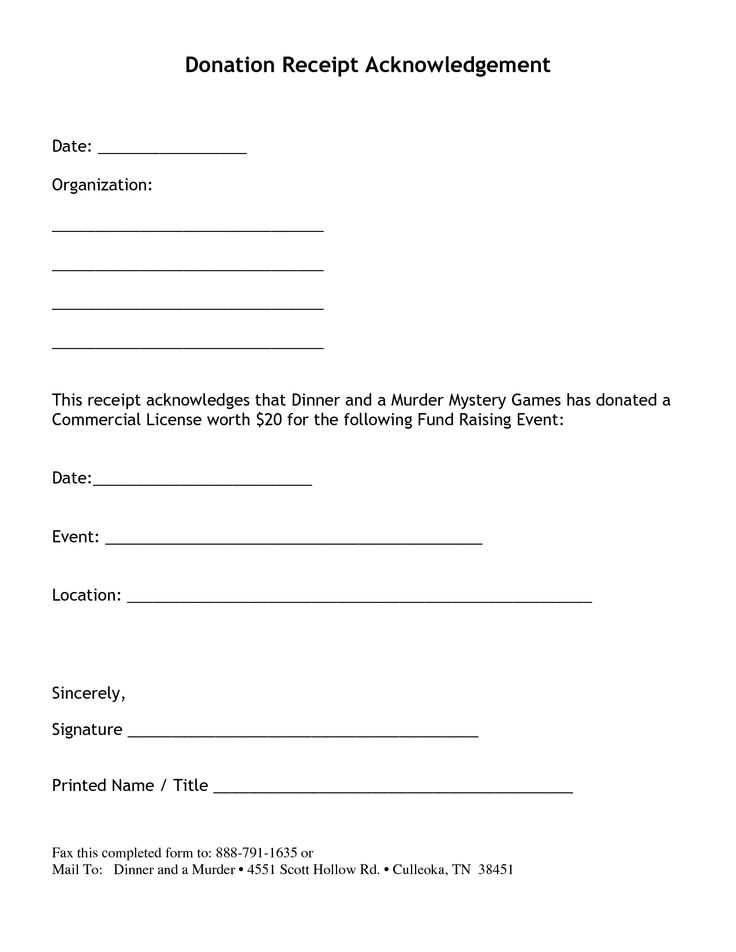

To create a receipt for a donation, it’s important to include key details that ensure clarity and meet legal requirements. A well-structured letter should acknowledge the contribution and provide the donor with all necessary information, such as the amount donated, the purpose of the donation, and the nonprofit’s tax-exempt status. This makes the donation process transparent and helps the donor with tax deductions.

