To simplify your childcare records, create a daycare receipt using a clear template that includes all the necessary details. A proper receipt helps track payments and ensures both parents and providers have accurate documentation for tax or reimbursement purposes.

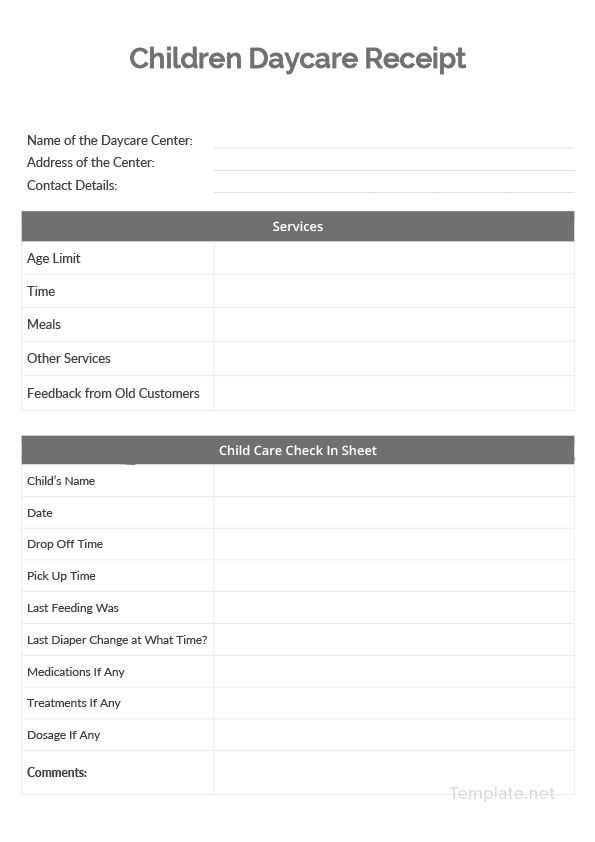

Start with the daycare provider’s contact details–name, address, phone number, and email. Then, include the parent’s contact information to make the receipt personal and traceable. Clearly state the service period, listing the start and end dates of the care provided, along with the total number of hours or days.

Make sure to itemize the cost for transparency. Break down the total amount by hours, daily rates, or any additional fees. It’s also helpful to note if any payments have been made in advance or if a deposit was paid. Lastly, include a unique receipt number for tracking purposes, and ensure it’s signed by the provider to validate the document.

Here’s the revised version:

To create a daycare receipt, include the following details:

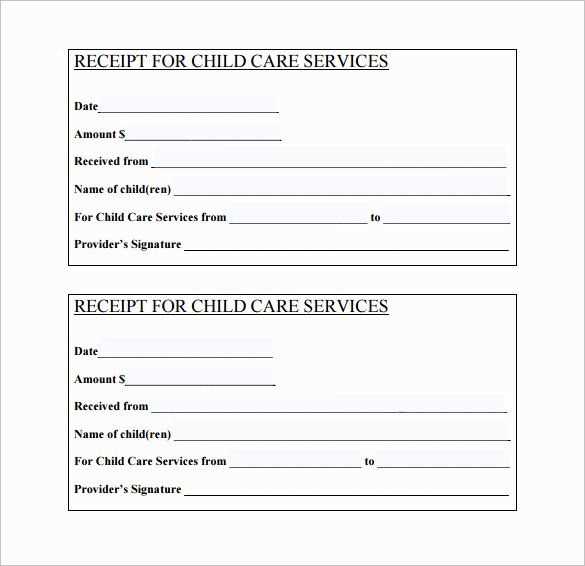

- Date of service: Specify the exact date(s) the daycare was provided.

- Child’s name: Include the full name of the child receiving care.

- Amount paid: Clearly state the total payment amount.

- Payment method: Note whether the payment was made by check, cash, or credit card.

- Provider’s information: Include the daycare provider’s name, address, and contact details.

