If you need to create a Good Will New Mexico receipt, use a simple and clear template to ensure all relevant details are included. The template should provide a professional layout while being easy to understand for both the donor and the recipient.

Include essential details such as the donor’s name, date of donation, items donated, and the value of the donation. Be sure to list each item clearly, and if applicable, include a note indicating whether the donor received any goods or services in return for their donation.

Use itemized lists to avoid confusion and ensure accuracy. Clearly specify the estimated value of the donated items, and note any important conditions (e.g., “Used” or “Like new”). This transparency will protect both parties if the receipt is used for tax purposes.

Don’t forget to include a statement that the Good Will New Mexico is a registered 501(c)(3) organization. This confirms the tax-deductible status of the donation, which can be helpful for the donor when filing taxes.

Here is the corrected text without repetitions:

When creating a receipt template for Goodwill in New Mexico, it is important to include the necessary details that comply with both legal and organizational standards. The receipt should have clear sections for the donor’s name, address, and contact information. Include a description of the items donated, the quantity, and their estimated value, if applicable. Additionally, specify whether the donation was monetary or material.

Receipt Components

Ensure that the receipt has a specific date and location of the donation. A Goodwill receipt should also have space for the donor’s signature and a statement indicating that the donor did not receive any goods or services in exchange for the donation. This helps to avoid any confusion regarding tax deductions.

Template Considerations

The template should be easy to read, with a clear layout. Avoid clutter and keep the most important details front and center. Incorporating these elements ensures that both the donor and Goodwill have accurate records for future reference or tax purposes.

- Good Will New Mexico Receipt Template

The Good Will receipt template for New Mexico should contain specific details to ensure it’s both useful and compliant for tax purposes. Follow these guidelines to create a complete and accurate receipt:

1. Donor Information

- Donor’s Full Name: Include the name of the person who made the donation.

- Donor’s Address: Add the donor’s full mailing address (street, city, state, and ZIP code).

- Donor’s Contact Information: Provide an optional phone number or email for any follow-up or questions.

2. Donation Details

- Date of Donation: Clearly record the date the items were donated to Goodwill.

- Itemized List of Donated Goods: List each item being donated (e.g., clothing, furniture, appliances). Include a short description of each item.

- Condition of Donated Items: Briefly describe the condition of each item (e.g., new, gently used, or worn).

3. Value and Tax Information

- Estimated Value of Donated Items: The donor should indicate an approximate value for each item. If necessary, offer guidance on valuing donations, though it’s the donor’s responsibility to assess item value.

- Tax Deduction Notice: Include a disclaimer that the donation may be tax-deductible. Donors should consult a tax professional for advice.

