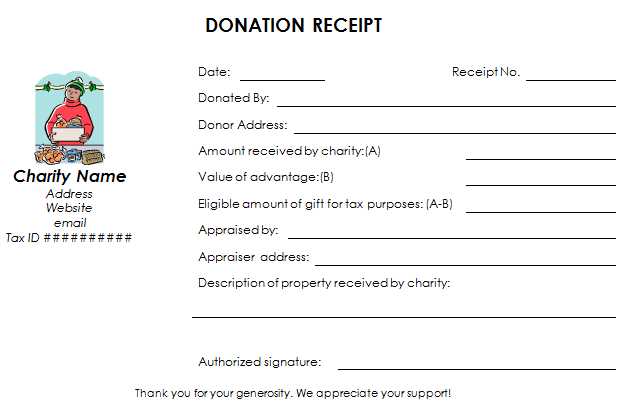

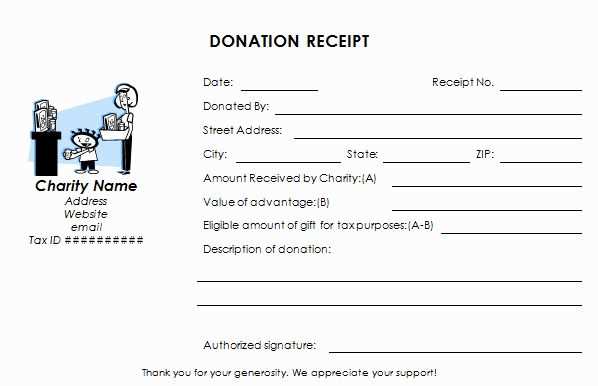

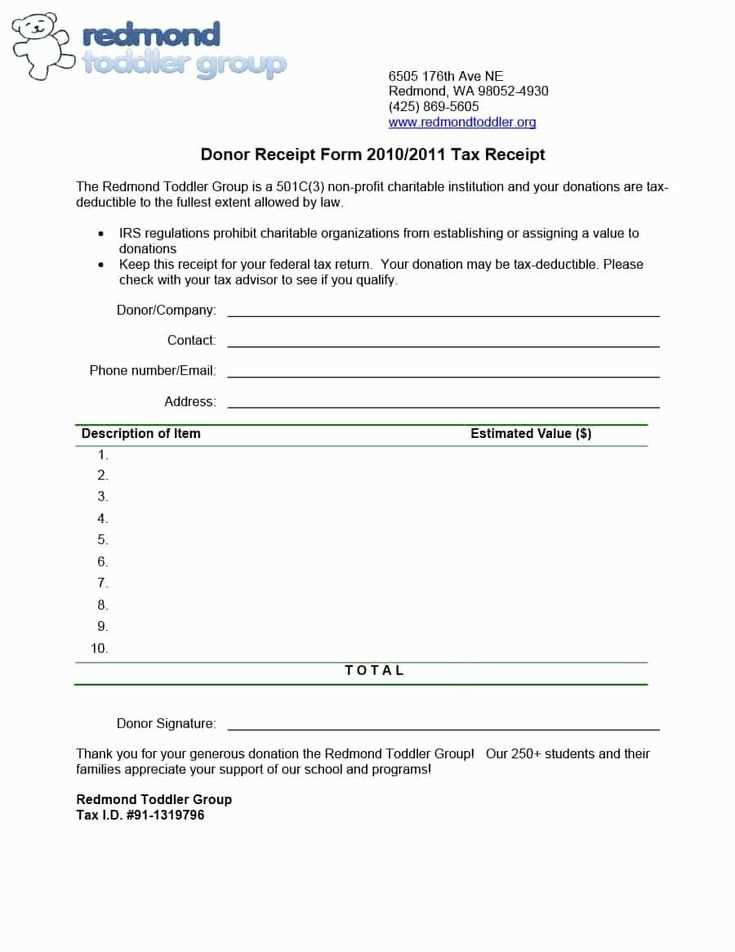

Creating a non-cash donation receipt template for your PTA is straightforward and crucial for proper documentation. A well-structured receipt serves as proof for donors and ensures transparency for your organization. Ensure the template includes the donor’s name, a description of the donated item(s), and an estimated value for tax purposes.