- Description of services: List any specific services provided (e.g., hours of care, meals, activities).

- Signature: Have the daycare provider sign the receipt for verification.

This format ensures clarity and helps both parties keep accurate records for future reference.

- Daycare Receipt Template

For accurate record-keeping, a daycare receipt template should include specific details such as the provider’s name, the parent’s name, the dates of service, the hourly or daily rate, and total amount paid. Make sure to provide space for payment method and any additional notes, like discounts or late fees.

Key Elements to Include

- Provider’s Name and Address

- Parent’s Name and Contact Information

- Date(s) of Service

- Service Description (e.g., hourly/daily care, additional services)

- Amount Paid and Payment Method

- Signature or Provider’s Authorization

This template helps both the parent and the daycare keep organized records for tax purposes and future reference. Make sure the document is clear and easy to read to avoid confusion. An organized receipt simplifies both financial planning and any potential disputes.

Begin by including the name of your daycare center or provider, followed by the address, contact information, and tax identification number. This ensures that parents have all the relevant details for future reference or any possible reimbursement claims.

1. Add Parent Information

Include the parent’s name, address, phone number, and email. This makes it clear who the receipt is intended for and prevents any confusion.

2. Clearly List Services Provided

List each service or care session provided, such as full-day care, half-day care, or special activities. Include dates for each service and the cost associated with it.

3. Mention the Total Amount Paid

At the bottom of the receipt, provide the total amount the parent paid. Break this down by day, week, or session if applicable.

4. Include Payment Method

State whether the payment was made in cash, check, or electronically. This adds transparency and helps track payments for both the daycare provider and the parent.

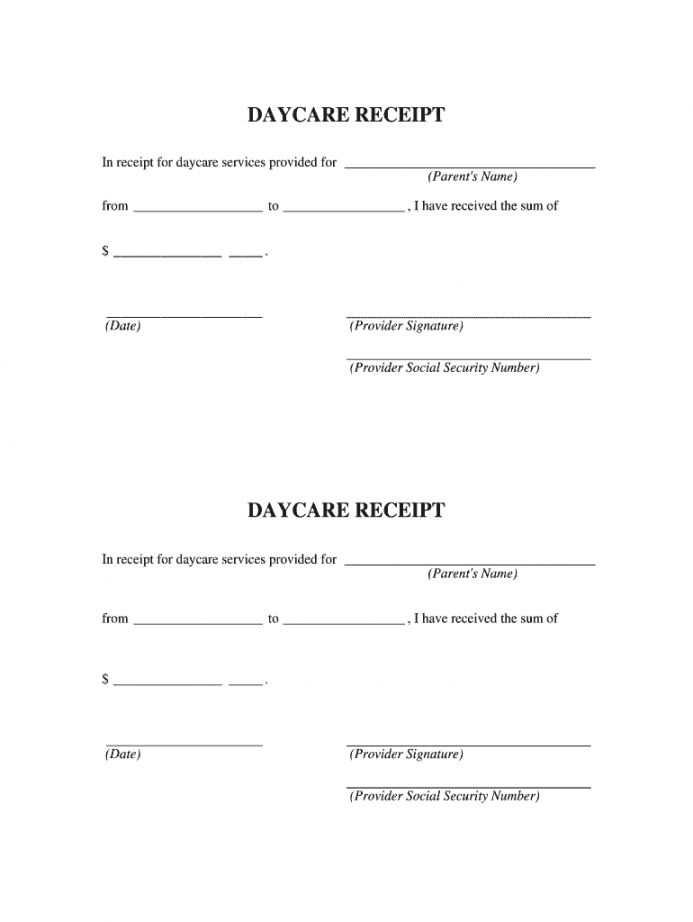

5. Date and Signature

End with the date the receipt was issued and, if necessary, a signature from the daycare provider. This provides authenticity and confirms the transaction.

Tip: Keep a copy of the receipt for your records. This way, both the daycare and the parent have a clear record of the payment transaction.