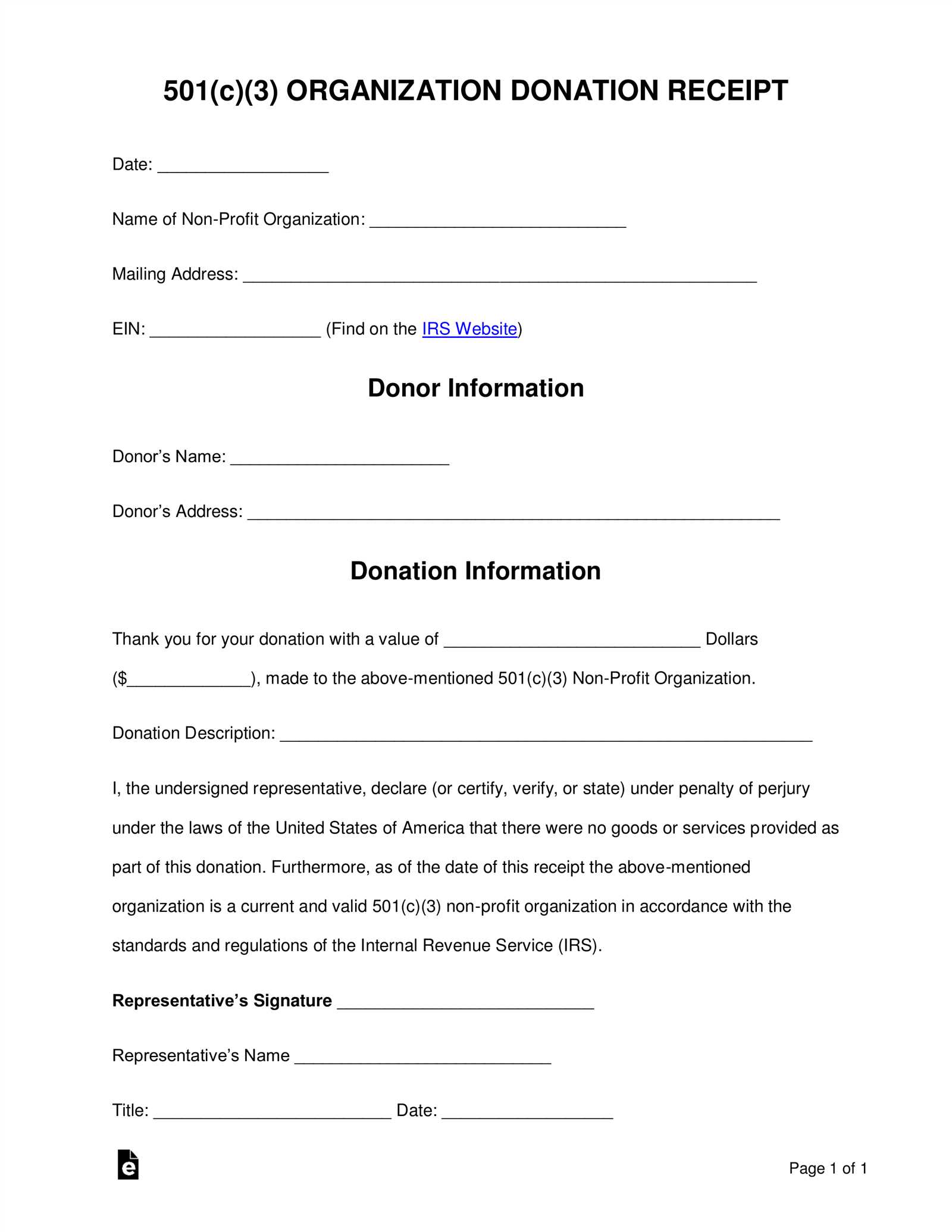

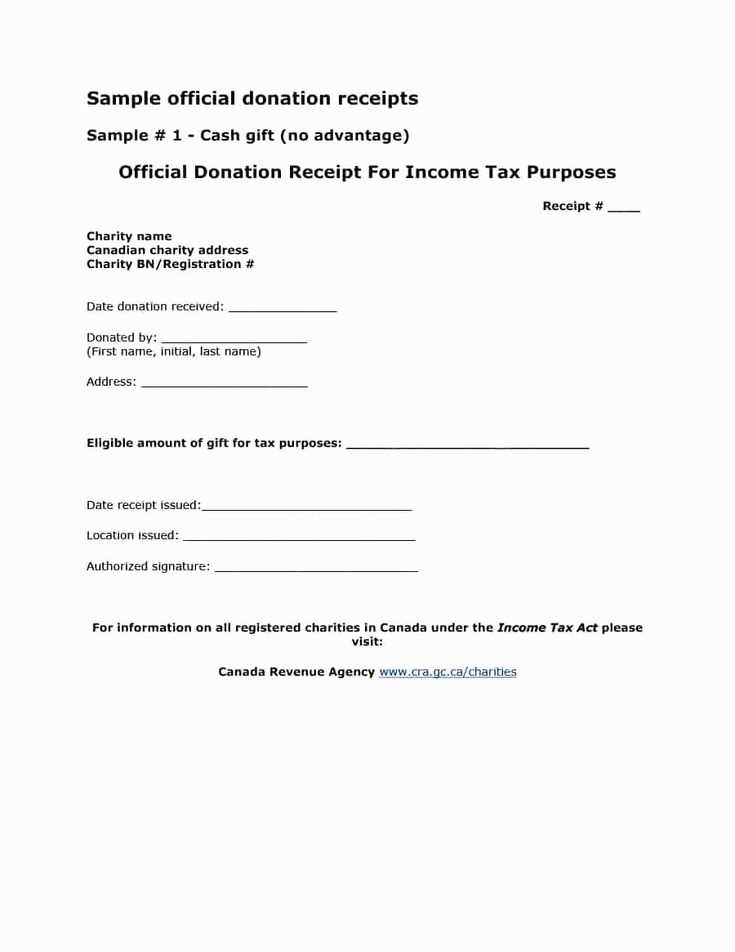

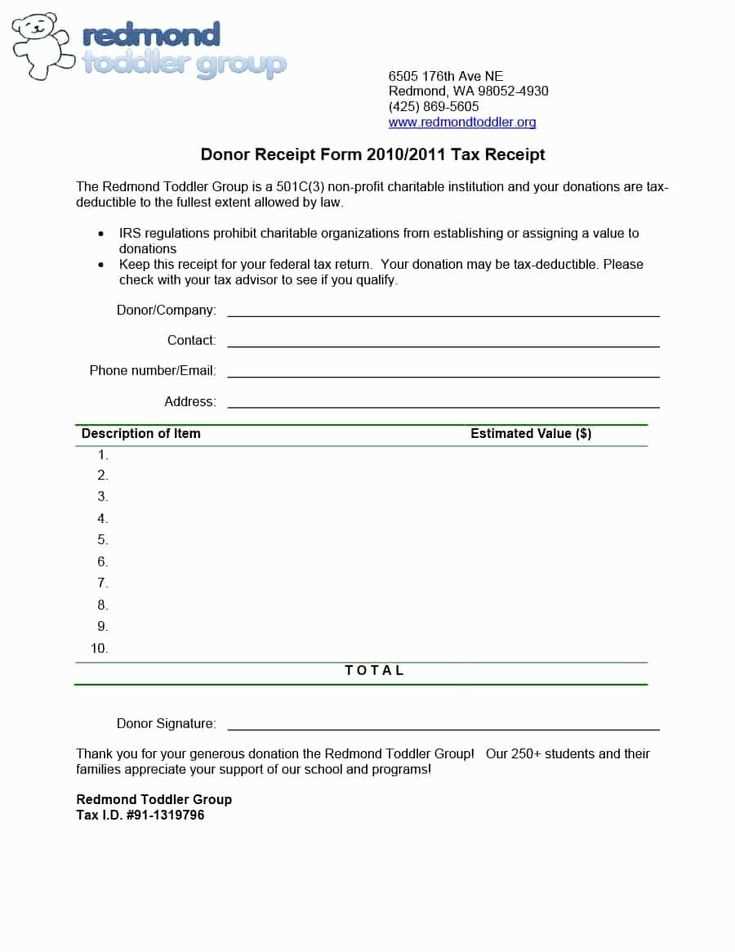

The receipt should clearly state the nonprofit organization’s name, address, and tax ID number. A reference to the specific program or project supported by the donation adds a personal touch and shows the donor how their contribution will make a difference. Avoid using vague descriptions–be specific about what was donated and the amount. If the donation included goods or services, note their estimated value as well.

Keep the tone polite and grateful, reinforcing the impact of the donor’s support. Including a statement of no goods or services received in exchange for the donation is a common practice for tax-exempt organizations. This ensures the donor can claim the full value of their donation when filing taxes.

Here’s the revised version:

When crafting a receipt of donation letter, make sure to include key details to keep the communication clear and professional. Start with a brief thank-you message, followed by the donor’s name, the donation amount, and the date received.

Structure of the Letter:

- Donor’s Full Name – Clearly mention the donor’s name to personalize the letter.

- Donation Amount – Specify the exact donation amount, whether it’s monetary or in-kind. Include a description for any non-cash donations.

- Date of Donation – Include the date the donation was received to maintain accurate records.

- Organization Details – Clearly identify your nonprofit’s name, address, and contact information for clarity.