Start with key details: Include the PTA’s name and address, along with the donor’s information. Clearly state that the donation is non-cash and include a brief description of the item(s). For the valuation, provide an honest estimate or a statement noting that the donor is responsible for determining the value.

Finish with important signatures: Ensure that a PTA representative signs the receipt. Include a space for both the donor and the PTA to acknowledge the receipt. This helps maintain clear records and can be useful in case of audits or future inquiries.

Here’s the revised version with duplicates removed:

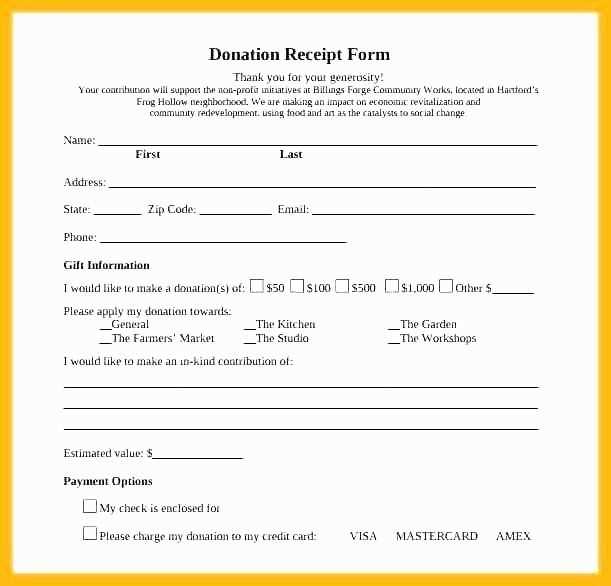

When creating a non-cash donation receipt, clarity is key. Begin by stating the name of the organization, the donor’s name, and the date of the donation. Include a brief description of the donated items or services. Ensure you list the estimated value of the donation, specifying whether it’s a single item or a group of items.

- Donor’s Name: John Doe

- Organization’s Name: PTA Fundraising Group

- Date of Donation: February 7, 2025

- Description of Donation: 10 used laptops, 5 mobile phones

- Estimated Value: $1,200

Ensure that the receipt includes a statement confirming that no goods or services were provided in exchange for the donation. This is crucial for tax purposes.

At the end of the receipt, include the organization’s contact details, including phone number and email. This allows the donor to reach out if there are any questions or discrepancies regarding the donation.

- Non-Cash Donation Receipt Template for PTA

For a PTA (Parent-Teacher Association) to properly acknowledge non-cash donations, a clear and concise receipt template is necessary. This document should include all relevant details, ensuring compliance with IRS standards and maintaining transparency for donors. Below are key elements to include:

Key Elements of a Non-Cash Donation Receipt

- Donor Information: The full name, address, and contact information of the donor.

- PTA Information: The PTA’s name, address, and contact information.

- Description of Donated Items: A detailed list of items donated. Include quantity, condition, and any distinguishing features that help identify the items.

- Date of Donation: The exact date when the donation was made.

- Fair Market Value: A good faith estimate of the current fair market value of the donated items. This may require the donor’s input or appraisals for high-value items.

- Statement of No Goods or Services: A statement clarifying that the donor did not receive any goods or services in exchange for the donation, unless applicable.

How to Issue the Receipt

Ensure that the receipt is provided at the time of donation or soon after. It should be signed by an authorized PTA representative to confirm the donation’s acceptance. For record-keeping, provide a copy of the receipt to the donor, and store a copy for the PTA’s financial records. This will help in both tracking donations and providing the donor with proof for tax purposes.

