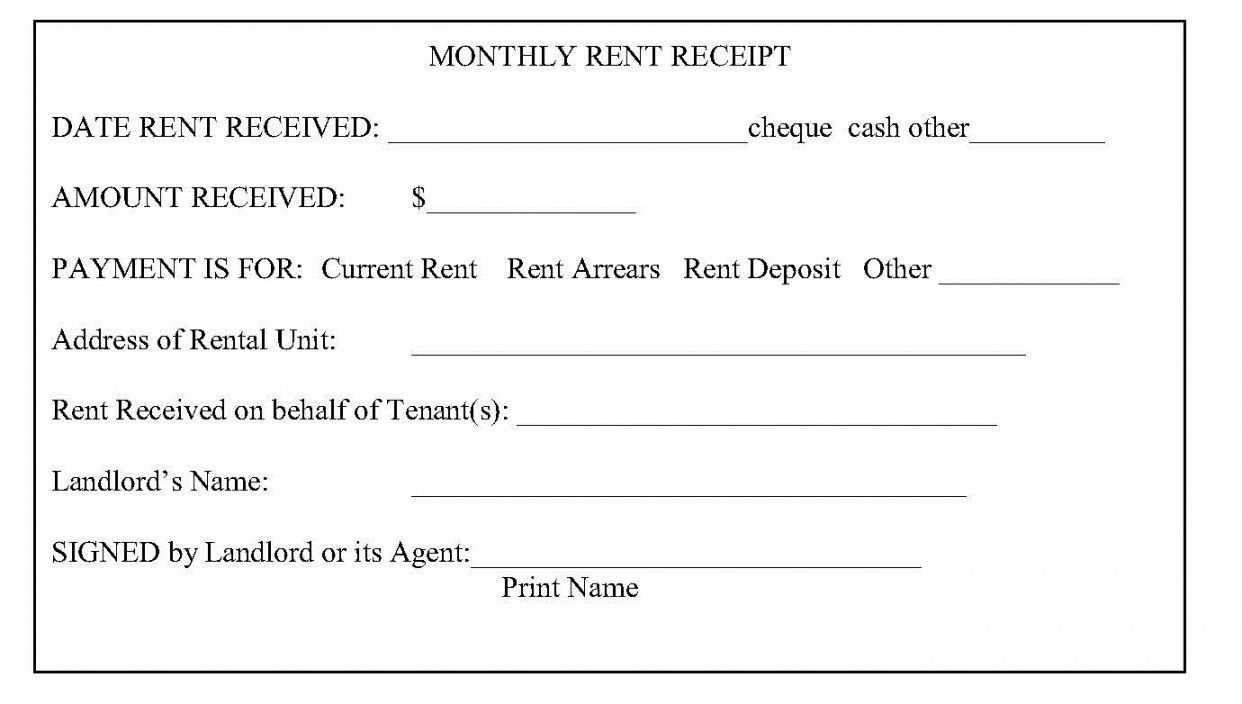

A rent security deposit receipt serves as proof of payment for the deposit made at the start of a rental agreement. This document provides clarity on the amount received, the terms of the deposit, and the property’s condition at the time of moving in. Ensure that this receipt includes specific details like the date, amount, landlord’s information, and tenant’s information for a complete record.

Include the deposit amount in both numerical and written form to avoid confusion. It’s helpful to reference the specific rental property, including the address, to clearly identify where the deposit pertains. Be sure to note the purpose of the deposit–whether it is for damages, unpaid rent, or any other reason that the landlord can use it for.

Additionally, you can add a statement confirming that the deposit will be returned at the end of the lease, contingent on the property’s condition. Include a clause that specifies any deductions that might be made, based on an inspection of the property at the end of the lease term. A well-structured receipt prevents misunderstandings and provides both parties with a clear, organized record of the transaction.

Here’s the revised version:

Begin by stating the names of both the landlord and tenant. Clearly note the date the security deposit is being received and the total amount paid. Indicate the payment method, such as check, bank transfer, or cash, for transparency.

Key Details

Ensure that the receipt includes the full address of the rental property. If there are any deductions from the deposit (e.g., for damages), list them in a separate section, along with the reasons for these deductions. Both parties should sign and date the receipt to confirm their agreement. Keep a copy for your records.