- Tax-exempt Status Information – If applicable, include your nonprofit’s tax-exempt status and relevant IRS identification number.

Conclude by thanking the donor again for their contribution and letting them know how it will support your organization’s work. Always keep a copy for your records to ensure compliance with tax reporting requirements.

- Receipt of Donation Letter Template for Non-Profit Organizations

A donation receipt letter should clearly reflect the contribution made, including the type and value of the donation. The letter must also include specific details to meet IRS requirements and provide proper documentation for the donor’s tax purposes.

Ensure the letter includes the following elements:

- Non-Profit Organization Name and Logo: Start with your organization’s name and logo at the top of the letter, making it clear who issued the receipt.

- Date of Donation: Specify the exact date on which the donation was received.

- Donor’s Information: Include the donor’s full name and address as provided, to ensure it matches the records.

- Description of the Donation: Clearly state what was donated. For example, whether it was cash, goods, or services, and provide an estimated value where applicable. If the donation is non-monetary, mention the condition and any applicable valuation method.

- Statement of No Goods or Services Provided: Include a declaration if the donation was a purely charitable contribution with no goods or services provided in exchange, as required by tax laws.

- Signature of Authorized Person: End with the signature of an authorized representative of the non-profit organization, along with their position and contact details.

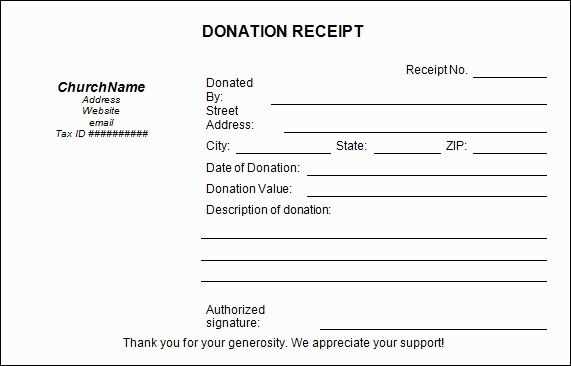

Here is a basic template you can use:

[Non-Profit Organization Name] [Organization Address] [City, State, ZIP Code] [Phone Number] [Email Address] [Date] [Donor's Name] [Donor's Address] [City, State, ZIP Code] Dear [Donor's Name], Thank you for your generous donation of [describe donation type] on [date]. Your contribution will help us [briefly describe the organization's mission or specific project the donation supports]. No goods or services were provided in exchange for your donation. We appreciate your support and look forward to keeping you informed on the progress of our efforts. Sincerely, [Authorized Representative's Name] [Title] [Contact Information]

Make sure to adjust the template to fit the specifics of each donation, and maintain clear records for both your organization and the donor.

Begin by clearly addressing the donor, using their full name or preferred title. This shows respect and makes the letter personal. Include the exact amount or description of the donation, whether monetary or in-kind. For monetary gifts, list the amount, and for items, describe them briefly.

Include the date the donation was received. This helps both the donor and your organization maintain accurate records for tax purposes. Ensure this date is correct and matches your donation receipt system.

Express your gratitude immediately after acknowledging the gift. A simple, sincere statement of thanks reinforces the positive impact of their contribution. For example, “Your generous support allows us to continue our work in [specific area of focus].”

Be specific about how the donation will be used, if possible. Donors appreciate knowing their money or goods are being put to good use. For example, mention specific projects, programs, or initiatives funded by their contribution.

If relevant, mention any tax-deduction information. Include your organization’s tax identification number (TIN) if required. This ensures the donor is clear about any benefits they may receive for tax purposes.

Finally, sign off with a warm closing, reaffirming your appreciation. Use a professional but friendly tone, and include the name of the person who is signing, along with their title in the organization. This adds credibility and ensures the donor knows who is personally thankful for their gift.

Include the donor’s full name and contact details. This helps confirm their identity and allows for follow-up communication if needed. Make sure the amount donated is clearly stated, as well as the date the donation was received. If the donation was a gift-in-kind, describe the item and its value. For tax purposes, add a statement confirming that no goods or services were exchanged in return for the donation, if applicable. Finally, add your organization’s name, tax ID, and a thank you for their generosity to make the acknowledgment personal and appreciative.

