ratio, ensuring all interactive elements are accessible by keyboard, and making sure the document is readable without relying on visual elements alone.

| Design Element | Recommendation |

|---|---|

| Font | Use sans-serif fonts like Arial or Helvetica; size no smaller than 12px for body text. |

| Contrast | Ensure high contrast between text and background for easy readability. |

| Text Organization | Break content into sections with headers and bullet points for easy scanning. |

| Images | Provide alt text for all images and graphics to aid screen reader users. |

| Keyboard Navigation | Ensure document can be fully navigated by keyboard, with properly labeled form fields. |

Integrating Automated Payment Tracking

Connect your payment system directly to your HOA platform to streamline payment tracking. By automating the process, you can eliminate manual entry errors and reduce the time spent on account reconciliation. This method allows for accurate, real-time updates on each resident’s payment status.

Choosing the Right Payment Gateway

Select a payment gateway that offers automatic integration with your HOA software. Ensure it supports various payment methods, such as credit cards, ACH transfers, and e-checks, while providing detailed transaction logs. This enables quick updates of payment statuses directly in your system without additional input.

Automated Payment Reminders

Set up automated reminders that are triggered when a payment is due or overdue. Customizable email or SMS notifications can be sent to residents, prompting them to make payments before late fees are applied. These reminders reduce the need for manual follow-ups, saving time and improving payment collection efficiency.

Ensuring Compliance with Local Tax Regulations

Verify that your receipt includes the necessary information to meet tax requirements. Many jurisdictions require specific details, such as the total amount, itemized charges, and applicable taxes. Ensure that the tax rate matches the local regulations, which may vary by location.

Accurate Reporting: Keep track of any taxes you collect and report them correctly. Failure to do so can result in fines or penalties. Regularly review the latest tax codes in your area to stay updated on any changes.

Clear Tax Breakdown: Display the tax amount separately on the receipt. This clarity helps both your clients and local authorities understand the financial breakdown and ensures proper documentation during audits.

Invoice Numbering: Assign a unique invoice number for each receipt. This system makes it easier to track payments and ensures you can match receipts to specific transactions during any tax review or audit.

Consult with a tax professional to confirm you are in line with local tax obligations. This step can prevent mistakes and save time in the long run.