For anyone who wants to claim tax deductions on charitable contributions, a donation receipt is a key document. Make sure to include specific details about the donation to ensure it’s valid for tax purposes. The receipt should clearly outline the donor’s information, the charity’s details, and a description of the donation, whether it’s cash or property.

Provide an accurate date of the donation and mention whether any goods or services were received in exchange. If the donor received something in return, the receipt should indicate the fair market value of the goods or services provided. This helps to separate the actual donation from the exchange and ensures the donor can deduct only the charitable portion.

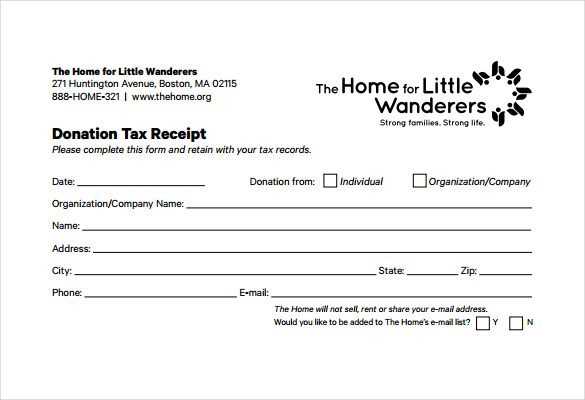

Keep the format clear and professional. Include your charity’s name, address, and tax identification number. If you can, offer a unique receipt number for record-keeping. By doing this, you maintain a transparent, organized system that both you and the donor can easily reference later.

Here’s the revised version:

For creating a tax-deductible donation receipt, it is crucial to include specific details that comply with tax regulations. Use the following template to ensure all necessary information is provided clearly and accurately.

| Field | Description |

|---|---|

| Donor’s Name | Full name of the person or organization making the donation. |

| Donation Amount | The exact value of the donation. If it’s non-cash, describe the donated item(s) along with an estimated value. |

| Organization’s Name | The full legal name of the charity receiving the donation. |

| Date of Donation | The date the donation was made. Ensure accuracy for tax records. |

| Tax-Exempt Status | A statement confirming that the organization is recognized as tax-exempt under IRS regulations, if applicable. |

| Statement of No Goods or Services | A clear statement that the donor did not receive any goods or services in exchange for the donation, unless applicable. |

| Organization’s Contact Info | Provide the charity’s address, phone number, and email for donor follow-up. |

This format ensures that all necessary information is included to meet the IRS requirements for a tax-deductible donation receipt.

- Tax Deductible Donation Receipt Template

To create a tax-deductible donation receipt, make sure it includes the necessary information for both the donor and the charity. Use the following structure for an effective and accurate receipt:

Key Components of the Receipt:

- Charity Information: Name of the organization, tax ID number, address, and contact details.

- Donor Information: Full name and address of the donor.

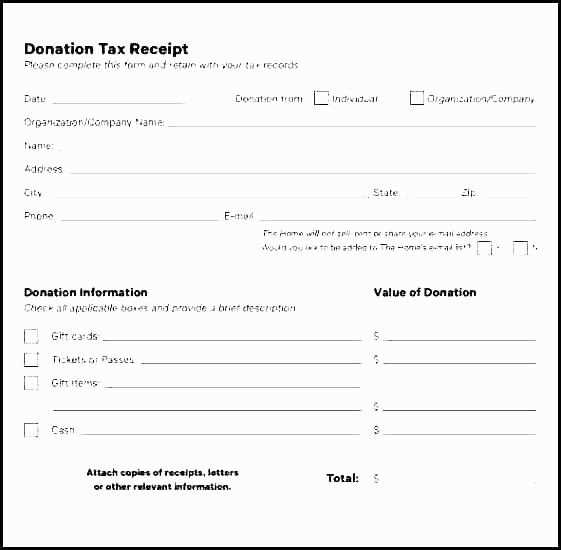

- Donation Details: Date of donation, description of the donation (whether cash, goods, or services), and the value of the donation (for non-cash items, a good-faith estimate is required).

- Declaration: A statement clarifying whether the donation is tax-deductible. Include a sentence like, “No goods or services were provided in exchange for this donation,” if applicable.

- Signature: A signature from an authorized person at the charity organization to validate the receipt.

Formatting Tips:

- Ensure the receipt is clear and easy to read, using a standard font and size.

- Include the charity’s logo at the top for added professionalism.

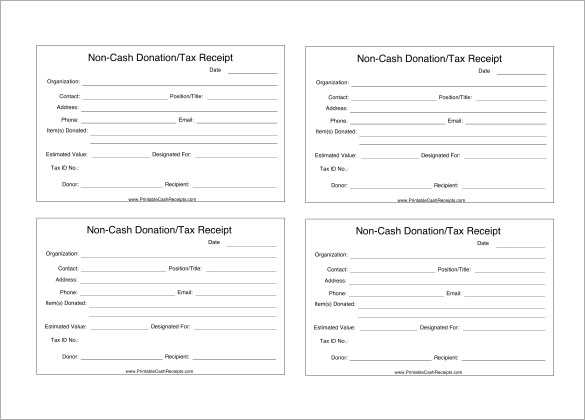

- For non-cash donations, provide an itemized list with descriptions and estimated values.