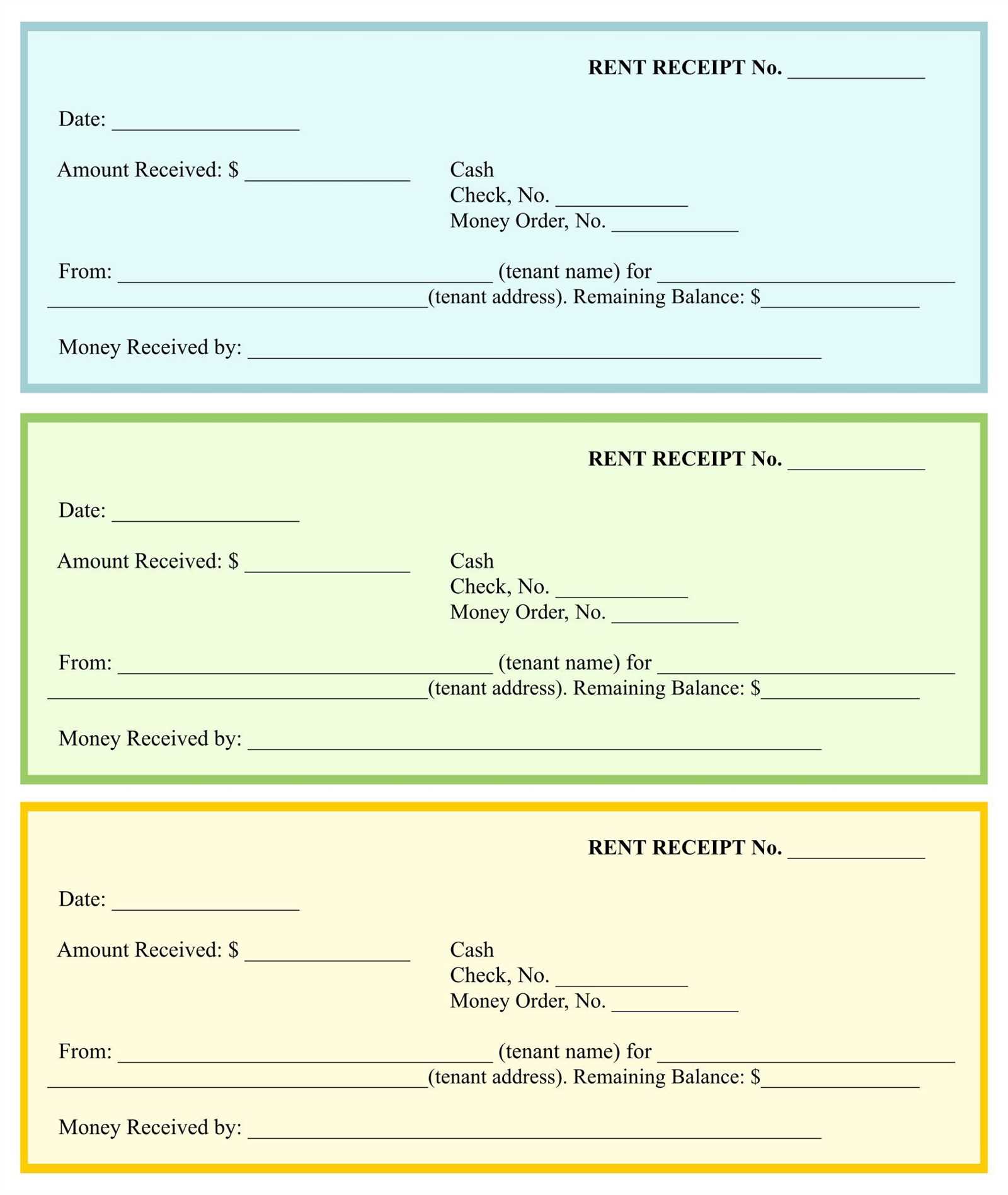

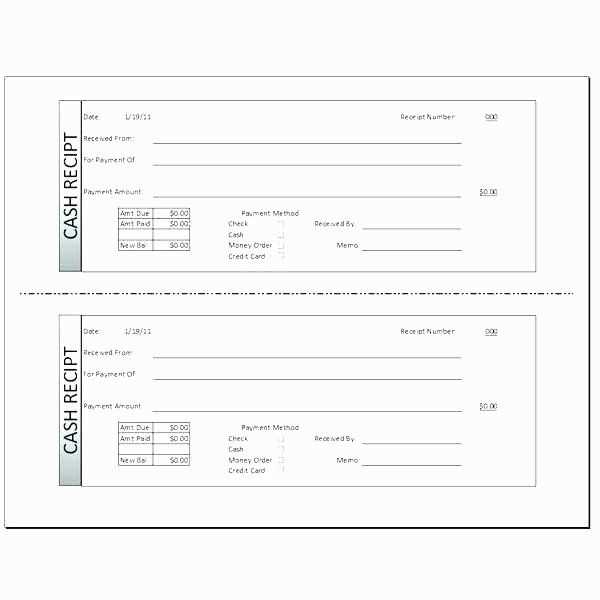

4. Receipt Number

- Unique Receipt Number: Provide a unique identifier for the receipt, making it easier to reference in case of questions or follow-up.