Ensure your daycare receipt includes the following key details for clarity and accuracy:

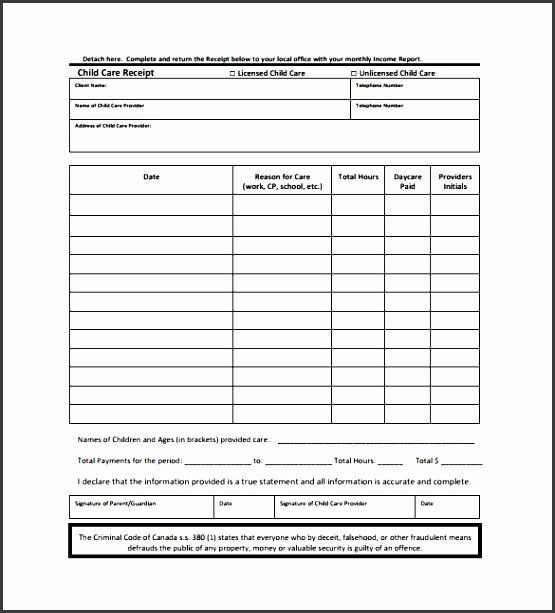

1. Date and Time of Service

Include the exact date and, if necessary, the times the childcare services were provided. This will help both the daycare provider and the client to track the exact services rendered.

2. Provider’s Information

Clearly state the daycare provider’s name, address, phone number, and any applicable business license or registration number. This provides legitimacy and verification for tax or reimbursement purposes.

3. Child’s Name and Age

List the full name and age of the child receiving care. This helps identify the specific services provided and is important for personalizing the receipt.

4. Payment Breakdown

Detail the cost for each service provided. This includes daily rates, hourly rates, any additional fees, or discounts. Break down the total amount to avoid any confusion about charges.

5. Method of Payment

Specify how the payment was made (e.g., cash, credit card, check, or digital payment). If paid by check, include the check number.

6. Signature

Include space for the daycare provider’s signature. This confirms the receipt of payment and the completion of services.

For tax reporting, daycare receipts must include specific details to meet IRS requirements. Ensure your receipt includes the following information:

Required Information

- Provider’s Name and Address: Include the full legal name and physical address of the daycare facility or provider.

- Tax Identification Number (TIN): This can be either a Social Security Number (SSN) or Employer Identification Number (EIN) depending on the provider’s status.

- Date of Service: List the exact dates that care was provided. For multiple days, list each date separately.

- Amount Paid: The total payment made for services rendered during the reporting period. Include any separate charges for late fees or special activities.

- Child’s Name: Specify the full name of the child receiving care.

- Provider’s Signature or Statement: Include a statement from the provider confirming that payment has been made, or a signature if applicable.

Formatting Tips

Be clear and concise in listing all necessary information. Ensure that the dates and amounts match your payment records. Include any additional services or special fees if relevant. Always keep a copy of the receipt for your records. This format will help ensure that the receipt is accepted for tax deductions and other financial needs.

Customizing a Receipt Template for Different Payment Methods

Adjust your receipt template to reflect various payment methods, ensuring accuracy and clarity for your clients. Begin by adding specific payment details, such as the payment type (credit card, cash, check, etc.), transaction ID, and payment authorization number if applicable. This allows for easy identification and verification of the transaction method.

Credit Card Payments

For credit card payments, include the last four digits of the card number and the card type (Visa, MasterCard, etc.). This helps clients recognize which card was used while maintaining privacy. Also, add a field for the authorization code or reference number generated during the transaction for quick future reference.

Cash and Check Payments

If the payment is made in cash or by check, clearly state the amount received. For checks, include the check number and bank name to ensure transparency. This will help track payments and avoid discrepancies later on.

Finally, consider adding a custom note or field for any special payment conditions or discounts applied to the transaction, making sure every detail of the payment is recorded clearly on the receipt.