- Use simple, direct language and avoid unnecessary legal jargon.

By following this template, you will help both the donor and your organization maintain proper tax records while ensuring the donation receipt meets IRS requirements.

To create a basic tax deductible receipt, include the following key elements:

- Organization’s Name and Contact Information: List the full legal name of your organization, along with its address, phone number, and email address. This ensures that the recipient can easily contact you for any inquiries.

- Donor’s Name and Address: Include the full name and address of the donor. This is important for proper tax filing and record-keeping.

- Date of Donation: Specify the exact date the donation was made. This is crucial for both the donor’s and your organization’s tax records.

- Donation Description: Clearly describe the donation, including its nature and value. If it’s a monetary gift, list the amount. If it’s an in-kind donation, describe the item(s) and provide an estimate of their fair market value.

- Statement of Tax Deductibility: Add a statement indicating that no goods or services were provided in exchange for the donation, or if they were, provide a description of them and their fair market value. This clarifies the tax-deductible status of the donation.

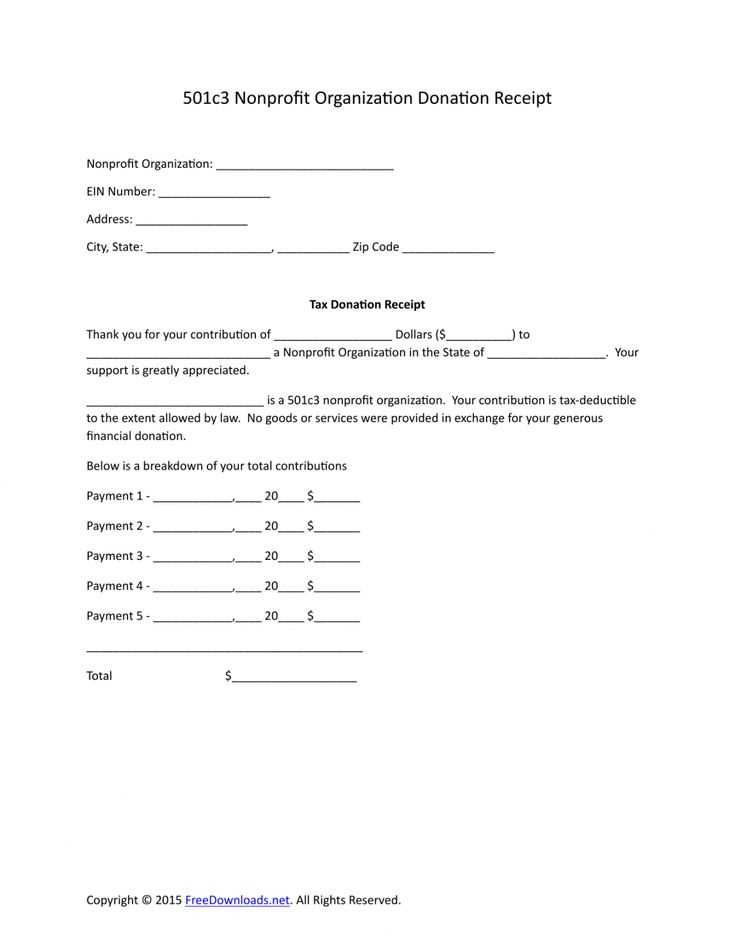

- Tax-Exempt Status: Mention your organization’s tax-exempt status, including the IRS identification number or charity registration number, if applicable. This assures the donor that their donation is eligible for tax deductions.

Example of a Basic Tax Deductible Receipt

Here’s a simple template:

- Organization Name: ABC Charity

- Contact Info: 123 Charity Lane, City, State, ZIP | Phone: (123) 456-7890 | Email: [email protected]

- Donor Name: John Doe

- Donor Address: 456 Donor Rd, City, State, ZIP

- Date of Donation: January 15, 2025

- Donation Description: $500.00 cash donation

- Tax-Deductibility Statement: No goods or services were provided in exchange for this donation.

- Tax-Exempt Status: ABC Charity is a 501(c)(3) tax-exempt organization, EIN 12-3456789.

Final Steps

Once the receipt is complete, provide it to the donor as soon as possible, ensuring that they have all the necessary information to claim their tax deduction. Keep a copy of the receipt for your own records.

Ensure your donation acknowledgment includes specific details for clarity and compliance. Start by providing the donor’s name and the donation date. Specify the amount donated and whether it was in cash, property, or goods. If the donation is non-monetary, describe the items in detail.

Tax-Exempt Status of the Organization

Clearly state the tax-exempt status of the organization, referencing the IRS determination letter or including the organization’s EIN (Employer Identification Number). This confirms the organization’s eligibility for tax-deductible donations.

Non-Receipt of Goods or Services

If the donor did not receive any goods or services in return for their contribution, explicitly mention this in the acknowledgment. If something was provided, include a description and estimate of the fair market value of that item or service.

