If you need a deposit receipt, there’s no need to pay for one. A free template can save you time and effort. With the right structure, it will ensure that all necessary details are included, such as the amount, date, purpose, and the names of both parties. You can use this template for personal or business transactions, making it a versatile tool for various situations.

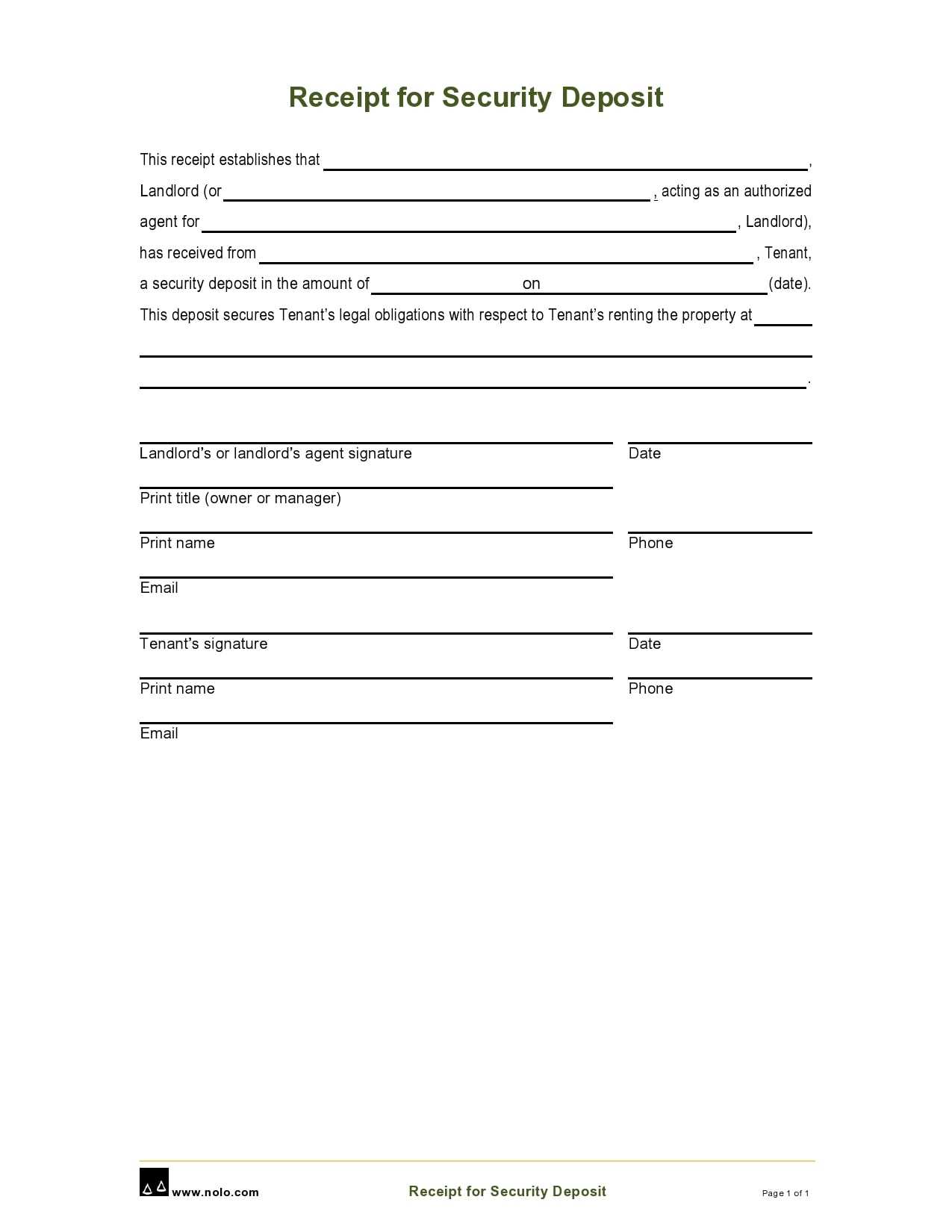

A deposit receipt acts as a confirmation of a payment made, so it’s crucial to make sure all information is clear and precise. The most important fields to include are the deposit amount, the method of payment, the depositor’s name, the recipient’s name, and a brief description of what the payment is for. Ensure there’s a space for both parties to sign, providing proof that the transaction was acknowledged.

With a free deposit receipt template, you can quickly create a professional document without any extra cost. You can find a variety of formats online, from simple text-based templates to more detailed, branded versions. The best part is that you can tailor it to meet your specific needs, saving you the hassle of creating a receipt from scratch each time you need one.