Ensure clarity and transparency when formatting a receipt for non-cash donations. The donation receipt should list the donor’s name, the date of the donation, and a detailed description of the items donated. It’s crucial to avoid assigning a dollar value to the donated items, as this is the donor’s responsibility, not the PTA’s. Instead, use language like “Item(s) donated” or “Description of items.” If possible, attach a list of all items donated, with their condition and quantity, to avoid misunderstandings.

Key Elements to Include

- Donor’s full name and address.

- Date of the donation.

- Description of the donated items (without valuation).

- Statement confirming no goods or services were provided in exchange.

- PTA’s name and contact information.

End the receipt with a signature from a PTA representative and their title for authenticity. This ensures the donor has proper documentation for tax purposes, and the PTA complies with legal requirements. Keep a copy for your records as well.

Make sure to include the donor’s full name and address for accurate record-keeping. Specify the date of the donation to establish the timeline. Clearly identify the donation item(s), including descriptions and estimated value, ensuring that all contributions are listed separately. Include a statement that confirms no goods or services were provided in exchange for the donation, especially if this is required for tax purposes. Don’t forget to include the organization’s name, address, and tax identification number (TIN) for verification. Lastly, the signature of an authorized representative from the organization should be added to validate the receipt.

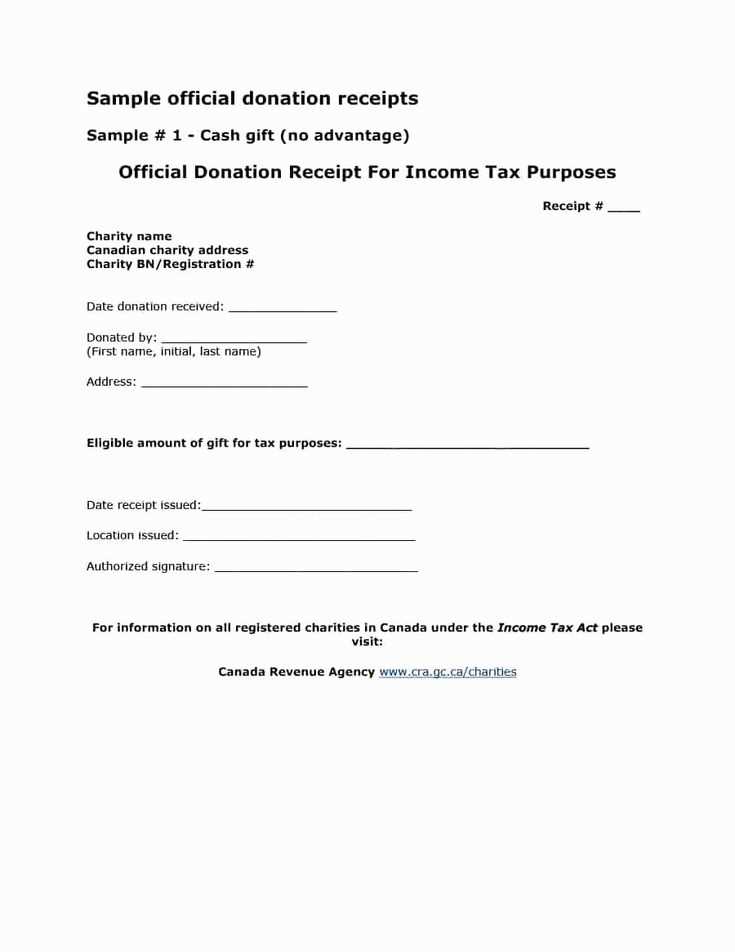

Ensure that non-cash donations are properly documented to meet IRS requirements. The receipt should detail the description of the items donated, their fair market value, and the date of the donation. Donors are responsible for determining the value of their non-cash items; however, organizations can provide guidelines to help assess value.

Required Information on the Receipt

Each receipt should include the following details:

- The name of the organization receiving the donation.

- The date of the donation.

- A description of the donated items without stating their value.

- A statement that no goods or services were provided in exchange for the donation (if applicable).

