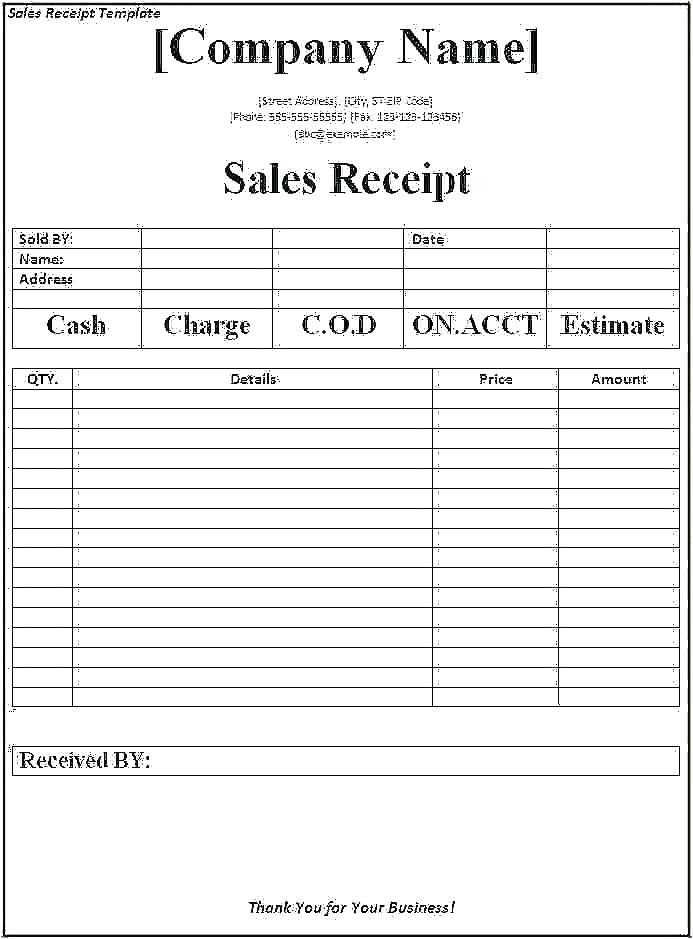

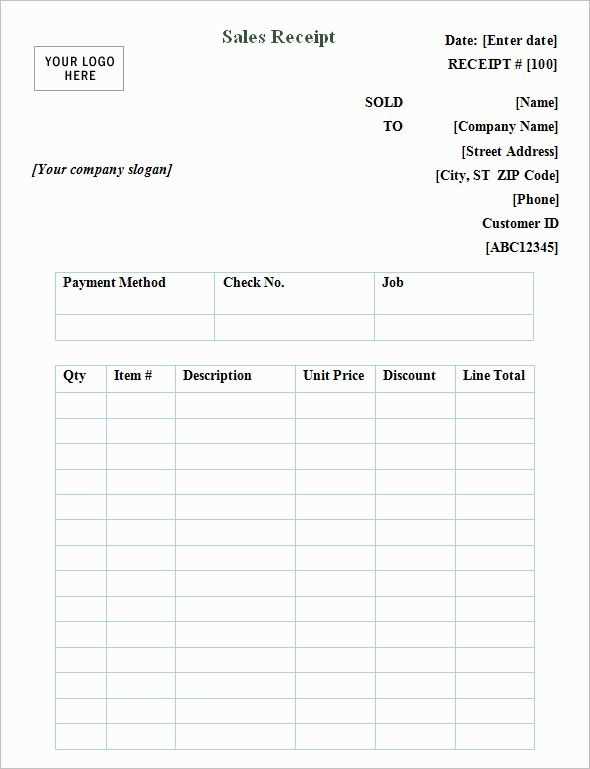

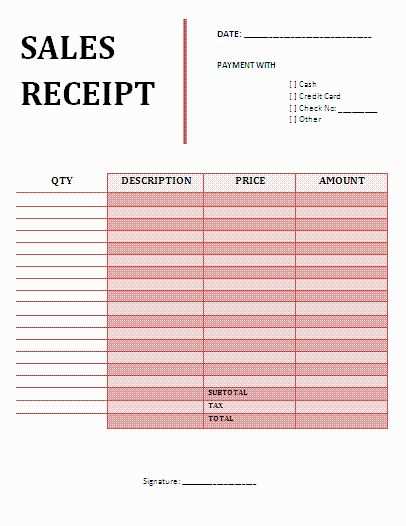

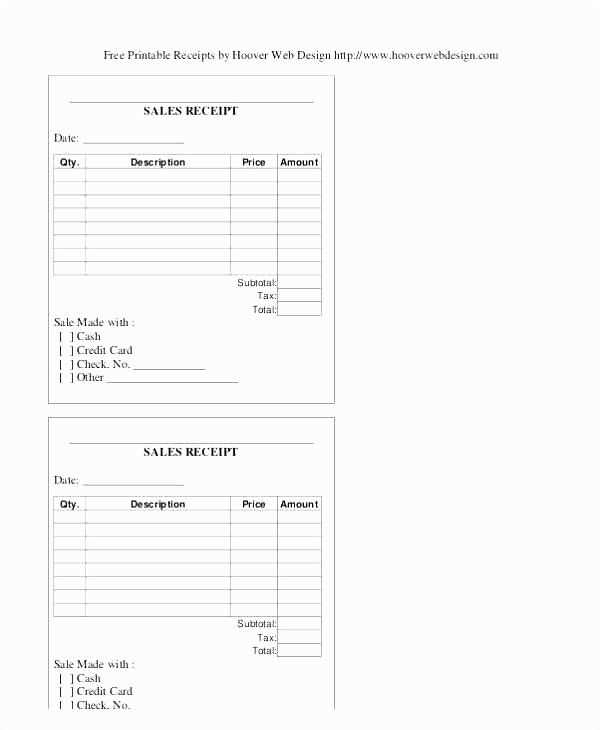

Creating a professional sale receipt is easier than ever with a customizable PDF template. A sale receipt not only provides a record of the transaction but also serves as a proof of purchase for both the buyer and seller. This template is designed to save time while ensuring consistency across your sales documents.

Downloadable as a PDF, the template allows for quick edits, including adding transaction details, customer information, and payment methods. By using a template, you streamline your process, reduce the risk of errors, and maintain a standardized format that can be easily shared with clients or stored for accounting purposes.

