To ensure clear documentation of equipment and property issued within the Department of Defense, use the Dod hand receipt template to track and confirm accountability. This template is a practical tool for both units and individual personnel. It allows for precise recording of items transferred, including serial numbers, descriptions, and the recipient’s details.

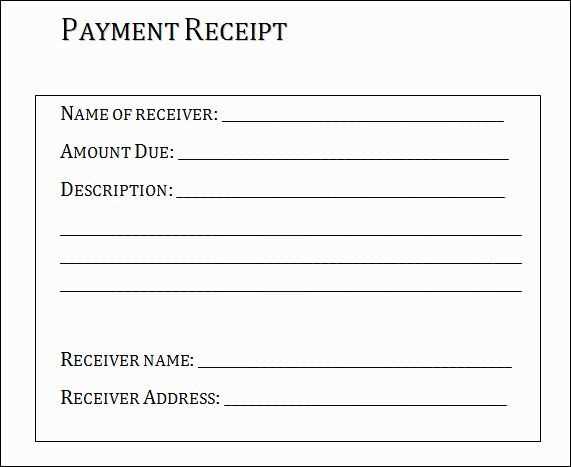

The template should include fields for the date of issue, item condition, and quantity, as well as an area for signatures from both the issuing authority and the receiving party. By filling out each section accurately, it becomes a reliable record that protects both parties in case of discrepancies or audits. Double-check the serial numbers and descriptions before signing to avoid mistakes that may lead to confusion later on.

Ensure that every hand receipt is filed correctly and stored in a secure location. This simple step prevents the loss of valuable property data. Regularly review and update these records, especially when items are returned or reassigned. The Dod hand receipt template is a key part of maintaining clear and organized accountability for government property.

Here’s a revised version of the plan with minimal repetition of words: Here’s a detailed plan for an informational article on the topic “DoD Hand Receipt Template” with six specific headings, formatted in HTML:

Focus on accuracy when filling out a hand receipt template. Ensure the equipment listed is clearly described, including serial numbers, model details, and condition reports. This avoids discrepancies and provides a clear record of asset transfers.

Use standardized formats provided by the DoD to maintain uniformity. These templates are designed to track government property effectively, ensuring that each item can be traced and accounted for during audits or asset reviews.

Check that all signatures are present where required. Missing signatures can delay the approval process and cause issues with accountability. Both the custodian and the hand receipt holder must sign off to verify the transfer of assets.

Maintain accurate dates on the template. Record both the date the property was issued and when it is due to be returned, as this impacts the status of the property and helps in planning for maintenance or replacement cycles.

Regularly update the hand receipt when assets are added, removed, or transferred. Keeping the document current ensures that inventory records are always up-to-date, which aids in seamless transitions during equipment assignments.

Provide additional notes or clarifications on the template, if necessary. Use the “Remarks” section to capture any special conditions, such as equipment restrictions or requirements for maintenance, ensuring no misunderstandings occur in the future.

Understanding the Purpose of the Receipt

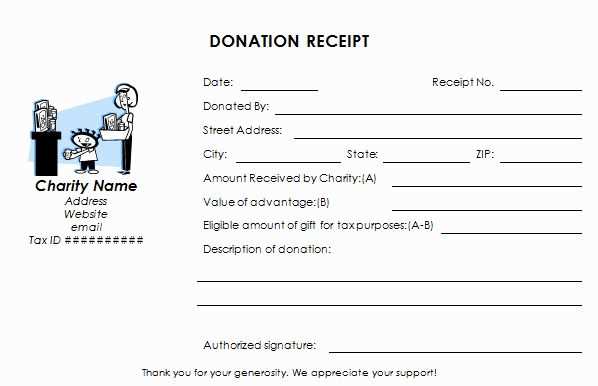

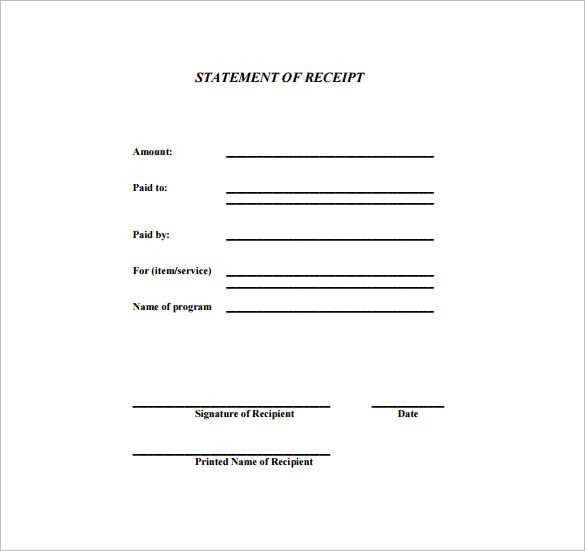

The receipt serves as an official document confirming the transfer of goods or services between parties. It provides both parties with a record of the transaction, ensuring accountability and transparency. This helps avoid disputes and serves as proof in case of audits or claims. Having a clear and accurate receipt is necessary for proper record-keeping and maintaining trust between the involved parties.