Here is the corrected version of the text:

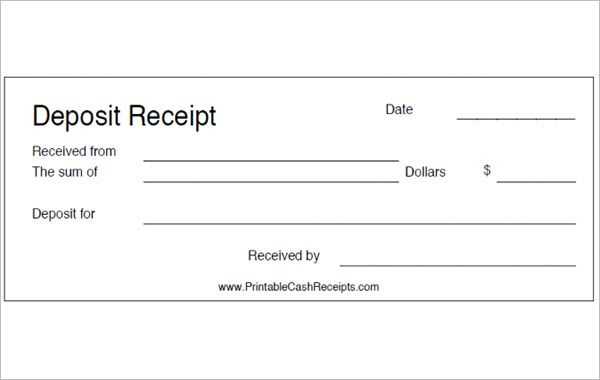

When creating a deposit receipt template, clarity and simplicity are key. Focus on essential details to ensure the document is both functional and legally sound. A basic deposit receipt should include:

- Receipt Title: Label the document clearly as a “Deposit Receipt” at the top.

- Recipient Information: Include the name of the person or entity receiving the deposit.

- Depositor Information: Add the name and contact details of the individual or company making the deposit.

- Amount: Specify the exact deposit amount, including the currency.

- Date: Include the date when the deposit was made.

- Deposit Method: Note whether the deposit was made by check, cash, or another method.

- Transaction Reference: Provide any relevant transaction number or identification for future reference.

Ensure that the layout is clean and the information is easy to read. Provide space for both parties to sign if needed. This format helps prevent confusion and maintains transparency in financial transactions.

Lastly, save your template in an editable format so it can be reused or customized in the future, ensuring it’s ready whenever a deposit is made.

- Deposit Receipt Template Free

To create a deposit receipt template, use a simple layout that includes all necessary details for both parties. Include fields such as the date, depositor’s name, amount deposited, and the purpose of the deposit. This template should also provide space for any reference number or transaction ID, ensuring clarity for record-keeping. For ease of use, consider using a straightforward table structure to organize the information cleanly.

Make sure to add a section for the signature of the recipient or authorized person, along with their contact details, in case the deposit needs verification later. By using this template, both parties can have a clear, organized record of the deposit without any confusion.

This free deposit receipt template can be adapted to various scenarios, whether for personal or business transactions. Keep it simple, focused, and consistent for maximum clarity and ease of reference.

Begin by setting up a clear layout that highlights the key details of the deposit. A simple receipt template should include the following sections: the date, the name of the person making the deposit, the amount deposited, and the method of payment.

Use a clean, readable font, and make sure each section stands out. Organize the information in a way that is easy to scan, especially for future reference.

Here’s a basic example of what the receipt structure could look like in a table format:

| Detail | Information |

|---|---|

| Date | [Enter date] |

| Depositor Name | [Enter name] |

| Deposit Amount | [Enter amount] |

| Payment Method | [Enter method] |

| Receipt Number | [Enter number] |

Ensure you include a receipt number or reference code for tracking purposes. This can be generated automatically or manually, depending on the level of sophistication desired for your template.

To wrap up, provide space at the bottom for any additional notes or terms, if necessary. This helps personalize the template and adds flexibility for different types of deposits.

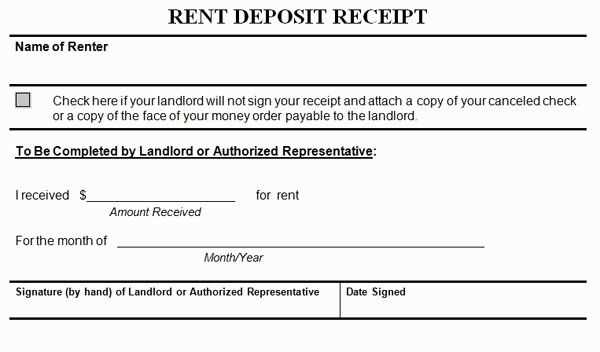

The deposit slip should include the account number where the funds will be deposited. Ensure this is accurate to avoid any processing errors.

List the total amount being deposited, specifying both the cash and check amounts separately. If depositing checks, write the check numbers to ensure they are properly credited.

Include the date of the deposit. This helps keep track of the transaction and ensures timely processing.

Provide your name or business name along with contact details if necessary. This helps the bank associate the deposit with the correct individual or business account.

