For landlords in India, providing a rent receipt to tenants is a standard practice that ensures transparency and avoids misunderstandings. The receipt serves as proof of payment for both parties. A well-structured template simplifies the process and ensures that all necessary details are included for legal and record-keeping purposes.

A typical rent receipt template should include the tenant’s name, property address, rent amount, and payment period. Be sure to include the date of payment, mode of payment (e.g., cash, cheque, online transfer), and any applicable taxes. Additionally, the landlord’s name and signature should be present to validate the receipt. These details help maintain clear documentation for both the landlord and tenant in case of disputes or for income tax purposes.

To streamline the process, use a predefined format that automatically fills in essential details. This ensures that every receipt is consistent and professional. Adjustments can be made easily for various payment methods or rental terms, making it a versatile tool for property owners and managers.

Here is the revised version where no word is repeated more than 2-3 times:

Ensure that all sections of the rent receipt are clear and concise. List the landlord’s and tenant’s details at the top, followed by the rental amount, payment method, and date. Include the rental period and any additional charges, such as maintenance or utilities. Avoid using identical terms repeatedly; instead, vary your phrasing to maintain readability. For example, instead of writing “rent payment” multiple times, use “payment amount,” “lease fee,” or simply “amount due” when needed.

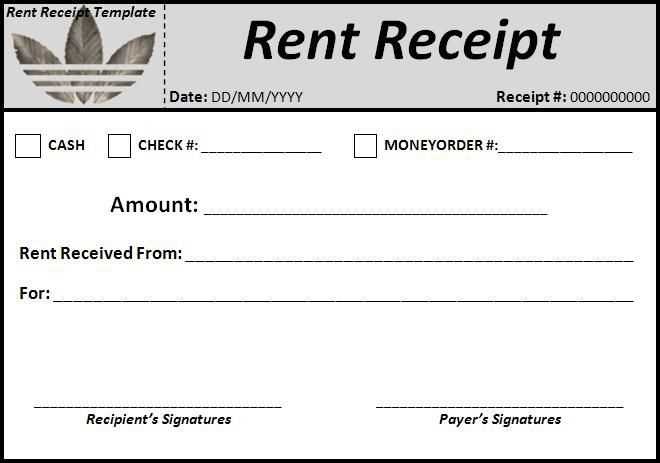

Example Template:

Landlord: John Doe

Tenant: Jane Smith

Amount Paid: ₹15,000

Payment Date: 5th February 2025

Rental Period: 1st January 2025 to 31st January 2025

Additional Charges: ₹2,000 (Maintenance Fee)

Tips for a Well-Formatted Receipt:

Keep the layout clean, with each detail placed in a logical order. Avoid over-explaining or over-stating the payment details. If multiple payments were made, list each one along with the corresponding dates. Avoid using phrases like “payment received” multiple times–vary the structure to keep the document readable and professional.

- Template for Rent Receipt in India

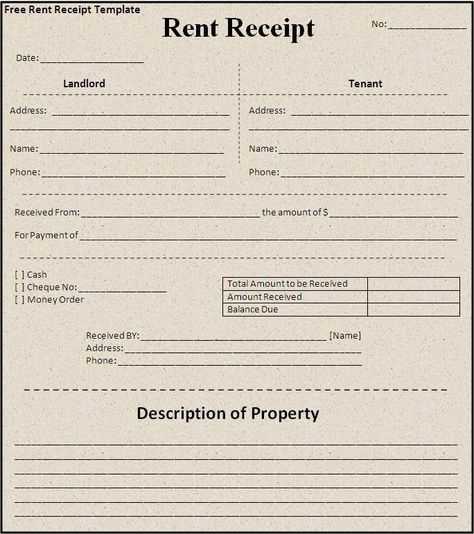

For landlords in India, providing a rent receipt is a standard practice to maintain transparency in rental transactions. The template should contain specific details to make it legally valid and useful for both parties. Below is a simple structure for a rent receipt template:

- Landlord’s Name and Address: Clearly state the landlord’s full name and contact information.

- Tenant’s Name and Address: Include the tenant’s full name and rental property address.