Key Functions of the Receipt

| Function | Description |

|---|---|

| Proof of Transaction | It verifies that the exchange took place, providing legal backing if needed. |

| Record for Financial Management | Receipts are important for budgeting, accounting, and tax purposes. |

| Protection for Both Parties | It ensures that the buyer received the correct product or service, and the seller is compensated. |

| Warranty and Return Reference | Receipts often include information needed for returning or exchanging items under warranty. |

Why Accuracy Matters

Details on the receipt, such as item descriptions, pricing, and dates, are crucial for clarity. Mistakes can lead to confusion, causing unnecessary complications later on. Always ensure that all the details are correct, especially when issuing receipts for official or legal purposes.

Key Elements of a Hand Receipt

A hand receipt serves as a formal document to acknowledge the transfer or receipt of government property. It requires precise information for accurate tracking and accountability.

Item Description

Provide a clear and concise description of each item. This includes the item’s serial number, model, and any distinguishing characteristics that make it identifiable. It’s crucial to include details like condition and quantity to ensure accuracy in reporting.

Accountable Person

Include the name and rank of the individual responsible for the items. This section helps to assign accountability and ensures the right person is held responsible for the assets listed on the receipt.

Signatures

Both the issuing and receiving individuals must sign the hand receipt. This acknowledges that the transfer has occurred, and both parties accept responsibility for the items listed. The signature section should also include dates for accurate record-keeping.

Item Condition

Document the condition of each item at the time of transfer. This will serve as a reference if there’s a need for a future inspection or if disputes arise regarding the state of the items.

Location of Items

Specify where the items are stored or located at the time of receipt. This is particularly helpful in large operations where multiple locations are involved, ensuring proper inventory management.

Steps to Complete a Receipt

Begin by filling in the recipient’s information, including their name, address, and contact details. This is key to ensure the transaction is clearly documented.