Indicate the branch name or location if required by your bank. This adds a layer of verification for the deposit’s origin.

Some banks may require your signature on the deposit slip, so be sure to sign if instructed to do so.

Where to Find Free Templates for Deposit Receipts Online

You can easily find free deposit receipt templates on several trusted websites that offer a wide range of customizable options. These platforms cater to different business needs, allowing you to download or create deposit receipts quickly. Here are some great options:

1. Google Docs Templates

Google Docs offers a selection of free deposit receipt templates that are easy to use and customize. Simply search for “deposit receipt” in the Google Docs template gallery, and you’ll find multiple designs to suit your needs. These templates are ready to use, and you can edit them directly in your browser.

2. Microsoft Office Templates

Microsoft Office provides several free templates for deposit receipts available in Word or Excel format. You can access these by visiting the Microsoft Office templates website and searching for “deposit receipt.” Many of these templates are simple to adjust and print, making them an excellent choice for personal and small business use.

3. Template.net

Template.net has a large selection of free and premium deposit receipt templates. The free templates are downloadable in multiple formats, including Word, Excel, and PDF. This site allows you to filter templates based on your requirements, such as layout or style, so you can find the one that fits your purpose.

4. Canva

Canva offers free deposit receipt templates that you can fully customize with its easy-to-use design tools. While some of the templates may require a subscription for premium features, many options are available for free. Canva’s drag-and-drop interface helps you design receipts with your business’s logo, colors, and other branding elements.

5. Vertex42

Vertex42 specializes in free Excel templates, including deposit receipts. You can download these templates and fill them out digitally or print them. These templates are ideal if you prefer using spreadsheets for accounting purposes.

6. Zoho

Zoho provides a free receipt template generator as part of its online tools. It allows you to create a deposit receipt from scratch or modify one of its pre-made templates. The platform also integrates with Zoho’s other accounting tools, making it a useful option for businesses already using Zoho services.

- Google Docs

- Microsoft Office

- Template.net

- Canva

- Vertex42

- Zoho

Start by tailoring the template to reflect the specifics of your deposit transaction. This includes adjusting the fields to show the exact amount deposited, the deposit date, and the method of payment (e.g., cash, check, bank transfer). Ensure that the template captures the deposit’s purpose, whether it’s for an account, rental, or service fee. Add any reference numbers or transaction IDs that help track the deposit, and include contact information for easy follow-up if needed.

Customize the Header and Footer

The header should clearly identify the entity receiving the deposit. Include the company or individual’s name, logo, and address. In the footer, add any necessary legal disclaimers, return policies, or terms related to the deposit. Make sure the footer space is reserved for any relevant messages you want to share with the customer, such as payment terms or next steps.

Incorporate Payment Details

Provide clear breakdowns of the payment method and any applicable taxes or fees. If applicable, include a breakdown of multiple payment methods or installments within the same receipt. This can help both you and the customer keep track of their deposit history. Customizing these fields can ensure the receipt serves as a helpful reference for both parties in future transactions.