Include a statement that the donor did not receive any quid pro quo benefits, making the donation fully deductible for tax purposes. This will help clarify the donor’s tax benefits and avoid potential misunderstandings.

Ensure the donation receipt includes the nonprofit’s legal name, address, and tax-exempt status. This confirms the legitimacy of the donation and provides essential details for the donor’s tax records. Include the amount or description of the donated property and a statement of whether any goods or services were provided in exchange for the donation.

The IRS requires a detailed description of the donated goods or services. For non-cash donations exceeding $500, the donor must include an itemized list along with a qualified appraisal for items valued over $5,000. This prevents potential disputes during an audit.

The receipt must explicitly state that the donation is tax-deductible. It should also clarify whether any benefits were provided to the donor in return for the donation, such as tickets or meals, and the fair market value of those benefits. If goods or services were given in exchange, subtract their value from the total donation amount.

| Required Information | Details |

|---|---|

| Nonprofit Name and Address | Include the full legal name and address of the organization. |

| Tax-Exempt Status | Clearly state the nonprofit’s 501(c)(3) status or other applicable tax-exempt designation. |

| Donation Amount/Description | Provide a detailed description or amount of the donation made. |

| Goods/Services Provided | If applicable, disclose any benefits received in return and their value. |

| Donor’s Signature | While not always required, a signature from the donor may be useful for record-keeping. |

By adhering to these guidelines, donors will have the necessary documentation to claim tax deductions, and organizations will comply with the IRS regulations, reducing the risk of complications or audits.

Customize the donation receipt template to reflect the specifics of the donation type. For example, for monetary contributions, include the exact dollar amount donated, the date of the donation, and the method of payment (credit card, check, etc.). If the donation is in-kind, such as goods or services, list the items or services donated along with their estimated fair market value.

- Monetary Donations: Clearly specify the donation amount and include the payment method used. This helps the donor understand the exact contribution and ensures clarity for tax reporting.

- In-Kind Donations: Describe the donated items or services in detail. It’s crucial to estimate their fair market value, as this affects the donor’s tax deduction.

- Recurring Donations: If the donation is part of a recurring arrangement, such as a monthly donation, specify the donation frequency and total for the year.

Ensure that your template is flexible enough to handle different donation types without overwhelming the donor with unnecessary details. Keep it clear, concise, and tailored to the specific donation format. This approach makes the receipt easier to use for both the donor and the organization.

Distribute tax-deductible receipts to donors through multiple channels to ensure accessibility and proper documentation. Ensure all receipts are clear, accurate, and in line with IRS guidelines before sending them out.

1. Email Delivery

Email is a fast and efficient way to send tax-deductible receipts. Attach the receipt as a PDF document with clear instructions and donor information. Make sure the subject line and body of the email clearly state that the document is for tax purposes. This method is particularly useful for small and mid-sized donations.

2. Physical Mail

For larger donations, some donors may prefer a physical receipt. Print the receipt on official letterhead and include a signature for added authenticity. Send the receipt via standard mail or, for more security, certified mail. Keep track of these receipts with a mailing log to ensure every donor receives their documentation.

Offer both digital and physical options when possible to cater to different preferences. Always include clear instructions on how donors can contact you for any issues or queries related to their receipts.

Ensure you provide the correct legal language in your acknowledgment to avoid tax-related issues. Omitting the necessary details, such as the donor’s name, donation amount, and a statement about whether any goods or services were provided in exchange, can lead to compliance problems.

1. Not Including a Description of Goods or Services

If you provided anything in return for the donation, always include a description and estimated value of those items or services. Failing to do so can result in an incomplete acknowledgment and potentially cause the donor to lose the ability to claim a tax deduction.

2. Incorrectly Reporting Donation Amounts

Always verify the exact donation amount. Reporting an incorrect amount, especially when dealing with non-cash contributions, can raise questions during audits. Make sure your figures match the donor’s records and the value of the donation.

In case of non-cash donations, provide a detailed list and fair market value of the items donated. Misreporting this value can lead to legal issues down the road.

3. Forgetting the IRS Required Statement

Don’t forget to include the IRS-required statement: “No goods or services were provided in exchange for this contribution,” if that is the case. Failing to add this statement may cause the donor’s tax deduction to be disallowed.

In this version, the repetition of the words “Donation” and “Receipt” is minimized while preserving the meaning of each point.

Focus on including the donor’s full name, address, and donation details. Ensure that the document clearly states the amount given, the date of the transaction, and a description of any items donated. Avoid redundancy by substituting the word “receipt” with “acknowledgment” when possible, and use “contribution” instead of “donation” in certain contexts to reduce repetitive phrasing.

Formatting and Clarity

Present the acknowledgment clearly. List donor details, contribution specifics, and your organization’s information in distinct sections. This not only simplifies the reading but also minimizes the chance of confusion. Avoid using “receipt” in every sentence; use phrasing such as “gift record” or “financial acknowledgment” where appropriate.

Legibility and Accuracy

Ensure accuracy by providing the donor with all relevant information without overcomplicating the text. Make the document straightforward and clear, while maintaining professionalism. Reiterate only essential details without unnecessary repetition.