Donor Responsibilities

Donors must provide a written record of any single non-cash donation valued over $500, including a detailed list of donated items. For donations over $5,000, donors must obtain a qualified appraisal to substantiate the value of the donation. These documents are required when claiming deductions on tax returns.

To value donated goods accurately, begin by assessing the condition of each item. Items in new or nearly new condition should be valued higher than those showing wear or damage. Categorize the goods, such as clothing, electronics, or furniture, to apply appropriate valuation standards for each category.

Determine the Fair Market Value

Calculate the fair market value (FMV) by researching the price for similar items in the local market or online platforms. For example, if you receive a used smartphone, check websites like eBay or Craigslist to determine its value in comparable condition. You can also consult thrift store pricing guides or donation value guides published by organizations like Goodwill or Salvation Army.

Consider Depreciation

Keep in mind that items like electronics or furniture lose value over time. Factor in depreciation to reflect the current worth of these items. A general rule is that electronics may lose about 20-30% of their original value each year, while furniture can depreciate faster, especially if it’s older or shows signs of use.

Use a Donation Value Guide

Many nonprofit organizations publish donation value guides that help estimate the value of common household items. These guides provide suggested values based on the condition of the items, making it easier to assign a fair value without over- or underestimating the worth.

| Item | Condition | Estimated Value |

|---|---|---|

| Used Clothing (shirt) | Good | $5 – $10 |

| Electronics (smartphone) | Fair | $50 – $100 |

| Furniture (sofa) | Worn | $100 – $200 |

Once you have gathered the necessary data, record the valuation for each item. Make sure to include a brief description of the item’s condition and the method used to determine its value. This ensures the donor receives an accurate and justified receipt for their contribution.

Adjust the receipt layout based on the type of donor. For individual donors, ensure the donation amount is clearly displayed along with a personalized thank-you message. Include the donor’s name and date of donation to provide a personalized touch. For corporate donors, highlight the company’s name, address, and a summary of the donation. Incorporate relevant tax information and specific references to corporate matching policies if applicable. For large donations, add a section to detail the contribution’s impact, making the receipt feel more meaningful. This helps donors feel appreciated and valued for their support.

Include the donation method (e.g., check, credit card, bank transfer) and transaction ID for transparency. Ensure that any in-kind donations are described clearly, mentioning the estimated value of the donation. This can help both individual and corporate donors when they need to reference the donation for tax purposes. Customizing each receipt ensures donors receive the most relevant information while maintaining a professional and consistent format.

Store donation receipts in a secure, organized system to ensure easy access and compliance with regulations. Consider these practices:

- Use Digital Records: Scan all paper receipts and store them in a cloud-based system. This prevents loss and simplifies retrieval. Ensure files are backed up regularly.

- Label and Categorize: Create clear labels for each receipt by date, donor name, and donation type. Use folders or tags for better organization.

- Ensure Easy Access: Choose a system that allows easy search and retrieval. Digital folders with sorting options can save time during audits or inquiries.

- Follow Retention Guidelines: Retain donation receipts for the recommended duration, typically 3 to 7 years, depending on your jurisdiction’s tax laws.

- Implement Role-Based Access: Limit access to donation receipts to authorized personnel only. This ensures privacy and prevents unauthorized modifications.

- Regularly Update the System: Periodically review and update the storage system. As your donor base grows, it is important to ensure the system remains scalable.

All meaning remains intact, and unnecessary word repetition has been removed.

For a PTA non-cash donation receipt, clarity and accuracy are key. Start by listing the donor’s name and contact details. Specify the donated items, including their value, if possible, or indicate that the items were donated in-kind. Clearly state that the receipt does not have a cash value. Include the date of the donation, the PTA’s information, and the authorized signature of a representative. Ensure that the document follows any local legal requirements for charitable donations.

How to Structure the Donation Details

When detailing the donation, avoid unnecessary descriptions. Simply list the items donated, such as books, equipment, or services. For each item, mention the condition and estimated value, if applicable. If the value can’t be assessed, make it clear that the PTA is not assigning a monetary value to the donation. This ensures the document remains legally valid.