Key Elements of a Trust Account Receipt

A trust account receipt should include clear details for both parties involved. It serves as proof of transaction and ensures transparency. Here’s a breakdown of the critical components:

- Receipt Number: Assign a unique identification number for tracking.

- Date of Transaction: Include the exact date the funds were received.

- Payee Information: Clearly mention the name of the party receiving the funds.

- Payer Information: Include the details of the individual or entity providing the funds.

- Amount Received: State the exact dollar amount in both numerical and written form.

- Purpose of Payment: Provide a brief description of the purpose of the payment, such as services, deposits, or other reasons.

- Trust Account Information: Specify the trust account where the funds will be held.

- Signature: Include spaces for the signatures of both the payee and the payer.

Template Example

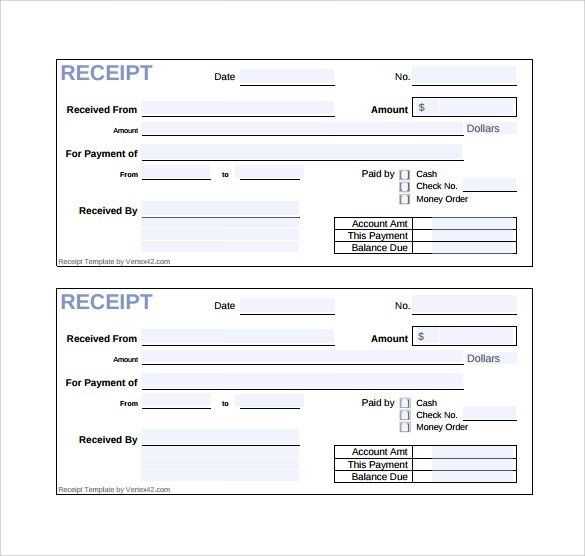

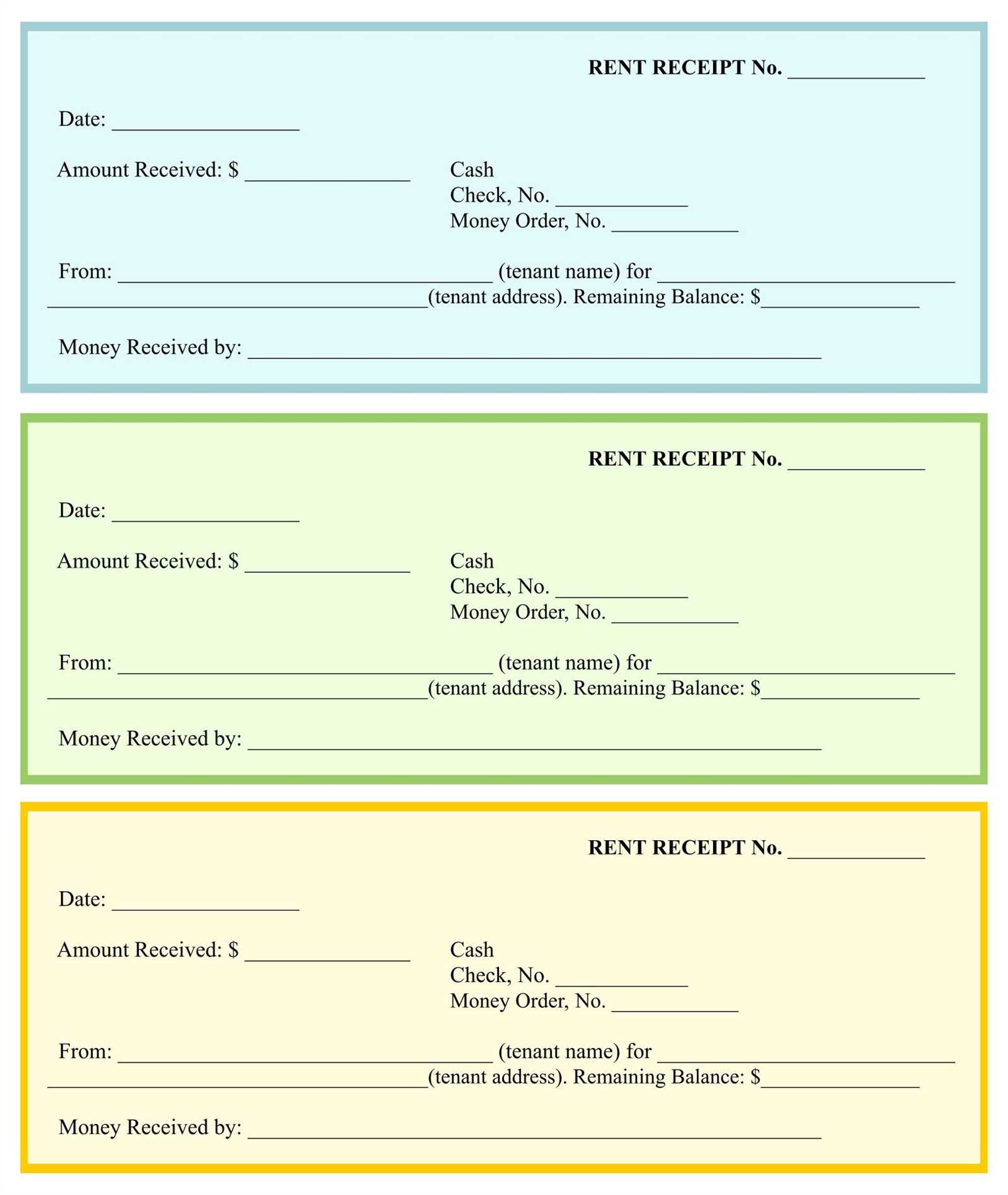

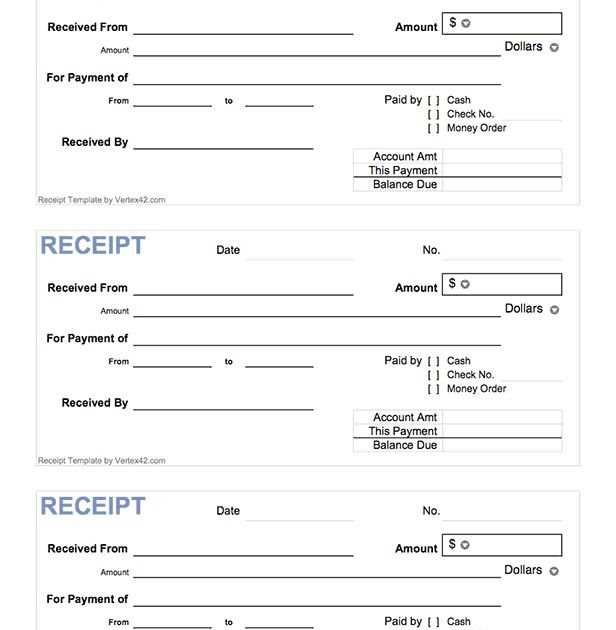

Below is a template for a trust account receipt that can be customized according to your needs:

Receipt Number: [Insert Receipt Number] Date of Transaction: [Insert Date] Payee Name: [Insert Payee Name] Payer Name: [Insert Payer Name] Amount Received: $[Insert Amount] ([Insert Amount in Words]) Purpose: [Insert Purpose] Trust Account Details: [Insert Trust Account Information] Payee Signature: ______________________ Payer Signature: ______________________

Best Practices

- Accurate Record-Keeping: Keep copies of all receipts for future reference and audit purposes.

- Clear Descriptions: Always provide specific descriptions for the purpose of the payment to avoid confusion.

- Timely Issuance: Issue receipts promptly to maintain trust and transparency between all parties involved.

By following these guidelines and using this template, you can ensure a smooth and professional process for managing trust account transactions.

Detailed Guide on Trust Account Receipt Template

Understanding the Structure of a Trust Account Receipt

Key Elements to Include in a Trust Account Receipt