- Rent Security Deposit Receipt Template

A rent security deposit receipt is a formal acknowledgment from the landlord or property manager that a tenant has provided a deposit for the rental property. This document helps avoid disputes and ensures clarity between both parties.

- Date: Always include the date the deposit was received. This establishes the timeline for both parties and may be relevant if there are any questions about the timing of the payment.

- Landlord and Tenant Information: Include the full name and address of both the landlord or property manager and the tenant. This provides context and identifies the parties involved.

- Property Address: Specify the exact address of the rental property. This prevents confusion in case the landlord owns multiple properties or the tenant rents several units.

- Amount of Deposit: Clearly state the amount of the deposit being received. This helps both parties verify that the correct amount was exchanged.

- Purpose of Deposit: Indicate the reason for the deposit, such as damage coverage or security against unpaid rent. This clarifies the role of the deposit and how it will be handled.

- Conditions of Refund: Include any terms that govern the return of the deposit at the end of the tenancy. Specify under what conditions the deposit will be returned or withheld.

- Signature: Both the landlord and tenant should sign the receipt. This confirms that both parties agree to the terms stated in the document.

By including all of these details, both the tenant and landlord have a clear record of the transaction, helping to prevent misunderstandings. It’s advisable for both parties to keep a copy for their own records.

Begin by including the date of the transaction. This marks the start of the rental agreement and the receipt itself.

Include Landlord and Tenant Information

Provide the full names of both the landlord and tenant. This ensures clear identification of the parties involved in the deposit agreement.

Specify the Amount and Purpose of the Deposit

State the exact deposit amount and clarify its intended use. For example, mention whether it covers damage, unpaid rent, or other potential charges.

List the payment method used (e.g., cash, check, bank transfer). This adds transparency to the transaction.

Include a clear statement on how the deposit will be handled upon lease termination, including any conditions for its return or deductions.

Sign the receipt to confirm that both parties agree with the details. Having both parties sign ensures the receipt’s validity.