Non-profit organizations must provide donation receipts that meet legal criteria. The IRS specifies that a receipt must include the donor’s name, the amount donated, and a statement of whether any goods or services were exchanged for the donation.

For cash donations, the receipt must clearly state the exact amount contributed. For donations of property, the receipt must describe the item(s) donated and their fair market value. Non-profits are not required to assign a value to non-cash donations, but they should provide a description of the item(s) donated.

If the donation exceeds $250, the non-profit must provide a written acknowledgment, which includes a statement that no goods or services were provided in exchange for the donation or, if applicable, a description and value of the goods or services received.

Non-profits must also ensure their receipts contain the organization’s name, address, and tax-exempt status, and donors must keep these receipts for tax purposes. A failure to meet these requirements can affect the donor’s ability to claim the deduction.

First, include your organization’s name, address, and contact details at the top of the receipt. Make sure the donor can easily identify the charity. Follow this with a clear statement that acknowledges the donation and specifies the date it was received. If possible, mention the donation’s purpose, especially for designated funds. For transparency, include the total amount donated, and indicate whether any goods or services were provided in exchange, alongside their value. Lastly, sign off with a thank-you note and the name of the person responsible for issuing the receipt. Always keep your template consistent with the tone and style of your organization.

To properly acknowledge a donor’s contribution, include the following key details in the receipt:

- Donor Information: Clearly state the donor’s name and contact details to ensure the acknowledgment is specific.

- Donation Amount: Specify the exact amount donated and, if applicable, the value of in-kind donations. Break down the donation if it includes both monetary and non-monetary gifts.

- Donation Date: Include the date the donation was received for record-keeping and tax purposes.

- Organization Details: Mention the name and tax-exempt status of your nonprofit organization to assure the donor of the legitimacy of the receipt.

- Purpose of the Donation: If the contribution is designated for a specific program or project, note this on the receipt for transparency.

- Non-Exchange Statement: Clearly state that the donation was not made in exchange for goods or services, to comply with tax regulations.

- Signature: Include the signature of a representative from your organization to authenticate the receipt.

Ensure the tone is personal and appreciative, showing genuine gratitude for the donor’s support.

Ensure receipts are sent within 48 hours of receiving a donation. This builds trust and assures donors that their contribution has been acknowledged.

Be Clear and Specific

Include details such as the donor’s name, donation amount, and the date of the contribution. If the donation is a gift-in-kind, describe the item or service donated. Always specify whether the donation is tax-deductible, and if so, provide the necessary information to support their tax filing.

Personalize the Communication

Tailor each receipt to the donor. A simple note that acknowledges their impact or the specific project their donation will support adds a personal touch. It shows that their contribution matters.

Use a professional and easy-to-read format. Make sure the receipt is free from any typos or errors. The clearer and more accurate the information, the more likely donors will feel confident about the transaction.

For larger donations, provide additional documentation, such as a detailed statement of all their contributions over the past year. This can serve as a year-end summary for tax purposes.

Keep your receipts concise, with no excessive or unrelated information. Donors should be able to quickly find what they need without any hassle.

Replaced a few words to avoid repetition while keeping the meaning intact.

When drafting a donation receipt letter, focus on clarity and simplicity. Make sure the donor’s name, address, and the donation amount are clearly stated. Include the organization’s name, contact details, and tax-exempt status information, if applicable.

Key Elements to Include in a Donation Receipt

The following sections are crucial for your letter’s effectiveness:

| Element | Description |

|---|---|

| Donor Information | Include the donor’s full name and address, along with their contribution details. |

| Donation Amount | Clearly state the amount of the donation or describe the value of the items donated. |

| Tax-Exempt Status | If applicable, provide your organization’s tax-exempt status, which will assist the donor with tax deductions. |

Remember to thank the donor for their contribution, offering appreciation and reinforcing how their support benefits your cause.