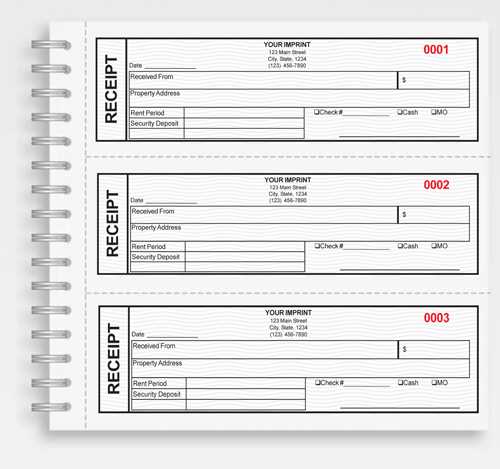

- Receipt Number: Assign a unique receipt number for reference.

- Date of Payment: Mention the date when the rent payment was received.

- Amount Paid: Clearly mention the rent amount paid in words and figures, including any taxes if applicable.

- Rental Period: Indicate the period for which the rent has been paid (e.g., January 2025 to February 2025).

- Payment Method: Specify whether the payment was made in cash, cheque, or online transfer.

- Signature of Landlord: The receipt must include the signature of the landlord for verification.

- Additional Notes: Include any other relevant information such as late fees, advance payments, or special agreements.

This template can be customized according to the specific needs of both the landlord and tenant. Ensure all fields are filled accurately to maintain clear records of payments and to avoid disputes in the future.

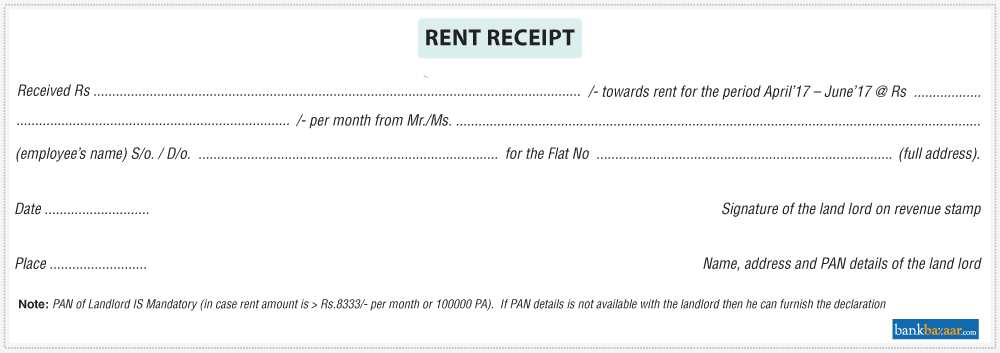

Rent receipts must meet specific legal criteria to be valid in India. The receipt should include the tenant’s name, the landlord’s name, the address of the rented property, the amount of rent paid, and the date of payment. The receipt should be signed by the landlord or an authorized representative. Without these key elements, a rent receipt may not be legally recognized in disputes or tax matters.

According to the Income Tax Act, if rent exceeds ₹3,000 per month, the tenant should receive a formal rent receipt. This helps both parties claim deductions and comply with taxation regulations. It is also recommended that rent receipts be issued on a monthly basis, ensuring that both the tenant and landlord maintain accurate records for tax purposes.

In some cases, landlords may be required to provide a stamped receipt, particularly when the rent exceeds a certain amount. It’s advisable to consult with a tax professional to ensure that the rent receipt complies with all applicable tax laws and regulations.

To ensure your rent receipt is legally valid and clear, include the following key elements:

Tenant and Landlord Details

Start with the full names of both the tenant and landlord. This clarifies who is involved in the transaction. Include contact information, such as addresses or phone numbers, for both parties, if applicable.

Property Information

Clearly mention the address of the rented property. This helps identify the exact location involved in the rental agreement.

Payment Details

Include the exact rent amount paid, the date of payment, and the rental period it covers. If there were any deductions or late fees, list them separately for transparency.

Receipt Number

Assign a unique receipt number to each payment for record-keeping purposes. This ensures easy tracking and prevents confusion in case of disputes.

Signature of the Landlord

A signed receipt by the landlord confirms the transaction. This adds an extra layer of authenticity to the document.

By including these key elements, your rent receipt will serve as a clear and professional record of the transaction.

To create a rent receipt that is suitable for tax purposes in India, focus on including specific information clearly and correctly. This will ensure the receipt is legally valid and can be used to claim deductions. Start with the following key components:

1. Landlord and Tenant Details

Include the full names and addresses of both the landlord and tenant. This helps identify the parties involved and avoids confusion in case of a tax audit.