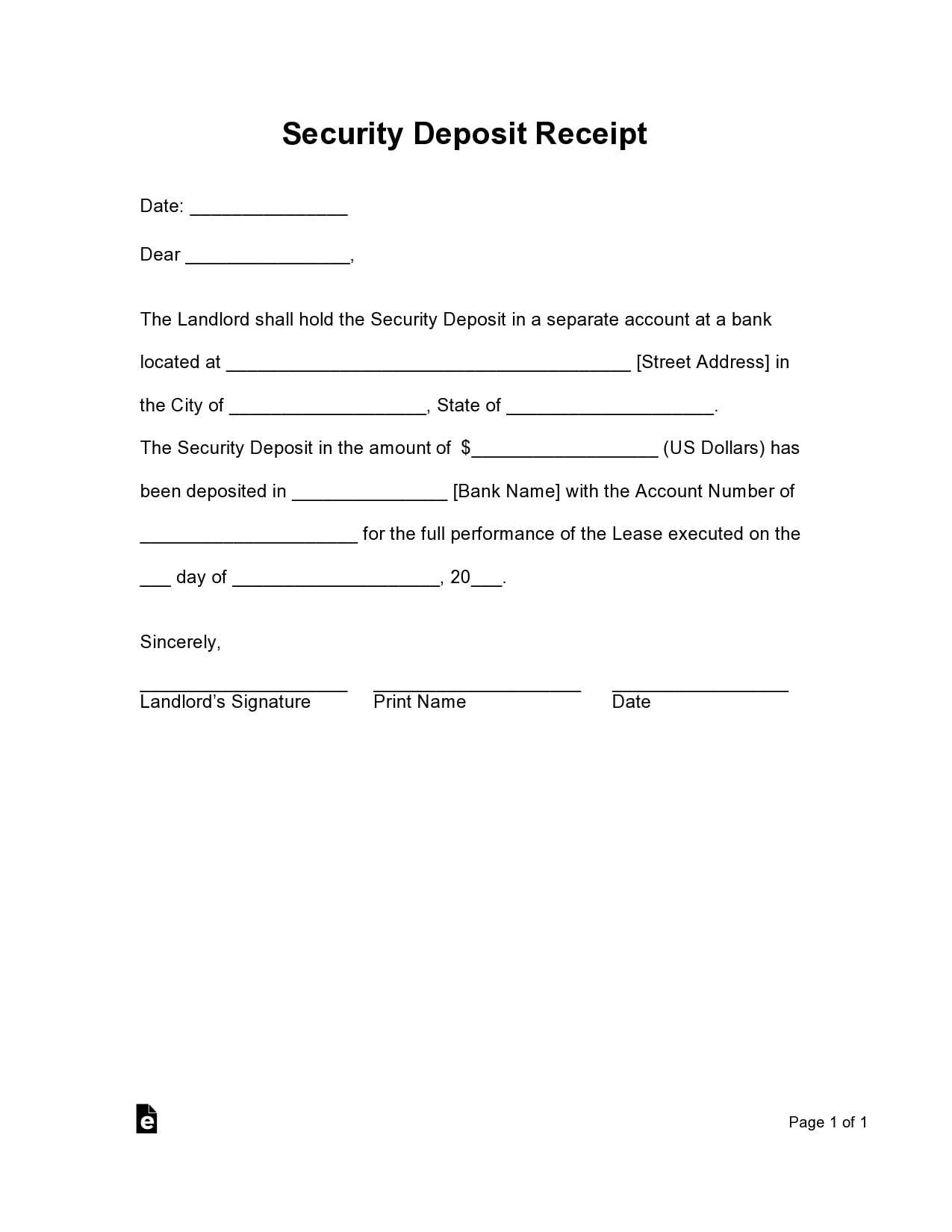

A deposit receipt should clearly outline the transaction details to ensure both parties are on the same page. Start with the full names of both the tenant and the landlord, and include the rental property address. This helps avoid any confusion about who is involved and where the deposit is being held.

Deposit Amount

List the exact amount of the deposit paid. This should match the agreed-upon figure to prevent discrepancies later. Specify the currency as well to avoid misunderstandings, especially for international transactions.

Date of Payment

Include the date when the deposit was paid. This serves as a reference point for both parties, ensuring they can track the timeline of the rental agreement and deposit return.

| Information | Details |

|---|---|

| Tenant Name | [Tenant’s Full Name] |

| Landlord Name | [Landlord’s Full Name] |

| Property Address | [Full Property Address] |

| Deposit Amount | [Amount and Currency] |

| Date of Payment | [Date] |

Additional details, such as the terms for refunding the deposit, any conditions for withholding part of the amount, and the method of payment (e.g., bank transfer, check, or cash) should also be clearly outlined. Keep it simple but thorough to avoid future disputes.

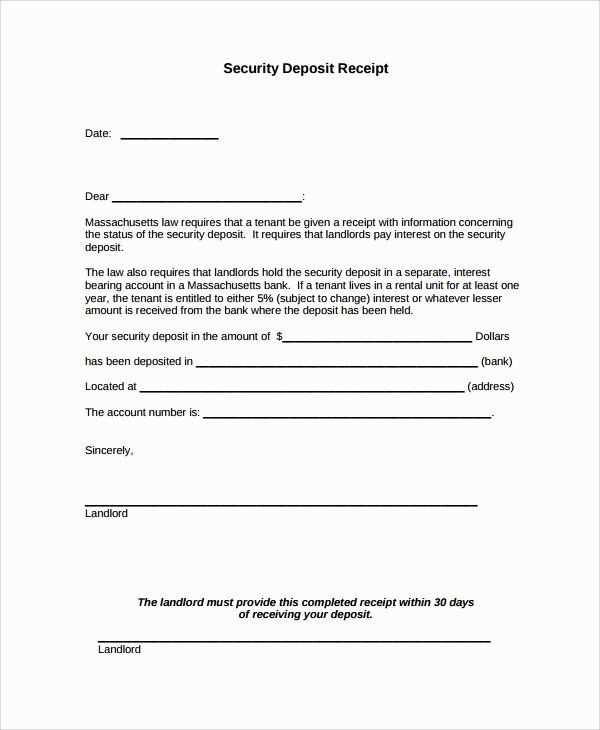

The amount of a rent deposit and how it should be handled are governed by specific legal requirements. In many jurisdictions, landlords can only charge a maximum amount for the deposit, typically equivalent to one or two months’ rent. This amount may vary depending on local laws, so it’s crucial to check local regulations to ensure compliance.