Record the Items

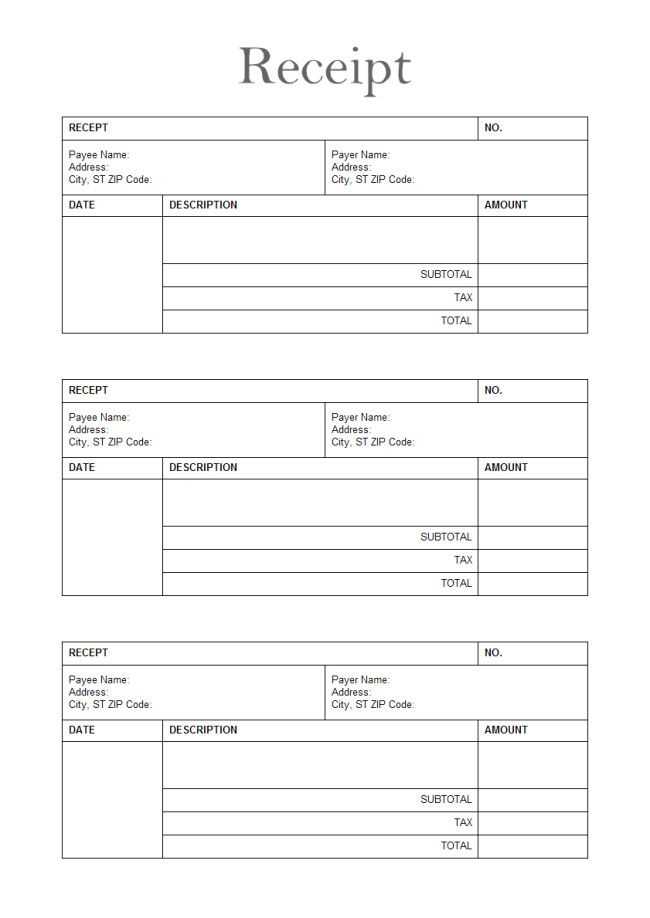

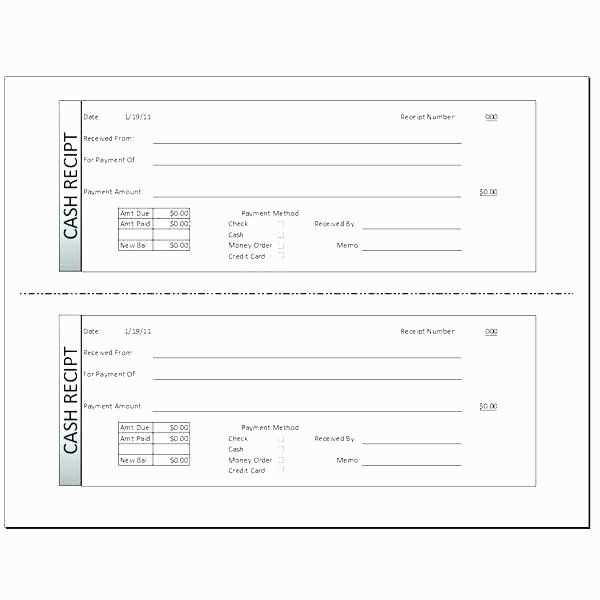

List each item or service provided. For each entry, include a brief description, quantity, unit price, and total amount. Be precise to avoid discrepancies later on.

Include Transaction Dates

Clearly indicate the date of the transaction to maintain an accurate timeline of events. This is especially important for future reference or audits.

Ensure the total amount is calculated correctly. Double-check for accuracy by adding the subtotals and tax before finalizing the receipt.

Sign and date the receipt to confirm that the transaction is completed. This signature serves as an acknowledgment of both parties involved.

Common Mistakes When Using Receipts

Ensure all information is correctly entered and legible. Mistakes in any of the details on the receipt can lead to complications in future processing or audits. Double-check the dates, item descriptions, and quantities.

Incorrect Date Entries

Entering the wrong date is a frequent error that can delay verification or cause confusion when reconciling receipts. Always verify the transaction date before finalizing the receipt.

Missing or Inaccurate Item Descriptions

Clearly describe the items listed. Avoid vague terms such as “miscellaneous” or “other.” Specificity is key to ensuring proper tracking of inventory and expenses.

- Ensure each item is properly identified with an accurate description.

- Check that quantities match the items received or purchased.

- Verify pricing details to ensure correctness.

Inaccurate item descriptions can also create issues with returns or warranty claims. Keep records clear and complete to avoid unnecessary confusion.

Failure to Include Vendor Details

Always include the name, address, and contact information of the vendor. Missing vendor details can result in difficulties when referencing the receipt later or contacting the vendor for clarification or returns.

Not Recording Payment Methods

Specify the method of payment, whether it’s cash, credit, or another form. This helps keep an accurate record of financial transactions and avoids discrepancies.

Not Filing Receipts Properly

Even the most well-printed receipts are useless if they are not stored correctly. Implement an organized filing system to keep track of all documents efficiently. Digital storage options can enhance organization and reduce the risk of misplacing receipts.

Tracking and Auditing Hand Receipts

Track hand receipts consistently by assigning unique identifiers for each transaction. Maintain a detailed record of all items issued, including serial numbers and descriptions. This will help quickly identify discrepancies when auditing. Ensure that each receipt is signed by the individual receiving the items, with dates clearly marked for accountability.

Establish Clear Procedures

Set up a regular schedule for reviewing hand receipts. This includes verifying physical items against the records and conducting random checks to ensure accuracy. Implement a process for reporting any missing or damaged items and updating the receipts promptly to reflect these changes.

Utilize Inventory Management Software

Leverage inventory management software to streamline tracking. These systems can automate the process of auditing by flagging discrepancies and generating reports, making the process more transparent. The software should integrate with hand receipt records for seamless updates.

Perform periodic audits to cross-check the records with actual items in inventory. This can prevent any loss or misuse and keep records up to date. Having a dedicated team for this task ensures that discrepancies are caught early, minimizing potential issues.

Digital vs. Paper Receipts: Pros and Cons

Digital receipts offer immediate access, helping users quickly retrieve transaction details without the hassle of physical storage. They can be organized and searched through apps or emails, making it easier to track purchases and manage records. Plus, they reduce paper waste, contributing to eco-friendly practices.

On the other hand, paper receipts provide a tangible record that doesn’t rely on electronic devices. This can be an advantage in situations where internet access or battery power is unavailable. Some users also prefer the simplicity of having a physical receipt for future reference.

Benefits of Digital Receipts

Digital receipts minimize clutter and streamline record-keeping. They are stored securely in apps or cloud services, reducing the risk of losing receipts or dealing with damaged paper. Additionally, digital receipts can be easily shared with others, such as for reimbursements or warranty claims, by forwarding emails or sharing files directly.

Advantages of Paper Receipts

Paper receipts don’t depend on technology and are accessible in any environment. They also serve as a physical reminder of purchases, useful for people who prefer offline documentation. Some retailers may also offer discounts or loyalty points through paper receipts, providing an added incentive for keeping them.