2. Rent Amount and Payment Period

Specify the total rent amount paid during the period. Include the start and end dates of the payment period, as this will ensure the receipt corresponds with the applicable tax year.

| Field | Details |

|---|---|

| Landlord’s Name | John Doe |

| Tenant’s Name | Jane Smith |

| Address of Landlord | 123 Main Street, Delhi |

| Address of Tenant | 456 Park Road, Delhi |

| Rent Amount | ₹20,000 |

| Payment Period | 1st January 2025 – 31st January 2025 |

Be precise about the amount and the specific month or duration. Any ambiguity could lead to issues later, especially if the receipt is used for tax filings.

3. Receipt Number and Signature

Each receipt should have a unique number for tracking and record-keeping purposes. The landlord’s signature or a digital equivalent verifies the document’s authenticity.

Incorporating these elements makes the rent receipt acceptable for tax purposes and helps prevent any future complications. Be sure to keep copies for your records, as they may be required for income tax filings or other legal purposes.

Adjusting rental receipt templates to suit various agreements is straightforward. Start by ensuring the template accommodates the specifics of the rental arrangement–whether it’s residential, commercial, or short-term. For instance, in a residential lease, include details about the rental term, payment schedule, and deposit information. A commercial rental receipt template, however, might need sections for business-specific clauses, like maintenance responsibilities or operating hours.

Residential Agreements

For residential leases, ensure the template captures tenant details, rental property address, and rent due dates. The template should also reflect the agreed-upon rent amount, whether it’s weekly, monthly, or another frequency. Include a section for security deposits, maintenance responsibilities, and any agreed-upon utilities to be included in the rent. Clear sections for late fees and rent adjustments help both parties understand their obligations.

Commercial Agreements

Commercial leases often have additional complexities, such as common area maintenance fees, parking space usage, and property tax responsibilities. Tailor your template to capture these details. You should also note lease renewal clauses and any modifications to rental rates based on market trends. A customizable receipt template can also account for payments related to maintenance, utilities, and repairs, making it more specific to the terms of the business rental.

Always ensure that the template remains simple and clear while capturing all necessary details. Customization ensures the receipt accurately reflects the terms of the specific rental agreement, reducing misunderstandings and potential legal disputes.

Digital rent receipts offer clear advantages over paper formats, mainly due to convenience and security. They can be stored and accessed anytime, reducing the chances of loss or damage. Additionally, they can be easily shared with tenants or landlords without any physical delivery, saving time and resources.

Speed and Accessibility

Digital receipts allow immediate generation and delivery via email or online platforms, streamlining the entire process. Tenants or landlords don’t have to wait for paper documents to be printed, mailed, or physically delivered. This immediate access makes digital receipts far more convenient for both parties.

Environmental Impact and Cost

Choosing digital receipts significantly reduces paper waste, contributing to environmental sustainability. It also eliminates printing costs, such as ink and paper, as well as postage fees. This makes digital receipts not only more eco-friendly but also cost-effective in the long run.

Always include the correct date on the receipt. Missing or incorrect dates can cause confusion and legal issues. Double-check that the date matches the transaction day.

Incorrect Amounts

Verify the payment amount before issuing the receipt. Mistakes in the total amount, especially rounding errors, can lead to disputes or legal complications.

Missing Payment Method

Clearly state the payment method used, whether it’s cash, cheque, credit card, or digital payment. Omitting this detail can lead to misunderstandings or difficulty verifying the transaction later.

- Always mention the payment method used

- Ensure the payment amount is accurately recorded

- Check that the amount and payment method align with the transaction records

Incorrect Party Details

Ensure that both the payer’s and receiver’s details, such as names, addresses, and contact information, are correctly listed. Mistakes here could cause confusion or difficulty in future communications.

Absence of Signature

Some receipts require signatures to be legally valid. Ensure that both the issuer and receiver sign if needed. Leaving this out may render the receipt invalid in certain legal contexts.

When preparing a rent receipt template in India, make sure to include the following details for accuracy:

- Tenant’s Name – Full name of the individual paying rent.

- Landlord’s Name – Full name of the property owner.

- Property Address – Complete address of the rented premises.

- Rent Amount – Exact amount paid by the tenant for the specified period.

- Payment Period – Clearly mention the month and year for which rent has been paid.

- Payment Date – Date on which the payment was received.

- Mode of Payment – Specify if the rent was paid via bank transfer, cheque, or cash.

- Receipt Number – Unique number for tracking the payment, if applicable.

Ensure that the rent receipt is signed by both parties, confirming the transaction. Including these points will provide clarity and avoid disputes later on.