The Sale Receipt Template PDF is particularly useful for small businesses, freelancers, and online sellers who want a simple yet professional way to document sales. Customizable fields ensure that you can adapt the receipt to your specific needs–whether you are selling goods, services, or both. The PDF format also makes it easy to print or email receipts directly to customers with minimal effort.

Here’s the corrected version:

To create a professional sales receipt, make sure it includes the following key components:

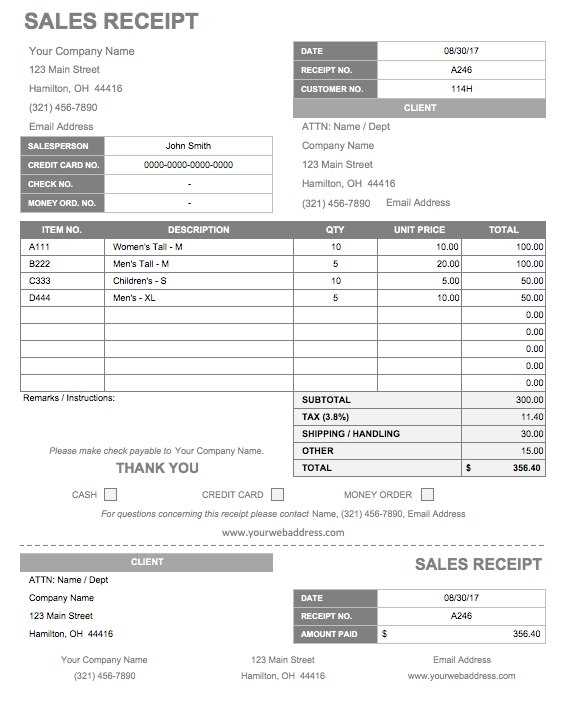

1. Vendor Details

Include your business name, address, phone number, and email. This information makes it easy for customers to contact you if needed. It’s also essential for any future references or returns.