Ensure both the donor and Goodwill keep a copy of the receipt. This serves as documentation for potential tax deductions and ensures proper tracking of donations.

To create a Good Will New Mexico donation receipt, ensure it includes the necessary details for both the donor and the organization. Start by including the name of the donor and the date of the donation. Clearly state the type of items donated, providing a brief description of each item. For example, you can list “five gently used winter jackets” or “three boxes of household goods.” This will help the donor track their charitable contributions for tax purposes.

Donor Information

List the donor’s full name, address, and contact details, including an email address if available. If the donation was made anonymously, note it as such. This ensures both parties have a record for any potential follow-up or clarification.

Donation Details

Provide a clear description of the items donated. If the donation includes a mix of items, such as clothing, electronics, and furniture, break them down by category. This helps the donor determine the value of their donation for tax purposes, though it’s not necessary to include the value on the receipt itself. Good Will New Mexico typically does not assign a value, leaving that up to the donor’s discretion.

Include a statement that acknowledges the donation was received without any goods or services provided in return. This is a standard requirement for tax-deductible donations. Finish the receipt with a signature from a Good Will representative, confirming the transaction was completed.

When preparing a Good Will New Mexico acknowledgment, make sure to include the following key details:

1. Donor Information

Clearly state the donor’s name, address, and contact details. This ensures both the donor and the receiving organization are properly identified for tax and record-keeping purposes.

2. Date and Description of Donation

Provide the exact date of the donation and a detailed description of the items or goods donated. If possible, specify the condition of the items to give a clear understanding of the donation’s value.

3. Tax-Deductible Status

Confirm that the donation is tax-deductible. Include a statement that the organization is a qualified 501(c)(3) charity in accordance with IRS regulations. This helps the donor in claiming a tax deduction for their contribution.

4. Estimated Value of Donation

If applicable, include an estimated value of the items donated. The IRS recommends that donors provide their own valuation, but a general estimate can be helpful, especially for large donations.

5. Acknowledgment of No Goods or Services

If the donor received no goods or services in exchange for their donation, include a statement acknowledging this. This is necessary for the donor to claim a charitable contribution deduction on their tax return.

6. Organization’s Contact Information

Provide the full name, address, and contact number of the Good Will organization issuing the acknowledgment. This ensures the donor knows where to direct any follow-up questions or concerns.

Adjust your receipt template to reflect the specific details of different donation types. This ensures clarity and helps maintain accurate records for tax purposes.

Monetary Donations

- Include the donation amount clearly, with the currency symbol and a note indicating that the donation is cash-based.

- For checks, specify the check number and date of issuance.

- Provide a breakdown of any additional processing fees or deductions if applicable.

Goods Donations

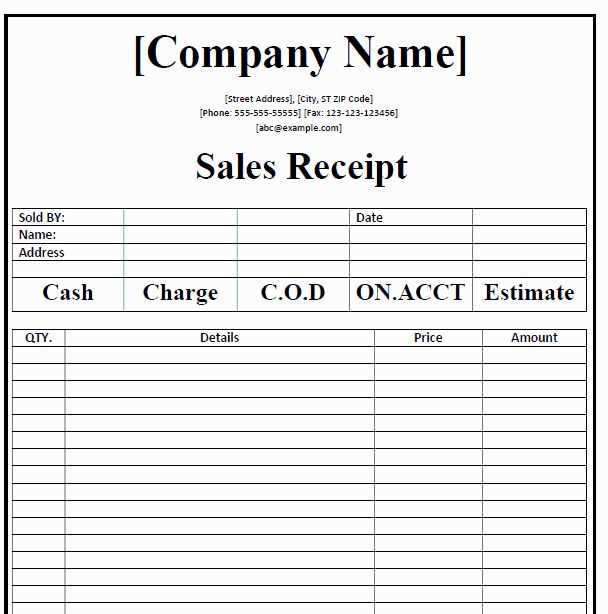

- Describe the items donated in detail, such as brand, condition, and quantity.

