If you’re looking to create a tax receipt for donations, using a template is the easiest way to ensure all the necessary details are included. These receipts help donors claim tax deductions and should follow legal guidelines. A good template will include key information such as the donor’s name, the donation date, the amount, and a statement confirming that no goods or services were provided in exchange for the donation.

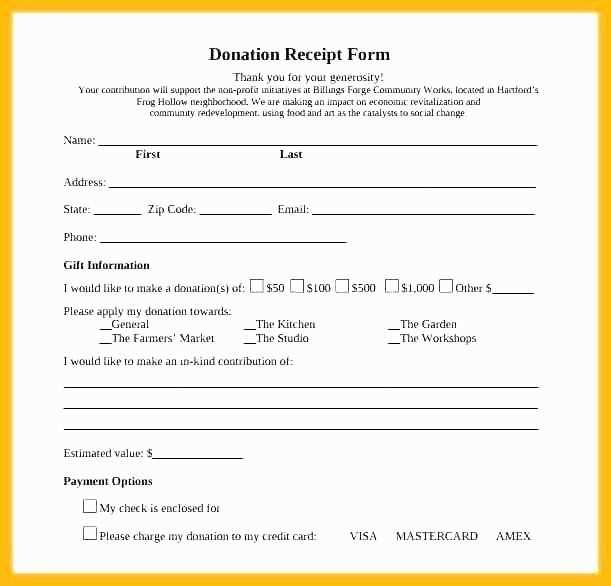

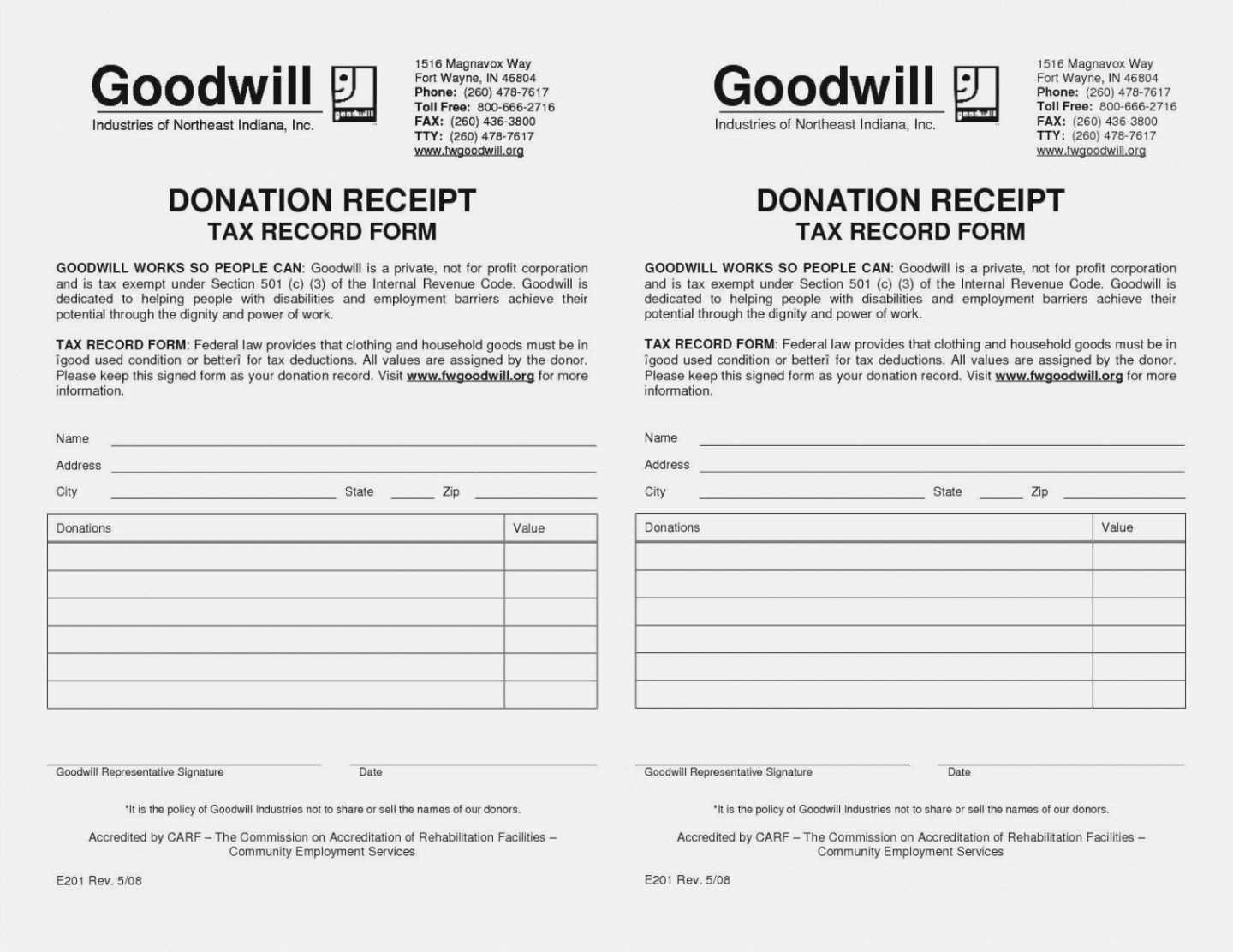

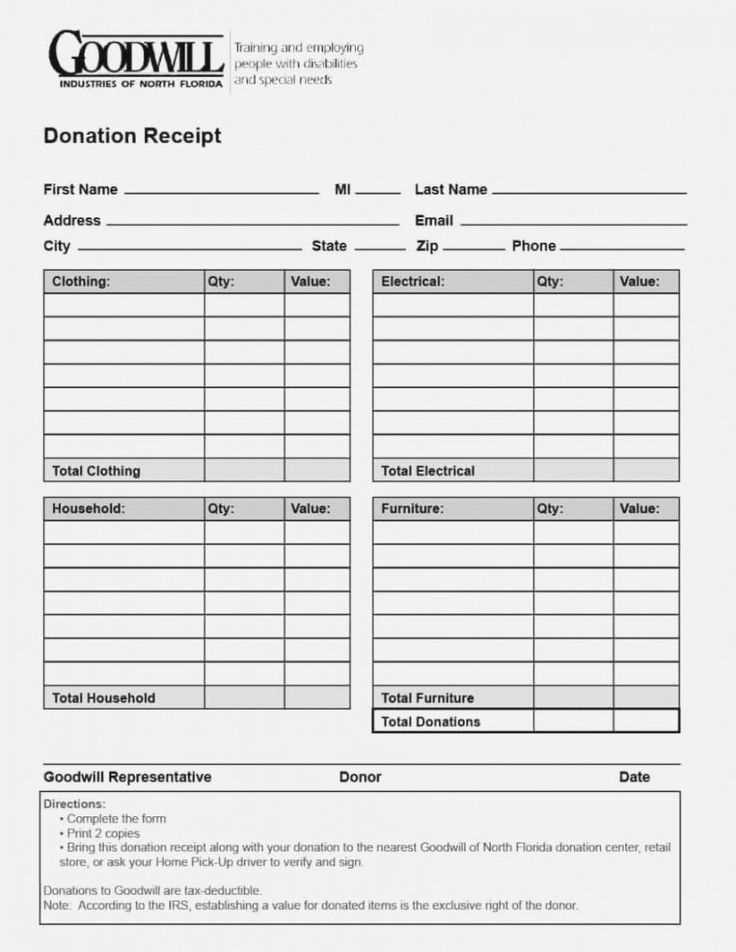

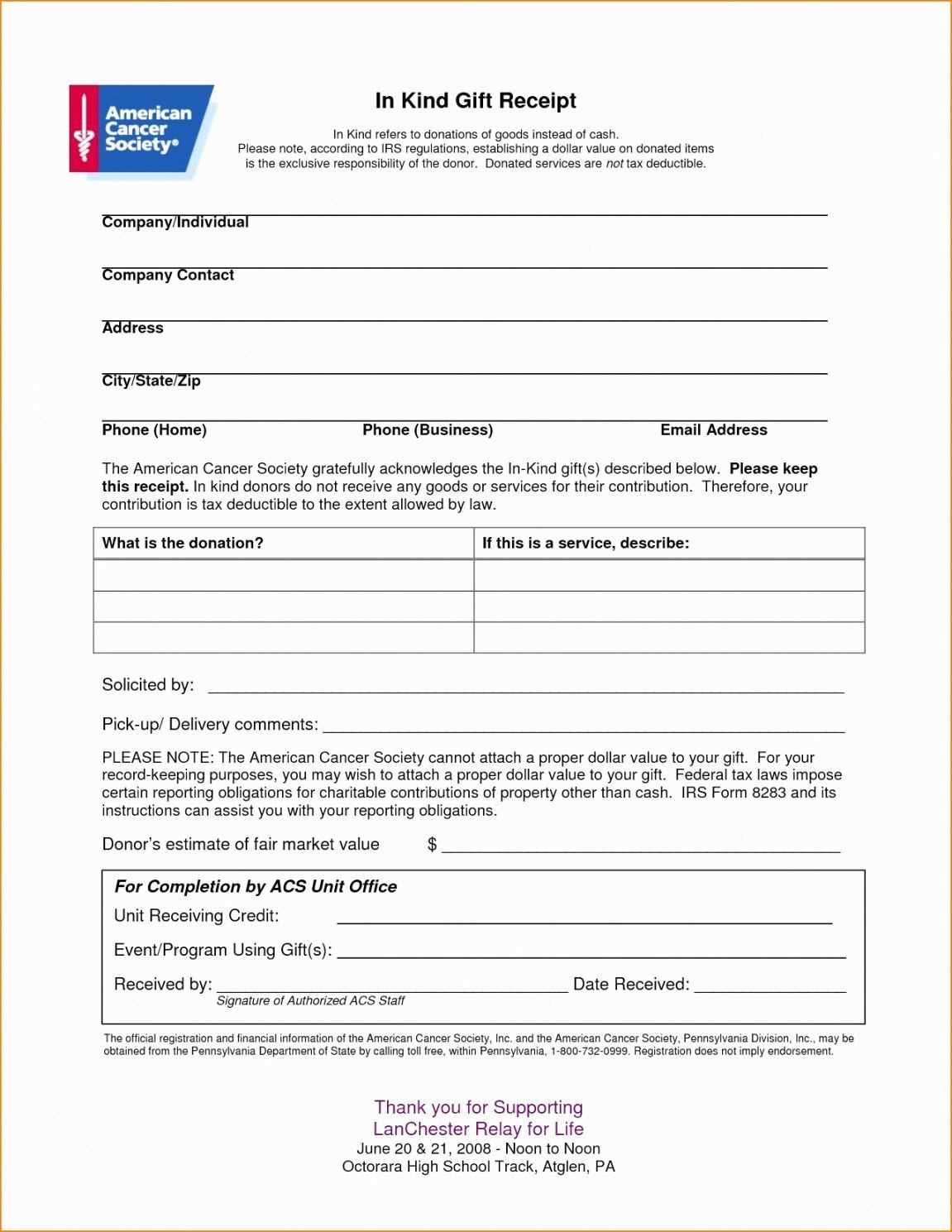

Choosing a template with clear sections for each piece of information simplifies the process for both you and your donor. It is essential to include a statement about your organization’s tax-exempt status, along with your official tax ID number, to make the receipt valid for tax purposes. Be sure to tailor the template to your organization’s specific needs, whether it’s for cash, check, or in-kind donations.

A well-designed template can save time and reduce errors. Using a reliable format ensures consistency and helps maintain trust with donors. With various options available, it’s worth investing time in finding or customizing a template that works for your organization’s specific requirements.

Here are the corrected lines with reduced repetition:

Ensure your donation receipt clearly states the donor’s name, the donation amount, and the date of the contribution. Specify the nonprofit organization’s details and tax identification number (TIN). Mention whether the donation was monetary or in-kind.

If applicable, include a statement that the donor did not receive any goods or services in exchange for the donation. This statement confirms the full donation is eligible for tax deduction purposes. Acknowledge the donor’s contribution without unnecessary repetition of phrases or redundant wording.

Check that the wording on the receipt matches your organization’s requirements and complies with local tax laws. Double-check the accuracy of figures and ensure all necessary information is clearly presented for tax purposes.