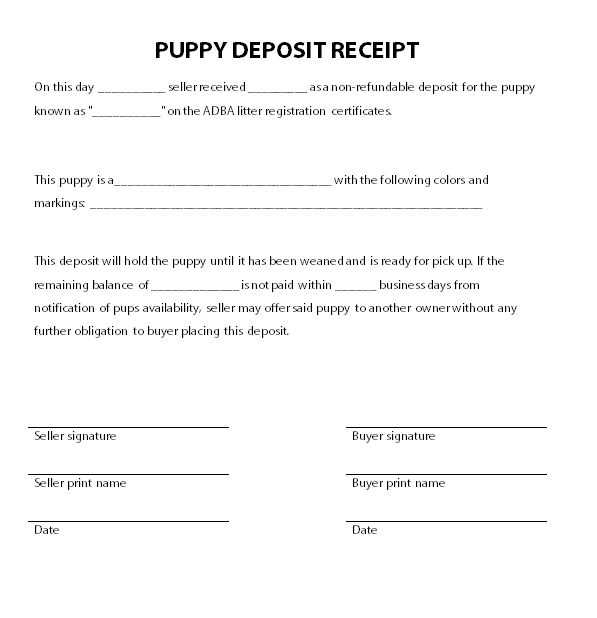

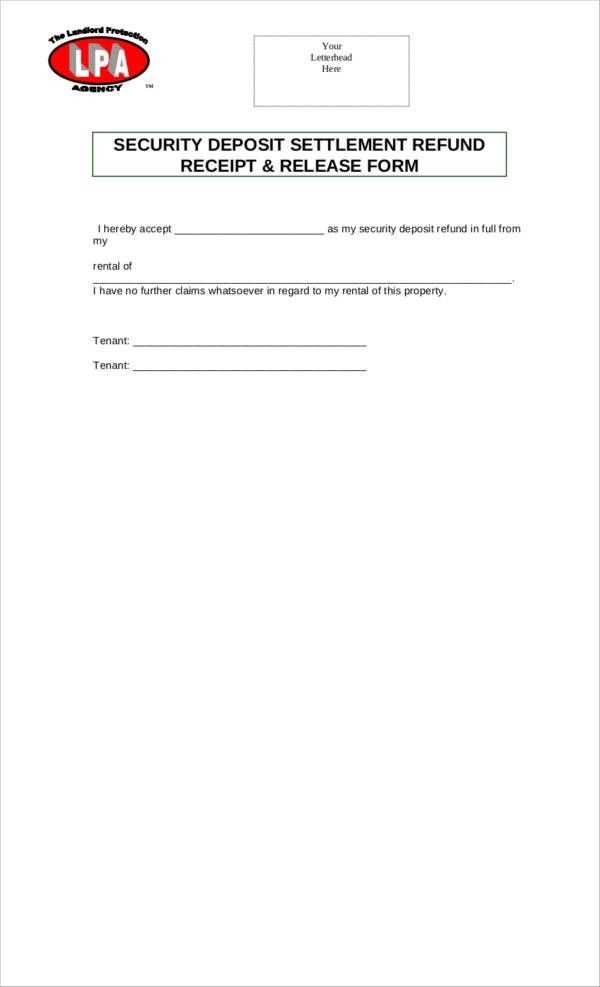

Clearly state the purpose of the deposit and the terms of its return. Ensure that both parties understand whether the deposit is refundable or non-refundable, and under what conditions it may be withheld. Be specific about the duration of the deposit agreement, including deadlines for returning the deposit if applicable.

Include detailed information about the parties involved, such as the name, address, and contact details of both the person receiving the deposit and the depositor. This helps avoid misunderstandings in case of disputes.

Clarify any fees or charges that may be deducted from the deposit, such as administrative costs or damage fees, and specify the procedure for refunding the balance, if applicable. This ensures transparency and prevents any potential conflicts.

State the legal jurisdiction under which the deposit agreement is governed. This provides clarity on the laws that will apply if a dispute arises. It is important to consider local laws regarding deposits to ensure compliance with legal requirements.

Make the terms easy to understand, avoiding ambiguous language. The deposit receipt should be clear and concise to ensure that both parties are on the same page. If necessary, consult a legal professional to ensure that the receipt meets local regulations and protects both parties.

Organize receipts by categorizing them based on type and date. Create separate folders for each category, such as “Business Expenses,” “Personal Purchases,” and “Tax-Related.” Use digital or physical storage solutions depending on your preference, but make sure to keep everything consistent for easy access.

Digital Organization

If you prefer digital storage, scan or photograph paper receipts and store them in a cloud service. Use folder structures like “2025 > January > Business” to easily locate records. Label each file clearly with the date and category, e.g., “2025-01-15_Business_Meeting.” Consider using receipt management apps that automatically categorize and store receipts for you.

Physical Organization

For physical records, use accordion folders or file boxes with labeled sections for each month and category. Store receipts in these sections immediately after receiving them, avoiding clutter. A simple filing system will save time during tax season or when reviewing expenses later on.

Regularly back up your digital records to prevent loss. Set reminders every few weeks to review and update your filing system. This ensures everything remains organized and accessible when you need it.

For creating a deposit receipt, it’s key to focus on clear structure and simplicity. Include essential details like the deposit amount, date, payer’s name, and a brief description of the transaction. Ensure that the document is easily understandable and professional. A good template should have a section for both the payer and recipient’s details, followed by a confirmation statement of the deposit. Keep it concise but detailed enough to serve as a reference for both parties. Add a space for signatures, if necessary, for validation. Always double-check that all information is accurate to avoid future discrepancies.

Consider using available free templates online to save time. These templates are customizable and provide a solid starting point. They include most of the basic fields you’ll need, and you can adjust them according to your specific requirements. Downloading a template ensures consistency in formatting, which is particularly useful for frequent transactions.

If you are working with digital receipts, ensure that the format supports easy printing and sharing. Many tools allow you to convert your receipt into a PDF, making it easy to distribute electronically or keep as a record.