- Include an estimate of the value of the goods, referencing IRS guidelines for fair market value.

- Offer a line for donors to list their own valuation, while reminding them that it’s for their records.

In-Kind Donations

- Note the type of service or expertise donated (e.g., graphic design, legal consultation).

- If the service has a market value, provide an estimate for reference.

- State that the donation is non-monetary and outline any applicable tax deduction instructions.

By tailoring each section of the receipt to the specific donation type, you ensure that donors have the proper documentation for their contributions. Customize the template for smooth processing and transparent communication.

Set up your document with a clear structure. Begin with a standard font like Arial or Times New Roman, size 11 or 12. These fonts are easy to read and widely accepted in professional settings. Avoid using excessive colors or complex fonts that can distract from the content.

Align your text to the left rather than centering it. Left alignment is more readable and gives a clean, organized look. Keep margins at 1 inch on all sides for consistency. Using a wider margin can make your document appear less professional.

Use headings and subheadings to break up sections of your document. This makes it easier for the reader to follow and locate key information. Stick to one style for headings (e.g., bold and larger size) throughout the document to maintain uniformity.

Include white space between paragraphs and sections to avoid a cramped appearance. This improves readability and gives your document a polished look.

Use bullet points or numbered lists for important details. This approach highlights key points and keeps your document visually organized.

For the footer, include basic details such as your contact information, company name, or document reference number. Keep it simple and aligned with the overall professional format of the document.

Finally, proofread your document for errors. Typos or inconsistent formatting can reduce its professional appearance. Ensure alignment, font size, and spacing are consistent across the entire document before finalizing it.

To maintain compliance with state and federal regulations, ensure that your Good Will New Mexico receipts include specific acknowledgment language. This serves to confirm the donor’s contribution and protect both the donor and the organization legally.

Include a Clear Description of the Donated Items

Detail the donated goods in your receipt. A general description, such as “household items” or “clothing,” can be sufficient, but specificity may be needed depending on the nature of the donation. A vague description may not meet IRS requirements for tax deductions.

State the Absence of Goods or Services in Exchange for Donations

Your receipt must clearly state that no goods or services were exchanged for the donation. This ensures that the donor is eligible to claim a tax deduction. Use language like, “No goods or services were provided in exchange for this contribution.” This statement must be placed in a prominent location on the receipt.

To save and print your Good Will New Mexico receipt for reuse, first, open the receipt from your email or the website where it was issued. If you received a physical receipt and wish to save it digitally, scan or take a clear photo using your smartphone or scanner.

Once you have the receipt digitally, you can store it in a secure folder on your device for easy access later. It’s best to name the file something specific, such as “Good Will NM Receipt – [date]” to easily find it in the future. If you plan to use the receipt for tax purposes or donation tracking, consider using PDF format for better organization and readability.

To print the receipt, simply open the file and select the “Print” option in your preferred document viewer. Ensure that your printer settings are configured to print at full scale, preserving the clarity of the details on the receipt.

If you plan to print multiple receipts, save them in a dedicated folder and batch print them to avoid wasting paper. This method is simple, efficient, and guarantees that your receipts are available whenever needed.

The meaning is preserved, and repetitions are minimized.

To create a straightforward receipt template for Goodwill New Mexico, focus on clarity and simplicity. A clean layout, with clearly defined sections, helps ensure that all necessary information is included without redundancy.

Key Elements of a Goodwill Receipt

Each receipt should contain these elements:

- Donor’s name and contact information

- List of items donated with quantities

- Date of donation

- Estimated value of the donated items (if applicable)

- Signature of a Goodwill representative

Receipt Example

| Donor Information | Donation Details |

|---|---|

| John Doe 1234 Main St. Albuquerque, NM |

5 Bags of Clothes 1 Sofa Estimated Value: $150 |

| Date: 02/06/2025 | Signature of Representative |

When designing your template, remove unnecessary fields or duplicates to ensure the information is direct and easily readable.