Childcare providers must include specific information on receipts to meet legal and tax obligations. The receipt should clearly state the provider’s name, address, and tax identification number (TIN). It must also specify the date of service, the child’s name, and the amount paid. Including the type of service provided, whether it’s full-time care, part-time, or after-school care, is also necessary. Receipts should be detailed enough to allow for proper documentation of payments for tax deductions or credits. Make sure to issue receipts promptly to avoid confusion and ensure compliance with local regulations.

Provide daycare receipts in a clear and structured format. Include all necessary details such as the parent’s name, date of service, and amount paid. Make sure to use a consistent template for all receipts to avoid confusion.

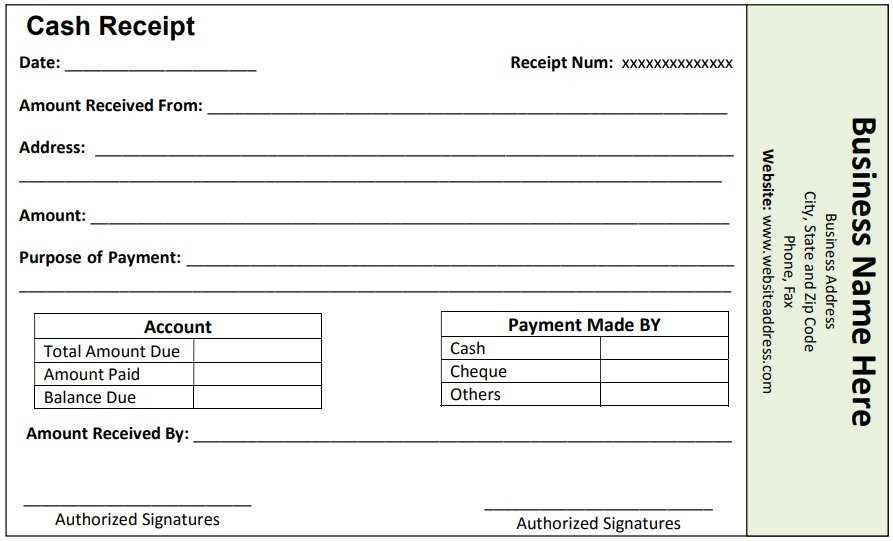

Each receipt should contain the following key elements:

| Element | Details |

|---|---|

| Parent’s Name | Full name of the client receiving the service |

| Service Date | Specific dates of the daycare service provided |

| Amount Paid | Total payment made by the client |

| Payment Method | Cash, check, or card payment details |

| Daycare Provider Name | Name and contact information of the daycare provider |

| Receipt Number | Unique identifier for each transaction |

For digital receipts, consider offering an email or PDF version to ensure easy access and storage. Make sure to keep a copy of each receipt for your own records, as it will help with accounting and tax purposes.

Offering receipts promptly after payment ensures a smooth process and builds trust with clients. Ensure clarity in every section and provide the necessary details in a timely manner.

Daycare Receipt Template

Create a detailed and clear daycare receipt using the following template to ensure transparency and accuracy for both parties.

- Provider Name and Contact Information: Include the daycare provider’s full name, address, phone number, and email.

- Parent or Guardian Information: Clearly list the name of the parent or guardian receiving the services, along with their contact details.

- Child’s Name and Age: State the child’s full name and age to confirm who the care was provided for.

- Date and Time of Care: Specify the exact dates and times the child attended daycare. If the care was partial or split between days, include all relevant times.

- Payment Breakdown: Itemize the total charges for services provided, including the hourly or daily rate, any discounts, or extra charges.

- Total Amount Paid: Clearly state the total amount paid by the parent or guardian, including any taxes or extra fees applied.

- Payment Method: Indicate the method of payment, such as cash, credit card, or check.

- Signature and Date: Both parties should sign and date the receipt to confirm the transaction.

Additional Information

If needed, you can add a section for notes or special agreements, such as late fees or holiday charges, to ensure clarity and avoid misunderstandings.