How to Customize a Template for Specific Transactions

Ensuring Legal Compliance in Trust Account Receipts

Common Errors to Avoid When Using the Template

Tools and Software for Creating Trust Receipts

A trust account receipt template should include clear, concise fields to document transactions accurately. The key components are the payer’s and payee’s details, the trust account number, the transaction amount, the date of receipt, and the description of the service or item for which the trust account is used. This structure ensures transparency and helps maintain records in line with legal requirements.

Key Elements to Include in a Trust Account Receipt

The following are essential elements for any trust account receipt template:

- Payer Information – Full name and contact details of the payer.

- Payee Information – Name and details of the entity receiving the funds.

- Transaction Amount – Total amount being deposited or transferred.

- Trust Account Number – Unique account identifier to track the funds.

- Date of Transaction – Date when the receipt is issued.

- Purpose of Transaction – A short description of the reason for the trust deposit.

- Receipt Number – A reference or invoice number to avoid duplicates.

How to Customize a Template for Specific Transactions

Tailor the template for different types of trust accounts by adding or removing fields based on the transaction type. For example, a real estate trust might require additional details, such as property address and contract reference. A legal trust may need to include case numbers and lawyer details. Ensure the template remains flexible, allowing easy modification for various transaction purposes while maintaining accuracy.

Stay compliant with local regulations by updating your template according to any changes in legal requirements for trust account receipts. Regularly consult with legal advisors to ensure that all required information is captured and that your template adheres to relevant guidelines.

By staying organized and precise with the template, you can streamline the receipt process and reduce errors related to missing or inaccurate information.