- Tax Receipt for Donations Templates

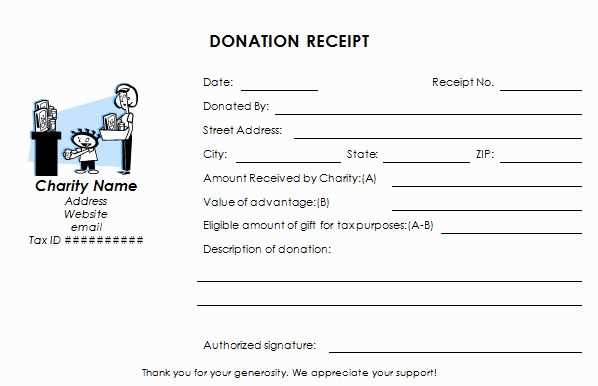

Start with a clear format. Include the charity’s name, address, and registration number. Add the donor’s full name, donation amount, and the date of donation. If applicable, specify whether the donation is cash or goods. A concise statement confirming no goods or services were provided in exchange for the donation is necessary for compliance.

Template Elements

Each template should have the following sections clearly displayed: the charity’s details, the donor’s details, and the donation specifics. Use consistent formatting to make it easy for the donor to identify the important information quickly. A reminder to keep the receipt for tax filing purposes can also be helpful.

Digital or Paper

Consider providing both options. A downloadable PDF or an email version is convenient for digital donors. If printing is preferred, ensure it is legible and formatted for easy filing. Both formats should meet legal requirements and allow donors to use them when filing taxes.

Designing a tax receipt template for charitable donations requires careful attention to both legal requirements and donor needs. Follow these steps to create a streamlined template that is clear and compliant.

Include Required Information

Ensure that your template includes all the necessary details for both legal and practical purposes. These elements should be present:

| Information | Description |

|---|---|

| Charity Name | Include the full legal name of your organization. |

| Donation Amount | State the exact amount donated or the fair market value of goods donated. |

| Donation Date | Clearly specify the date when the donation was received. |

| Donor Information | Include the name and contact details of the donor. |

| Tax Identification Number (TIN) | Provide the TIN or EIN of your organization for tax purposes. |

| Statement of No Goods or Services Provided | For donations over a certain threshold, indicate whether anything of value was received in return. |

Use Clear, Professional Layout

A clean design ensures the receipt is easy to understand. Use simple fonts and avoid clutter. Make sure that each section is clearly labeled, and leave space between each part of the receipt for easy reading. Consider using a header with your organization’s logo to maintain professionalism.

Ensure your donation tax receipt includes the following key details to comply with regulations and provide clarity to the donor:

- Donor’s Name: Clearly display the name of the individual or organization making the donation.

- Date of Donation: Specify the exact date the donation was received, as this impacts tax deduction eligibility.

- Donation Amount: List the total monetary value of the donation. For in-kind donations, include a description of the items and their estimated value.

- Organization’s Details: Include the name, address, and registration number of the charitable organization, as well as any tax-exempt status information if applicable.

- Statement of No Goods or Services Received: Confirm that the donor did not receive anything in exchange for the donation, or specify what was received if applicable.

- Signature: The receipt should be signed by an authorized representative of the organization.

Additional Information for In-kind Donations

- Description of Donated Items: Provide a clear and detailed list of items donated, especially for non-cash donations.

- Estimated Fair Market Value: For non-cash donations, include a reasonable estimate of the fair market value of the items donated.

For monetary donations, include fields for the donation amount and payment method. You should also add the transaction ID to track the payment for reference. This information is vital for both donor records and tax reporting.

In case of in-kind donations, your template should have a description section for the items received, along with their estimated value. Including a note that the donor is responsible for determining the fair market value will ensure clarity on both sides.

For recurring donations, add a section specifying the frequency (monthly, quarterly, etc.) and include the total amount contributed over a specific period. This helps donors verify their contributions for tax purposes.