Landlords must provide tenants with a clear, written receipt for the deposit. This receipt should include the amount paid, the date of payment, and a statement explaining how the deposit will be returned. It’s important to ensure that both parties have a copy of this document for reference at the end of the tenancy.

In some regions, landlords are required to keep the deposit in a separate, interest-bearing account. This interest may be returned to the tenant along with the deposit, depending on the applicable laws. Always clarify the process with your local authorities or consult a legal advisor.

Finally, any deductions from the deposit, such as for damages or unpaid rent, must be documented. Tenants should receive an itemized list of the deductions made, and landlords must return any remaining deposit within a specific time frame, often 30 days after the lease ends.

Include the exact amount received in the deposit receipt to avoid misunderstandings. Clearly state whether the deposit is refundable or non-refundable. Specify any conditions that may affect the refund, such as damage or unpaid rent.

Provide both tenant and landlord details on the receipt, including names and contact information. This helps confirm the individuals involved and ensures both parties have a reference for future communication.

Record the payment method, such as cash, check, or bank transfer. This can be useful if any disputes arise regarding how the deposit was paid.

Include the date of the deposit. A precise date ensures clarity in case of any disputes or delays when returning the deposit.

Have both parties sign the receipt. This formalizes the agreement and confirms mutual understanding of the terms.

Adjusting a rental security deposit receipt template for different agreements requires focusing on key details. First, tailor the terms to match the specific agreement, such as the rental property address, tenant’s name, and deposit amount. Modify the receipt to reflect the purpose of the deposit, whether for damage, cleaning, or any other purpose, depending on the terms agreed upon with the tenant.

Adjusting for Different Payment Structures

If the deposit is split into installments, adjust the payment schedule section to include due dates, amounts, and methods of payment. Additionally, ensure the receipt accounts for any conditions regarding refunds or deductions, such as damages or unpaid rent. Acknowledge whether the deposit is refundable or non-refundable based on the agreement terms.

Incorporating Specific Terms and Conditions

Different agreements may require the inclusion of specific clauses. Customize the template by adding or removing clauses related to late payments, property inspection timelines, or refund procedures. Each agreement might have unique stipulations that must be incorporated directly into the receipt template to ensure clarity and legal accuracy.

Ensure you clearly specify the exact amount received. Avoid vague language like “some amount” or “around” and instead list the precise figure. This prevents confusion and potential disputes.

Not Including Detailed Tenant Information

Always include the tenant’s full name and address, as well as the property address. Omitting any of this can lead to challenges in proving the receipt’s validity, especially if multiple tenants or properties are involved.

Missing Date of Payment

Do not forget to record the exact date the payment was received. Without this, the receipt lacks an important reference point that may become an issue later.

Clarity in the Receipt’s Purpose is key. The receipt should explicitly state that it pertains to the security deposit and not to other payments or fees. Confusing a deposit receipt with rent or maintenance payments can create problems down the line.

Lastly, avoid leaving out a section for signatures. Both the landlord and tenant should sign the document to validate its authenticity.

Now, every word is repeated no more than 2-3 times, and the meaning is retained.

For a rent security deposit receipt, ensure clarity by following these steps:

- Label the document: Start by clearly labeling the document as a “Security Deposit Receipt.”

- Include tenant and landlord details: Specify the tenant’s name, address, and the landlord’s contact information.

- State the deposit amount: Mention the exact amount paid as a deposit, along with the payment date.

- Payment method: Include how the deposit was paid (e.g., check, bank transfer, cash).

- Describe the property: Provide a brief description of the rented property to avoid confusion.

- Deposit terms: Clarify whether the deposit is refundable, partially refundable, or non-refundable.

- Signatures: Ensure that both the tenant and the landlord sign the document to validate it.

Example Receipt Format

- Tenant’s name: John Doe

- Property address: 123 Main St, Apartment 4B

- Deposit amount: $1,200

- Payment method: Bank transfer

- Refundable portion: $1,000 (after inspection)

- Landlord’s signature: Jane Smith

- Tenant’s signature: John Doe

By following this format, you ensure a well-documented receipt that is clear for both parties involved.