2. Transaction Information

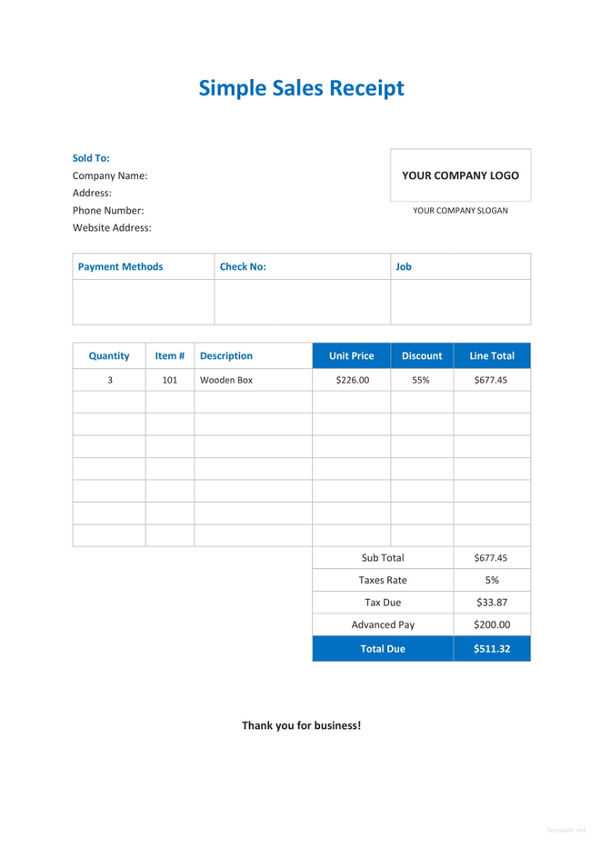

Clearly list the items sold, with a brief description, quantity, unit price, and total cost. If applicable, provide any discounts, taxes, and shipping fees separately to ensure transparency.

Note: Always include a unique receipt number for easy tracking and reference in the future.

3. Payment Method

Specify the payment method (credit card, cash, or other). If a credit card was used, mention the last four digits of the card for verification.

Tip: Offering an electronic version of the receipt in PDF format can make it more convenient for both you and the customer.

4. Date and Time

Make sure to include the exact date and time of the transaction. This helps both you and your customer keep accurate records for returns or warranty claims.

By following these guidelines, you’ll ensure your sales receipts are clear, complete, and professional every time.

Sale Receipt Template PDF: A Practical Guide

How to Create a Sale Receipt Template in PDF Format

Key Elements to Include in a Sale Receipt PDF

Customizing Your PDF Template for Various Business Needs

Best Tools for Generating Sale Receipt Templates in PDF

How to Ensure Accuracy in Receipt Information

How to Distribute and Store Sale Receipts Securely in PDF

To create an effective sale receipt template in PDF format, focus on clarity and precision. Start by incorporating the core details: the business name, date of sale, items or services purchased, quantities, individual prices, total cost, and payment method. This ensures that the receipt serves both as proof of transaction and as a useful reference for both buyer and seller.

The template should also include space for customer and seller information, such as names, addresses, and contact details. Adding a unique transaction or receipt number helps with tracking and referencing. A section for taxes or additional charges can further improve the accuracy and transparency of the document.

Customization is key. Tailor your template to fit specific business needs, whether you’re in retail, service industries, or online sales. Include relevant branding elements like logos, business colors, or specific terms of service. Make sure the layout adapts to different screen sizes or printers if customers might need a digital copy or a hard copy of the receipt.

To generate sale receipts efficiently, use tools like Adobe Acrobat, Google Docs, or specialized invoicing software like Zoho Invoice or QuickBooks. These allow you to easily create, edit, and save templates in PDF format. They often include pre-built templates for various industries, saving time on the design process.

Accuracy in receipt details is vital. Double-check each entry before saving the PDF. Ensure correct item names, prices, and tax calculations. To minimize errors, use auto-calculation tools available in most PDF generators or invoicing platforms. A review process for each receipt before it’s finalized helps catch mistakes before they reach the customer.

For secure distribution and storage, ensure the PDF receipts are password-protected if necessary. Use cloud storage platforms with encryption, such as Google Drive or Dropbox, for easy access and safe archiving. When sending receipts via email, use secure communication channels, and consider adding a watermark or encryption for extra protection against unauthorized use or tampering.