For fundraising events, include details about the event, such as the event name, date, and location. You can also list any additional benefits or items the donor may have received, such as tickets or merchandise, to ensure the contribution is accurately reflected.

| Donation Type | Required Fields |

|---|---|

| Monetary | Donation amount, payment method, transaction ID |

| In-kind | Item description, estimated value, donor’s responsibility |

| Recurring | Frequency, total donation amount |

| Fundraising Event | Event details, additional benefits received |

Make sure to fill in all the required information accurately. Missing details, such as the donor’s full name, donation amount, or date, can lead to confusion and may even invalidate the receipt for tax purposes.

Incorrect Valuation of Non-Cash Donations

If the donation involves non-cash items, ensure you specify the correct fair market value. Donors are responsible for appraising these items, but it’s essential to indicate that they must provide their own valuation. Failing to do so could complicate the receipt’s validity.

Omitting Required Statements

Donation receipts must include specific legal statements. For example, confirm that no goods or services were exchanged in return for the donation, if applicable. Leaving this out may lead to compliance issues for both the donor and the organization.

- Ensure the receipt mentions the tax-exempt status of the organization if applicable.

- List any goods or services provided in exchange for donations, with a description and value.

Always double-check that the template is in line with local laws and tax requirements. Templates that don’t reflect current tax regulations can cause complications during audits or tax filings.

Ensure that donation receipts meet the legal requirements of your country or region. For tax purposes, receipts should clearly state the donor’s name, the donation amount, and the date it was made. If the donor received anything in return, such as goods or services, note the fair market value of those items on the receipt. This helps differentiate between a charitable gift and a transaction. Always include a statement confirming that no goods or services were provided, if applicable.

Double-check that the receipt includes the registered charity’s name, address, and tax ID number (or equivalent). This is necessary for donors to claim their tax deductions. If you’re a registered charity, keep records of all issued receipts and donations. This helps to ensure compliance in case of audits. It’s also crucial to issue receipts only for legitimate donations, avoiding any discrepancies that could lead to legal issues.

For larger donations, it’s common to request additional documentation, like a written acknowledgment, which further outlines the value of the donation. Ensure receipts are signed and include an official stamp if required. By following these guidelines, you help protect both your organization and your donors, ensuring transparency and compliance with tax laws.

For downloading donation tax receipt templates, you have both free and paid options, depending on your needs and preferences. Free resources are widely available online and cater to simple requirements. Paid resources often offer more customization and additional features, which can be helpful for organizations with specific needs.

Free Resources

There are several websites offering free templates. Some popular ones include:

- Template.net – Offers a variety of free donation receipt templates in different formats such as Word and PDF.

- Microsoft Office Templates – Provides easy-to-use donation receipt templates for Word and Excel, perfect for personal or small organization use.

- NonprofitEasy – Features downloadable free templates tailored to nonprofit organizations that need a quick solution.

Paid Resources

If you need more specialized templates, you can opt for paid resources, which usually come with more features and customization options:

- Zoho – A paid service that offers fully customizable donation tax receipt templates, which integrate seamlessly with their accounting software.

- Canva Pro – Offers premium, customizable donation receipt templates that can be easily adjusted for any donation size or type.

- TemplateMonster – Provides professional templates that offer additional functionalities such as automated tax receipt generation for larger operations.

How to Structure a Tax Receipt for Donations Template

Begin with a clear title at the top of the receipt: “Tax Receipt for Donation.” This helps the donor immediately recognize the purpose of the document.

Key Elements to Include:

- Donor Information: Include the donor’s full name, address, and contact details.

- Organization Details: Add the name of the organization, tax-exempt status, and contact information.

- Donation Information: List the donation amount, date of donation, and method (cash, check, or online transfer).

- Purpose of Donation: Specify if the donation is for a particular project or program within the organization.

- Tax Identification Number (TIN): Ensure that the organization’s tax ID is clearly stated for tax reporting purposes.

Additional Considerations:

- Thank You Message: Include a brief message acknowledging the donor’s contribution and its impact.

- Non-Cash Donations: For in-kind gifts, describe the item(s) donated along with their estimated fair market value.

- Legal Disclaimers: If required, include any necessary legal language regarding the receipt’s validity for tax purposes.

Ensure that the template is simple and clear, making it easy for both the donor and the organization to record the transaction accurately.